Free Tax Filing For Veterans

Tax season can be a challenging time for many individuals, especially for those who have served our country and may face unique financial circumstances. Fortunately, veterans have access to several resources and programs that can make tax filing easier and, in some cases, even free of charge. This comprehensive guide will explore the various avenues available to veterans for free tax filing, ensuring they receive the support they deserve.

Understanding Free Tax Filing Options for Veterans

Veterans, active-duty military personnel, and their families often have access to a range of financial benefits and services, including tax assistance. While many veterans are eligible for free tax preparation and filing services, it’s crucial to understand the different options available to ensure a smooth and stress-free process.

The Internal Revenue Service (IRS) and various nonprofit organizations offer free tax preparation and filing services to qualifying individuals, including veterans. These services are designed to assist taxpayers with limited income, the disabled, and the elderly, ensuring they can navigate the complex tax system with ease.

IRS Free File Program

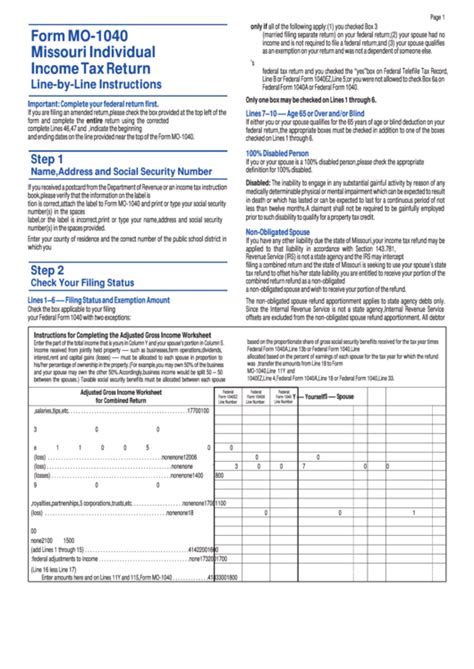

The IRS Free File Program is a partnership between the IRS and various tax software companies. This program allows eligible taxpayers to prepare and file their federal tax returns online for free. Veterans and their spouses can take advantage of this program if their adjusted gross income is typically $73,000 or less.

The IRS Free File Program offers a user-friendly interface, guiding taxpayers through the filing process step by step. It provides a secure and confidential way to complete tax returns, ensuring veterans can claim their rightful deductions and credits without incurring any costs.

Voluntary Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE)

The IRS also sponsors the VITA and TCE programs, which provide free tax help to individuals who earn $58,000 or less annually. These programs offer in-person assistance, making them particularly beneficial for veterans who may prefer face-to-face interactions or require additional support.

VITA sites are typically located in community centers, libraries, and other convenient locations. Volunteers, many of whom are trained and certified by the IRS, provide free basic tax return preparation services. They can help veterans understand and claim various tax benefits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit.

TCE sites focus on providing tax counseling and return preparation for taxpayers aged 60 and above. These sites are often staffed by experienced volunteers who can assist veterans with unique financial situations and ensure they receive the credits and deductions they are entitled to.

Military OneSource

Military OneSource is a valuable resource for active-duty military members, National Guard and Reserve members, and their families. This program offers a range of services, including tax preparation and filing assistance.

Through Military OneSource, veterans can access free tax preparation and e-filing services provided by certified tax consultants. These professionals are well-versed in military-specific tax issues, ensuring veterans receive accurate and personalized guidance. The program also offers a toll-free phone number and online resources to address any tax-related questions.

| Resource | Description |

|---|---|

| IRS Free File Program | Online tax preparation and filing for eligible taxpayers with an AGI of $73,000 or less. |

| VITA and TCE Programs | In-person tax assistance for individuals earning $58,000 or less, with a focus on basic tax return preparation. |

| Military OneSource | Free tax preparation and e-filing services, along with tax-related support, for military personnel and their families. |

Tax Benefits Specifically for Veterans

Veterans may be eligible for various tax benefits that can significantly reduce their tax liability. Understanding these benefits is crucial to maximizing their financial advantages during tax season.

