Georgia Car Tax Calculator

The Georgia Car Tax Calculator is a valuable tool for vehicle owners and prospective buyers in the state of Georgia. Understanding the intricacies of vehicle taxation can be complex, and this calculator simplifies the process, providing an accurate estimation of the taxes owed when purchasing or owning a vehicle in Georgia. In this article, we delve into the specifics of the Georgia Car Tax Calculator, exploring its features, benefits, and the impact it has on vehicle owners.

Understanding the Georgia Car Tax System

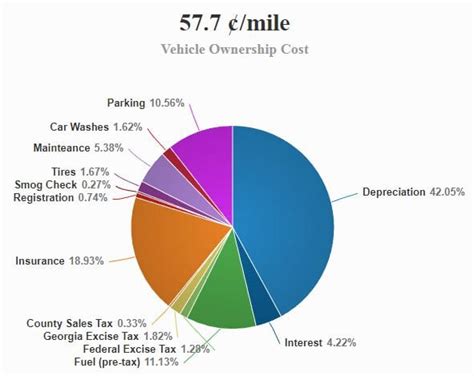

Georgia’s vehicle taxation system is based on the ad valorem principle, which means taxes are calculated based on the value of the vehicle. This value-based taxation differs from other states that may use weight or engine size as tax bases. The Georgia Car Tax Calculator is designed to help navigate this system by providing a clear breakdown of the taxes applicable to different vehicles.

The tax rates in Georgia vary depending on the county where the vehicle is registered. While the state sets a base tax rate, individual counties have the authority to impose additional taxes. This calculator takes into account these county-specific variations, ensuring an accurate estimation for vehicle owners across the state.

Features and Benefits of the Calculator

The Georgia Car Tax Calculator offers a user-friendly interface, making it accessible to all vehicle owners and buyers. Its key features include:

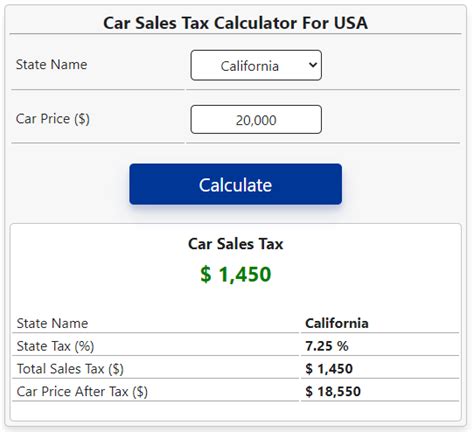

- Vehicle Value Assessment: Users can input the vehicle's make, model, and year, along with its purchase price. The calculator then estimates the vehicle's value, which is crucial for tax calculation.

- Tax Rate Determination: Based on the vehicle's value and the user's county of residence, the calculator determines the applicable tax rate. It considers both the state and county-specific rates, providing a comprehensive estimation.

- Estimation of Total Taxes: After assessing the vehicle's value and tax rate, the calculator provides an estimate of the total taxes owed. This includes both the state and county taxes, giving users a clear financial overview.

- Comparison with Other States: For those considering a move to Georgia or purchasing a vehicle from another state, the calculator offers a comparison feature. It showcases how the estimated taxes in Georgia compare to other states, aiding in financial planning.

- Historical Tax Data: The calculator provides a historical perspective on vehicle taxes in Georgia. Users can explore how tax rates have changed over the years, offering insight into potential future trends.

Using the Calculator: A Step-by-Step Guide

Utilizing the Georgia Car Tax Calculator is straightforward and can be done in a few simple steps:

- Access the Calculator: Visit the official Georgia Department of Revenue website or use the calculator provided by trusted third-party sources.

- Enter Vehicle Details: Provide information about your vehicle, including its make, model, year, and purchase price. Ensure the details are accurate for precise estimations.

- Select Your County: Choose your county of residence from the provided list. This ensures the calculator considers the correct tax rates for your specific location.

- Review the Results: The calculator will display an estimated total tax amount. It may also provide a breakdown of the state and county taxes, offering a clear financial perspective.

- Explore Additional Features: Take advantage of the calculator's comparison and historical data features to gain a deeper understanding of vehicle taxation in Georgia.

Impact on Vehicle Owners

The Georgia Car Tax Calculator has a significant impact on vehicle owners and prospective buyers in the state. By offering an accurate estimation of vehicle taxes, it empowers individuals to make informed decisions about vehicle purchases and ownership.

For current vehicle owners, the calculator provides a tool to understand their tax obligations and plan their finances accordingly. It helps in budgeting for annual vehicle taxes and can also be used to assess the impact of vehicle upgrades or modifications on tax liabilities.

Prospective buyers benefit from the calculator by gaining insight into the financial implications of their vehicle choice. This information is crucial when deciding between different vehicles, especially when considering the overall cost of ownership.

Future Outlook and Potential Developments

As vehicle taxation systems evolve, the Georgia Car Tax Calculator is likely to adapt and improve. Potential future developments include:

- Integration with Vehicle Registration: The calculator could be integrated into the vehicle registration process, providing a seamless experience for vehicle owners.

- Real-time Tax Rate Updates: Regular updates to the calculator could ensure that users always have access to the most current tax rates, especially when counties adjust their tax structures.

- Enhanced User Experience: Future iterations of the calculator may include additional features, such as personalized tax planning tools or the ability to save and track tax estimations over time.

Conclusion

The Georgia Car Tax Calculator is a valuable resource for vehicle owners and buyers in Georgia. Its accurate estimations, user-friendly interface, and insightful features make it an essential tool for understanding vehicle taxation in the state. As vehicle taxation systems continue to evolve, the calculator will play a crucial role in helping individuals navigate the complexities of vehicle ownership and make informed financial decisions.

Frequently Asked Questions

Can I use the calculator for vehicles registered outside of Georgia?

+Yes, the calculator can provide estimates for vehicles registered in other states. However, it’s important to note that the results will only reflect Georgia’s tax rates and may not accurately represent the taxes owed in other jurisdictions.

Are there any exceptions or exemptions to the vehicle tax in Georgia?

+Yes, certain vehicles may be exempt from or eligible for reduced tax rates. This includes vehicles used for specific purposes like agriculture, emergency services, or those with a disability-related exemption. It’s recommended to consult the official guidelines or seek professional advice for specific exemption details.

How often are the tax rates updated in the calculator?

+The calculator aims to provide the most current tax rates available. However, it’s important to note that tax rates can change annually, and the calculator may not reflect the latest adjustments until an update is made. It’s recommended to cross-reference the calculator’s results with official sources for the most accurate information.

Can the calculator estimate taxes for used vehicles?

+Yes, the calculator can estimate taxes for used vehicles. Users can input the purchase price and relevant details of the used vehicle to obtain an estimation. It’s important to note that the calculator may not consider the vehicle’s age or condition, so it’s advisable to consult with a professional for a more precise assessment.

Are there any additional fees or surcharges besides the calculated taxes?

+In addition to the calculated taxes, there may be other fees and surcharges associated with vehicle registration and ownership in Georgia. These can include title fees, license plate fees, and emissions testing fees. It’s recommended to review the official guidelines or consult with a local DMV office for a comprehensive understanding of all applicable fees.