Las Vegas Taxes

The city of Las Vegas, Nevada, is renowned for its vibrant entertainment scene, bustling casinos, and world-class resorts. However, the tax landscape in this renowned gambling hub is just as fascinating and complex as the city itself. Understanding the taxes in Las Vegas is crucial for both residents and visitors alike, as it impacts various aspects of daily life and business operations. This comprehensive guide will delve into the intricacies of Las Vegas taxes, providing a detailed analysis of the city's tax structure, its unique considerations, and its implications for individuals and businesses.

The Complex World of Las Vegas Taxes

Las Vegas boasts a diverse tax system, encompassing various taxes that contribute to the city’s revenue and economic stability. From income taxes to sales taxes and gaming-specific levies, the tax landscape in Sin City is a multifaceted one. This section will provide an overview of the key taxes in Las Vegas, shedding light on their purpose, rates, and how they are administered.

Income Taxes in Las Vegas

One of the primary sources of revenue for the state of Nevada is income tax. While Nevada is often touted as a tax-friendly state, it does impose income taxes on its residents. The income tax structure in Las Vegas operates on a progressive basis, with higher tax rates applicable to higher income brackets. The current income tax rates in Las Vegas range from 0.95% to 8.25%, depending on an individual’s taxable income.

For instance, a resident with a taxable income of 30,000 would fall into the lowest tax bracket, paying an effective tax rate of 0.95%. On the other hand, a high-income earner with a taxable income of 1,000,000 would be subject to the highest tax rate of 8.25%. These rates are subject to change, so it is essential to stay updated with the latest tax laws.

Sales and Use Taxes

Sales taxes in Las Vegas play a significant role in generating revenue for the city and state. The sales tax rate in Las Vegas currently stands at 8.25%, which is the combined rate of the state and local sales taxes. This rate applies to most tangible personal property and certain services sold or provided within the city limits.

However, it’s important to note that certain items are exempt from sales tax in Las Vegas. These exemptions vary depending on the item and the purpose for which it is purchased. For example, prescription medications, most groceries, and certain machinery used in manufacturing are exempt from sales tax. Understanding these exemptions can help individuals and businesses navigate the sales tax landscape more effectively.

| Sales Tax Type | Rate |

|---|---|

| State Sales Tax | 6.85% |

| Local Sales Tax | 1.40% |

Gaming Taxes: The Heart of Las Vegas Revenue

Las Vegas is synonymous with gaming, and the revenue generated from this industry is a vital component of the city’s economy. The gaming industry in Las Vegas is subject to a unique set of taxes designed to support the state’s gaming regulatory framework and contribute to the city’s development.

One of the key gaming taxes in Las Vegas is the gaming device tax. This tax is levied on each gaming device, such as slot machines and video poker machines, found in casinos and other gaming establishments. The tax rate varies depending on the type of gaming device, with rates ranging from 20 to 200 per device per month.

Additionally, casinos and gaming operators in Las Vegas are subject to a gross gaming revenue tax. This tax is calculated based on the total revenue generated from gaming activities, including table games and slot machines. The gross gaming revenue tax rate currently stands at 6.75%, making it a significant source of revenue for the state.

| Gaming Tax Type | Rate |

|---|---|

| Gaming Device Tax | Varies (from $20 to $200 per device per month) |

| Gross Gaming Revenue Tax | 6.75% |

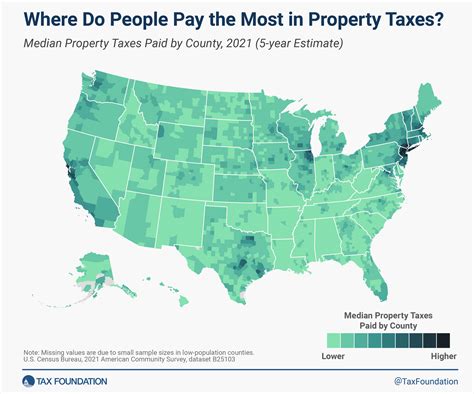

Property Taxes in Las Vegas

Property taxes in Las Vegas are an essential component of the city’s tax structure. These taxes are levied on both real property, such as land and buildings, and personal property, including vehicles and certain business assets. The property tax rate in Las Vegas is determined by the assessed value of the property and the tax rate set by the local taxing authority.

