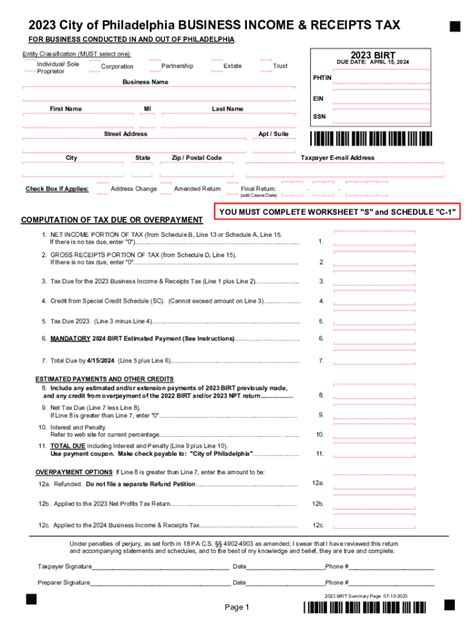

Philadelphia Income Tax

Philadelphia's income tax system is an important aspect of the city's fiscal landscape, contributing significantly to its revenue stream and shaping the economic environment for both residents and businesses. This comprehensive guide aims to delve into the intricacies of the Philadelphia Income Tax, exploring its history, current structure, impact on taxpayers, and future prospects.

The Evolution of Philadelphia Income Tax

Philadelphia’s journey with income taxation began in 1939, marking a pivotal moment in the city’s fiscal history. The introduction of this tax was a strategic move to bolster the city’s financial stability during a period of economic uncertainty. Over the years, the income tax has undergone several transformations, adapting to the changing needs of the city and its residents.

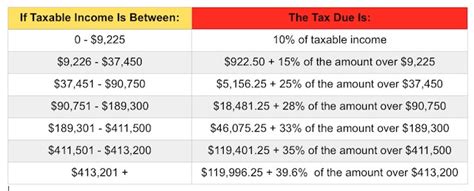

Initially, the tax rate was set at a modest 1%, applicable to all income earned within the city limits. This rate remained unchanged for several decades, providing a stable source of revenue for essential city services. However, as the city's economic landscape evolved, so did the tax system. In the late 1980s, Philadelphia witnessed a significant shift with the introduction of a graduated tax rate structure.

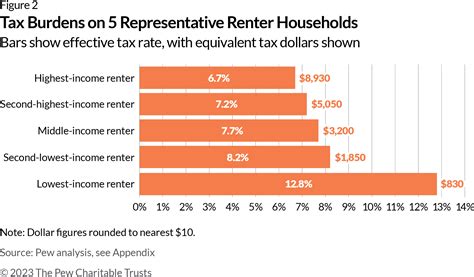

The new system implemented a progressive tax model, where the tax rate increased with higher income levels. This move aimed to promote fairness and ensure that higher-income earners contributed proportionally more to the city's coffers. The graduated rates provided a more equitable distribution of the tax burden, recognizing the varying financial capacities of taxpayers.

Understanding the Current Philadelphia Income Tax Structure

Today, Philadelphia’s income tax system is a sophisticated framework, designed to balance revenue generation with taxpayer fairness. The current structure is built on a foundation of graduated tax rates, with the specific rates determined by the taxpayer’s residency status and income level.

Residency-Based Tax Rates

Philadelphia differentiates between residents and non-residents when it comes to tax rates. Residents, defined as individuals who spend more than 183 days within the city limits, are subject to a slightly lower tax rate compared to non-residents. This distinction recognizes the varying levels of engagement and contribution to the city’s economy.

| Residency Status | Tax Rate |

|---|---|

| Resident | 3.869% |

| Non-Resident | 3.8804% |

Income-Based Tax Brackets

Within the residency categories, the tax system further differentiates based on income levels. The income brackets are designed to ensure that individuals with higher earnings contribute a greater share of their income to the city’s revenue. This progressive structure aims to promote economic equity and support essential city services.

| Income Bracket | Tax Rate |

|---|---|

| Up to $30,000 | 3.869% |

| $30,001 - $75,000 | 3.935% |

| $75,001 and above | 4.008% |

Impact on Taxpayers: A Comprehensive Analysis

The Philadelphia Income Tax has a profound impact on the financial well-being of its residents and businesses. Understanding this impact is crucial for individuals and entities operating within the city’s boundaries.

