When Is Tn Tax Free Weekend

The Tennessee Tax-Free Weekend, a highly anticipated event for residents, offers a great opportunity to save on certain essential items. This annual occurrence, strategically timed to align with back-to-school preparations, provides a tax respite on eligible purchases, making it a favorable time for consumers to stock up on necessary goods without the burden of state sales tax. Let's delve into the specifics of this event, exploring its dates, eligible items, and the potential savings it offers.

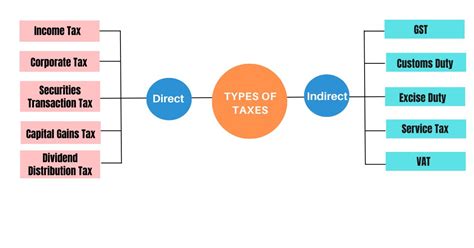

Understanding the Tn Tax-Free Weekend

The Tennessee Tax-Free Weekend, a unique sales tax holiday, is a dedicated period when the state suspends its sales tax on specific items. This initiative is designed to ease the financial burden on residents, especially those with upcoming educational needs. The weekend provides a chance to purchase essential items at a reduced cost, fostering economic growth and supporting local businesses.

This event has become a tradition in Tennessee, with residents eagerly awaiting its arrival each year. It not only benefits consumers but also stimulates the local economy, encouraging increased spending during this tax-free period.

Dates and Timing

The Tennessee Tax-Free Weekend typically occurs during the first weekend of August, spanning from Friday to Sunday. This year, the event is scheduled for August 5th to August 7th, 2022. Marking a consistent calendar spot, it provides residents with an annual reminder to plan their purchases strategically.

The specific dates are determined by state legislation, with the aim of providing a convenient and predictable timeline for shoppers. This advanced notice allows consumers to budget effectively and make informed decisions about their purchases.

Eligible Items and Categories

The Tennessee Tax-Free Weekend encompasses a wide range of items, focusing on essential goods for education, clothing, and school supplies. Here’s a breakdown of the eligible categories:

- Clothing: All clothing items, including apparel, accessories, footwear, and even sports equipment, are tax-free during this weekend. This category covers a broad spectrum, from everyday wear to specialized gear.

- School Supplies: Essential school items like notebooks, pens, calculators, and backpacks are exempt from sales tax. This category ensures that students can acquire the necessary tools for their educational journey without the added tax burden.

- Computers and Related Accessories: Computers, tablets, printers, and related accessories are included in the tax-free category. This provision acknowledges the increasing importance of technology in education and provides an opportunity for cost-effective upgrades.

- Books: All types of books, whether textbooks, novels, or reference materials, are eligible for the tax exemption. This encourages reading and supports the educational goals of residents.

It's important to note that there are specific thresholds and limitations for some categories. For instance, clothing items must be priced under $100, and computer purchases are limited to those under $1,500. These restrictions ensure that the tax-free benefits are focused on essential items and prevent potential abuse.

Potential Savings

The Tennessee Tax-Free Weekend offers significant savings for residents, especially those with extensive shopping lists. For instance, a family with multiple school-going children could save hundreds of dollars on their back-to-school shopping, considering the wide range of eligible items.

To illustrate, let's consider a hypothetical scenario. A family planning to purchase new clothing, school supplies, and a laptop during this weekend could save approximately 9.25% on their total expenditure, which is the current state sales tax rate in Tennessee. This translates to substantial savings, especially when considering the number of items typically required for a new school year.

| Item Category | Estimated Cost | Potential Savings |

|---|---|---|

| Clothing | $300 | $27.75 |

| School Supplies | $150 | $13.88 |

| Laptop | $1,000 | $92.50 |

| Total Savings | $1,450 | $134.13 |

This example showcases the potential savings, which can significantly reduce the financial strain associated with back-to-school preparations. It's a testament to the state's commitment to supporting its residents and fostering a thriving local economy.

Preparing for the Tn Tax-Free Weekend

With the Tennessee Tax-Free Weekend approaching, it’s essential to plan your shopping strategy to maximize savings. Here are some tips to ensure a successful and efficient shopping experience:

Create a Shopping List

Start by making a comprehensive list of all the items you need, especially those that fall under the eligible categories. This list will help you stay focused and ensure you don’t miss out on any essential purchases. Consider the upcoming school year’s requirements and make sure to include clothing, school supplies, and any necessary technology upgrades.

