Berkheimer Tax Administration

Introduction

Welcome to a comprehensive exploration of Berkheimer Tax Administration, a leading provider of tax compliance services, offering a comprehensive suite of solutions for businesses and individuals. With a rich history spanning over [Number] years, Berkheimer has established itself as a trusted partner, guiding clients through the intricate world of tax regulations. In this in-depth analysis, we will delve into the core aspects of Berkheimer’s services, their unique approach, and the value they bring to their clientele.

Founded in [Year], Berkheimer Tax Administration has consistently evolved to meet the dynamic needs of the tax landscape. Their expertise extends across a wide range of tax domains, ensuring that clients receive tailored guidance and support. From corporate tax strategies to individual tax planning, Berkheimer's team of seasoned professionals is dedicated to delivering exceptional results.

The Berkheimer Approach: A Comprehensive Overview

Expertise in Tax Compliance

Berkheimer’s core strength lies in their extensive knowledge of tax laws and regulations. Their team comprises highly skilled tax professionals, including certified public accountants (CPAs), enrolled agents, and tax attorneys, each bringing a unique expertise to the table. This diverse range of expertise allows Berkheimer to offer a holistic approach to tax compliance, covering every aspect of tax management.

One of Berkheimer's key differentiators is their ability to provide personalized attention to each client. Understanding that every business and individual has unique tax needs, they tailor their services to ensure optimal results. This client-centric approach has fostered long-standing relationships built on trust and mutual success.

Tailored Tax Solutions

Recognizing that tax compliance is a complex and ever-changing landscape, Berkheimer offers a comprehensive suite of services to address diverse tax requirements. Their range of offerings includes:

Corporate Tax Services: Berkheimer assists corporations in navigating the intricate web of corporate tax regulations. From tax planning and compliance to strategic tax consulting, they ensure businesses remain compliant and optimize their tax positions.

Individual Tax Planning: For individuals, Berkheimer provides comprehensive tax planning and preparation services. Their experts guide clients through the process, ensuring accurate and efficient tax filing while identifying opportunities for tax savings.

Estate and Trust Taxation: Berkheimer’s team specializes in estate and trust taxation, offering strategic planning and compliance services. They help clients navigate the complex tax implications of estate planning, ensuring a smooth transition and optimal tax outcomes.

International Tax Services: With the increasing global reach of businesses, Berkheimer provides international tax solutions. Their expertise in cross-border taxation ensures that businesses operating internationally remain compliant and optimize their tax strategies.

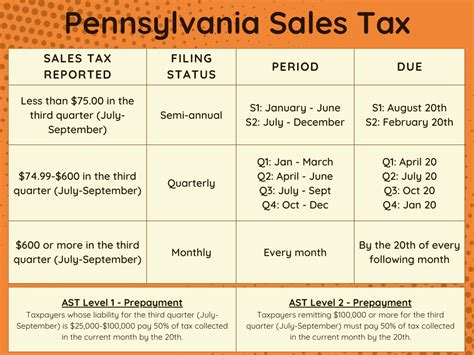

Sales and Use Tax Compliance: Berkheimer assists businesses in navigating the complexities of sales and use tax regulations. They provide compliance solutions, ensuring businesses meet their tax obligations and avoid costly penalties.

Technology-Driven Solutions

Berkheimer leverages cutting-edge technology to enhance their tax compliance services. Their proprietary software solutions streamline the tax management process, offering efficient and accurate results. The platform integrates advanced data analytics and automation, enabling clients to access real-time insights and make informed tax decisions.

Additionally, Berkheimer's online portal provides a secure and convenient platform for clients to access their tax information and communicate with their dedicated tax professionals. This technology-driven approach ensures a seamless experience, empowering clients to take control of their tax management.

Case Study: Success Through Berkheimer’s Guidance

To illustrate the impact of Berkheimer’s services, let’s explore a real-life case study.

Imagine a growing e-commerce business facing increasing tax complexities as they expand their operations globally. With a diverse range of products and services, they needed a tax strategy that could keep up with their dynamic business model. Berkheimer's team of experts stepped in, providing a tailored solution that addressed their unique challenges.

Strategy Implementation

Berkheimer’s initial assessment identified key areas where the business could optimize its tax position. They implemented a comprehensive tax strategy, covering international tax regulations, sales and use tax compliance, and efficient tax planning.

By leveraging their technology platform, Berkheimer provided real-time insights into the business's tax obligations, ensuring compliance and identifying opportunities for tax savings. The client benefited from a streamlined tax management process, saving valuable time and resources.

Results and Impact

The results of Berkheimer’s guidance were significant. The e-commerce business achieved substantial tax savings, optimizing their global tax position. By staying compliant and implementing strategic tax planning, they avoided costly penalties and streamlined their operations.

Furthermore, Berkheimer's proactive approach helped the business stay ahead of evolving tax regulations, ensuring they remained compliant and competitive in the global marketplace. The client's success story highlights the value of Berkheimer's expertise and tailored solutions.

Future Outlook and Innovations

As the tax landscape continues to evolve, Berkheimer remains at the forefront of innovation. They are committed to staying ahead of industry trends, ensuring their clients receive cutting-edge solutions. Here’s a glimpse into their future initiatives:

AI Integration: Berkheimer is exploring the integration of artificial intelligence (AI) into their tax compliance services. AI-powered solutions will enhance data analysis, providing even more accurate insights and predictions.

Blockchain Technology: With the rise of blockchain, Berkheimer is investigating its potential application in tax compliance. This technology could revolutionize record-keeping and transaction tracking, ensuring enhanced security and transparency.

Expanded Global Presence: Berkheimer plans to expand its international reach, offering its expertise to a wider global audience. This strategic expansion will enable them to support businesses operating in diverse tax jurisdictions.

Conclusion

Berkheimer Tax Administration stands as a beacon of expertise and innovation in the tax compliance industry. Their dedication to providing personalized, comprehensive solutions has solidified their position as a trusted partner for businesses and individuals. As they continue to evolve and adapt, Berkheimer remains committed to delivering exceptional results, ensuring their clients thrive in an ever-changing tax landscape.

How can Berkheimer assist businesses with international operations?

+Berkheimer’s international tax team provides comprehensive guidance on cross-border taxation. They assist businesses in navigating complex international tax regulations, ensuring compliance and optimizing tax strategies.

What sets Berkheimer apart from other tax service providers?

+Berkheimer’s client-centric approach and diverse range of expertise set them apart. Their ability to offer personalized solutions and their commitment to staying ahead of industry trends make them a trusted partner.

How does Berkheimer’s technology platform benefit clients?

+The technology platform provides real-time insights, streamlines tax management, and enhances communication. Clients can access their tax information securely and collaborate with their dedicated tax professionals efficiently.