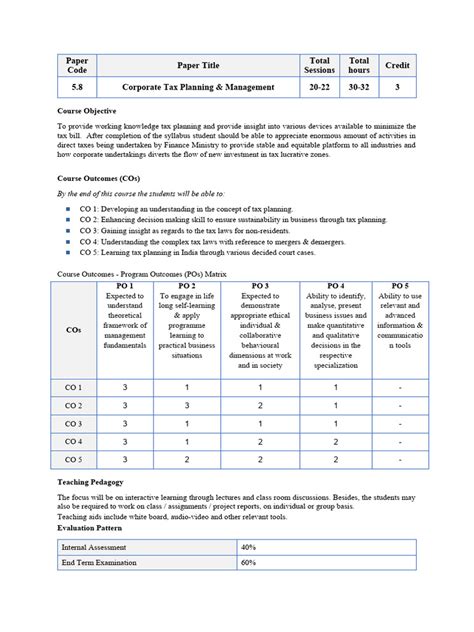

Corporate Tax Planning

In the complex world of finance and business, effective corporate tax planning is a strategic cornerstone for any organization aiming to optimize its financial performance and ensure long-term sustainability. This article delves into the intricacies of corporate tax planning, offering a comprehensive guide to help businesses navigate the tax landscape efficiently and proactively.

Maximizing Efficiency: The Art of Corporate Tax Planning

Corporate tax planning is an essential practice for businesses of all sizes and industries. It involves a strategic approach to managing tax liabilities, optimizing cash flow, and ensuring compliance with tax regulations. By implementing effective tax planning strategies, corporations can enhance their financial health, mitigate risks, and unlock opportunities for growth.

Understanding the Fundamentals

At its core, corporate tax planning involves a thorough analysis of a company’s financial structure, operations, and tax obligations. This process begins with a deep understanding of the applicable tax laws and regulations, both at the national and international levels. By staying abreast of these legal frameworks, businesses can identify potential tax advantages and pitfalls, shaping their financial strategies accordingly.

One of the key aspects of corporate tax planning is identifying tax-efficient structures. This involves examining various factors such as the company's legal entity type, ownership structure, and operational location. By optimizing these aspects, businesses can leverage tax incentives, minimize exposure to unnecessary taxes, and enhance overall financial performance.

Tax Strategies and Techniques

Effective corporate tax planning employs a range of strategies and techniques to optimize tax liabilities. One such strategy is tax deferral, where businesses strategically time their income recognition and expense deductions to minimize current tax obligations. This approach allows companies to defer tax payments to future periods, enhancing cash flow and financial flexibility.

Another crucial aspect is tax credit and incentive utilization. Many jurisdictions offer tax credits and incentives to encourage certain business activities, such as research and development, job creation, or environmental initiatives. By understanding and leveraging these incentives, corporations can significantly reduce their tax liabilities and invest more resources into core business operations.

Moreover, corporate tax planning often involves a careful examination of tax treaties and international tax laws. For businesses operating across borders, understanding these treaties can lead to significant tax savings. By structuring their operations and transactions strategically, corporations can avoid double taxation and take advantage of favorable tax rates in different jurisdictions.

The Role of Compliance and Reporting

While tax planning aims to optimize financial outcomes, it must always be conducted within the boundaries of tax compliance. Corporations must ensure accurate and timely reporting of their financial activities and tax obligations. Failure to comply with tax regulations can lead to severe penalties, legal issues, and reputational damage.

To ensure compliance, businesses often engage tax professionals and accountants who specialize in corporate tax matters. These experts help companies interpret complex tax laws, prepare accurate tax returns, and maintain proper documentation. By investing in robust tax compliance practices, corporations can avoid costly mistakes and maintain a positive relationship with tax authorities.

| Tax Strategy | Description |

|---|---|

| Tax Deferral | Strategic timing of income recognition and expense deductions to minimize current tax obligations. |

| Tax Credits and Incentives | Leveraging tax incentives and credits to reduce overall tax liabilities. |

| International Tax Planning | Structuring operations to take advantage of tax treaties and favorable international tax rates. |

Case Study: Tax Planning for a Global Technology Firm

To illustrate the practical application of corporate tax planning, let’s consider the case of a multinational technology company, TechCorp Inc. TechCorp operates in various countries, each with its own tax regulations and incentives. The company’s tax planning strategy involves a comprehensive analysis of these regulations to identify opportunities for tax optimization.

