State Vt Tax Refund Status

In the state of Vermont, tax refund inquiries and management are an essential part of the financial calendar for both individuals and businesses. The Vermont Department of Taxes provides a straightforward and accessible process for residents to check the status of their tax refunds, ensuring transparency and timely responses. This guide delves into the specifics of the Vermont tax refund status process, offering an in-depth look at the procedures, timelines, and resources available to taxpayers.

Understanding the Vermont Tax Refund Process

The Vermont Department of Taxes is responsible for administering state tax laws, including the processing and issuance of tax refunds. The process begins with the timely submission of tax returns by individuals and businesses. Once the returns are received, the Department undertakes a thorough review to ensure accuracy and compliance with state tax regulations.

After the review, the Department proceeds with the refund calculation. This involves a meticulous assessment of the tax payer's financial information, including income, deductions, and credits. The calculation process is designed to ensure that taxpayers receive the correct refund amount, in line with their tax obligations.

Timelines and Expectations

The Vermont Department of Taxes aims to process tax refunds within a specific timeframe. For standard refunds, the Department strives to issue refunds within 45 days of receiving the tax return. However, it’s important to note that certain factors can influence this timeline, such as the complexity of the return, any errors or discrepancies, or additional information required from the taxpayer.

For taxpayers who submit their returns early in the tax season, the refund process can be faster. Conversely, returns filed later in the season may experience slightly longer processing times. The Department also prioritizes processing for specific groups, such as low-income earners or the elderly, to ensure prompt refunds for those who may rely heavily on their tax returns.

| Refund Type | Processing Timeline |

|---|---|

| Standard Refunds | 45 days |

| Early Filers | 30 days |

| Priority Groups | 2-3 weeks |

Checking Refund Status

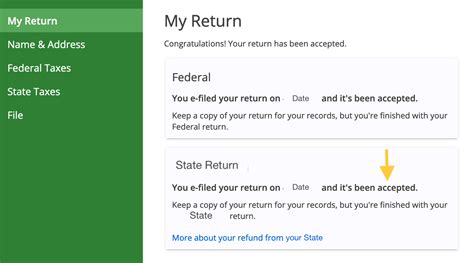

Taxpayers can easily check the status of their Vermont tax refunds through the Department’s online portal. This user-friendly platform provides real-time updates on the progress of the refund, from the initial receipt of the tax return to the final issuance of the refund.

To access the refund status, taxpayers need to log in to their Vermont Department of Taxes account. The account provides a comprehensive overview of the taxpayer's financial information, including tax returns, payments, and any outstanding balances. Within the account, a dedicated section is reserved for refund status updates, offering a clear and concise view of the refund journey.

For taxpayers who prefer a more traditional approach, the Department also offers a telephone inquiry service. This service is particularly useful for those who may not have easy access to the internet or prefer a more personal interaction. The telephone service provides the same up-to-date information as the online portal, ensuring that taxpayers have multiple avenues to track their refund status.

Addressing Common Refund Issues

While the Vermont Department of Taxes strives for accuracy and timeliness in refund processing, certain issues can arise. These may include errors in the tax return, missing information, or discrepancies in the taxpayer’s financial data. When such issues are identified, the Department reaches out to the taxpayer to resolve them promptly.

In the event of an error or discrepancy, taxpayers should respond to the Department's inquiries as soon as possible. Providing the necessary information or corrections ensures that the refund process can resume without delay. It's important for taxpayers to keep their contact information up-to-date with the Department to facilitate smooth communication.

Error Resolution Process

When an error is detected, the Department sends a notification to the taxpayer, detailing the issue and requesting the necessary corrections. Taxpayers should carefully review the notification and take immediate action to rectify the error. This may involve providing additional documentation, clarifying certain financial details, or making adjustments to the tax return.

The Department offers a range of resources to assist taxpayers in resolving errors. These include detailed guides on common error types, step-by-step instructions for corrections, and direct assistance from tax experts. Taxpayers can also seek help from registered tax professionals or accounting firms to ensure that the necessary corrections are made accurately and efficiently.

