Sales Tax Rate Denver

In the bustling city of Denver, Colorado, sales tax is an essential component of the local economy. It plays a crucial role in funding various public services and infrastructure projects. Understanding the sales tax rate in Denver is vital for both residents and businesses, as it directly impacts their financial decisions and obligations. This article delves into the intricacies of Denver's sales tax, shedding light on its composition, variations, and implications for the community.

Unraveling Denver’s Sales Tax Structure

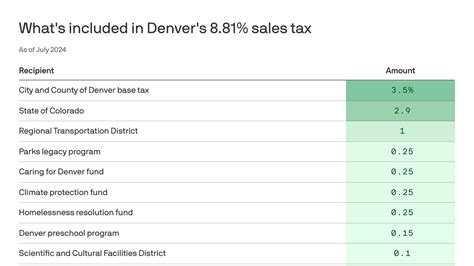

Denver’s sales tax system is a layered structure, consisting of several components that combine to form the total sales tax rate. At the heart of this structure is the state sales tax, a uniform rate applicable across the state of Colorado. This foundational rate is then augmented by additional taxes levied by local jurisdictions, including Denver County and the City and County of Denver.

The state sales tax in Colorado stands at 2.9%, a rate that has remained consistent since its inception. However, it is the local taxes that introduce variability into Denver's sales tax landscape. These local taxes are imposed by the county and municipal authorities to fund specific initiatives and projects within their jurisdictions.

Local Sales Tax Rates in Denver

Denver County and the City and County of Denver each impose their own sales tax rates, which are added to the state sales tax. Currently, Denver County levies an additional 3.12% sales tax, while the City and County of Denver applies a 4.62% tax on top of the state rate.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Colorado | 2.9% |

| Denver County | 3.12% |

| City and County of Denver | 4.62% |

When these rates are combined, Denver's total sales tax rate stands at 10.64%. This means that for every purchase made within the city limits, consumers pay a sales tax of 10.64% on top of the item's base price.

Understanding the Impact of Sales Tax

Sales tax has a significant impact on the cost of living and doing business in Denver. For residents, it influences their purchasing decisions and overall financial planning. A higher sales tax rate can make certain goods and services more expensive, potentially affecting the affordability of everyday items.

From a business perspective, sales tax is a critical consideration when pricing products and services. Companies must factor in the sales tax rate when determining their profit margins and setting competitive prices. Additionally, businesses with a physical presence in Denver are responsible for collecting and remitting sales tax to the appropriate authorities, adding an administrative burden to their operations.

Variations and Exemptions: Navigating Denver’s Sales Tax Landscape

While the standard sales tax rate in Denver is 10.64%, there are certain variations and exemptions that can alter this rate. These exceptions are designed to promote specific industries, encourage particular behaviors, or provide relief to vulnerable populations.

Special Sales Tax Rates for Specific Goods

Denver, like many other jurisdictions, imposes different sales tax rates on specific categories of goods. For instance, groceries, a staple of daily life, are often subject to a reduced sales tax rate. In Denver, the sales tax on groceries is 4.62%, significantly lower than the standard rate. This exemption aims to ease the financial burden on residents, particularly those with lower incomes, by making essential food items more affordable.

| Good Category | Sales Tax Rate |

|---|---|

| Groceries | 4.62% |

| Restaurant Meals | 7.62% |

| Lodging (Hotels) | 14.62% |

Similarly, restaurant meals and lodging (such as hotels) are subject to higher sales tax rates. Restaurant meals are taxed at 7.62%, while lodging carries a hefty 14.62% sales tax. These higher rates are often used to support tourism and hospitality-related initiatives, as well as fund specific infrastructure projects in these industries.

Sales Tax Exemptions and Special Considerations

Beyond variations in tax rates, Denver also offers certain exemptions and special considerations for specific transactions. For instance, sales tax holidays are periods during which certain goods are exempt from sales tax altogether. These holidays typically occur during back-to-school seasons, allowing families to purchase school supplies and clothing without incurring the usual sales tax.

Additionally, certain items, such as prescription medications, are permanently exempt from sales tax. This exemption aims to make essential healthcare more accessible and affordable for residents. Similarly, sales tax is often waived for non-profit organizations and charitable purchases, encouraging charitable giving and supporting community initiatives.

Sales Tax and Economic Development: Denver’s Approach

Denver’s sales tax policy is intricately linked to the city’s economic development strategies. The city leverages sales tax revenue to fund various initiatives aimed at enhancing the local economy and improving the quality of life for its residents.

Infrastructure Projects and Economic Growth

A significant portion of Denver’s sales tax revenue is directed towards infrastructure development. This includes funding for transportation projects, such as road improvements, public transit expansion, and the construction of new bridges and tunnels. These initiatives not only enhance the city’s connectivity but also attract businesses and stimulate economic growth.

Additionally, sales tax revenue is used to support public works projects, such as the development of parks, recreational facilities, and cultural centers. These amenities enhance the city's appeal, making it an attractive destination for tourists and potential residents alike. The economic benefits of these projects are far-reaching, contributing to a thriving local economy.

Promoting Local Businesses and Industries

Denver’s sales tax policy also includes incentives and exemptions aimed at supporting local businesses and fostering economic diversification. For instance, the city may offer reduced sales tax rates or exemptions for startups and small businesses, especially those in emerging industries. These measures aim to encourage entrepreneurship and innovation, driving the city’s economic growth.

