Tax Preparation Jobs

Tax preparation is an essential service that millions of individuals and businesses rely on each year. As tax seasons come and go, the demand for tax preparers fluctuates, creating a unique and challenging job market. In this article, we will delve into the world of tax preparation jobs, exploring the various roles, qualifications, and opportunities available in this dynamic industry.

The Tax Preparation Landscape

Tax preparation is a crucial process that ensures compliance with tax laws and regulations. It involves the accurate calculation and filing of taxes for individuals, businesses, and other entities. The complexity of tax systems and the ever-changing tax codes make tax preparation a specialized field, attracting professionals with diverse skill sets.

The tax preparation industry is characterized by seasonal peaks and troughs. While the peak season typically falls between January and April, tax preparers often stay busy throughout the year, assisting clients with tax planning, audits, and other related services.

Roles in Tax Preparation

The tax preparation industry offers a range of job roles, each requiring a unique set of skills and qualifications. Here are some of the key positions:

Tax Preparer

Tax preparers are the backbone of the industry. They work directly with clients, gathering financial information, calculating taxes, and preparing tax returns. Tax preparers must possess strong mathematical and analytical skills, as well as a deep understanding of tax laws and regulations.

To become a tax preparer, individuals typically need to complete tax preparation courses or obtain relevant certifications. These programs cover topics such as tax code interpretation, filing requirements, and ethical practices. Some tax preparers also specialize in specific areas, such as small business taxes or estate planning.

| Key Skills | Certifications |

|---|---|

| Analytical Thinking | Enrolled Agent (EA) |

| Attention to Detail | Certified Public Accountant (CPA) |

| Communication | Registered Tax Return Preparer (RTRP) |

| Time Management | Accredited Tax Advisor (ATA) |

Tax Accountant

Tax accountants take on a more advanced role, providing comprehensive tax planning and advisory services. They work closely with clients to optimize their tax strategies, ensure compliance, and identify potential tax savings opportunities.

To become a tax accountant, individuals usually pursue a bachelor's or master's degree in accounting or a related field. Additionally, obtaining a Certified Public Accountant (CPA) license is highly advantageous, as it opens up a wide range of career paths in accounting and finance.

Tax Manager

Tax managers are responsible for overseeing the tax operations of a company or organization. They lead a team of tax professionals, ensuring accurate and timely tax filings, as well as developing and implementing tax strategies.

Tax managers typically have extensive experience in tax preparation and accounting. They possess strong leadership skills and a deep understanding of tax regulations and corporate tax structures. A CPA license is often a requirement for this senior-level position.

Tax Auditor

Tax auditors play a crucial role in maintaining tax compliance. They examine tax returns and financial records to ensure accuracy and identify any potential issues or discrepancies. Tax auditors work for government agencies or private firms, conducting audits and investigations.

A background in accounting or finance, coupled with specialized training in tax auditing, is essential for tax auditors. They must have a keen eye for detail and possess excellent analytical skills to detect potential tax fraud or errors.

Qualifications and Education

The qualifications and educational requirements for tax preparation jobs vary depending on the role and the organization. Here are some key considerations:

Education

- Tax Preparer: While a degree is not always necessary, completing tax preparation courses or obtaining certifications is highly recommended. These programs provide a solid foundation in tax laws and regulations.

- Tax Accountant: A bachelor’s degree in accounting or a related field is typically required. Some employers may prefer candidates with a master’s degree in accounting or taxation.

- Tax Manager: A bachelor’s degree is the minimum requirement, but most tax managers possess a master’s degree or a CPA license. Extensive experience in tax preparation and accounting is crucial.

- Tax Auditor: A bachelor’s degree in accounting, finance, or a related field is common. Additional training in tax auditing or forensic accounting can be advantageous.

