Ny State Sales Tax Rate

Understanding the intricacies of sales tax regulations is crucial for businesses and consumers alike, especially in a diverse and populous state like New York. This comprehensive guide aims to demystify the New York State Sales Tax Rate, providing an in-depth analysis of the current tax structure, its historical evolution, and its implications for various industries and consumers.

The Current Landscape of New York State Sales Tax

As of my last update in January 2023, the New York State Sales Tax Rate stands at 4%, which is a standard rate applicable to most goods and services across the state. This base rate, however, is just the beginning of a complex tax system that varies depending on the location and the type of transaction.

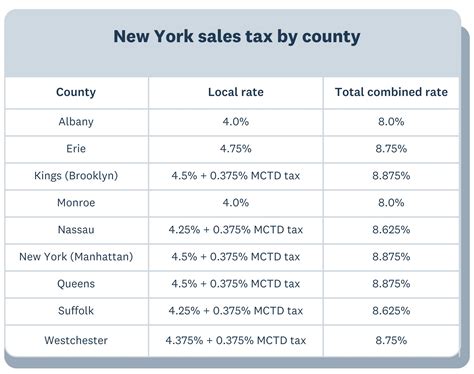

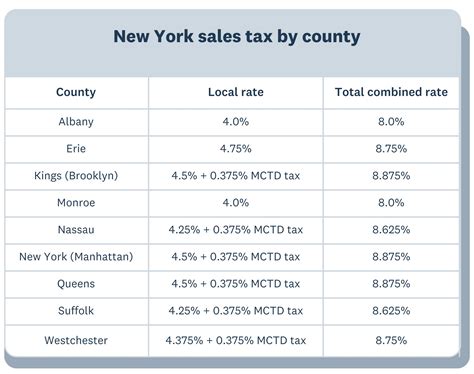

New York is known for its local sales tax rates, which are imposed by counties and cities, often leading to a wide range of rates across the state. For instance, while the base rate is 4%, the total sales tax rate in New York City is 8.875%, comprising the state rate, a 4.5% city rate, and other additional taxes. On the other hand, some counties, like Suffolk County, have a 5.625% total sales tax rate.

The New York State Department of Taxation and Finance provides an online Sales Tax Rate Lookup Tool that offers precise sales tax rates for every location within the state. This tool is invaluable for businesses operating in multiple locations and for consumers who want to understand the true cost of their purchases.

Categories and Exemptions

The sales tax in New York is not a one-size-fits-all tax. Various categories of goods and services are subject to different tax rates or are exempt altogether. For example, most groceries are exempt from sales tax, while certain prepared foods and soft drinks are taxable. The state also provides sales tax exemptions for specific types of organizations, such as religious or educational institutions.

Additionally, New York offers tax incentives and abatements for certain industries and locations to encourage economic development. These incentives can significantly impact the overall tax burden for businesses and may vary based on the type of business and its location.

Online Sales and Remote Sellers

With the rise of e-commerce, the sales tax landscape has become even more complex. New York, like many other states, has implemented laws to collect sales tax on online sales, even if the seller does not have a physical presence in the state. This is known as the marketplace seller law and applies to remote sellers who make over a certain threshold of sales in New York.

| Category | Sales Tax Rate |

|---|---|

| Standard Rate (Statewide) | 4% |

| New York City | 8.875% |

| Suffolk County | 5.625% |

| Other Counties (varies) | Varies from 4% to 5% |

Historical Perspective and Future Trends

The New York State Sales Tax Rate has undergone significant changes over the years. The state first implemented a sales tax in 1965, with an initial rate of 4%, which was increased to 4.375% in 1970. Since then, the rate has fluctuated, with the most recent increase occurring in 2009 when it was raised to its current level of 4%.

Potential Changes and Reforms

There have been ongoing discussions about sales tax reform in New York, particularly regarding the complexity of the current system. Some proposed changes include simplifying the tax structure, reducing or eliminating local sales taxes, and exploring options for a statewide uniform sales tax rate.

However, with the diverse needs and economies of different regions within the state, any significant reform would require careful consideration and planning. The current system, despite its complexities, allows for localized tax rates that can benefit specific communities and industries.

Impact of E-commerce and Remote Work

The growth of e-commerce and the shift towards remote work have had a significant impact on sales tax collection. New York’s efforts to collect sales tax from remote sellers have been successful, but the state continues to face challenges in keeping up with the rapidly evolving e-commerce landscape.

As more businesses operate online and across state lines, the need for a uniform approach to sales tax collection becomes more apparent. This could potentially lead to federal reforms that would impact sales tax regulations across the United States.

Implications for Businesses and Consumers

The New York State Sales Tax Rate has far-reaching implications for both businesses and consumers. For businesses, especially those operating in multiple locations or online, understanding and managing sales tax can be a complex task. It requires accurate record-keeping, timely filing of tax returns, and compliance with various tax laws and regulations.

Challenges for Businesses

One of the primary challenges for businesses is staying informed about the ever-changing tax landscape. This includes keeping track of rate changes, new tax laws, and tax incentives that may apply to their operations. Additionally, businesses must ensure that their accounting systems and sales platforms are configured correctly to collect and remit the appropriate sales tax.

Consumer Perspective

For consumers, the sales tax can significantly impact their purchasing decisions and overall spending. With varying rates across the state, consumers may choose to shop in areas with lower tax rates, especially for big-ticket items. The sales tax can also affect online shopping habits, with consumers considering the total cost, including tax, when making purchases.

Educating consumers about sales tax, especially those who may be new to the state or unfamiliar with its complexities, is crucial. Clear and transparent communication about sales tax rates and their application can help consumers make informed choices and avoid surprises at the checkout.

Conclusion: Navigating the Complex World of New York Sales Tax

The New York State Sales Tax Rate is a multifaceted and dynamic component of the state’s economy. Its current structure, while complex, allows for localized control and the ability to adapt to the diverse needs of different regions. However, as the state continues to evolve, particularly in the digital age, the sales tax system will likely undergo further changes and reforms.

For businesses and consumers, staying informed and adapting to these changes is essential. Whether it's through utilizing online tools to calculate sales tax rates, exploring tax incentives, or simply understanding the basic principles of sales tax, being proactive can help navigate the complexities of New York's sales tax landscape.

What is the standard New York State Sales Tax Rate?

+The standard New York State Sales Tax Rate is 4% as of January 2023.

How do local sales tax rates work in New York?

+New York has local sales tax rates imposed by counties and cities. These rates can vary widely, leading to different total sales tax rates across the state.

Are there any categories of goods or services exempt from sales tax in New York?

+Yes, certain categories like groceries and specific types of organizations are exempt from sales tax in New York.

How does New York collect sales tax from online sales and remote sellers?

+New York has implemented laws to collect sales tax from remote sellers who make over a certain threshold of sales in the state. This is known as the marketplace seller law.