International Tax Strategy

TechCorp’s tax team carefully examines the tax treaties and regulations in each country where it operates. By understanding these legal frameworks, they identify opportunities to minimize tax liabilities. For instance, in Country A, TechCorp leverages a tax treaty that allows for reduced withholding tax rates on royalty payments, enabling them to optimize their intellectual property licensing structure.

In Country B, the company takes advantage of a tax incentive program that encourages research and development activities. By structuring its R&D operations strategically, TechCorp qualifies for significant tax credits, reducing its overall tax burden and freeing up resources for further innovation.

Transfer Pricing and Profit Allocation

Transfer pricing, the practice of setting prices for transactions between different entities within a corporate group, is a critical aspect of TechCorp’s tax planning. The company’s tax team ensures that transfer prices are set in accordance with market conditions and arm’s-length principles. By optimizing transfer pricing, TechCorp can allocate profits to jurisdictions with more favorable tax rates, minimizing its global tax liability.

Compliance and Transparency

Despite its aggressive tax planning strategies, TechCorp maintains a strong focus on tax compliance. The company invests in robust compliance systems and engages with tax authorities to ensure transparency. By maintaining open lines of communication and providing accurate financial information, TechCorp fosters a positive relationship with tax regulators, reducing the risk of audits and penalties.

Future Implications and Challenges

The landscape of corporate tax planning is dynamic and ever-evolving. As tax laws and regulations continue to change, businesses must adapt their tax strategies to stay compliant and optimize their financial performance.

Tax Policy Changes

Governments and international bodies frequently introduce new tax policies and regulations to address various economic and social objectives. These changes can significantly impact corporate tax planning strategies. For instance, the introduction of digital services taxes or the modification of transfer pricing rules can necessitate a reevaluation of tax structures and strategies.

International Tax Cooperation

In an increasingly globalized world, international tax cooperation is becoming more crucial. Efforts such as the Base Erosion and Profit Shifting (BEPS) project by the OECD aim to combat tax avoidance and promote fair tax competition. Corporations must stay informed about these initiatives and adapt their tax planning strategies to align with evolving international tax standards.

Technology and Data-Driven Tax Planning

The rise of technology and data analytics is transforming the field of corporate tax planning. Advanced tax planning software and data-driven insights enable businesses to make more informed decisions and optimize their tax strategies. By leveraging technology, corporations can enhance the efficiency and accuracy of their tax planning processes, leading to improved financial outcomes.

Conclusion: A Strategic Approach to Financial Success

Corporate tax planning is a complex yet crucial aspect of business management. By adopting a proactive and strategic approach to tax management, corporations can unlock significant financial benefits, enhance their competitive advantage, and ensure long-term sustainability. The key lies in staying informed, adapting to changing tax landscapes, and leveraging the expertise of tax professionals to navigate the intricate world of corporate taxation.

What are the key benefits of effective corporate tax planning?

+Effective corporate tax planning offers several key benefits, including optimized cash flow, reduced tax liabilities, and enhanced financial flexibility. It allows businesses to take advantage of tax incentives, defer tax payments, and make strategic financial decisions that align with their long-term goals.

How can businesses stay updated with changing tax laws and regulations?

+Businesses can stay updated by subscribing to tax law updates from reputable sources, engaging with tax professionals who specialize in corporate tax matters, and participating in industry associations or forums that provide insights into tax-related changes.

What are some common challenges in corporate tax planning?

+Common challenges include keeping up with complex and ever-changing tax laws, ensuring compliance with various jurisdictions’ regulations, and managing the potential risks associated with aggressive tax planning strategies. Additionally, staying informed about international tax cooperation initiatives and their implications is crucial.