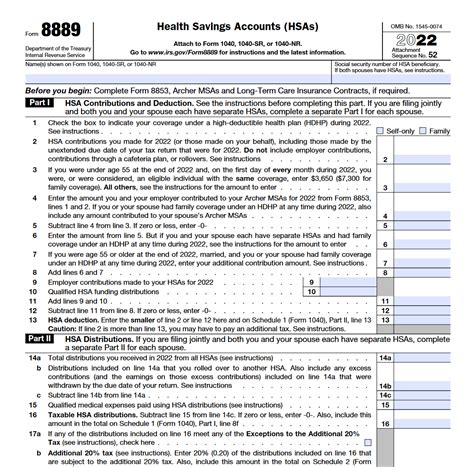

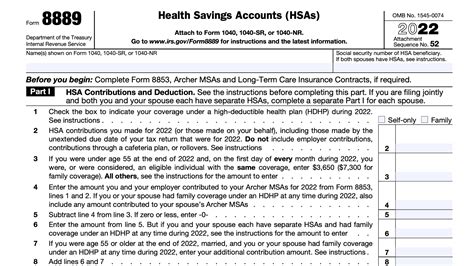

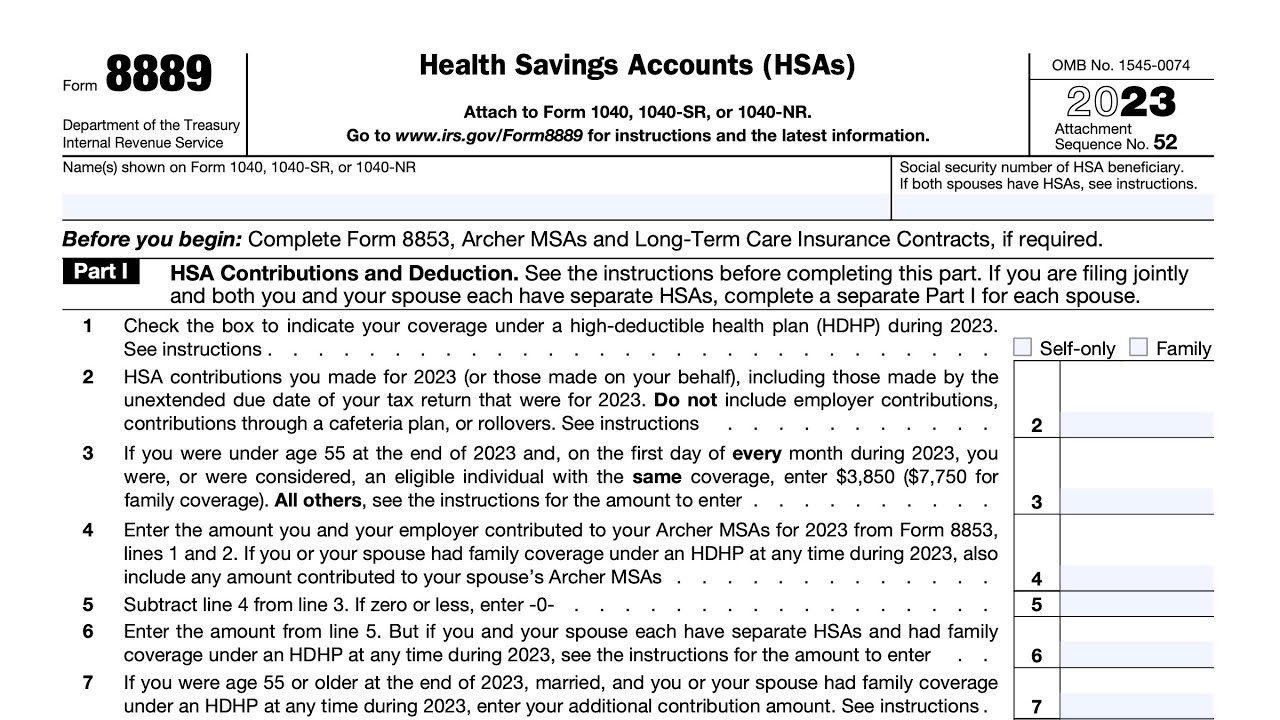

Tax Form 8889

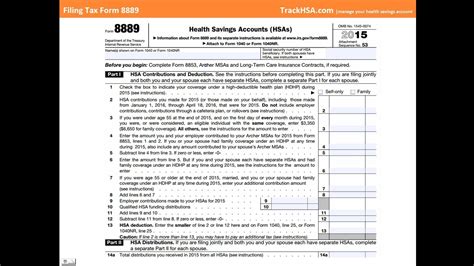

Taxes are an essential aspect of financial management, and understanding the various forms and their implications is crucial for individuals and businesses alike. Form 8889, also known as the "Health Savings Accounts (HSAs), Archer MSAs, Medicare Advantage MSAs, and Health Flexible Spending Arrangements (FSAs) Tax Worksheet," plays a vital role in reporting health-related savings and expenses for tax purposes. In this comprehensive guide, we will delve into the intricacies of Form 8889, exploring its purpose, key sections, and the impact it has on your tax obligations.

Unraveling Form 8889: A Comprehensive Guide

Form 8889 is a critical document for individuals who contribute to or receive distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), Medicare Advantage MSAs, or Health Flexible Spending Arrangements (FSAs). It serves as a comprehensive worksheet that allows taxpayers to calculate and report various aspects of their health savings and expenses, ensuring compliance with the Internal Revenue Service (IRS) regulations.

Key Sections of Form 8889

Form 8889 is divided into several sections, each addressing specific aspects of health savings and expenses. Let’s explore these sections in detail:

Section A: Health Savings Accounts (HSAs)

This section is dedicated to individuals who have established or contributed to an HSA. An HSA is a tax-advantaged savings account designed to help individuals pay for qualified medical expenses. Here, taxpayers must report their contributions, deductions, and distributions from their HSA. It’s crucial to ensure that all contributions and distributions are accurately recorded to avoid any penalties or errors in tax calculations.

For instance, consider the case of Sarah, a self-employed individual who contributes to an HSA. She must carefully record her annual contributions, ensuring they do not exceed the maximum allowed limit. Additionally, if she incurs any qualified medical expenses, she can use her HSA funds to cover them, and these distributions must be reported accurately to avoid any tax implications.

Section B: Archer Medical Savings Accounts (Archer MSAs)

Archer MSAs are similar to HSAs but are specifically designed for individuals who are self-employed and meet certain eligibility criteria. This section of Form 8889 allows taxpayers to report their contributions, deductions, and distributions from their Archer MSA. It’s essential to understand the eligibility requirements and ensure compliance with the rules to avoid any penalties.

Take the example of John, a self-employed dentist who has established an Archer MSA. He must carefully track his contributions and ensure they align with the guidelines set by the IRS. Any distributions from his Archer MSA must be used solely for qualified medical expenses, and he must maintain proper documentation to support these expenses.