Financial Obligations for Individuals

For individuals, the income tax is a direct financial obligation that can significantly impact their disposable income. The graduated tax rates mean that higher-income earners face a steeper tax burden, which can influence their spending habits, savings, and overall financial planning.

Additionally, the residency-based differentiation in tax rates adds a layer of complexity for individuals who frequently travel or have multiple residences. Understanding their residency status and the corresponding tax rate is essential for accurate tax filings and financial management.

Implications for Businesses

Businesses operating in Philadelphia also face unique tax considerations. The income tax applies to both pass-through entities and traditional corporations, impacting their bottom line and operational costs.

For corporations, the tax rate is a direct cost of doing business within the city. It influences their profitability and can factor into strategic decisions such as expansion plans, investment strategies, and even relocation considerations. The tax rate's competitiveness compared to other cities can be a critical factor in business growth and sustainability.

Pass-through entities, such as partnerships and sole proprietorships, face a different set of challenges. While they benefit from pass-through taxation at the federal level, the city's income tax applies to their business income. This can create a complex tax landscape, requiring careful planning and compliance to ensure accurate filings.

Performance Analysis and Future Prospects

The Philadelphia Income Tax has been a stable and reliable source of revenue for the city, contributing significantly to its fiscal health. An analysis of the tax’s performance over the years reveals its effectiveness in generating revenue and supporting city initiatives.

The progressive tax structure has proven to be a successful strategy, promoting fairness and ensuring a robust revenue stream. The city's ability to adapt the tax rates based on economic conditions and resident needs has been a key factor in its resilience.

Future Considerations

As Philadelphia looks to the future, the income tax system will continue to play a pivotal role in its economic development. The city’s leadership and financial experts are actively engaged in discussions to refine and enhance the tax system, ensuring its sustainability and effectiveness.

Potential future considerations include adjustments to tax rates to maintain competitiveness with neighboring cities, as well as exploring tax incentives to attract and retain businesses. The city's commitment to a fair and efficient tax system is evident in its ongoing efforts to strike a balance between revenue generation and taxpayer fairness.

Conclusion

Philadelphia’s income tax system is a dynamic and evolving entity, shaped by the city’s economic needs and the changing landscape of taxation. Its history, current structure, and impact on taxpayers provide a comprehensive understanding of this vital aspect of Philadelphia’s fiscal environment.

As the city continues to adapt and grow, the income tax will remain a critical tool for fiscal stability and economic development. The ongoing commitment to fairness, efficiency, and adaptability ensures that the Philadelphia Income Tax remains a cornerstone of the city's financial framework.

How is Philadelphia’s income tax different from other cities?

+Philadelphia’s income tax stands out with its residency-based differentiation and graduated tax rates. This structure ensures a fair tax burden for residents and non-residents, promoting economic equity within the city.

What are the key benefits of Philadelphia’s income tax system?

+The system’s benefits include its progressive nature, ensuring higher-income earners contribute proportionally more. This, coupled with residency-based rates, promotes fairness and generates a stable revenue stream for essential city services.

How does the income tax impact businesses operating in Philadelphia?

+Businesses face a direct cost of doing business with the income tax. The rate can influence strategic decisions, such as expansion plans and investment strategies. Pass-through entities also face unique challenges with their business income being subject to the tax.

What are the future prospects for Philadelphia’s income tax system?

+The city is actively exploring adjustments to maintain competitiveness and attract businesses. The focus remains on fairness and sustainability, ensuring the tax system continues to support Philadelphia’s economic growth and development.