Calculate Nj Sales Tax

In the United States, sales tax is a tax imposed on the sale of goods and services. Each state has its own sales tax rates, which can vary significantly, and these rates may also apply differently to various categories of items. In the case of New Jersey, understanding its sales tax system is crucial for businesses and consumers alike.

New Jersey, often referred to as the Garden State, has a complex sales tax structure, which is designed to provide revenue for the state's operations and public services. This article will delve into the specifics of New Jersey's sales tax, providing an in-depth analysis of its rates, exemptions, and the impact it has on businesses and residents.

Understanding New Jersey's Sales Tax Rates

The sales tax rate in New Jersey is comprised of two components: the state sales tax and any applicable local taxes. The state sales tax rate in New Jersey is 6.625%, which is relatively competitive compared to other states. However, it's important to note that this is a minimum rate, and it can be higher depending on the location of the sale.

In addition to the state sales tax, there are local taxes that can be imposed by counties and municipalities. These local taxes can range from 0% to 3.5%, making the total sales tax rate in New Jersey anywhere between 6.625% and 10.125%, depending on the location.

For instance, if you make a purchase in Atlantic City, you will pay a total sales tax of 8.625%, which includes the state sales tax and a local tax of 2%. On the other hand, a purchase in Cape May County would attract a total sales tax of 7.125%, with an additional local tax of 0.5%.

These varying local tax rates can significantly impact the total cost of goods and services, making it essential for businesses and consumers to understand the specific rates applicable to their location.

| County/Municipality | Additional Local Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Atlantic City | 2% | 8.625% |

| Cape May County | 0.5% | 7.125% |

| Camden County | 1.5% | 8.125% |

| Passaic County | 3.5% | 10.125% |

Sales Tax Rates for Specific Items

New Jersey's sales tax structure becomes even more intricate when considering the tax rates for specific categories of items. For example, certain food items, such as unprepared food products, are exempt from sales tax, while prepared foods are taxed at the full sales tax rate.

Here's a breakdown of some specific sales tax rates for different categories in New Jersey:

- Unprepared Food: 0%

- Prepared Food: 6.625% (state rate) to 10.125% (including local tax)

- Clothing: 6.625% to 10.125% (varies based on local tax)

- Prescription Drugs: 0%

- Over-the-Counter Drugs: 6.625% to 10.125%

- Alcoholic Beverages: 15% for wine and spirits, 8.13% for beer (including both state and local taxes)

- Vehicle Sales: 6.625% (state rate) to 10.125% (including local tax)

Sales Tax Exemptions and Special Considerations

New Jersey's sales tax system also includes a number of exemptions and special considerations that can significantly impact the tax liability of businesses and consumers.

Exemptions

There are several categories of items and services that are exempt from sales tax in New Jersey. These include:

- Prescription drugs

- Certain medical devices

- Unprepared food

- Educational books and materials

- Certain agricultural products

- Manufacturing equipment

- Non-prepared food sold for on-premises consumption

Special Considerations

In addition to the exemptions, New Jersey's sales tax system also includes some special considerations for specific situations. For example, there is a use tax that applies to goods purchased out of state and brought into New Jersey for use. This ensures that even if a purchase is made in a state with a lower sales tax rate, the New Jersey rate is applied if the item is used within the state.

Another special consideration is the sales tax holiday, which is a period when certain items are exempt from sales tax. In New Jersey, there is an annual Sales Tax Holiday for Back-to-School shopping, during which clothing and school supplies under a certain price threshold are exempt from sales tax.

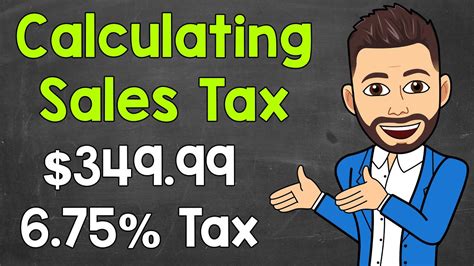

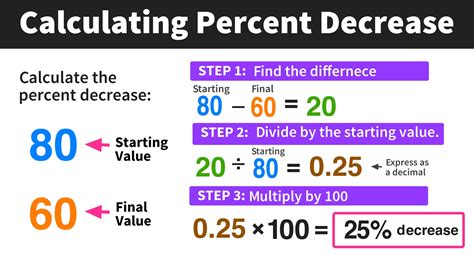

Calculating Sales Tax: A Step-by-Step Guide

Calculating sales tax in New Jersey can be a straightforward process once you understand the applicable rates and exemptions. Here's a step-by-step guide to help you calculate the sales tax on a purchase:

- Determine the state sales tax rate for your location. This is typically 6.625%, but it can be higher depending on local taxes.