Section C: Medicare Advantage MSAs

Medicare Advantage MSAs are available to individuals who participate in certain Medicare Advantage plans. This section of Form 8889 is dedicated to reporting contributions, deductions, and distributions from these accounts. It’s crucial to understand the specific rules and regulations associated with Medicare Advantage MSAs to ensure accurate reporting.

Imagine a retiree, Ms. Davis, who has enrolled in a Medicare Advantage plan with an associated MSA. She must carefully track her contributions and ensure they comply with the guidelines. Additionally, she must be aware of the eligible expenses that can be covered by her MSA funds, as any misuse of these funds could result in penalties.

Section D: Health Flexible Spending Arrangements (FSAs)

Health FSAs are employer-sponsored plans that allow employees to set aside pre-tax dollars for qualified medical expenses. This section of Form 8889 focuses on reporting contributions, deductions, and distributions from Health FSAs. It’s essential for employees to understand the limitations and eligibility criteria associated with Health FSAs to avoid any tax issues.

Consider an employee, Mr. Smith, who has enrolled in his company’s Health FSA. He must carefully review his eligible expenses and ensure that he only uses his FSA funds for qualified medical expenses. Any excess funds remaining at the end of the year may be subject to specific rules, such as rollover or grace period provisions.

| Section | Account Type | Key Focus |

|---|---|---|

| A | Health Savings Accounts (HSAs) | Contributions, deductions, and distributions |

| B | Archer Medical Savings Accounts (Archer MSAs) | Contributions, deductions, and distributions for self-employed individuals |

| C | Medicare Advantage MSAs | Contributions, deductions, and distributions for Medicare Advantage plan participants |

| D | Health Flexible Spending Arrangements (FSAs) | Contributions, deductions, and distributions for employer-sponsored plans |

The Impact of Form 8889 on Your Taxes

Form 8889 plays a significant role in determining your tax obligations when it comes to health savings and expenses. By accurately completing this form, you ensure that you receive the tax benefits associated with your health savings accounts and properly report any distributions or expenses. Here are some key considerations:

Tax Benefits and Savings

Health savings accounts, such as HSAs and Archer MSAs, offer tax advantages that can significantly reduce your overall tax liability. By contributing to these accounts, you can enjoy tax-free growth on your savings and deduct contributions from your taxable income. Form 8889 helps you calculate and claim these deductions accurately.

