Maryland Death Tax

The Maryland Death Tax, officially known as the Maryland Estate Tax, is a critical component of the state's revenue system, impacting many individuals and families in the region. With a rich history dating back to the early 20th century, this tax has undergone significant changes over the years, shaping the estate planning landscape for Maryland residents. In this comprehensive guide, we will delve into the intricacies of the Maryland Death Tax, exploring its origins, current regulations, and its implications for those navigating the estate planning process.

Understanding the Maryland Death Tax

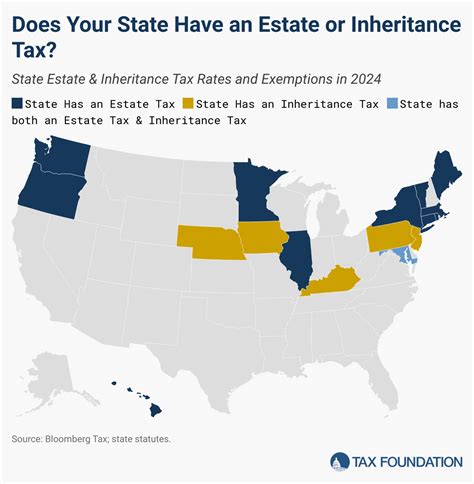

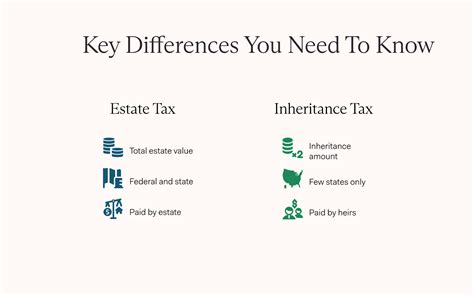

The Maryland Death Tax is a tax levied on the transfer of an individual’s estate upon their death. It is a state-level tax, separate from the federal estate tax, and is an important consideration for Maryland residents with substantial assets. The tax aims to generate revenue for the state while also ensuring that estates are distributed fairly and in accordance with the deceased’s wishes.

Historically, the Maryland Death Tax has played a pivotal role in funding various state programs and initiatives. Over the years, the tax has been a subject of debate, with changes in legislation reflecting the evolving needs of the state and its residents. Understanding the current regulations and exemptions is essential for effective estate planning in Maryland.

Key Features of the Maryland Death Tax

- The tax is imposed on the transfer of assets at the time of an individual’s death.

- It applies to estates exceeding a certain threshold, known as the exemption amount.

- The tax rate varies based on the size of the estate, with larger estates facing higher rates.

- Maryland offers an unlimited spousal exemption, meaning assets transferred to a surviving spouse are typically exempt from the tax.

- Certain assets, such as life insurance proceeds and retirement accounts, may be subject to different rules and exemptions.

By understanding these key features, individuals can make informed decisions about estate planning strategies to minimize tax liabilities and ensure the smooth transfer of assets to their beneficiaries.

The Evolution of the Maryland Death Tax

The history of the Maryland Death Tax is a fascinating journey through the state’s fiscal policies and societal changes. It was first introduced in the early 1900s as a means to generate revenue and address the growing needs of the state’s population. Over the decades, the tax has undergone several revisions, reflecting the changing economic landscape and the evolving priorities of Maryland’s leadership.

Notable Changes and Milestones

One of the most significant milestones was the introduction of the unlimited spousal exemption in the late 20th century. This change recognized the importance of family unity and the need to support surviving spouses financially. It allowed for the transfer of assets between spouses without incurring estate taxes, a crucial consideration for married couples planning their estates.

In recent years, there have been ongoing discussions and legislative efforts to modernize the tax system and align it with the needs of a diverse and evolving Maryland population. These efforts include proposals to simplify the tax structure, update exemption amounts, and ensure fairness for all taxpayers.

Current Regulations and Exemptions

As of [current year], the Maryland Death Tax is applicable to estates valued above $5 million. This threshold is subject to periodic adjustments to account for inflation and changing economic conditions. It’s essential for individuals with estates nearing this limit to stay updated on any potential changes to the exemption amount.