Veterans Disability Compensation

Veterans who receive disability compensation from the Department of Veterans Affairs (VA) may be exempt from paying federal income tax on this income. This benefit applies to veterans with service-connected disabilities and those receiving compensation for disabilities incurred during their military service.

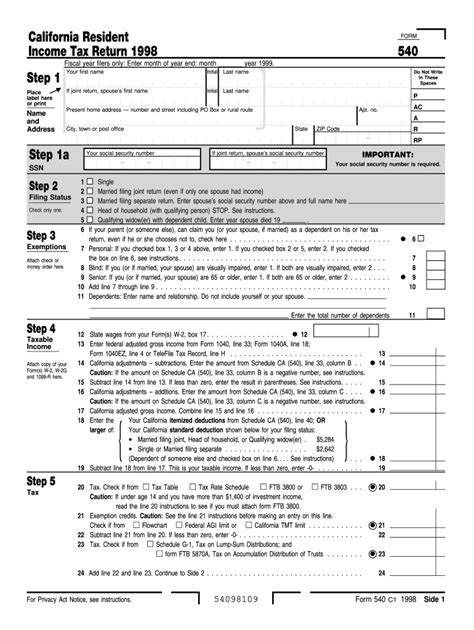

To claim this exemption, veterans must complete Form 1040 and attach a statement explaining their disability status. It's essential to consult with a tax professional or the VA to ensure compliance with the necessary requirements.

Veterans Pension

Veterans who meet specific income and asset limits may be eligible for a VA pension. This pension provides monthly payments to veterans who served during wartime and are in need of financial assistance. The income from this pension is typically tax-free, allowing veterans to maintain a stable financial situation.

Veterans receiving the VA pension should carefully review their tax forms and consult with tax experts to ensure they are not taxed on this income.

Educational Benefits

Veterans who have utilized educational benefits, such as the Post-9⁄11 GI Bill or the Montgomery GI Bill, may be eligible for tax-free tuition assistance. This benefit allows veterans to pursue higher education without the added burden of paying taxes on their educational expenses.

Veterans should carefully review their financial aid packages and consult with their educational institution's financial aid office to understand the tax implications of their educational benefits.

Mortgage Relief

Veterans who have taken advantage of the VA home loan program may be eligible for tax benefits related to their mortgage. The interest paid on VA loans is typically tax-deductible, allowing veterans to reduce their taxable income and save on taxes.

Veterans should consult with a tax professional or their mortgage lender to ensure they are claiming the appropriate deductions and receiving the full extent of their tax benefits.

Maximizing Tax Refunds for Veterans

Maximizing tax refunds is a crucial aspect of financial planning for veterans. While tax refunds may not be as significant as other financial benefits, they can still provide a welcome boost to a veteran’s finances.

Filing Accurately and Early

Filing tax returns accurately and early is essential to ensuring veterans receive their refunds promptly. By taking the time to gather all necessary documentation and filing their returns without delays, veterans can avoid potential processing issues and receive their refunds in a timely manner.

Additionally, filing early can help veterans avoid potential penalties and interest charges that may accrue if their returns are filed late.

Claiming All Eligible Deductions and Credits

Veterans should carefully review their tax returns to ensure they are claiming all eligible deductions and credits. This includes claiming deductions for medical expenses, charitable contributions, and state and local taxes. Additionally, veterans should explore their eligibility for tax credits such as the Child Tax Credit, Earned Income Tax Credit, and the Credit for the Elderly or the Disabled.

By claiming all applicable deductions and credits, veterans can maximize their tax refunds and potentially reduce their tax liability.

Utilizing Tax Preparation Software

Tax preparation software can be a valuable tool for veterans looking to maximize their tax refunds. These software programs guide users through the filing process, ensuring all relevant deductions and credits are considered. They also provide a convenient and secure way to file tax returns online, reducing the risk of errors and potential delays.

Veterans should explore the various tax preparation software options available and choose one that suits their needs and preferences.

Avoiding Common Tax Mistakes for Veterans

While free tax filing programs and resources are invaluable, it’s essential for veterans to be aware of common tax mistakes to avoid potential issues and penalties.