For example, if you contribute the maximum amount to your HSA, you can potentially save a substantial sum in taxes, especially if you fall into a higher tax bracket. This tax-free growth can accumulate over time, providing a significant financial advantage.

Penalty Avoidance

Accurate reporting on Form 8889 is crucial to avoid penalties. Misreporting or failing to report distributions or contributions can result in penalties imposed by the IRS. These penalties can be costly and may include additional taxes, interest, and even criminal charges in severe cases.

It’s essential to understand the rules and regulations associated with each account type and ensure that you are in compliance. Seeking professional tax advice can help you navigate these complexities and avoid any potential penalties.

Simplifying Tax Preparation

Form 8889 serves as a comprehensive guide for taxpayers, simplifying the process of reporting health savings and expenses. By having all the necessary information in one place, taxpayers can efficiently complete their tax returns and ensure accuracy. This form streamlines the tax preparation process, reducing the likelihood of errors and making it easier to manage your tax obligations.

Best Practices for Completing Form 8889

To ensure a smooth and accurate completion of Form 8889, consider the following best practices:

- Gather all relevant documentation: Collect statements, receipts, and records related to your health savings accounts and expenses. This ensures that you have the necessary information to complete the form accurately.

- Understand eligibility criteria: Familiarize yourself with the eligibility requirements for each account type. This knowledge will help you determine if you are eligible to contribute or receive distributions, avoiding any potential mistakes.

- Stay updated with IRS guidelines: The IRS regularly updates its guidelines and regulations. Stay informed about any changes or updates to ensure compliance and avoid any surprises during tax season.

- Seek professional advice: If you have complex financial situations or are unsure about any aspect of Form 8889, consult with a tax professional. They can provide personalized guidance and ensure that you are on the right track.

- Double-check your calculations: Accuracy is crucial when dealing with tax forms. Double-check your calculations and ensure that all figures are correct. Small errors can have significant consequences, so take the time to review your work.

Conclusion: Empowering Taxpayers with Knowledge

Form 8889 is a powerful tool that empowers taxpayers to navigate the complexities of health savings and expenses. By understanding the purpose and intricacies of this form, individuals can maximize their tax benefits, avoid penalties, and simplify their tax preparation process. Whether you have an HSA, Archer MSA, Medicare Advantage MSA, or Health FSA, accurate reporting is essential for a stress-free tax season.

Stay informed, consult professionals when needed, and embrace the advantages that health savings accounts offer. With careful planning and attention to detail, you can make the most of your health savings and navigate the tax landscape with confidence.

What is the maximum contribution limit for an HSA in 2023?

+

The maximum contribution limit for an HSA in 2023 is 3,750 for individuals with self-only coverage and 7,500 for individuals with family coverage. These limits may be subject to adjustments for inflation in future years.

Can I contribute to both an HSA and an Archer MSA in the same year?

+

No, you cannot contribute to both an HSA and an Archer MSA in the same year. These accounts are mutually exclusive, and individuals must choose one or the other based on their eligibility.

Are there any age restrictions for opening an HSA?

+

No, there are no age restrictions for opening an HSA. Individuals of any age can establish an HSA as long as they meet the eligibility criteria, which includes having a high-deductible health plan (HDHP) and not being covered by certain other types of insurance.

Can I use my HSA funds to pay for over-the-counter medications?

+

Yes, you can use your HSA funds to pay for eligible over-the-counter medications. However, it’s important to keep in mind that certain items, such as sleeping aids and vitamins, may not be considered eligible expenses. It’s recommended to consult the IRS guidelines or seek professional advice to ensure compliance.

What happens if I exceed the contribution limits for my HSA or Archer MSA?

+

Exceeding the contribution limits for an HSA or Archer MSA can result in penalties and additional taxes. It’s crucial to stay within the allowed limits to avoid any financial repercussions. If you realize you’ve exceeded the limit, consult with a tax professional to understand your options and potential penalties.