How To Find Average Tax Rate

Calculating the average tax rate is a fundamental concept in understanding one's financial obligations and planning effectively. Whether you're an individual assessing your income taxes or a business evaluating its tax liability, knowing how to find the average tax rate is crucial. This comprehensive guide will walk you through the process, providing you with the tools and insights to calculate this essential metric accurately.

Understanding Average Tax Rate

The average tax rate represents the proportion of your income or earnings that is paid in taxes. It provides a holistic view of your tax liability, offering a more comprehensive understanding than the marginal tax rate, which only considers the tax rate applicable to the last dollar earned.

For instance, consider an individual with an annual income of $100,000 who pays a total of $20,000 in taxes. Their average tax rate would be 20%, indicating that for every dollar earned, 20 cents goes towards taxes. This rate can be used to compare tax liabilities across different income levels and assess the impact of tax policies on your financial situation.

Calculating Average Tax Rate: Step-by-Step Guide

-

Gather Necessary Data

To calculate the average tax rate, you’ll need the following information:

- Total Income: This includes all sources of income, such as wages, salaries, investments, and business profits.

- Taxable Income: The portion of your total income that is subject to taxation. This may differ from your total income due to deductions, exemptions, and credits.

- Total Taxes Paid: The sum of all taxes paid, including income tax, payroll tax, property tax, and any other applicable taxes.

-

Calculate Total Taxable Income

Total Taxable Income = Total Income - Adjustments

Here, “Adjustments” refer to deductions, exemptions, and credits that reduce your taxable income. These can include contributions to retirement accounts, education expenses, or medical deductions. Consult your tax advisor or relevant tax guidelines for a comprehensive list of adjustments applicable to your situation.

-

Determine Total Taxes Paid

Total Taxes Paid = Income Tax + Payroll Tax + Property Tax + Other Applicable Taxes

Income tax is the tax levied on your taxable income. Payroll tax includes deductions for social security, Medicare, and other employment-related taxes. Property tax is applicable if you own real estate, and “Other Applicable Taxes” can include state and local taxes, sales tax, or any other taxes relevant to your financial situation.

-

Calculate Average Tax Rate

Average Tax Rate = (Total Taxes Paid / Total Taxable Income) * 100

This formula provides the average percentage of your taxable income that goes towards taxes. It offers a more accurate representation of your tax liability than simply using the marginal tax rate, which can be misleading when dealing with progressive tax systems.

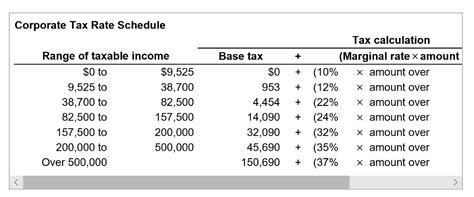

Example Calculation: Average Tax Rate for a Business

Let’s consider a business with the following financial data:

| Total Revenue | 500,000</th> </tr> <tr> <td>Cost of Goods Sold</td> <td>200,000 |

|---|---|

| Operating Expenses | 150,000</td> </tr> <tr> <td>Depreciation</td> <td>25,000 |

| Interest Expenses | 10,000</td> </tr> <tr> <td>Taxable Income</td> <td>115,000 |

| Income Tax | 28,750</td> </tr> <tr> <td>Payroll Tax</td> <td>12,000 |

| Property Tax | 5,000</td> </tr> <tr> <td>Total Taxes Paid</td> <td>45,750 |

Using the formula:

Average Tax Rate = ($45,750 / $115,000) * 100

The business's average tax rate is approximately 39.82%.

Factors Influencing Average Tax Rate

The average tax rate can be influenced by various factors, including:

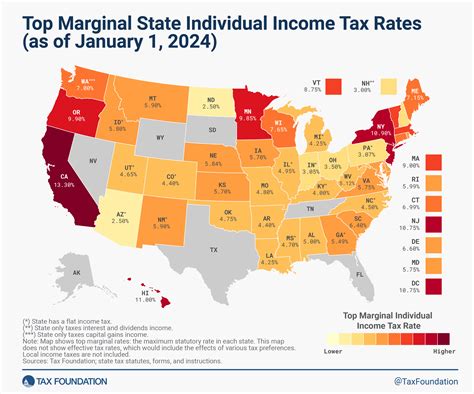

- Tax Brackets: Progressive tax systems, where tax rates increase with income, can lead to higher average tax rates for individuals with higher incomes.

- Tax Deductions and Credits: Deductions and credits can reduce taxable income, resulting in a lower average tax rate.

- Tax Policy Changes: Changes in tax laws, such as tax rate adjustments or the introduction of new tax incentives, can significantly impact the average tax rate.

- Business Structure: The legal structure of a business, such as a sole proprietorship, partnership, or corporation, can affect the applicable tax rates and, consequently, the average tax rate.

Why Understanding Average Tax Rate Matters

Grasping the concept of the average tax rate is vital for several reasons:

- Financial Planning: It allows individuals and businesses to budget effectively, ensuring sufficient funds are allocated for tax obligations.

- Tax Strategy: Understanding your average tax rate can guide decisions related to tax planning, such as optimizing deductions or exploring tax-advantaged investments.

- Comparative Analysis: Average tax rates can be used to compare tax liabilities across different income levels, industries, or geographic locations, providing valuable insights for strategic decision-making.

- Policy Analysis: Analyzing the impact of tax policies on average tax rates can inform public policy discussions and help assess the fairness and effectiveness of tax systems.

Frequently Asked Questions (FAQ)

Can the average tax rate be lower than the marginal tax rate?

+

Yes, it is possible for the average tax rate to be lower than the marginal tax rate. This typically occurs when deductions, exemptions, or credits reduce taxable income, resulting in a lower average tax rate than the highest tax bracket you fall into.

How often should I calculate my average tax rate?

+

It’s beneficial to calculate your average tax rate annually to understand your tax liability and make informed financial decisions. Additionally, you may want to recalculate it whenever there are significant changes in your income, deductions, or tax laws.

Are there any online tools or software that can help calculate the average tax rate?

+

Yes, several online tax calculators and financial planning software offer tools to calculate average tax rates. These tools can simplify the process and provide estimates based on your income and deductions. However, it’s always recommended to consult a tax professional for accurate and personalized advice.

How does the average tax rate differ for individuals and businesses?

+

The average tax rate for individuals is calculated based on their personal income and applicable tax rates. For businesses, it considers the total revenue, expenses, and applicable taxes, resulting in a different calculation and often a distinct tax rate.