Cyprus Income Tax Rates 2025

The income tax system in Cyprus is a fundamental aspect of the country's financial landscape, and its intricacies are of great interest to both residents and international investors. With an evolving tax landscape, understanding the income tax rates for the upcoming year, 2025, is crucial for effective financial planning.

Overview of Cyprus’ Progressive Income Tax Structure

Cyprus operates on a progressive income tax system, which means that the tax rate an individual pays is dependent on their income level. This system ensures that higher-income earners contribute a larger proportion of their income to the government, promoting fairness and equality. The income tax rates for the year 2025 are expected to follow a similar structure, with adjustments made to account for inflation and economic growth.

Income Tax Rates for 2025: A Detailed Breakdown

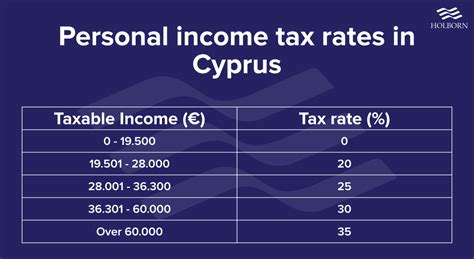

The following table provides a comprehensive overview of the projected income tax rates for Cyprus in 2025, along with the corresponding income brackets.

| Income Bracket (EUR) | Tax Rate (%) |

|---|---|

| Up to 19,500 | 0 |

| 19,501 - 28,000 | 20 |

| 28,001 - 36,300 | 25 |

| 36,301 - 60,000 | 30 |

| Above 60,000 | 35 |

It's important to note that these rates are subject to change and are based on current economic projections. The Cypriot government may adjust these rates to accommodate economic fluctuations, so it's advisable to refer to official sources for the most up-to-date information.

Tax Exemptions and Deductions: Maximizing Your Income

Cyprus offers a range of tax exemptions and deductions that can significantly reduce an individual’s taxable income. These include personal allowances, pension contributions, and expenses related to employment, such as travel and professional development.

For instance, individuals are entitled to a personal allowance of €1,950, which is deducted from their taxable income. Additionally, contributions to approved pension schemes are exempt from taxation up to a certain limit. By understanding and utilizing these exemptions, individuals can effectively minimize their tax liabilities.

The Impact of Cyprus’ Attractive Tax Environment

Cyprus has long been recognized as a favorable jurisdiction for businesses and high-net-worth individuals due to its competitive tax rates and various incentives. The country’s income tax rates are significantly lower than many other European countries, making it an attractive destination for investment and business establishment.

Furthermore, Cyprus offers a range of tax incentives, such as the Special Contribution for the Defence of the Republic, which is currently set at 3% for individuals. This contribution is a unique feature of the Cypriot tax system and is applied to taxable income above a certain threshold.

Conclusion: Planning for 2025 and Beyond

As we anticipate the income tax rates for 2025, it’s evident that Cyprus continues to offer a stable and competitive tax environment. The country’s progressive income tax system ensures fairness, while the various exemptions and incentives provide opportunities for individuals and businesses to optimize their financial strategies.

Stay informed about the latest developments in Cyprus' tax landscape to ensure that your financial planning remains up-to-date and aligned with the country's economic trajectory. By doing so, you can make the most of the opportunities presented by Cyprus' attractive tax system.

What is the personal allowance in Cyprus for 2025?

+

The personal allowance, which is a tax-free threshold, is expected to remain at €1,950 for the year 2025. This means that individuals can earn up to this amount without paying any income tax.

Are there any special tax rates for specific industries in Cyprus?

+

Yes, Cyprus offers a range of tax incentives and special rates for specific sectors. For instance, the gaming industry enjoys a reduced corporate tax rate of 12.5%, making it an attractive jurisdiction for gaming companies.

How does Cyprus’ tax system compare to other European countries?

+

Cyprus’ income tax rates are generally lower than many other European countries, making it a favorable destination for businesses and individuals seeking a competitive tax environment. However, it’s important to consider the overall tax landscape, including corporate and property taxes, when comparing jurisdictions.

What are the key tax deadlines for individuals in Cyprus?

+

The deadline for submitting income tax returns in Cyprus is typically 31 July. However, it’s advisable to refer to official sources for the most accurate and up-to-date information on tax deadlines, as these may vary slightly from year to year.