- Identify any additional local taxes that apply to your location. These can range from 0% to 3.5%.

- Add the state and local tax rates to get your total sales tax rate. For example, if the state rate is 6.625% and the local tax is 1.5%, the total rate would be 8.125%.

- Identify the category of the item you are purchasing. Different categories have different sales tax rates, as outlined above.

- Apply the appropriate sales tax rate to the pre-tax price of the item. For example, if you are purchasing a piece of clothing for $50 and the total sales tax rate is 8.125%, the sales tax would be $4.06.

- Add the sales tax to the pre-tax price to get the total cost of the item. In our example, the total cost would be $54.06.

Online Sales Tax Calculation

For online purchases, many e-commerce platforms will automatically calculate and display the applicable sales tax based on the shipping address. However, if you are purchasing from a platform that does not automatically calculate sales tax, you can use the steps outlined above to manually calculate the tax.

The Impact of Sales Tax on Businesses and Consumers

The sales tax in New Jersey has a significant impact on both businesses and consumers. For businesses, it is a crucial consideration in pricing strategies, as it directly affects the final cost of goods and services to consumers. Businesses must also ensure they are collecting and remitting the correct amount of sales tax to the state and local governments.

For consumers, the sales tax can significantly impact their purchasing decisions and overall spending. Higher sales tax rates can discourage certain purchases, particularly for non-essential items, as they increase the final cost. On the other hand, sales tax holidays and exemptions can encourage spending during specific periods or on certain items.

Staying Informed About Sales Tax Changes

Sales tax rates and regulations can change periodically, and it's crucial for businesses and consumers to stay updated on these changes. New Jersey's Division of Taxation provides regular updates and resources on its website, including tax rate charts and information on sales tax holidays.

Additionally, many accounting and tax software platforms offer features to help businesses stay compliant with the latest sales tax regulations. These tools can automate sales tax calculations, ensuring accurate tax collection and reporting.

Conclusion: Navigating New Jersey's Sales Tax Landscape

Understanding New Jersey's sales tax system is a complex but necessary task for both businesses and consumers. With its varying rates, exemptions, and special considerations, the sales tax landscape in New Jersey can significantly impact the cost of goods and services.

By staying informed about the latest rates and regulations, businesses can ensure compliance and develop effective pricing strategies. Consumers, on the other hand, can make more informed purchasing decisions, taking into account the impact of sales tax on their overall spending.

Whether you're a business owner or a consumer, staying up-to-date with New Jersey's sales tax regulations is a key step in navigating the state's unique sales tax landscape.

How often do sales tax rates change in New Jersey?

+Sales tax rates in New Jersey can change annually or even more frequently. It’s important to check for updates regularly, as these changes can impact your business or personal finances.

Are there any online tools to help calculate sales tax in New Jersey?

+Yes, there are several online sales tax calculators available, such as the ones provided by tax software companies. These tools can simplify the process of calculating sales tax based on your location and the type of item being purchased.

What happens if a business doesn’t collect or remit the correct sales tax in New Jersey?

+Businesses that fail to collect or remit the correct sales tax may face penalties and interest charges from the state. It’s crucial for businesses to understand their sales tax obligations and stay compliant to avoid these consequences.

Are there any resources available to help businesses understand and comply with New Jersey’s sales tax regulations?

+Yes, the New Jersey Division of Taxation provides a wealth of resources on its website, including guides, webinars, and tax rate charts. Additionally, many accounting and tax professionals can offer guidance and support to businesses navigating New Jersey’s sales tax landscape.