Anne Arundel County Property Taxes

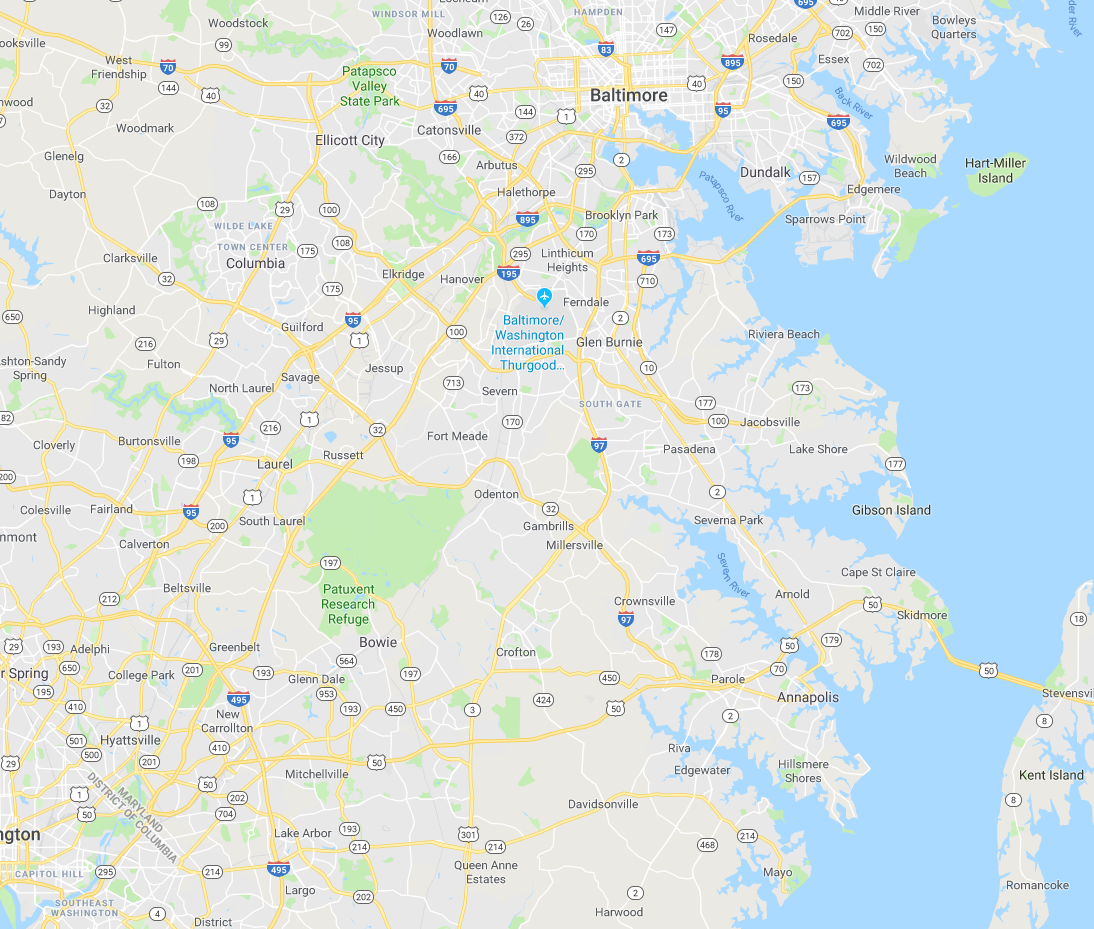

In the United States, property taxes are a significant source of revenue for local governments, including counties and municipalities. These taxes play a crucial role in funding essential public services and infrastructure. Anne Arundel County, located in the state of Maryland, is no exception, with its property tax system being a key component of the county's financial landscape. This article aims to provide an in-depth analysis of Anne Arundel County's property taxes, exploring the rates, assessment process, tax breaks, and their impact on residents and the local economy.