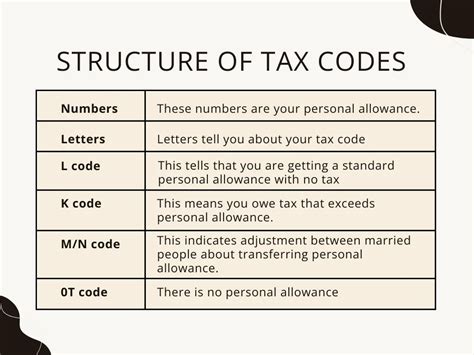

Certifications

Certifications are highly valued in the tax preparation industry. They demonstrate a professional’s expertise and commitment to continuous learning. Some popular certifications include:

- Enrolled Agent (EA) - EAs are licensed by the IRS to represent taxpayers in all matters related to the IRS.

- Certified Public Accountant (CPA) - CPAs are highly respected professionals with a broad range of accounting and tax expertise.

- Registered Tax Return Preparer (RTRP) - This certification is for tax preparers who want to establish their credentials and demonstrate their knowledge.

- Accredited Tax Advisor (ATA) - The ATA certification focuses on advanced tax planning and advisory skills.

Opportunities and Career Growth

The tax preparation industry offers a wealth of opportunities for professionals at various career stages. Here are some potential paths:

Independent Tax Preparer

Many tax preparers choose to work independently, establishing their own tax preparation businesses. This path allows for flexibility and the opportunity to build a client base and reputation. Independent tax preparers can specialize in specific tax areas and cater to niche markets.

Tax Preparation Firms

Joining a tax preparation firm provides access to a broader range of resources and opportunities. Firms often offer training programs, mentorship, and a supportive environment for professional growth. Working in a firm can lead to promotions and advancement into senior roles such as tax manager or partner.

Corporate Tax Departments

Large corporations and organizations often have dedicated tax departments. Working in a corporate tax department offers stability and the chance to work on complex tax matters. Tax professionals in these roles contribute to strategic tax planning and ensure compliance for the entire organization.

Government Agencies

Government agencies, such as the IRS, employ tax professionals to enforce tax laws and conduct audits. Working for a government agency provides a unique opportunity to contribute to tax administration and ensure fairness and compliance.

The Future of Tax Preparation Jobs

The tax preparation industry is constantly evolving, driven by technological advancements and changing tax regulations. Here are some key trends and considerations for the future:

Technology Integration

Tax preparation software and automation are transforming the industry. Tax professionals must embrace technology to stay competitive and efficient. The use of data analytics and artificial intelligence is expected to grow, enhancing tax preparation processes and improving accuracy.

Continuous Learning

With the complexity of tax laws and frequent updates, tax professionals must commit to lifelong learning. Staying up-to-date with tax regulations and advancements is crucial for career growth and success. Continuous learning ensures that tax preparers can provide accurate and reliable services to their clients.

Specialization and Niche Markets

As the tax landscape becomes more complex, specialization in specific tax areas is becoming increasingly valuable. Tax professionals can differentiate themselves by focusing on niche markets, such as international taxation, estate planning, or tax litigation. Specialization allows for deeper expertise and a competitive edge in the job market.

Remote Work and Flexibility

The COVID-19 pandemic has accelerated the trend of remote work in the tax preparation industry. Many tax professionals have embraced remote collaboration tools and online tax preparation platforms. This shift towards remote work offers increased flexibility and opens up opportunities for professionals across the globe.

How can I get started in the tax preparation industry?

+To begin a career in tax preparation, consider completing tax preparation courses or obtaining relevant certifications. These provide a solid foundation in tax laws and regulations. Building a strong network and gaining practical experience through internships or entry-level positions can also be beneficial.

What are the earnings prospects in the tax preparation industry?

+Earnings in the tax preparation industry can vary widely depending on factors such as experience, location, and specialization. Entry-level tax preparers may start with moderate earnings, while experienced professionals with advanced certifications can command higher salaries. Building a successful career in tax preparation often involves developing a strong client base and establishing a reputation for expertise.

Are there opportunities for remote work in tax preparation?

+Yes, the tax preparation industry has embraced remote work, particularly since the COVID-19 pandemic. Many tax professionals now offer remote services, utilizing online platforms and collaboration tools. Remote work provides flexibility and opens up opportunities for professionals to work with clients from different locations.