Columbus Ohio Income Tax

Columbus, Ohio, is a vibrant city known for its diverse economy, vibrant culture, and growing population. As residents and businesses thrive in this bustling metropolis, understanding the intricacies of its tax system becomes crucial. The income tax landscape in Columbus is an essential aspect to explore, as it directly impacts the financial well-being of individuals and the city's overall economic health.

Unraveling the Columbus Income Tax Structure

Columbus, like many other cities in the United States, imposes an income tax on its residents and businesses. This tax is a vital source of revenue for the city, contributing to the development and maintenance of various public services and infrastructure. Let’s delve into the specifics of the Columbus income tax system.

Resident and Non-Resident Tax Rates

The Columbus income tax is divided into two categories: resident and non-resident rates. Residents of Columbus are subject to a higher tax rate compared to non-residents. As of [insert current year], the resident tax rate stands at 2.5%, while non-residents pay a 1.5% income tax rate. This differentiation ensures that those who benefit from the city’s amenities and services contribute accordingly.

| Tax Category | Tax Rate |

|---|---|

| Resident | 2.5% |

| Non-Resident | 1.5% |

It's important to note that the resident tax rate applies to individuals who reside within the city limits of Columbus and maintain their primary residence there. Non-residents, on the other hand, include individuals who work within the city but reside outside its boundaries.

Income Tax Exemptions and Credits

Columbus offers certain exemptions and credits to alleviate the tax burden on its residents. These incentives aim to promote economic growth and support individuals with varying financial circumstances. Here’s an overview of some key exemptions and credits:

- Retirement Income Exemption: Residents who meet specific age and income requirements can benefit from an exemption on their retirement income. This exemption encourages individuals to plan for their retirement and ensures a portion of their income remains tax-free.

- Military Service Exemption: Active-duty military personnel stationed in Columbus are eligible for an income tax exemption. This gesture of appreciation recognizes the sacrifices made by our armed forces.

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit designed to provide relief to low- and moderate-income workers. Eligible individuals can receive a credit, reducing their tax liability or even resulting in a refund.

- Education Tax Credit: Columbus encourages education by offering a tax credit for qualified education expenses. Residents can claim a portion of their tuition, books, and other educational costs, making higher education more accessible.

Taxable Income and Filing Requirements

Understanding what constitutes taxable income is crucial for Columbus residents and businesses. The income tax applies to various sources, including wages, salaries, bonuses, commissions, self-employment income, and certain types of investment earnings. It’s essential to keep accurate records and comply with filing requirements to avoid penalties.

The Columbus Income Tax Division provides comprehensive guidelines and resources to assist taxpayers in understanding their obligations. They offer online tools, such as tax calculators and filing instructions, to simplify the process. Additionally, the division organizes informational workshops and outreach programs to ensure residents are well-informed about their tax responsibilities.

Economic Impact and City Development

The income tax revenue generated in Columbus plays a pivotal role in funding essential city services and infrastructure projects. It contributes to the maintenance and improvement of roads, public transportation, parks, and recreational facilities. Moreover, the tax revenue supports vital social services, including healthcare, education, and public safety initiatives.

The city's commitment to fiscal responsibility and strategic investment has led to notable economic growth. Columbus has experienced a boom in various industries, such as technology, healthcare, and logistics, attracting businesses and creating job opportunities. The income tax system, coupled with a business-friendly environment, has positioned Columbus as a desirable location for both established companies and startups.

Columbus: A City of Opportunity and Progress

Columbus, Ohio, continues to evolve and thrive, offering a unique blend of urban vibrancy and a strong sense of community. The city’s income tax system, while an essential component of its economic framework, is designed to support its residents and drive growth. As Columbus moves forward, its commitment to fiscal responsibility and strategic investment will undoubtedly shape its future trajectory.

Stay tuned for updates and further insights into the dynamic world of Columbus' tax landscape and its impact on the city's growth and prosperity.

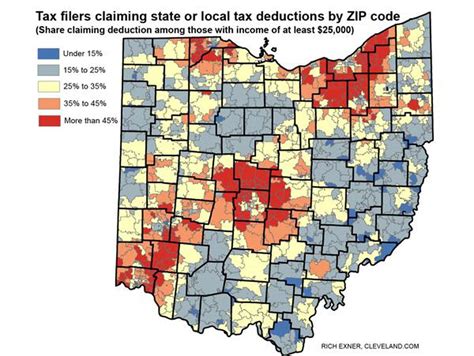

How does Columbus’ income tax compare to other major cities in Ohio?

+Columbus’ income tax rate is slightly higher than some neighboring cities in Ohio. For instance, Cleveland’s resident tax rate is 2.25%, while Cincinnati’s is 2.1%. However, Columbus’ rate remains competitive and aligns with its commitment to providing excellent public services.

Are there any tax incentives for businesses operating in Columbus?

+Yes, Columbus offers various tax incentives to attract and support businesses. These include tax abatements, job creation credits, and research and development credits. The city actively promotes economic development and encourages businesses to invest in the community.

What are the filing deadlines for Columbus income tax returns?

+The filing deadline for Columbus income tax returns aligns with the federal and state tax deadlines. Residents and businesses must file their returns by April 15th each year. However, it’s advisable to check for any potential extensions or updates on the Columbus Income Tax Division’s website.