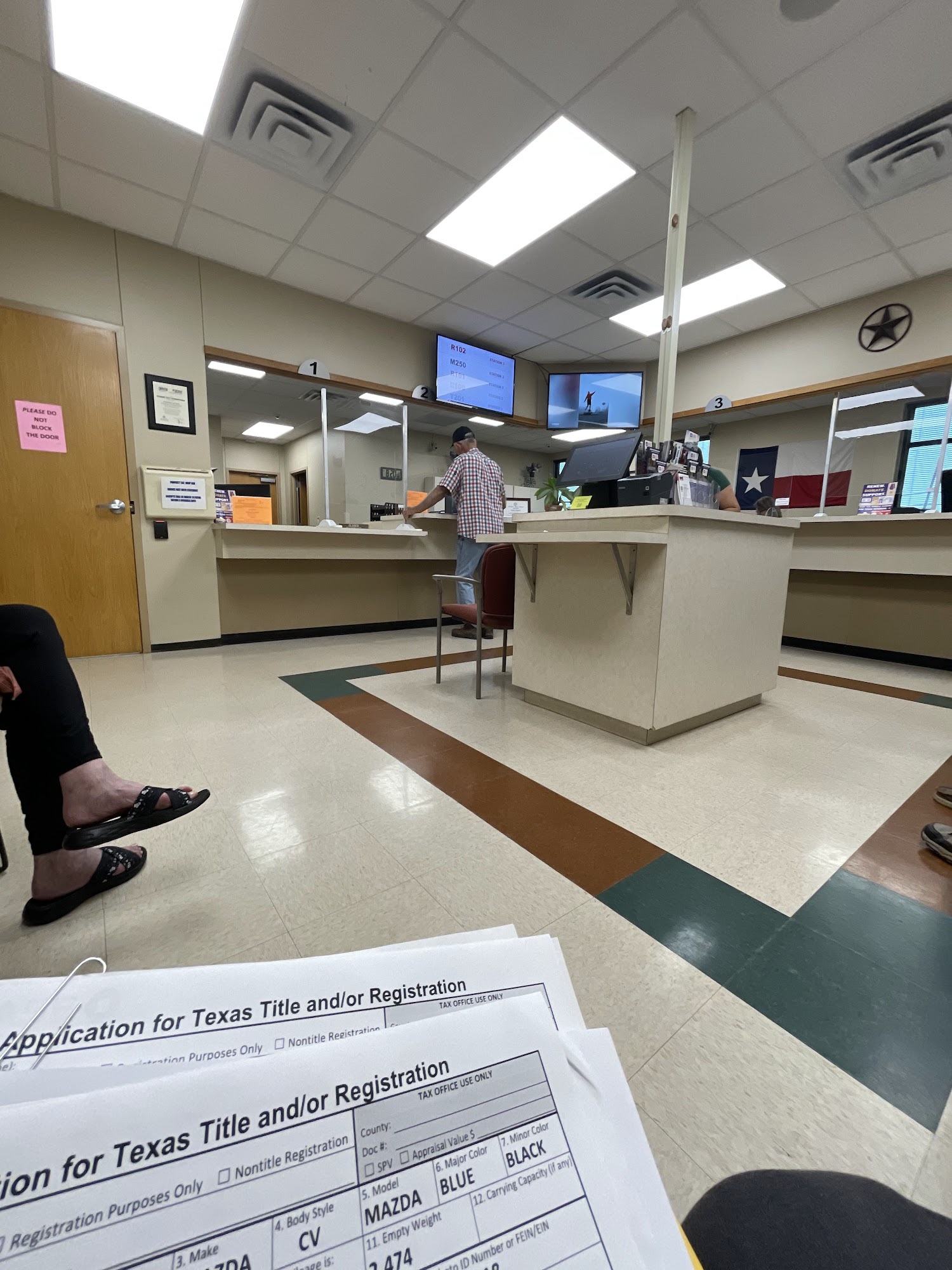

Williamson County Tax Office

Welcome to a comprehensive exploration of the Williamson County Tax Office, a pivotal entity in the local government of Williamson County, Texas. This article aims to delve into the intricate workings of this tax office, shedding light on its functions, services, and impact on the community. With a focus on transparency and expertise, we aim to provide an insightful journey through the world of local taxation, offering valuable information to residents, businesses, and anyone interested in understanding the inner workings of this essential governmental department.

Unveiling the Williamson County Tax Office: A Comprehensive Overview

Nestled in the heart of Texas, the Williamson County Tax Office stands as a cornerstone of local governance, playing a vital role in the financial management and development of the county. This tax office, though often behind the scenes, is integral to the smooth functioning of the county’s administration, impacting everything from public services to community development initiatives.

A Historical Perspective: The Evolution of the Williamson County Tax Office

The origins of the Williamson County Tax Office can be traced back to the early days of the county’s establishment. Over the years, it has evolved from a simple tax collection entity to a sophisticated administrative body, adapting to the changing needs of the county and its residents. A notable milestone in its history was the implementation of the modern property tax system, which revolutionized the way taxes were assessed and collected, bringing efficiency and transparency to the process.

| Key Milestones | Year |

|---|---|

| Establishment of Williamson County | 1848 |

| Implementation of Modern Property Tax System | 1980 |

| Expansion of Online Services | 2005 |

Today, the Williamson County Tax Office is renowned for its efficient operations and commitment to public service. It employs a dedicated team of professionals who are experts in tax law and administration, ensuring that the county's tax processes are fair, accurate, and accessible to all.

