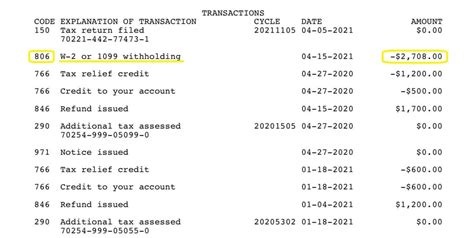

806 Tax Code

The 806 Tax Code is a critical aspect of the UK tax system, impacting individuals' tax obligations and deductions. This article aims to delve into the intricacies of the 806 Tax Code, providing a comprehensive guide to understanding its implications and how it affects taxpayers. By exploring real-world examples and expert insights, we aim to demystify this code and empower readers with the knowledge to navigate their tax responsibilities effectively.

Understanding the 806 Tax Code

The 806 Tax Code is a specific tax code assigned to individuals by Her Majesty’s Revenue and Customs (HMRC) in the United Kingdom. It indicates that the taxpayer’s income is subject to a particular set of tax rules and deductions. This code is essential as it determines the amount of tax deducted from an individual’s earnings and ensures compliance with UK tax regulations.

The 806 Tax Code is often associated with employment and payroll tax calculations. When an employer receives this code from HMRC, it serves as a directive for the correct tax treatment of an employee's income. The code takes into account various factors, including the individual's personal circumstances, employment status, and any eligible deductions or allowances.

For instance, let's consider the case of Mr. Smith, a UK resident working for a local business. Upon receiving his payslip, he notices the 806 Tax Code. This code indicates that Mr. Smith's income is taxed according to the standard rate, with no additional allowances or deductions applied. In this scenario, the code ensures that Mr. Smith's employer deducts the correct amount of tax from his salary, adhering to UK tax laws.

Key Features of the 806 Tax Code

The 806 Tax Code possesses several distinctive features that set it apart from other tax codes:

- Standard Rate Taxation: This code is typically associated with individuals earning within the standard tax bracket. It signifies that the taxpayer’s income is subject to the basic rate of income tax, which is currently set at 20% for most earnings.

- No Additional Allowances: Unlike some other tax codes, the 806 code does not automatically incorporate additional allowances or deductions, such as marriage allowances or pension contributions. These allowances must be claimed separately by the taxpayer.

- Employer Responsibility: Employers play a crucial role in implementing the 806 Tax Code. They are responsible for ensuring that the correct tax deductions are made from their employees’ salaries based on the provided code. This requires accurate payroll calculations and compliance with HMRC guidelines.

It's important to note that the 806 Tax Code is just one of many codes used by HMRC. Other codes, such as the 1100L or BR, indicate different tax scenarios and allowances. Understanding the specific code assigned to you is crucial for accurate tax calculations and ensuring compliance with UK tax regulations.

| Tax Code | Description |

|---|---|

| 806 | Standard rate of tax with no additional allowances |

| 1100L | Personal allowance for individuals with no tax liabilities |

| BR | Basic rate of tax for individuals with income above the personal allowance |

Tax Code Variations and Their Impact

While the 806 Tax Code is a common code for many taxpayers, it’s crucial to recognize that tax codes can vary depending on individual circumstances. HMRC assigns different codes based on factors such as income level, personal allowances, and tax liabilities.

Common Tax Code Variations

Some of the most frequently encountered tax codes, aside from 806, include:

- 1100L: This code is assigned to individuals who have a personal allowance but no tax liabilities. It indicates that the taxpayer’s income falls below the standard tax threshold and, therefore, no tax is deducted.

- BR: The BR code is used for individuals whose income exceeds the personal allowance and is subject to the basic rate of tax. It signifies that the taxpayer’s earnings are taxed at a rate of 20% up to a certain threshold.

- K Codes: K codes are used to indicate specific tax circumstances, such as underpayment or overpayment of tax in previous years. These codes are often temporary and require additional attention to ensure accurate tax calculations.

Understanding the specific tax code assigned to you is vital, as it directly impacts the amount of tax deducted from your income. Misinterpretation or incorrect application of the code can lead to overpayment or underpayment of tax, potentially resulting in financial penalties or complications with HMRC.

Impact on Tax Calculations

The tax code assigned to you plays a pivotal role in determining your tax liabilities. Let’s delve into some real-world examples to illustrate the impact of different tax codes on tax calculations:

-

Example 1: Personal Allowance (1100L)

Ms. Johnson, a UK resident with an annual income of £12,500, receives the 1100L tax code. This code indicates that her income falls within the personal allowance threshold, and therefore, no tax is deducted from her earnings. In this scenario, Ms. Johnson can enjoy her full income without any tax obligations.

-

Example 2: Basic Rate Tax (BR)

Mr. Brown, a self-employed individual, has an annual income of £35,000. He is assigned the BR tax code, which means he is subject to the basic rate of tax. In this case, Mr. Brown’s income above the personal allowance threshold is taxed at 20%, resulting in a tax liability of £4,200 for the year.

-

Example 3: Overpayment of Tax (K Code)

Mrs. Davis, a recent retiree, discovers that she has been overpaying tax due to an error in her tax code. HMRC assigns her a K code to rectify the situation. This code ensures that Mrs. Davis receives a tax refund, allowing her to reclaim the overpaid amount and adjust her future tax calculations accordingly.

These examples highlight the significance of understanding your tax code and its implications. Accurate tax calculations not only ensure compliance with HMRC regulations but also help individuals maximize their financial planning and avoid potential penalties.