The assessed value of a property is typically based on its fair market value. However, certain exemptions and deductions may apply, reducing the taxable value of the property. For instance, homeowners in Las Vegas may be eligible for the Homestead Exemption, which reduces the taxable value of their primary residence by a certain amount.

Navigating the Las Vegas Tax Landscape: A Comprehensive Guide

Understanding the tax system in Las Vegas is crucial for anyone residing or conducting business in the city. The unique nature of Las Vegas’s tax structure, particularly its gaming-specific taxes, sets it apart from many other cities and states. This section will delve deeper into the intricacies of Las Vegas taxes, offering practical guidance and insights for individuals and businesses.

Tax Compliance and Filing Requirements

Ensuring compliance with tax laws and timely filing of tax returns is essential to avoid penalties and legal issues. Las Vegas residents and businesses have specific tax filing requirements, depending on their income, business structure, and other factors.

For individuals, the tax filing deadline in Las Vegas aligns with the federal tax deadline, which is typically April 15th of each year. However, it is crucial to note that certain circumstances may require an extension, such as being unable to file a complete and accurate return by the deadline. In such cases, individuals can request an extension, which provides additional time to file their tax returns.

Businesses in Las Vegas have varying tax filing requirements based on their structure and revenue. For instance, sole proprietors and partnerships may be required to file estimated taxes quarterly, while corporations and other entities may have different reporting and filing obligations.

Tax Incentives and Benefits in Las Vegas

Las Vegas offers a range of tax incentives and benefits aimed at attracting businesses and promoting economic growth. These incentives can significantly reduce the tax burden for businesses, making Las Vegas an attractive destination for entrepreneurs and investors.

One notable tax incentive in Las Vegas is the Enterprise Zone Program. This program offers reduced tax rates and other benefits to businesses operating within designated enterprise zones. These zones are typically located in economically disadvantaged areas, and businesses operating within them can enjoy a reduced sales tax rate of 3.38% for certain qualifying transactions.

Additionally, Las Vegas provides tax credits and incentives for businesses investing in research and development, renewable energy projects, and job creation. These incentives can take the form of tax credits, tax exemptions, or grants, making it more feasible for businesses to expand their operations and contribute to the local economy.

The Impact of Tourism and Gaming on Las Vegas Taxes

Las Vegas’s reputation as a global tourism and gaming hub has a significant impact on its tax revenue. The tourism industry generates substantial tax revenue through sales taxes on accommodations, food and beverage, and entertainment. Additionally, the gaming industry contributes a substantial portion of the city’s tax revenue through gaming-specific taxes.

The revenue generated from tourism and gaming taxes in Las Vegas is often directed towards infrastructure development, public services, and tourism promotion. This ensures that the city can maintain its reputation as a world-class destination and continue to attract visitors and investors.

Las Vegas Taxes: A Comprehensive Analysis and Insights

The tax system in Las Vegas is a complex yet fascinating subject, offering a unique blend of traditional taxes and gaming-specific levies. This section will provide a deeper analysis of the tax landscape in Las Vegas, offering expert insights and real-world examples to illustrate the impact of taxes on individuals and businesses.

Case Studies: The Impact of Taxes on Businesses

Understanding the real-world impact of taxes on businesses is crucial to appreciate the implications of the tax system. Let’s consider a case study of a hypothetical business, VegasTech Innovations, to illustrate how taxes influence business operations in Las Vegas.

VegasTech Innovations is a technology startup specializing in developing innovative software solutions for the gaming industry. The company is headquartered in Las Vegas and employs a diverse range of professionals, from software developers to marketing experts.

As a business operating in Las Vegas, VegasTech Innovations is subject to various taxes, including income taxes, sales taxes, and gaming-specific taxes. The company’s income is taxed at the state and local levels, with the current tax rates applicable to its income bracket. Additionally, the company must comply with sales tax laws, collecting and remitting sales tax on its products and services sold within the city limits.

