Lake County Il Real Estate Taxes

Lake County, Illinois, is renowned for its diverse real estate market, ranging from picturesque lakefront properties to quaint suburban neighborhoods. However, when it comes to homeownership, one crucial factor that often takes center stage is the real estate tax landscape. In this comprehensive guide, we will delve into the intricacies of Lake County IL Real Estate Taxes, offering an in-depth analysis to empower prospective buyers and current homeowners alike.

Understanding Lake County’s Real Estate Tax Structure

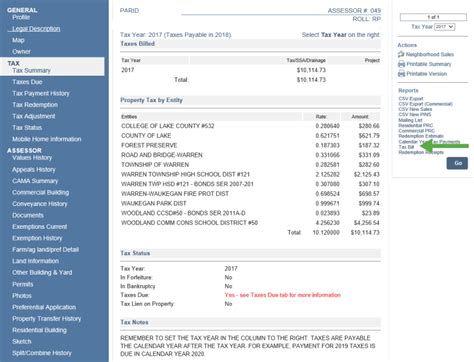

Lake County’s real estate tax system is a complex yet essential component of the local economy. It is a primary source of revenue for various governmental bodies, including county, municipal, and school district authorities. These taxes are levied on the assessed value of properties, and the funds generated contribute to vital services and infrastructure development.

The real estate tax rate in Lake County is determined by a combination of factors, including the tax rate set by each taxing body and the equalized assessed value (EAV) of the property. The EAV is calculated based on the property's market value, taking into account recent sales data and other relevant factors. This assessment process ensures fairness and uniformity across the county.

Key Taxing Bodies in Lake County

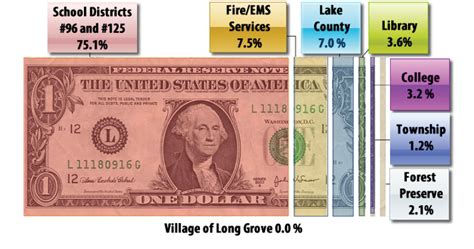

Several entities have the authority to levy taxes on real estate within Lake County. These include:

- Lake County Government: Responsible for county-wide services and infrastructure, the county government plays a significant role in setting tax rates.

- Municipalities: Each city, village, or township within Lake County has its own taxing body, which collects taxes for local services and projects.

- School Districts: Lake County is home to numerous school districts, each with its own tax rate to support education and related initiatives.

- Special Districts: These include entities like fire protection districts, library districts, and park districts, each serving specific purposes and collecting taxes accordingly.

The combination of these tax rates from different bodies results in the total real estate tax rate for a property in Lake County. It's important to note that these rates can vary significantly between different areas within the county, influenced by the unique needs and services provided by each taxing body.

| Taxing Body | Tax Rate (per $100 of EAV) |

|---|---|

| Lake County Government | 1.50 |

| Lake County School District | 3.25 |

| Lake Forest Municipality | 2.70 |

| Libertyville Township High School District | 2.20 |

| Lake Forest Fire Protection District | 0.60 |

The Impact of Real Estate Taxes on Property Owners

Real estate taxes in Lake County have a significant impact on property owners, influencing both their day-to-day finances and long-term financial planning. Let’s explore these impacts in detail.

Annual Budget and Financial Planning

Real estate taxes are typically due annually, with bills issued by the Lake County Treasurer’s office. These taxes can represent a substantial portion of a homeowner’s annual expenses. It is essential for homeowners to factor these taxes into their budget planning to ensure timely payments and avoid penalties.

Prospective buyers should also consider real estate taxes as a crucial element of their home-buying decision. The tax burden can vary significantly between properties, impacting the overall affordability of a home. A thorough understanding of the tax landscape can help buyers make informed choices that align with their financial capabilities.

Property Value and Tax Assessment

The assessed value of a property, as determined by the Lake County Assessor’s office, is a critical factor in calculating real estate taxes. This value can fluctuate over time due to market conditions, improvements made to the property, or changes in assessment methodology.

Homeowners should stay informed about their property's assessed value and ensure its accuracy. Discrepancies in assessment can lead to unfair tax burdens. If a homeowner believes their property's assessed value is incorrect, they have the right to appeal through the Lake County Board of Review.

Tax Relief and Exemptions

Lake County offers various tax relief programs and exemptions to eligible homeowners. These initiatives aim to ease the tax burden on certain segments of the population, such as senior citizens, veterans, and individuals with disabilities.

- Senior Citizens' Homestead Exemption: This exemption reduces the equalized assessed value of a property for homeowners aged 65 and older.

- Veterans' Exemption: Qualified veterans may be eligible for a reduction in their property's assessed value, providing tax relief.

- Disabled Persons' Homestead Exemption: This exemption benefits individuals with disabilities by reducing the assessed value of their primary residence.

Understanding the eligibility criteria and application process for these exemptions can help homeowners maximize their tax savings.