Navigating the 806 Tax Code: Tips and Considerations

When dealing with the 806 Tax Code, it’s essential to approach the process with careful consideration and understanding. Here are some key tips and insights to help you navigate this tax code effectively:

Understanding Your Tax Liability

The 806 Tax Code implies that you are liable for the standard rate of tax on your income. This means that a percentage of your earnings will be deducted as tax. To calculate your tax liability accurately, you should consider the following:

- Your total income for the tax year, including all sources of earnings.

- Any additional deductions or allowances you may be entitled to, such as pension contributions or charitable donations.

- The tax-free personal allowance, which is a set amount of income that is not subject to tax.

By understanding your tax liability, you can ensure that your tax deductions are correct and avoid overpayment or underpayment of tax.

Maximizing Deductions and Allowances

While the 806 Tax Code does not automatically incorporate additional allowances, you may still be eligible for certain deductions or tax reliefs. It’s crucial to explore these options to maximize your tax efficiency. Some common deductions and allowances include:

- Pension contributions: Making regular pension contributions can reduce your taxable income and provide long-term financial benefits.

- Charitable donations: If you donate to registered charities, you may be able to claim Gift Aid, which allows you to reclaim the tax already paid on your donations.

- Business expenses: If you’re self-employed or have a side hustle, keeping track of business-related expenses can help reduce your taxable income.

Consulting with a tax professional or utilizing online tax calculators can help you identify and maximize these deductions, ensuring you get the most out of your tax liabilities.

Regularly Reviewing Your Tax Code

Tax codes can change over time due to various factors, such as changes in income, employment status, or personal circumstances. It’s essential to regularly review your tax code to ensure it remains accurate and up-to-date. This practice helps prevent unexpected tax liabilities and ensures you’re not overpaying or underpaying tax.

HMRC provides online tools and services that allow taxpayers to check their tax codes and update them if necessary. By staying proactive and keeping an eye on your tax code, you can avoid potential complications and maintain compliance with UK tax regulations.

Seeking Professional Advice

Navigating the complexities of the UK tax system can be challenging, especially when dealing with specific tax codes like 806. If you find yourself unsure or overwhelmed, seeking professional advice is highly recommended. Tax advisors and accountants can provide personalized guidance, ensuring you understand your tax obligations and take advantage of any available deductions or allowances.

Additionally, professional advice can help you stay informed about any changes in tax laws or regulations, ensuring you remain compliant and avoid potential penalties. Investing in professional tax guidance can provide peace of mind and help you make informed financial decisions.

Future Outlook and Implications

As the UK tax landscape continues to evolve, it’s essential to stay informed about potential changes and their impact on the 806 Tax Code. While the specific future of this code is uncertain, several factors and trends could influence its application and implications.

Potential Changes in Tax Rates

Tax rates are subject to change based on government policies and economic conditions. The standard rate of tax associated with the 806 Tax Code may be adjusted in the future, impacting the tax liabilities of individuals. Keeping an eye on any proposed changes in tax rates can help taxpayers prepare and adjust their financial planning accordingly.

Impact of Technological Advancements

The advancement of technology, particularly in the realm of digital taxation, could have significant implications for the 806 Tax Code. HMRC is continuously exploring ways to streamline the tax system, improve efficiency, and enhance compliance. Technological innovations, such as digital tax returns and real-time information sharing, may influence the way tax codes are assigned and calculated.

Changing Economic Landscape

Economic factors, such as inflation, wage growth, and employment trends, can also impact the relevance and application of the 806 Tax Code. As the economic landscape shifts, the tax system may need to adapt to ensure fairness and sustainability. Changes in tax thresholds, allowances, and deductions could arise, affecting taxpayers’ obligations and benefits.

International Tax Considerations

In an increasingly globalized world, international tax considerations cannot be overlooked. The UK’s tax system must align with international standards and agreements to prevent tax evasion and ensure fairness. As the UK’s relationship with international tax bodies evolves, the 806 Tax Code and other tax codes may need to adapt to comply with global tax regulations.

Long-Term Financial Planning

Understanding the potential future implications of the 806 Tax Code is crucial for long-term financial planning. Taxpayers should consider the potential changes and their impact on their financial goals. By staying informed and proactive, individuals can make informed decisions about investments, savings, and tax strategies to maximize their financial outcomes.

While the future of the 806 Tax Code is uncertain, staying vigilant and adaptable is key. By staying informed about tax rates, technological advancements, economic trends, and international considerations, taxpayers can navigate the evolving tax landscape with confidence and make the most of their financial opportunities.

Frequently Asked Questions (FAQ)

What happens if my tax code is incorrect?

+If you believe your tax code is incorrect, it’s important to take action promptly. Contact HMRC to inform them of the issue and provide any necessary documentation to support your claim. HMRC will review your case and make the necessary adjustments to your tax code. In the meantime, it’s advisable to pay the correct amount of tax to avoid any potential penalties.

Can I change my tax code if I start a new job?

+Yes, if you start a new job, your tax code may change. Your new employer will need to obtain your correct tax code from HMRC. It’s essential to provide accurate information to your employer, such as your National Insurance number and any relevant tax details, to ensure the correct tax code is applied.

How often should I check my tax code?

+It’s recommended to check your tax code at least once a year, typically around the start of the new tax year. This allows you to ensure that your tax code remains accurate and up-to-date. Additionally, if you experience significant changes in your personal circumstances or income, it’s advisable to review your tax code more frequently.

Can I claim additional allowances or deductions with the 806 Tax Code?

+Yes, even with the 806 Tax Code, you may still be eligible for additional allowances or deductions. It’s important to review your personal circumstances and explore any available tax reliefs or allowances. Consulting with a tax professional can help you identify and maximize these opportunities.