Furthermore, Denver may collaborate with local industries to develop targeted sales tax incentives. For example, the city might offer tax breaks for companies investing in renewable energy or those committing to create a certain number of jobs. Such initiatives not only attract investment but also align with the city's long-term economic and environmental goals.

Sales Tax Compliance and Administration

Ensuring compliance with Denver’s sales tax regulations is a critical responsibility for both businesses and consumers. Failure to comply with these regulations can result in significant penalties and legal repercussions.

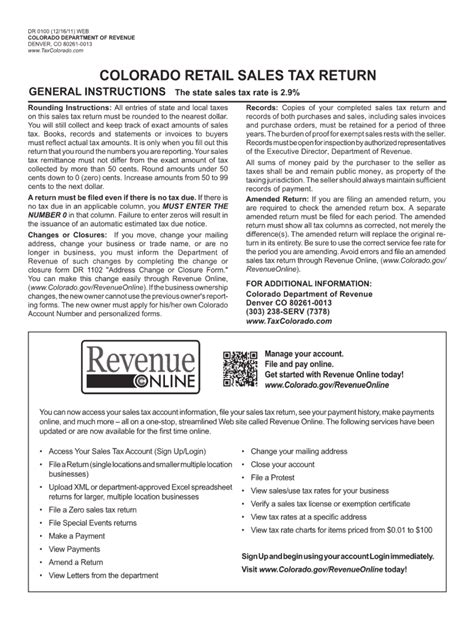

Business Obligations and Registration

Businesses operating in Denver are required to register for a sales tax permit with the appropriate authorities. This permit authorizes them to collect and remit sales tax on behalf of the government. Businesses must also maintain accurate records of all sales transactions, ensuring that sales tax is calculated and collected correctly.

Regular sales tax filings are a crucial aspect of compliance. Businesses must file sales tax returns on a periodic basis, typically quarterly or monthly, depending on their sales volume. These filings involve reporting the total sales tax collected and remitting the appropriate amount to the taxing authorities.

Consumer Awareness and Responsibilities

Consumers, too, have a role to play in ensuring sales tax compliance. It is essential for consumers to be aware of the applicable sales tax rates when making purchases. By understanding the tax implications of their transactions, consumers can make more informed decisions and hold businesses accountable for accurate sales tax calculations.

Additionally, consumers should be vigilant about sales tax exemptions and special rates. For instance, if a business fails to apply the correct sales tax rate to a purchase, consumers should bring it to the attention of the store or report it to the appropriate authorities. This helps maintain fairness and integrity in the sales tax system.

The Future of Sales Tax in Denver: Trends and Predictions

As Denver continues to evolve and adapt to changing economic landscapes, the city’s sales tax policy is likely to undergo modifications. Understanding these potential trends and their implications is crucial for both businesses and residents.

Potential Sales Tax Rate Adjustments

While the current sales tax rate in Denver is 10.64%, there is always the possibility of future rate adjustments. These adjustments could be influenced by various factors, including economic conditions, budget requirements, and changes in state or local legislation.

For instance, if Denver faces budgetary constraints or seeks to fund specific large-scale projects, it may consider raising the sales tax rate. On the other hand, in times of economic prosperity or to stimulate economic growth, the city might opt to reduce the sales tax rate temporarily or introduce new incentives.

Emerging Trends in Sales Tax Administration

The administration and enforcement of sales tax are also subject to technological advancements and changing regulatory environments. Denver, like many other jurisdictions, is likely to explore the use of digital tools and platforms to streamline sales tax compliance and collection processes.

For instance, the city might introduce electronic filing systems for sales tax returns, making the process more efficient and reducing administrative burdens for businesses. Additionally, Denver may leverage data analytics and machine learning to identify potential sales tax evasion or errors, ensuring fair and accurate tax collection.

The Impact of E-Commerce and Online Sales

The rise of e-commerce and online sales presents unique challenges and opportunities for Denver’s sales tax policy. As more transactions move online, the city may need to adapt its regulations to ensure that sales tax is collected on these transactions. This could involve collaborating with online marketplaces and developing policies to address the unique nature of digital commerce.

Furthermore, Denver might explore the concept of a state-wide sales tax nexus, where online retailers with substantial connections to the state are required to collect and remit sales tax, even if they lack a physical presence in Denver. Such a policy would help ensure that online retailers contribute fairly to the city's revenue stream.

How often do sales tax rates change in Denver?

+Sales tax rates in Denver can change periodically, typically in response to economic conditions, budgetary needs, or legislative changes. However, major rate adjustments are not frequent and often require significant consideration and public input.

Are there any ongoing initiatives to simplify Denver’s sales tax system?

+Yes, Denver, like many cities, is exploring ways to simplify its sales tax system. This includes the potential adoption of unified tax rates across different jurisdictions and the use of digital tools to streamline compliance and administration processes.

How can businesses stay informed about sales tax changes in Denver?

+Businesses can stay informed by subscribing to updates from the city’s tax authorities, following local news sources, and engaging with industry associations that provide regular updates on tax regulations. Additionally, consulting with tax professionals can ensure businesses remain compliant with any changes.

Are there any tax incentives for businesses investing in Denver’s renewable energy sector?

+Yes, Denver offers various tax incentives to encourage investment in renewable energy. These incentives can include reduced sales tax rates, property tax abatements, and other financial benefits. Businesses interested in these incentives should consult with the city’s economic development office for specific details.