Understanding Anne Arundel County’s Property Tax Rates

Anne Arundel County operates on a fiscal year basis, with property taxes assessed annually. The tax rate is expressed in dollars per hundred dollars of assessed property value, also known as the mill rate. For the fiscal year 2023, the county’s residential property tax rate was set at 0.979 per hundred dollars of assessed value</strong>, while the commercial and industrial property tax rate was <strong>1.398 per hundred dollars of assessed value. These rates are subject to change annually, as determined by the county’s governing bodies.

It's important to note that property tax rates can vary within the county, depending on the tax districts or special tax areas. For instance, the Crofton Special Tax Area has a higher tax rate than the general county rate, providing additional funding for specific services and infrastructure improvements within that district.

Tax Rate Calculation Example

Let’s illustrate how property tax rates are applied using a real-world example. Consider a residential property in Anne Arundel County with an assessed value of $300,000. The tax calculation would be as follows:

| Residential Tax Rate | $0.979 per $100 of assessed value |

|---|---|

| Assessed Property Value | $300,000 |

| Tax Calculation | $0.979 x $3000 = $2,937 |

In this case, the annual property tax for the given property would amount to $2,937.

Property Assessment Process in Anne Arundel County

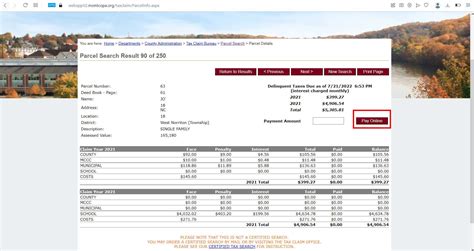

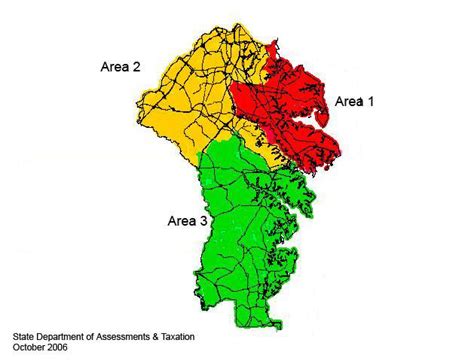

The Anne Arundel County Department of Assessments and Taxation is responsible for assessing the value of all properties within the county. This assessment process occurs at regular intervals, typically every three years, and involves a comprehensive evaluation of each property’s market value. The assessed value serves as the basis for calculating property taxes.

Factors Influencing Property Assessment

- Market Value: The department considers the property’s current market value, taking into account recent sales of similar properties in the area.

- Improvements and Renovations: Any significant improvements or renovations made to the property can impact its assessed value.

- Location and Neighborhood: The property’s location and the overall neighborhood’s desirability are key factors in determining its assessed value.

- Property Type and Condition: Whether the property is residential, commercial, or industrial, as well as its overall condition, plays a role in the assessment.

The department employs a team of professional appraisers who conduct on-site inspections and utilize various assessment tools and databases to ensure accurate and fair assessments.

Property Tax Breaks and Exemptions in Anne Arundel County

Anne Arundel County offers several tax breaks and exemptions to eligible property owners, aimed at providing relief and promoting certain initiatives. These include:

Homestead Tax Credit

The Homestead Tax Credit is a significant tax break available to Anne Arundel County homeowners. It provides a credit of $2,500 against the assessed value of the primary residence, effectively reducing the taxable value of the property. This credit is automatically applied to eligible homeowners and helps alleviate the tax burden for many residents.

Senior Citizen and Disabled Property Tax Credit

Eligible senior citizens and individuals with disabilities may qualify for the Senior Citizen and Disabled Property Tax Credit. This credit reduces the taxable value of the property by $4,000, providing additional relief to those who meet the income and residency requirements. To apply for this credit, homeowners must complete and submit the necessary documentation to the county.

Other Exemptions and Credits

- Veteran’s Exemption: Qualified veterans may be eligible for a property tax exemption of up to $4,500 in assessed value.

- Agricultural Use Assessment: Properties used for agricultural purposes may be assessed at a lower rate, encouraging and supporting local farming activities.

