Nc Sales Tax Rate

Understanding the sales tax landscape in the state of North Carolina is essential for businesses and consumers alike. The sales tax rate is a crucial component of the state's revenue generation and is subject to various regulations and guidelines. This comprehensive guide will delve into the specifics of the NC Sales Tax Rate, exploring its structure, applicability, and potential impacts.

The Structure of NC Sales Tax

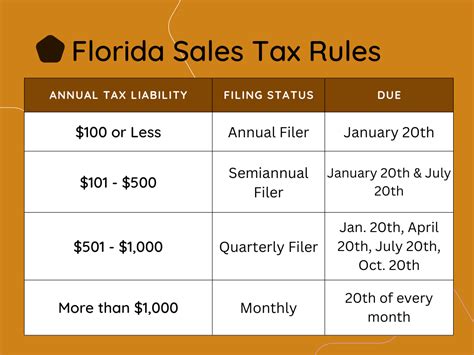

The sales tax in North Carolina operates on a state-wide level, with a unified rate applicable across the state. This ensures consistency and simplifies compliance for businesses operating in multiple regions within North Carolina. As of my last update in January 2023, the NC Sales Tax Rate stood at 4.75%. However, it’s important to note that this base rate can be subject to change, so staying informed about any updates is crucial.

Additionally, it's worth mentioning that North Carolina allows for local sales tax rates to be imposed on top of the state rate. These local sales tax rates vary by county and municipality, with some areas having additional sales tax rates as high as 2.5%. This means that the sales tax rate a consumer pays can vary depending on their location within the state.

Breakdown of the NC Sales Tax Rate

The NC Sales Tax Rate is composed of several components, each serving a specific purpose in the state’s tax structure.

| Component | Rate |

|---|---|

| State Sales Tax | 4.75% |

| Local Sales Tax (Average) | 2.5% |

| Total Average Rate | 7.25% |

The State Sales Tax is a uniform rate applicable across North Carolina and forms the foundation of the state's sales tax system. The Local Sales Tax, on the other hand, is imposed by individual counties and municipalities and can vary significantly, as mentioned earlier. This local rate is added to the state rate, resulting in a Total Average Rate that consumers often encounter during their purchases.

Applicability of NC Sales Tax

The NC Sales Tax is applicable to a wide range of goods and services, encompassing most retail transactions within the state. However, it’s important to note that certain items are exempt from sales tax, and understanding these exemptions is vital for both businesses and consumers.

Taxable Goods and Services

The list of taxable goods and services in North Carolina is extensive and includes everyday items like groceries, clothing, electronics, and more. Additionally, certain services such as repair and maintenance, entertainment, and certain professional services are also subject to sales tax.

For instance, when a consumer purchases a new smartphone, the sales tax is applied to the total cost of the device, including any accessories and applicable fees. Similarly, when dining out at a restaurant, the sales tax is added to the bill, covering both the food and any beverages consumed.

Exemptions and Special Cases

While the NC Sales Tax has a broad reach, there are specific items and scenarios where sales tax is not applicable. These exemptions can vary and often depend on the nature of the item or the intended use.

- Food and Beverage Exemptions: Certain food items, such as unprepared groceries and non-alcoholic beverages, are exempt from sales tax in North Carolina. However, prepared foods and meals are generally taxable.

- Educational and Medical Supplies: Items specifically designed for educational or medical purposes may be exempt from sales tax, provided they are intended for use in those respective fields.

- Manufacturing and Resale: Goods purchased for manufacturing or resale purposes are often exempt from sales tax, as they are considered part of the production or distribution chain.

It's important for businesses to stay informed about these exemptions to ensure they are not overcharging their customers and to avoid potential compliance issues.

Impact of NC Sales Tax on Businesses and Consumers

The NC Sales Tax rate has a significant impact on both businesses and consumers within the state. Understanding these impacts can provide valuable insights into the economic landscape and consumer behavior.

Impact on Businesses

For businesses operating in North Carolina, the sales tax rate plays a crucial role in their pricing strategies and overall profitability. Here are some key considerations:

- Pricing Strategies: Businesses often factor in the sales tax rate when setting their prices. This ensures that the post-tax price aligns with their desired profit margins and competitive positioning.

- Compliance and Reporting: Collecting and remitting sales tax accurately is a legal obligation for businesses. Failure to comply can result in penalties and legal repercussions.

- Impact on Margins: The sales tax rate directly affects the margin businesses can retain on each sale. A higher sales tax rate can squeeze margins, especially for businesses operating on tight profit margins.

To navigate these challenges, businesses often employ sales tax software and tools to automate compliance and reporting processes, ensuring accuracy and efficiency.

Impact on Consumers

Consumers in North Carolina bear the brunt of the sales tax rate through the prices they pay for goods and services. Here’s how the sales tax rate can influence consumer behavior and spending patterns:

- Price Sensitivity: A higher sales tax rate can make consumers more price-conscious, leading them to seek out discounts, sales, and tax-free shopping opportunities.

- Online Shopping: With the convenience of online shopping, consumers may opt to purchase items from out-of-state retailers to avoid sales tax or take advantage of tax-free days or events.

- Budgeting and Planning: Understanding the sales tax rate can help consumers budget effectively and plan their purchases accordingly, especially for larger-ticket items.

Businesses often leverage these consumer behaviors by offering tax-inclusive pricing, highlighting tax-free days, and providing incentives to encourage in-state purchases.

Conclusion: Staying Informed and Adaptable

The NC Sales Tax Rate is a dynamic component of North Carolina’s economic landscape, and staying informed about any changes or updates is essential for both businesses and consumers. By understanding the structure, applicability, and impacts of the sales tax rate, individuals and businesses can make informed decisions and navigate the state’s tax system effectively.

As the state's economy continues to evolve, so too will its sales tax policies. Staying adaptable and proactive in response to these changes will be key to success for businesses and a smooth consumer experience for all North Carolinians.

How often does the NC Sales Tax Rate change?

+The NC Sales Tax Rate can change annually or even more frequently. It is typically adjusted based on economic factors and legislative decisions. It is essential to stay updated with the latest tax rates to ensure compliance and accurate pricing.

Are there any online resources to check the current NC Sales Tax Rate?

+Yes, you can find the most up-to-date information on the North Carolina Department of Revenue website. They provide official guidelines and rate updates, ensuring businesses and consumers have access to accurate tax information.

How can businesses ensure they are collecting the correct sales tax rate?

+Businesses can utilize sales tax software or consult with tax professionals to ensure they are collecting the correct sales tax rate. These tools and experts can help navigate the complex tax landscape and ensure compliance with local and state regulations.