However, VegasTech Innovations also benefits from certain tax incentives and programs offered by the city and state. For instance, the company may be eligible for tax credits and grants for investing in research and development, which can significantly reduce its tax burden and provide much-needed financial support for its innovative endeavors.

Expert Insights: Navigating the Complex Tax Landscape

Navigating the complex tax landscape in Las Vegas requires expertise and a thorough understanding of the tax laws and regulations. Here are some expert insights and tips to help individuals and businesses effectively manage their tax obligations:

- Stay Informed: Tax laws and regulations are subject to change. It is crucial to stay updated with the latest tax news and updates to ensure compliance and take advantage of any new incentives or programs.

- Seek Professional Advice: For complex tax situations, seeking advice from tax professionals or accountants can be invaluable. They can provide personalized guidance and ensure that your tax obligations are met accurately and efficiently.

- Understand Tax Incentives: Las Vegas offers a range of tax incentives and benefits. Take the time to research and understand these incentives, as they can significantly reduce your tax burden and provide financial support for your business.

- Plan Ahead: Effective tax planning is essential. By planning your finances and tax obligations in advance, you can make informed decisions and potentially reduce your tax liability.

The Future of Las Vegas Taxes: Implications and Considerations

As Las Vegas continues to evolve and adapt to changing economic and social landscapes, the city’s tax system will also undergo transformations. This section will explore the future implications of Las Vegas taxes, considering potential changes and their impact on individuals and businesses.

Potential Tax Reforms and Their Impact

Tax reforms are a constant possibility, and Las Vegas is no exception. The city and state may consider various reforms to enhance revenue generation, promote economic growth, or address emerging challenges. Here are some potential tax reforms and their potential implications:

- Income Tax Reform: Changes to the income tax structure, such as adjusting tax brackets or introducing new tax rates, could impact individuals and businesses differently. Higher-income earners may face increased tax burdens, while lower-income individuals may benefit from reduced rates.

- Sales Tax Reform: Reforming the sales tax system could involve expanding the list of exempt items or adjusting the tax rate. This could impact consumer behavior and the competitiveness of local businesses.

- Gaming Tax Reform: The gaming industry is a vital component of Las Vegas’s economy. Reforms to gaming taxes, such as adjusting the tax rates or introducing new levies, could have significant implications for casinos and gaming operators.

Economic Growth and Tax Stability

Las Vegas’s economic growth and stability are closely tied to its tax revenue. As the city continues to attract businesses and investors, ensuring tax stability is crucial for long-term economic prosperity. Here are some considerations for maintaining tax stability:

- Diversifying Revenue Sources: While the gaming industry is a significant revenue generator, diversifying the city’s revenue sources can provide a more stable economic foundation. Encouraging growth in other sectors, such as technology, healthcare, and hospitality, can reduce the reliance on a single industry.

- Promoting Tax Incentives: Tax incentives play a vital role in attracting businesses and investors. By offering competitive tax incentives, Las Vegas can maintain its appeal as a business destination and promote economic growth.

- Investing in Infrastructure: Infrastructure development is crucial for the city’s long-term success. Investing in transportation, education, and other public services can enhance the quality of life for residents and attract businesses and talent.

¿Cuál es la tasa de impuestos sobre la renta en Las Vegas?

+La tasa de impuestos sobre la renta en Las Vegas varía según el ingreso imponible de un individuo. Las tasas actuales van desde el 0.95% hasta el 8.25%, dependiendo del rango de ingreso.

¿Cómo funcionan los impuestos sobre las ventas en Las Vegas?

+Los impuestos sobre las ventas en Las Vegas se aplican a la mayoría de las propiedades personales y ciertos servicios vendidos o prestados dentro de los límites de la ciudad. La tasa de impuesto sobre las ventas actual es del 8.25%, que es la tasa combinada del impuesto estatal y local.

¿Cuáles son los impuestos específicos de la industria del juego en Las Vegas?

+La industria del juego en Las Vegas está sujeta a impuestos específicos, como el impuesto sobre dispositivos de juego y el impuesto sobre los ingresos brutos de juego. Estos impuestos son una fuente importante de ingresos para el estado.