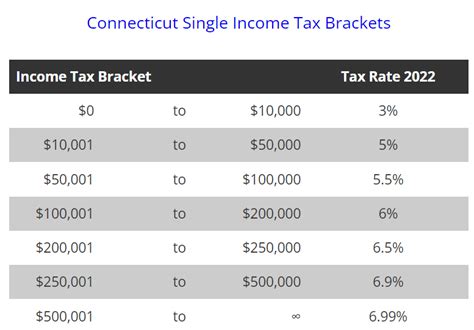

| Exemption Amount | Tax Rate |

|---|---|

| $5 million | 0% |

| $5 million - $10 million | 3% |

| Above $10 million | 9% |

It's worth noting that Maryland has a portability provision, which allows for the unused exemption of a deceased spouse to be utilized by the surviving spouse, further reducing potential tax liabilities. Additionally, the state offers various tax credits and deductions to eligible taxpayers, providing opportunities for further tax savings.

Estate Planning Strategies for Maryland Residents

Given the complexity of the Maryland Death Tax, it’s crucial for residents to adopt comprehensive estate planning strategies. These strategies aim to minimize tax liabilities, protect assets, and ensure the smooth transition of wealth to future generations.

Key Considerations for Effective Estate Planning

- Utilize trusts to manage and distribute assets, taking advantage of the state’s trust laws and potential tax benefits.

- Explore gifting strategies to transfer assets during one’s lifetime, reducing the overall value of the taxable estate.

- Consider life insurance policies with proper planning to provide financial security for beneficiaries while potentially reducing tax burdens.

- Implement charitable giving strategies to support causes close to your heart while also benefiting from potential tax deductions.

- Work closely with estate planning attorneys and financial advisors to customize strategies based on your unique circumstances and goals.

Real-Life Examples of Successful Estate Planning

Consider the case of Mr. Johnson, a successful Maryland entrepreneur with a substantial estate. By establishing a revocable living trust, he was able to maintain control over his assets during his lifetime while also ensuring a smooth transition upon his death. The trust allowed for efficient asset management and distribution, minimizing tax liabilities and providing clarity for his beneficiaries.

Another example involves Ms. Smith, a philanthropist with a passion for supporting local education initiatives. Through careful planning, she structured her estate to include charitable remainder trusts, which provided her with a steady income stream during her retirement years while also ensuring a significant portion of her estate would benefit local schools after her passing. This strategy not only fulfilled her philanthropic goals but also provided potential tax benefits.

Future Implications and Trends

Looking ahead, the future of the Maryland Death Tax is intertwined with the state’s economic and demographic shifts. As Maryland continues to grow and evolve, there may be increasing demands on state resources, potentially influencing tax policies. Here are some key trends and implications to consider:

Potential Changes on the Horizon

- With a focus on economic growth and fairness, there may be proposals to adjust exemption amounts to keep pace with inflation and rising asset values.

- The state may explore alternative revenue sources to reduce the reliance on estate taxes, which could lead to changes in tax structures or the introduction of new taxes.

- As the population ages, there could be a greater emphasis on long-term care planning and the potential for tax incentives to encourage residents to plan for their future care needs.

It's essential for Maryland residents to stay engaged with the legislative process and advocate for tax policies that align with their interests and the state's overall well-being.

Conclusion: Navigating the Maryland Death Tax

The Maryland Death Tax is a critical aspect of estate planning for residents of the state. By understanding its history, current regulations, and potential future changes, individuals can make informed decisions to protect their assets and ensure a secure future for their loved ones. Effective estate planning requires a holistic approach, considering various strategies and seeking professional guidance to navigate the complexities of the Maryland tax landscape.

Frequently Asked Questions

Are there any exceptions to the Maryland Death Tax for small estates?

+Yes, Maryland offers an estate tax exemption for estates valued below a certain threshold. As of [current year], estates valued at or below $5 million are exempt from the Maryland Death Tax. This exemption helps ensure that smaller estates are not subject to the tax, providing relief for many Maryland residents.

How often are the exemption amounts adjusted for the Maryland Death Tax?

+The exemption amounts for the Maryland Death Tax are typically reviewed and adjusted periodically to account for inflation and changing economic conditions. These adjustments are made through legislative processes, ensuring that the tax remains fair and aligned with the state’s fiscal needs.

Can I utilize both the spousal exemption and the unlimited marital deduction in my estate plan?

+Absolutely! The spousal exemption and the unlimited marital deduction are two separate provisions in the Maryland Death Tax system. By utilizing both, you can effectively reduce your estate tax liability and ensure a smooth transfer of assets to your surviving spouse. It’s an essential strategy for married couples to consider.