Missing Important Deadlines

One of the most critical aspects of tax filing is adhering to deadlines. Veterans should mark their calendars with important tax dates, such as the federal and state tax filing deadlines, to ensure they meet all requirements.

Missing tax deadlines can result in penalties and interest charges, which can quickly accumulate and become a financial burden. By staying organized and aware of deadlines, veterans can avoid these unnecessary expenses.

Forgetting to Report All Income

It’s crucial for veterans to report all sources of income accurately on their tax returns. This includes income from wages, self-employment, pensions, investments, and any other taxable sources. Failing to report income can lead to audits and potential legal consequences.

Veterans should carefully review their tax forms and ensure they have included all relevant income information. If they have questions or concerns, they should consult with a tax professional to ensure compliance.

Overlooking Tax Credits and Deductions

Veterans should be aware of the various tax credits and deductions they may be eligible for, as overlooking these benefits can result in paying more taxes than necessary.

Some common tax credits and deductions for veterans include the American Opportunity Tax Credit for educational expenses, the Child and Dependent Care Credit, and the Medical Expense Deduction. Veterans should research and understand these benefits to ensure they are claiming all applicable credits and deductions.

Seeking Professional Tax Assistance

While free tax filing programs are excellent resources, some veterans may benefit from seeking professional tax assistance. Tax professionals can provide personalized guidance and ensure veterans are taking advantage of all available tax benefits.

Benefits of Working with a Tax Professional

Working with a tax professional offers several advantages for veterans. These experts can help navigate complex tax situations, such as filing for multiple states or understanding the implications of military-specific income sources.

Tax professionals can also assist veterans in claiming all eligible deductions and credits, ensuring they receive the maximum refund possible. Additionally, they can provide ongoing tax planning advice to help veterans optimize their financial situation throughout the year.

Finding a Reputable Tax Professional

When seeking a tax professional, veterans should take the time to find a reputable and experienced individual or firm. Word-of-mouth recommendations from trusted sources, such as fellow veterans or military support organizations, can be valuable in identifying reliable tax professionals.

Veterans should also consider the tax professional's credentials and experience in handling military-related tax issues. A Certified Public Accountant (CPA) or Enrolled Agent (EA) with experience in military tax matters can provide specialized knowledge and expertise.

Veterans Tax Clinics

Veterans Tax Clinics are specialized tax assistance programs that focus on providing free tax help to veterans and their families. These clinics are typically run by law schools or nonprofit organizations and offer confidential tax assistance and representation.

Veterans Tax Clinics can be particularly beneficial for veterans facing complex tax situations, such as those with tax controversies or those who need assistance with tax debt resolution. These clinics are staffed by experienced attorneys and tax professionals who can provide expert guidance and support.

FAQs

How do I know if I’m eligible for the IRS Free File Program?

+To be eligible for the IRS Free File Program, your adjusted gross income must typically be $73,000 or less. This program offers online tax preparation and filing for free, making it an excellent option for many veterans.

What are the benefits of using Military OneSource for tax filing?

+Military OneSource provides free tax preparation and e-filing services to military personnel and their families. These services are offered by certified tax consultants who understand military-specific tax issues. Additionally, Military OneSource offers a toll-free phone number and online resources for tax-related support.

Can veterans claim tax benefits for their service-connected disabilities?

+Yes, veterans who receive disability compensation from the VA for service-connected disabilities may be exempt from paying federal income tax on this income. To claim this exemption, veterans must complete Form 1040 and attach a statement explaining their disability status.

Are there any tax benefits for veterans using educational benefits like the GI Bill?

+Yes, veterans who utilize educational benefits, such as the Post-9⁄11 GI Bill or the Montgomery GI Bill, may be eligible for tax-free tuition assistance. This benefit allows veterans to pursue higher education without the added burden of paying taxes on their educational expenses.

What should I do if I miss a tax deadline?

+If you miss a tax deadline, it’s important to take immediate action. Contact the IRS or your tax professional to discuss your options. You may be able to request an extension or file a late return. However, it’s crucial to act promptly to avoid penalties and interest charges.