- Historic Property Tax Credit: Owners of historic properties may qualify for a tax credit of 20% of the eligible renovation costs, promoting the preservation of historical landmarks.

Impact of Property Taxes on Anne Arundel County Residents

Property taxes play a crucial role in the financial well-being of Anne Arundel County residents. While these taxes contribute to essential public services and infrastructure, they also represent a significant expense for homeowners and businesses. The tax rates and assessment process directly impact the financial planning and budgeting of individuals and organizations within the county.

Financial Planning and Budgeting

Property taxes are a recurring expense that homeowners and businesses must consider in their financial plans. For residents, property taxes can significantly affect their overall cost of living. Businesses, on the other hand, must factor in property taxes when determining their operational costs and profitability.

Anne Arundel County provides online tools and resources to help residents estimate their property taxes based on the assessed value and applicable tax rates. These tools assist in financial planning and budgeting, allowing individuals and businesses to make informed decisions about their real estate holdings.

Economic Impact

The property tax system in Anne Arundel County has a profound impact on the local economy. It influences investment decisions, business growth, and the overall financial health of the community. A well-managed and fair property tax system can attract businesses and investors, leading to economic growth and job creation. On the other hand, excessive or unpredictable tax rates may deter investment and hinder economic development.

The county's tax breaks and exemptions, such as the Homestead Tax Credit and Senior Citizen/Disabled Property Tax Credit, can provide much-needed relief to certain segments of the population, promoting economic stability and social welfare.

Performance Analysis and Future Implications

The performance of Anne Arundel County’s property tax system can be evaluated based on several key factors, including:

Revenue Generation

Property taxes are a vital source of revenue for the county, funding various public services and infrastructure projects. The efficiency and effectiveness of the tax system in generating revenue directly impact the county’s ability to provide quality services and maintain a healthy financial outlook.

Fairness and Equity

A well-designed property tax system should ensure fairness and equity among property owners. This includes a transparent and consistent assessment process, as well as tax rates that are proportional to the value and use of the property. The county’s tax breaks and exemptions should also be accessible and equitable, providing relief to those who need it most.

Economic Impact and Growth

The property tax system should encourage economic growth and development while also supporting social welfare initiatives. The tax rates and assessment process should strike a balance between generating revenue and promoting a healthy business environment. This balance is crucial for the long-term sustainability and prosperity of Anne Arundel County.

Future Implications and Potential Reforms

As the county’s population and economic landscape continue to evolve, the property tax system may require periodic reforms to remain effective and fair. Potential areas for improvement could include:

- Assessment Frequency: Evaluating the current assessment cycle and determining if a shorter cycle would lead to more accurate and responsive assessments.

- Tax Rate Structure: Analyzing the current tax rate structure and considering alternative models that may provide more equitable distribution of the tax burden.

- Tax Breaks and Exemptions: Regularly reviewing and updating tax breaks and exemptions to ensure they align with the county's changing demographics and economic needs.

- Online Services and Transparency: Enhancing online tools and resources to provide residents and businesses with better access to information and improved transparency.

Frequently Asked Questions (FAQ)

How often are property assessments conducted in Anne Arundel County?

+Property assessments in Anne Arundel County are conducted every three years. However, the county reserves the right to conduct reassessments more frequently if deemed necessary.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Yes, property owners have the right to appeal their assessments. The Anne Arundel County Department of Assessments and Taxation provides detailed instructions on how to file an appeal. It’s important to note that appeals must be filed within a specified timeframe, usually within 45 days of receiving the assessment notice.

Are there any online resources available to estimate my property taxes in Anne Arundel County?

+Yes, the county’s website offers an online property tax calculator. This tool allows residents to estimate their property taxes based on their assessed value and applicable tax rates. It’s a useful resource for financial planning and budgeting.

How can I stay informed about changes in property tax rates and assessment processes in Anne Arundel County?

+The county’s official website is the primary source for up-to-date information on property tax rates, assessment processes, and any changes or reforms. It’s advisable to regularly check the website or subscribe to their email updates to stay informed.