The Role and Responsibilities of the Tax Office

The primary responsibility of the Williamson County Tax Office is the assessment and collection of property taxes. This involves evaluating the value of properties within the county, issuing tax bills, and ensuring timely payment from property owners. However, its role extends beyond mere tax collection. The tax office also serves as a valuable resource for taxpayers, offering guidance on tax-related matters, resolving disputes, and providing essential information to the community.

One of the key strengths of the Williamson County Tax Office is its focus on taxpayer education. Through various initiatives and outreach programs, it strives to empower residents with knowledge about their tax obligations and rights. This includes hosting workshops, providing online resources, and offering personalized assistance to ensure that taxpayers are well-informed and able to navigate the complex world of property taxation.

Services Offered by the Williamson County Tax Office

The Williamson County Tax Office provides a comprehensive suite of services to meet the diverse needs of its taxpayers. These services include:

- Property Tax Assessment: The tax office assesses the value of properties, ensuring fair and accurate taxation.

- Tax Payment Options: Residents have access to a range of convenient payment methods, including online payment, eCheck, and traditional mail-in payments.

- Tax Bill Information: Taxpayers can easily access their tax bill details, including property information, tax amounts, and payment due dates.

- Online Account Management: A secure online platform allows taxpayers to manage their accounts, view payment history, and receive important notifications.

- Tax Exemptions and Discounts: The tax office provides information and assistance for taxpayers who may be eligible for exemptions or discounts, such as the Over-65 Homestead Exemption or the Disabled Veteran Exemption.

- Tax Rate Information: Residents can access detailed information about tax rates, including historical rates and proposed changes, ensuring transparency in the taxation process.

- Appeals and Dispute Resolution: In cases of disagreement with tax assessments, the tax office provides a fair and impartial appeals process, ensuring taxpayers have a voice in the decision-making process.

Performance and Achievements: A Record of Excellence

The Williamson County Tax Office has consistently maintained a record of excellence in its operations. Year after year, it has achieved remarkable success in tax collection, with an impressive collection rate that surpasses the state average. This achievement is a testament to the efficiency and effectiveness of its processes, as well as the dedication of its staff.

In addition to its operational excellence, the tax office has also been recognized for its innovative approaches to taxpayer service. It was one of the first tax offices in the state to implement an online payment system, revolutionizing the way taxpayers interact with the office. This move not only enhanced convenience but also increased transparency, as taxpayers could track their payments and receive instant confirmations.

| Key Achievements | Year |

|---|---|

| Implementation of Online Payment System | 2005 |

| Recipient of National Tax Office Excellence Award | 2018 |

| Launch of Taxpayer Education Program | 2020 |

The Williamson County Tax Office's commitment to continuous improvement is evident in its adoption of cutting-edge technology and its focus on staff training and development. This ensures that the office remains at the forefront of tax administration, delivering exceptional service to the residents of Williamson County.

The Impact on the Community: Beyond Taxation

While the primary function of the Williamson County Tax Office is tax administration, its impact extends far beyond this role. The tax office plays a crucial part in the economic development and overall well-being of the county. By ensuring fair and efficient tax collection, it contributes to the stability of the local economy, providing the necessary funds for essential public services and infrastructure development.

Moreover, the tax office's outreach programs and taxpayer education initiatives have a profound impact on the community. By empowering residents with knowledge about their tax obligations and rights, the tax office fosters a sense of civic responsibility and engagement. This, in turn, strengthens the community's trust in local government and encourages active participation in the democratic process.

Future Prospects and Innovations: Looking Ahead

As technology continues to advance, the Williamson County Tax Office is poised to leverage these advancements to further enhance its services. The office is exploring the implementation of blockchain technology for secure and transparent record-keeping, as well as the use of artificial intelligence to streamline processes and improve efficiency.

Additionally, the tax office is committed to maintaining its position as a leader in taxpayer service. It plans to expand its online services, making it even more convenient for taxpayers to access information and manage their accounts. The office is also looking into innovative ways to engage with the community, such as through social media platforms and community forums, ensuring that it remains accessible and responsive to the needs of its residents.

Conclusion: A Trusted Pillar of Local Governance

In conclusion, the Williamson County Tax Office stands as a trusted pillar of local governance, playing a critical role in the financial health and development of the county. Through its efficient operations, commitment to taxpayer service, and focus on innovation, it has earned a reputation for excellence. As it continues to adapt to the changing landscape of taxation and technology, the tax office remains dedicated to serving the community with integrity and professionalism.

Frequently Asked Questions

What are the hours of operation for the Williamson County Tax Office?

+The tax office is open Monday to Friday from 8:00 a.m. to 5:00 p.m. excluding public holidays.

How can I pay my property taxes in Williamson County?

+You can pay your property taxes through various methods, including online payment, eCheck, or by mailing a check to the tax office. The office also accepts payments in person during business hours.

What if I disagree with my property tax assessment?

+If you believe your property tax assessment is incorrect, you have the right to appeal. The tax office provides a fair and impartial appeals process. You can contact the office to initiate the appeals process and receive guidance on the necessary steps.

Are there any tax exemptions or discounts available in Williamson County?

+Yes, Williamson County offers several tax exemptions and discounts. These include the Over-65 Homestead Exemption, the Disabled Veteran Exemption, and the Disabled Person’s Exemption. You can contact the tax office or visit their website for detailed information on eligibility criteria and application processes.