Quick Guide to Understanding and Managing Santa Ana Sales Tax

While many associate sales tax with straightforward state and local rates, the Santa Ana Sales Tax introduces a unique blend of municipal regulations, historical evolution, and economic implications that often confound residents and business owners alike. A detailed comprehension of how Santa Ana's sales tax system functions—and how to manage compliance and strategic planning—can considerably impact local commerce and individual fiscal health. Dispelling misconceptions and providing clarity is essential, particularly in a jurisdiction where tax policies are frequently misinterpreted or oversimplified.

Understanding Santa Ana Sales Tax: Foundations and Common Misconceptions

Santa Ana, California, imposes a multifaceted sales tax structure that includes state, county, and district taxes, each with specific purposes and legislative origins. Despite its seemingly straightforward premise—collecting a percentage on retail sales—numerous misconceptions cloud public understanding. For example, many believe that the sales tax rate is static across all of Santa Ana; however, due to the layered tax districts and occasional temporary increases, actual rates can fluctuate even within the same neighborhood. Furthermore, common assumptions about what goods or services are taxed are often flawed, as exemptions vary significantly depending on the item or service provided. Recognizing these intricacies is vital for accurate compliance, strategic pricing, and calculating total transaction costs.

Dissecting the Components of Santa Ana Sales Tax: A Breakdown

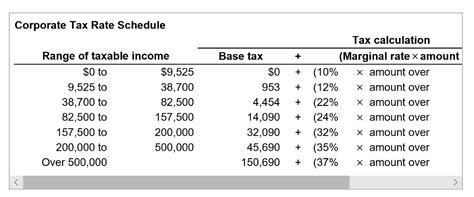

The overall sales tax rate in Santa Ana typically hovers around 7.75% to 8.75%, depending on district-specific levies and recent legislative adjustments. This percentage incorporates:

- Statewide base sales tax (California Department of Tax and Fee Administration, CDTFA)

- County local transportation and Measure M taxes

- Special district taxes dedicated to tourism, infrastructure, or public safety

Each component has a distinct legislative history. For example, the statewide rate has remained relatively stable at 7.25%, but district taxes frequently change based on funding measures approved by voters or local government initiatives. Analyzing these components reveals that the total rate is subject to both macroeconomic factors and local political decisions—an aspect often overlooked by businesses and consumers when calculating costs and margins.

Historical Evolution and Legislative Context

The evolution of Santa Ana’s sales tax system reflects broader trends in California’s fiscal policy. Post-1980s, numerous districts began imposing supplemental taxes to address specific municipal needs, leading to an increasingly granular tax landscape. For instance, in 2010, Santa Ana adopted a Measure to enhance public safety funding, resulting in a modest increase in local district sales taxes. These changes, while beneficial for project funding, complicate compliance for businesses operating across multiple districts within Santa Ana.

| Relevant Category | Substantive Data |

|---|---|

| Main Sales Tax Rate | 7.75% (statewide base, as of 2023) |

| Total Local Plus District Taxes | Up to 1.0-1.75%, depending on district |

Myth Busting: Clearing Up Falsehoods about Santa Ana Sales Taxes

Myth 1: All products and services in Santa Ana are taxed at the same rate.

While the base rate is uniform, exemptions and special district taxes alter the effective rate on specific items or services. For example, groceries are partially exempt from certain state taxes but not from district levies, creating a complex mosaic of taxation that varies considerably depending on product classification.

Myth 2: Tourist-related transactions are exempt from sales tax in Santa Ana.

This misconception persists; however, sales tax applies uniformly to most retail transactions, including those involving tourists. Special districts might have additional levies targeting tourism, but these are incorporated into the total rate rather than specific exemptions.

Myth 3: Business owners do not need to track district-specific rates.

Failure to account for district variations can lead to under- or over-collection of taxes, risking penalties. Proper registration with the California Department of Tax and Fee Administration (CDTFA) and diligent tracking are essential for compliance, especially for businesses with multiple storefronts across districts.