Lake County’s Real Estate Tax Performance and Trends

Analyzing the performance and trends of real estate taxes in Lake County provides valuable insights into the financial health and stability of the region. Let’s examine some key indicators and their implications.

Tax Revenue Growth

Over the past decade, Lake County has experienced steady growth in real estate tax revenue. This growth is primarily driven by two factors: an increase in the county’s overall property values and the expansion of its tax base as new developments are completed.

The consistent growth in tax revenue has been a positive indicator for the county's financial stability, allowing for improved services and infrastructure development. However, it also underscores the importance of vigilant financial planning for homeowners and prospective buyers.

Tax Rate Stability

Despite the rising tax revenue, Lake County has maintained a relatively stable tax rate over the years. This stability is a result of careful budgeting and strategic allocation of funds by the county’s governing bodies. It ensures that homeowners are not burdened with sudden and drastic increases in their tax obligations.

Stable tax rates provide homeowners with a sense of financial security and predictability, making it easier to plan for the future. However, it's essential for homeowners to stay informed about any proposed changes to tax rates, as these can have a significant impact on their financial obligations.

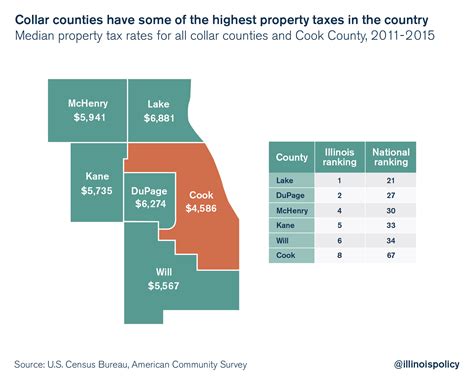

Comparative Analysis with Neighboring Counties

When assessing the tax landscape, it’s beneficial to compare Lake County’s real estate tax rates with those of its neighboring counties. Such comparisons provide valuable context and help homeowners and buyers understand the relative affordability of properties in the region.

| County | Tax Rate (per $100 of EAV) |

|---|---|

| Lake County | 6.50 |

| McHenry County | 5.80 |

| Cook County | 7.20 |

| Kenosha County, WI | 5.20 |

| Waukesha County, WI | 6.00 |

As seen in the table above, Lake County's tax rate is relatively competitive when compared to its neighboring counties. This analysis can be a valuable tool for buyers deciding between different regions, helping them make informed choices based on their financial considerations.

The Future of Real Estate Taxes in Lake County

As Lake County continues to evolve and grow, the landscape of real estate taxes is likely to experience shifts and adjustments. Several factors will influence the future trajectory of these taxes, including economic trends, demographic changes, and governmental policies.

Economic Factors

The health of the local economy plays a pivotal role in determining the future of real estate taxes. A robust economy with a thriving job market and stable property values can lead to sustained growth in tax revenue. Conversely, economic downturns can result in decreased property values and a potential reduction in tax revenue.

Demographic Shifts

Changes in the demographic composition of Lake County can also impact real estate taxes. For instance, an influx of younger residents may drive demand for new developments, leading to an expansion of the tax base. On the other hand, an aging population might result in an increased demand for senior-focused tax relief programs.

Governmental Policies and Initiatives

The decisions made by county and municipal governments can significantly influence real estate taxes. These include initiatives to attract businesses, investments in infrastructure, and changes in tax rates or assessment methodologies. Homeowners and prospective buyers should stay informed about these developments to anticipate potential changes in their tax obligations.

Technological Advancements

The integration of technology in the assessment and collection of real estate taxes is another factor to consider. Lake County, like many other regions, is increasingly adopting digital tools to streamline these processes. This can lead to improved efficiency and potentially reduced costs, benefiting both taxpayers and governmental bodies.

Conclusion

Understanding the intricacies of Lake County’s real estate tax system is essential for both current homeowners and prospective buyers. By comprehending the tax rates, assessment processes, and available relief programs, individuals can make informed decisions about their financial obligations and plan for the future effectively.

As Lake County continues to thrive and evolve, staying abreast of the latest developments and trends in real estate taxes will empower individuals to navigate the local market with confidence and financial acumen.

How often are real estate taxes assessed in Lake County?

+Real estate taxes in Lake County are assessed annually. The Lake County Assessor’s office determines the equalized assessed value (EAV) of each property, which forms the basis for tax calculations.

Are there any ways to reduce my real estate tax burden in Lake County?

+Yes, Lake County offers various tax relief programs and exemptions. These include the Senior Citizens’ Homestead Exemption, Veterans’ Exemption, and Disabled Persons’ Homestead Exemption. Additionally, keeping your property well-maintained and appealing any incorrect assessments can help reduce your tax burden.

How can I stay informed about proposed changes to real estate tax rates in Lake County?

+Staying informed about proposed tax changes is crucial. You can monitor local news outlets, attend public meetings, and subscribe to updates from the Lake County Treasurer’s office and other relevant taxing bodies. This ensures you’re aware of any potential increases or adjustments to tax rates.