Ellis County Tax Office

The Ellis County Tax Office is a vital administrative hub in the heart of Texas, serving as a key liaison between residents, businesses, and the local government. This office plays a critical role in ensuring the efficient management of property taxes, vehicle registration, and other crucial governmental services. With a dedicated team and a commitment to technological advancements, the Ellis County Tax Office strives to make tax-related processes as seamless and accessible as possible for its constituents.

A Comprehensive Overview of Ellis County Tax Office Services

At the heart of the Ellis County Tax Office’s operations is the management of property taxes. This office is responsible for the valuation and assessment of all taxable properties within the county, ensuring fair and accurate taxation for residents and businesses alike. The office’s experts are well-versed in the intricate details of property tax laws, providing valuable guidance to property owners and ensuring compliance with state regulations.

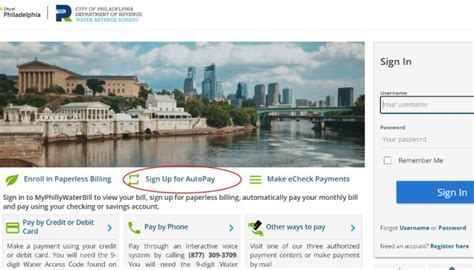

One of the standout features of the Ellis County Tax Office is its embrace of technology. The office offers an array of online services, allowing taxpayers to access their accounts, view property details, and make payments from the comfort of their homes. This digital approach not only enhances convenience but also streamlines processes, reducing the time and effort required for tax-related tasks.

Beyond property taxes, the Ellis County Tax Office provides a wide range of services. This includes vehicle registration and titling, where residents can register their vehicles, obtain titles, and handle any related transfers or changes. The office also facilitates the registration of boats and other watercraft, ensuring that all aquatic vehicles are properly registered and compliant with state laws.

Specialized Services and Initiatives

The Ellis County Tax Office is known for its proactive approach to serving the community. One notable initiative is the “Property Tax Assistance Program,” designed to provide relief to elderly and disabled residents. This program offers reduced property tax rates, helping these individuals maintain their homes and ensuring they are not burdened by excessive taxation.

In addition, the office regularly conducts outreach programs and educational workshops, keeping residents informed about tax laws, deadlines, and any changes in legislation. These initiatives foster a sense of community engagement and empower residents to actively participate in the tax process.

Performance Analysis and Future Prospects

The Ellis County Tax Office has consistently maintained a high level of efficiency and customer satisfaction. Its adoption of digital platforms and streamlined processes has significantly reduced wait times and improved overall service delivery. Feedback from residents and businesses has been overwhelmingly positive, commending the office for its professionalism, transparency, and commitment to excellence.

Looking ahead, the office plans to continue its technological advancements, aiming to further digitize its services and enhance its online platforms. This includes the development of mobile applications, providing residents with even more convenient access to tax-related information and services. Additionally, the office is exploring the integration of artificial intelligence and machine learning technologies to improve data analysis and enhance decision-making processes.

Furthermore, the Ellis County Tax Office is committed to fostering a culture of continuous improvement. This involves regular staff training, ensuring that employees are up-to-date with the latest tax laws and best practices. The office also actively seeks feedback from the community, incorporating suggestions and concerns into its strategic planning to better serve the needs of Ellis County residents.

| Service | Description |

|---|---|

| Property Tax Management | Valuation, assessment, and collection of property taxes |

| Vehicle Registration | Registration, titling, and transfer of vehicles and watercraft |

| Online Services | Digital platforms for account access, payment, and information retrieval |

| Community Initiatives | Outreach programs, educational workshops, and assistance programs |

FAQs

What is the role of the Ellis County Tax Office in property tax assessment and collection?

+The Ellis County Tax Office is responsible for the valuation and assessment of all taxable properties within the county. It ensures fair and accurate taxation by adhering to state regulations and providing guidance to property owners. The office also collects property taxes and distributes the revenue to various local entities, such as school districts and municipalities.

How can I access my tax account and make payments online?

+To access your tax account and make online payments, visit the official website of the Ellis County Tax Office. You’ll need to create an account using your property information. Once logged in, you can view your account details, including tax amounts, due dates, and payment history. Online payments can be made using credit/debit cards or e-checks.

What are the office hours and contact information for the Ellis County Tax Office?

+The Ellis County Tax Office is open from 8:00 AM to 5:00 PM, Monday through Friday. The office is located at 1200 N. Highway 77, Waxahachie, TX 75165. For inquiries, you can call (972) 825-5100 or send an email to taxoffice@co.ellis.tx.us.

How often are property tax rates reviewed and adjusted in Ellis County?

+Property tax rates in Ellis County are typically reviewed annually. The Tax Assessor-Collector’s office, in consultation with the county’s governing bodies, assesses the tax rate needed to fund essential services and maintains a balanced budget. Adjustments to the tax rate may occur to account for changes in the local economy, inflation, and the need to support public services.