Sales Tax Washington State

Welcome to a comprehensive guide on understanding and navigating the complex world of sales tax in Washington State. This article aims to demystify the sales tax regulations, offering a clear and detailed overview for businesses and consumers alike. Washington State, like many other jurisdictions, imposes sales tax on various goods and services, and keeping up with these regulations is crucial for compliance and smooth business operations.

Unraveling the Sales Tax Landscape in Washington State

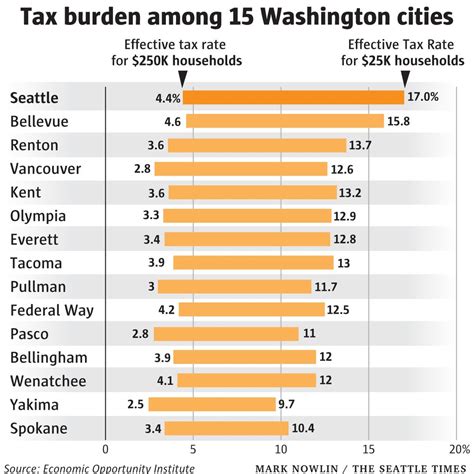

Washington State’s sales tax system is a critical component of its revenue generation strategy, contributing significantly to the state’s fiscal health. The sales tax rate in Washington is set at 6.5%, which is applied to most retail sales, including tangible personal property and some services. However, it’s essential to note that sales tax in Washington is not a flat rate across the board. The state allows local jurisdictions, such as counties and cities, to impose additional sales taxes, resulting in varying tax rates depending on the location of the sale.

For instance, in the bustling city of Seattle, the sales tax rate stands at 10.1%, which includes the state tax rate of 6.5%, a 2.2% city tax, and a 1.4% county tax. These additional local taxes are often used to fund specific projects or initiatives, such as transportation infrastructure or community development programs. Therefore, understanding the nuances of sales tax rates is crucial, especially for businesses operating in multiple jurisdictions within the state.

Furthermore, Washington State's sales tax regulations extend beyond the standard retail sales. Certain services, such as lodging and rental car services, are subject to a higher tax rate of 9.5%. Additionally, there are exemptions and special provisions for certain types of sales, including food, prescription drugs, and manufacturing equipment. Navigating these exemptions and special provisions requires a deep understanding of the state's tax code and can significantly impact a business's tax liability.

Key Aspects of Sales Tax in Washington State

One unique aspect of Washington State’s sales tax system is the concept of “destinations-based sourcing.” This means that the tax rate applied to a sale is determined by the location where the product or service is delivered or used, rather than the location of the seller. This rule can be particularly relevant for online retailers, as it requires them to have a thorough understanding of the tax rates in all potential delivery destinations.

Another critical aspect is the treatment of remote sellers. Washington State has implemented a "marketplace facilitator law," which requires online marketplace facilitators, such as Amazon or eBay, to collect and remit sales tax on behalf of their third-party sellers. This law ensures that even remote sellers, who might not have a physical presence in the state, comply with Washington's sales tax regulations.

| Sales Tax Rate | Tax Rate (%) |

|---|---|

| Statewide | 6.5% |

| Seattle (City + County) | 10.1% |

| Special Sourcing Rate (Lodging, Rental Cars) | 9.5% |

The Impact of Sales Tax on Businesses and Consumers

The implementation of sales tax has a profound impact on both businesses and consumers in Washington State. For businesses, particularly those operating in multiple jurisdictions, the challenge lies in accurately calculating and remitting the correct sales tax. This requires a robust tax management system that can handle varying tax rates and regulations. Additionally, businesses must stay updated with any changes in tax laws, which can be frequent and complex.

From a consumer perspective, sales tax adds to the cost of goods and services, impacting their purchasing power and decision-making. Understanding the sales tax rate in their area can help consumers budget effectively and make informed choices. Moreover, the variation in sales tax rates across different jurisdictions can lead to "tax shopping," where consumers choose to make purchases in areas with lower tax rates, potentially impacting local economies.

Strategies for Businesses to Navigate Sales Tax Complexity

To effectively navigate the complex world of sales tax in Washington State, businesses can employ several strategies. Firstly, investing in a robust tax management system that can handle varying tax rates and regulations is crucial. This system should integrate seamlessly with the business’s accounting and point-of-sale systems, ensuring accurate tax calculations and record-keeping.

Secondly, businesses should consider seeking professional tax advice to ensure compliance and optimize their tax liability. Tax professionals can provide insights into the latest tax laws and regulations, help with tax planning, and offer strategies to minimize tax burdens. Regular consultations with tax experts can help businesses stay ahead of any changes in tax laws and avoid potential pitfalls.

Lastly, staying informed about sales tax regulations and any proposed changes is essential. Washington State's Department of Revenue provides resources and updates on its website, including guidance on tax rates, exemptions, and special provisions. Subscribing to their newsletters or following their social media accounts can ensure businesses are kept up-to-date with the latest tax news and changes.

Conclusion: A Dynamic and Evolving Tax Landscape

Washington State’s sales tax regulations present a dynamic and evolving landscape that requires constant vigilance and adaptation. With varying tax rates, complex regulations, and frequent changes in tax laws, businesses and consumers must stay informed and agile. By understanding the intricacies of sales tax, businesses can ensure compliance, optimize their tax liability, and contribute to the state’s fiscal health.

As the tax landscape continues to evolve, businesses that embrace innovative tax management strategies and seek professional guidance will be better positioned to thrive in this complex environment. For consumers, understanding the impact of sales tax on their purchases can lead to more informed decision-making and budgeting.

In conclusion, navigating Washington State's sales tax system is a critical aspect of doing business in the state. By staying informed, adopting robust tax management strategies, and seeking professional advice, businesses and consumers can effectively navigate this complex landscape, ensuring compliance and optimizing their tax obligations.

What is the current sales tax rate in Washington State?

+

The current sales tax rate in Washington State is 6.5%, which is applied statewide. However, local jurisdictions, such as counties and cities, may impose additional taxes, resulting in varying rates.

Are there any sales tax exemptions in Washington State?

+

Yes, Washington State offers exemptions for certain types of sales, including food, prescription drugs, and manufacturing equipment. These exemptions can significantly impact a business’s tax liability.

How does Washington State treat remote sellers?

+

Washington State has implemented a marketplace facilitator law, requiring online marketplace facilitators to collect and remit sales tax on behalf of their third-party sellers. This ensures compliance for remote sellers.