Research and Compare Prices

Take time to research and compare prices for the items on your list. With the tax-free weekend, you can save even more by finding the best deals. Online price comparison tools can be helpful, but don’t forget to check local stores as well. Some retailers may offer additional discounts or promotions during this period, so keep an eye out for those opportunities.

Plan Your Shopping Route

Consider the locations of the stores you plan to visit and map out an efficient route. This will save you time and ensure you can cover all your shopping needs in one go. Remember that stores may have different opening hours and stock availability, so planning ahead is crucial. You might also want to check if any stores offer online shopping or click-and-collect services to further streamline your experience.

Stay Informed on Store Policies

Different retailers may have varying policies during the Tax-Free Weekend. Some stores might offer additional discounts or promotions, while others may have specific rules about refunds or returns. Stay updated on these policies to avoid any surprises and ensure a smooth shopping experience. It’s also a good idea to check if stores have extended their operating hours to accommodate the increased footfall during this period.

Be Prepared for Crowds

The Tax-Free Weekend is a popular event, and stores can get busy. Be prepared for potential crowds and plan your shopping trip accordingly. If you prefer a more relaxed environment, consider shopping early in the morning or during off-peak hours. Alternatively, online shopping can be a convenient option to avoid the hustle and bustle of crowded stores.

Take Advantage of Online Shopping

Online shopping can be a great alternative during the Tax-Free Weekend, especially if you prefer the convenience of shopping from home or want to avoid crowds. Many retailers offer online discounts and promotions during this period, so be sure to check their websites. Additionally, online shopping allows you to compare prices and read reviews more easily, helping you make informed purchasing decisions.

Consider Alternative Payment Methods

While the Tax-Free Weekend is focused on sales tax exemptions, it’s still a good idea to consider your payment options. Some retailers may offer additional benefits or discounts when using specific payment methods, such as credit cards or loyalty programs. Be aware of these opportunities and choose the payment method that provides the most value for your purchases.

Review Your Receipts

After your shopping trip, take a moment to review your receipts. This will help you ensure that all eligible items were correctly taxed (or rather, not taxed) and that you received the expected savings. It’s also a good practice to keep your receipts for future reference, especially if you need to return any items or make warranty claims.

In Conclusion: A Smart Shopping Strategy

The Tennessee Tax-Free Weekend is a valuable opportunity for residents to save on essential items, especially during the back-to-school season. By understanding the eligible categories, planning your shopping strategy, and staying informed about store policies and discounts, you can make the most of this annual event.

Remember to create a detailed shopping list, research prices, and plan your shopping route efficiently. Consider both in-store and online shopping options, and be mindful of potential crowds. By following these tips, you can navigate the Tax-Free Weekend with ease and enjoy the benefits of tax-free savings.

As you prepare for the upcoming Tax-Free Weekend, keep in mind that this event is not just about saving money; it's also about supporting local businesses and contributing to the growth of the state's economy. Your strategic shopping choices can make a positive impact, so make the most of this opportunity and enjoy the rewards of your thoughtful planning.

What is the Tennessee Tax-Free Weekend, and when does it occur?

+The Tennessee Tax-Free Weekend is a designated period when the state suspends sales tax on certain items. It typically occurs during the first weekend of August, from Friday to Sunday. This year, it will take place from August 5th to August 7th, 2022.

What types of items are eligible for tax-free status during this weekend?

+Eligible items include clothing, school supplies, computers, and related accessories, as well as books. There are specific thresholds and limitations for some categories, ensuring the focus remains on essential items.

How much can I expect to save during the Tennessee Tax-Free Weekend?

+The potential savings depend on the items you purchase and their prices. For example, a family buying clothing, school supplies, and a laptop could save around 134.13 based on a 9.25% sales tax rate. This can significantly reduce the financial burden associated with back-to-school preparations.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any restrictions or limitations on the tax-free benefits?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, there are specific restrictions and thresholds for some categories. Clothing items, for instance, must be priced under 100, and computer purchases are limited to those under $1,500. These limitations ensure that the tax-free benefits are focused on essential items.

What are some tips for preparing for the Tennessee Tax-Free Weekend?

+Create a shopping list, research prices, plan your shopping route, and stay informed about store policies and discounts. Consider both in-store and online shopping options, and be prepared for potential crowds. By planning ahead, you can make the most of this event and enjoy significant savings.