Prince William Property Tax

Property tax is an essential aspect of local government finances, providing a significant revenue stream for essential public services and infrastructure development. The Prince William County, located in the state of Virginia, has a robust property tax system in place, and this article aims to delve into the specifics of Prince William property tax, offering an in-depth analysis of the rates, assessments, exemptions, and their impact on the community.

Understanding Prince William County’s Property Tax System

The Prince William County, with its vibrant communities and diverse population, relies on a well-structured property tax system to fund critical services such as education, public safety, and infrastructure maintenance. The tax rate and assessment process are designed to ensure fairness and transparency, contributing to the overall prosperity of the county.

Property Tax Rates and Assessments

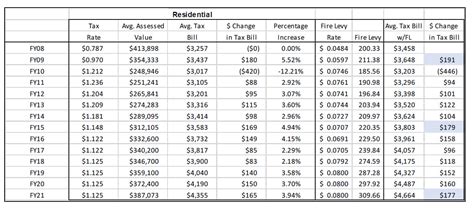

The property tax rate in Prince William County is determined annually by the Board of Supervisors. This rate is applied to the assessed value of each property, which is conducted by the county’s Department of Land Records and Real Estate Assessments. The assessment process involves evaluating properties based on factors such as location, size, improvements, and recent sales data of comparable properties.

As of the latest available data, the Prince William County property tax rate stands at 1.065 per 100 of assessed value. This rate is relatively competitive compared to other counties in Virginia, striking a balance between generating sufficient revenue and maintaining affordability for property owners.

| Tax Rate | Assessment Date |

|---|---|

| $1.065 per $100 | January 1st, annually |

The assessed value of a property is subject to change every year, reflecting market conditions and improvements made to the property. Property owners have the right to appeal their assessments if they believe the value is inaccurate. The appeals process is overseen by the Prince William County Board of Equalization, ensuring a fair and impartial review.

Property Tax Exemptions and Credits

Prince William County offers various property tax exemptions and credits to eligible homeowners, providing financial relief and promoting homeownership. These exemptions and credits include:

- Homestead Exemption: This exemption reduces the assessed value of a primary residence by $25,000, resulting in a lower tax bill. It is available to all homeowners who use the property as their primary residence.

- Senior Citizen Tax Relief: Property owners aged 65 and older may qualify for a reduction in their property taxes. The relief is based on income and property value, offering a maximum benefit of $750.

- Disabled Veterans Exemption: Certain disabled veterans and their surviving spouses are eligible for a full or partial exemption from property taxes. The exemption is applied to the assessed value of the primary residence.

- Land Preservation Tax Credit: Property owners who voluntarily place their land under a conservation easement may qualify for a tax credit. This credit aims to encourage the preservation of open spaces and natural habitats.

These exemptions and credits contribute to the overall financial well-being of the community, especially for vulnerable populations such as seniors and veterans. They also promote the conservation of natural resources, enhancing the quality of life in Prince William County.

The Impact of Property Taxes on Prince William County

Property taxes play a pivotal role in shaping the economic landscape and overall development of Prince William County. The revenue generated from these taxes funds essential services, infrastructure projects, and community initiatives, directly impacting the quality of life for residents.

Funding Essential Services

The majority of property tax revenue is allocated to funding critical services such as:

- Education: A significant portion of property taxes goes towards supporting public schools, ensuring that students receive a quality education. This includes funding for teachers, resources, and school infrastructure.

- Public Safety: Property taxes contribute to maintaining a robust public safety system, including police, fire, and emergency medical services. These services are vital for the safety and well-being of the community.

- Infrastructure: Property taxes are used to maintain and improve roads, bridges, and other public infrastructure. Well-maintained infrastructure enhances mobility and connectivity within the county.

- Social Services: These taxes also support social services programs, providing assistance to vulnerable populations such as low-income families, the elderly, and individuals with disabilities.

Community Development and Initiatives

Beyond essential services, property tax revenue is directed towards various community development initiatives, such as:

- Economic Development: The county utilizes property tax funds to attract businesses and create job opportunities, fostering economic growth and prosperity.

- Recreational Facilities: Funds are allocated for the construction and maintenance of parks, recreational centers, and sports facilities, promoting an active and healthy lifestyle for residents.

- Cultural Programs: Property taxes support cultural events, arts programs, and historical preservation efforts, enriching the cultural fabric of the community.

- Environmental Conservation: A portion of the revenue is dedicated to environmental initiatives, including conservation efforts, waste management, and sustainable development practices.

Future Outlook and Considerations

As Prince William County continues to grow and evolve, the property tax system will need to adapt to meet the changing needs of the community. Here are some key considerations for the future:

Sustainable Revenue Sources

The county should explore additional revenue streams to complement property taxes, ensuring a diversified and sustainable financial base. This could include exploring options such as:

- Expanding the commercial tax base by attracting more businesses and industries.

- Implementing user fees for certain services to reduce the burden on property owners.

- Leveraging grants and federal funding for specific projects and initiatives.

Equitable Tax Policy

Maintaining an equitable tax policy is crucial to ensure that the tax burden is distributed fairly across different segments of the population. This involves regularly reviewing and adjusting tax rates, assessments, and exemptions to reflect market conditions and community needs.

Technology and Data-Driven Assessments

Adopting advanced technologies and data analytics can enhance the accuracy and efficiency of property assessments. This approach can help identify under-assessed properties, ensure fairness, and optimize revenue collection.

Community Engagement

Engaging with the community is essential for a transparent and accountable property tax system. The county should actively involve residents in discussions and decision-making processes related to tax policies, assessments, and budget allocations.

Conclusion

Prince William County’s property tax system is a vital component of the local economy, funding essential services and contributing to the overall well-being of the community. With a balanced tax rate, fair assessment process, and targeted exemptions, the county ensures that property taxes are a stable and equitable source of revenue. As the county continues to grow and evolve, a forward-thinking approach to property taxation will be crucial to meet the changing needs and expectations of its residents.

How are property taxes calculated in Prince William County?

+Property taxes are calculated by multiplying the assessed value of a property by the tax rate. The assessed value is determined by the Department of Land Records and Real Estate Assessments, taking into account various factors such as location, size, and improvements. The tax rate is set annually by the Board of Supervisors and is applied uniformly to all properties.

What is the process for appealing a property assessment in Prince William County?

+Property owners who wish to appeal their assessment must first submit a written request to the Department of Land Records and Real Estate Assessments. The request should include specific reasons for the appeal and any supporting documentation. The appeal is then reviewed by the Board of Equalization, which may schedule a hearing to gather additional information. The Board’s decision is final and binding.

Are there any property tax relief programs for low-income homeowners in Prince William County?

+Yes, Prince William County offers the Property Tax Relief Program for low-income homeowners. To qualify, homeowners must meet certain income and asset limits. The program provides a credit against property taxes, reducing the overall tax liability. Applications are typically accepted in the spring, and eligible homeowners must reapply each year to continue receiving the benefit.