Strategies for Managing Santa Ana Sales Tax Effectively

Businesses operating within Santa Ana must integrate precise tax collection procedures and stay informed about legislative updates. Key strategies include:

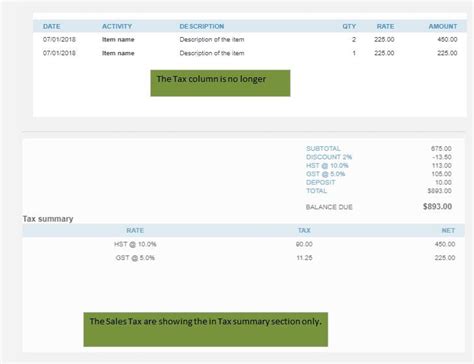

- Enhance Point-of-Sale (POS) Systems: Ensure they are configured to automatically calculate district-specific rates based on the transaction location.

- Regular Tax Rate Audits: Conduct audits at least quarterly to verify compliance with recent changes, especially after district tax adjustments or new measures.

- Maintain Accurate Records: Document all transactions meticulously to facilitate audit readiness and accurate tax remittance.

- Engage with Professional Tax Advisors: Leverage expert knowledge to interpret complex legislative changes and optimize tax strategies.

Legal and Regulatory Considerations

Compliance frameworks are governed by California law, particularly through CDTFA regulations. Non-compliance carries penalties, interest charges, and potential legal repercussions. Furthermore, remote and e-commerce transactions have added complexity, requiring digital tracking and possibly third-party compliance tools to handle varying district rates seamlessly.

| Relevant Category | Substantive Data |

|---|---|

| Best Practice | Use automated tax calculation tools integrated into POS systems |

| Legal Requirement | Remit collected taxes monthly to CDTFA with detailed district breakdowns |

Future Trends and Policy Developments in Santa Ana Sales Tax

Looking ahead, several trends may influence Santa Ana’s sales tax environment. Incremental increases in district taxes are likely to fund infrastructure projects, climate initiatives, and public health programs, especially as California prioritizes sustainability and resilience. Additionally, digital commerce expansion demands adaptive policies to ensure that sales tax collection remains accurate across an increasingly remote economy.

Potential Legislative Changes

California’s legislature periodically revisits sales tax rates and exemptions, often driven by economic needs or political shifts. Proposed bills could expand or modify district taxes, impacting Santa Ana’s overall rates. Furthermore, initiatives aiming to simplify the complex tax landscape—such as integrating district taxes into a unified rate—are under discussion, which could significantly transform compliance practices.

| Projected Change | Impact |

|---|---|

| Increase in District Taxes | Higher total transaction costs, requiring strategic adjustments |

| Tax Simplification Initiatives | Reduced compliance burden, but potential loss in localized funding |

Key Points

- Understanding the layered structure of Santa Ana's sales tax is critical for accurate compliance and strategic business planning.

- Common misconceptions hinder effective tax management; recognizing exemptions and district-specific rates improves accuracy.

- Technological integration in POS and accounting systems streamlines compliance and minimizes risks.

- Legislative vigilance ensures readiness for policy shifts and maintains operational stability.

- Expert advisement elevates tax strategy sophistication, leading to cost savings and legal safety.

How do I determine the correct sales tax rate for my location in Santa Ana?

+Use the CDTFA’s online rate lookup tool or integrated POS software configured with geographic tax zones. Rates vary depending on the precise address, district boundaries, and recent legislative updates.

Are online sales in Santa Ana subject to the same sales tax rules?

+Yes, remote and online sales are subject to the same district-specific rates, requiring sellers to track buyers’ locations accurately and remit taxes accordingly—especially following California’s marketplace facilitator law revisions.

What are the penalties for incorrect sales tax collection in Santa Ana?

+Penalties include interest charges on unpaid taxes, fines ranging from 5% to 25% of owed amounts, and potential legal action. Timely and accurate remittance is essential to mitigate these risks.

Can businesses apply for sales tax exemptions in Santa Ana?

+Exemptions are limited and specific, often applicable to certain types of nonprofit organizations or qualified resellers. Proper documentation and registration are prerequisites for claiming exemptions.