Discrepancies and Adjustments

In some cases, the Department may identify discrepancies between the tax return and the taxpayer’s financial records. This could be due to changes in income, deductions, or credits that were not reflected in the initial tax return. When such discrepancies are found, the Department calculates the necessary adjustments and informs the taxpayer of the revised refund amount.

Taxpayers should carefully review the adjusted refund amount and the reasons for the adjustment. If they disagree with the adjustment or require further clarification, they can contact the Department's taxpayer assistance line. The Department's tax experts are available to provide detailed explanations and guidance, ensuring that taxpayers understand the reasons behind any adjustments.

Receiving Your Vermont Tax Refund

Once the refund process is complete and any necessary adjustments are made, taxpayers can expect to receive their refund promptly. The Vermont Department of Taxes offers multiple refund options to accommodate different preferences and circumstances.

Refund Options

The primary refund method is direct deposit, which is the fastest and most convenient option. Taxpayers who opt for direct deposit receive their refund directly into their bank account, typically within a few days of the Department’s issuance. This method eliminates the risk of lost or stolen checks and provides immediate access to the refund funds.

For taxpayers who prefer a more traditional approach, the Department also offers the option of receiving a paper check. The check is mailed to the taxpayer's address on record, and its arrival may take slightly longer than a direct deposit. Taxpayers should ensure that their address information is up-to-date with the Department to avoid any delays in receiving their refund.

| Refund Method | Processing Time |

|---|---|

| Direct Deposit | 3-5 business days |

| Paper Check | 7-10 business days |

Tracking Your Refund

To ensure that taxpayers have a clear understanding of the refund journey, the Department provides a detailed tracking system. This system provides real-time updates on the status of the refund, from the moment the tax return is received to the final issuance of the refund. Taxpayers can access the tracking system through their online account or by calling the Department’s taxpayer assistance line.

The tracking system offers a transparent view of the refund process, showing the various stages and the estimated timeline for each. This helps taxpayers manage their expectations and provides a clear picture of where their refund is in the process. It also allows taxpayers to identify any potential delays and take appropriate action to expedite the refund, if necessary.

Conclusion: Navigating the Vermont Tax Refund Process

The Vermont Department of Taxes is committed to providing a transparent and efficient tax refund process for its residents. By offering multiple avenues for checking refund status, addressing common issues, and providing a range of refund options, the Department ensures that taxpayers can navigate the process with ease and confidence.

For taxpayers, understanding the refund process, staying informed about their refund status, and responding promptly to any inquiries from the Department are key to a smooth and timely refund experience. With the right knowledge and resources, managing tax refunds in Vermont can be a straightforward and stress-free endeavor.

What should I do if I haven’t received my refund within the expected timeframe?

+

If you haven’t received your refund within the expected timeframe, it’s important to first check the status of your refund through the online portal or by calling the Department’s taxpayer assistance line. If the status indicates that your refund is still in process, you may need to be patient and allow for additional time, especially if you filed your return later in the tax season. However, if the status shows that your refund has been issued but you haven’t received it, you should contact the Department to inquire about potential delays and to ensure that your refund was not returned to the Department due to an incorrect address.

How can I avoid errors in my tax return that may delay my refund?

+

To avoid errors in your tax return, it’s crucial to carefully review your financial information and calculations before submitting your return. Double-check income, deductions, and credits to ensure accuracy. Consider using tax preparation software or seeking the assistance of a tax professional to minimize errors. Additionally, keep your contact information up-to-date with the Department to facilitate smooth communication in case any issues arise.

Can I change my refund method after submitting my tax return?

+

Changing your refund method after submitting your tax return may be possible, but it depends on the stage of the refund process. If your refund has already been issued, it may be more challenging to make changes. However, if your refund is still in process, you can contact the Department to request a change in refund method. Keep in mind that changing the refund method may introduce additional processing time, so it’s best to make such requests as early as possible.

What happens if I owe additional taxes after receiving my refund?

+

If you receive a notice indicating that you owe additional taxes after receiving your refund, it’s important to respond promptly. Review the notice carefully to understand the reasons for the additional taxes. You may need to provide additional financial information or make adjustments to your tax return. Contact the Department’s taxpayer assistance line for guidance on how to proceed and ensure that you address the issue within the given timeframe to avoid penalties.