Riverside Tax Collector

The Riverside Tax Collector's office is an essential government entity responsible for efficiently managing and collecting taxes to fund vital public services and infrastructure in the Riverside County community. This office plays a crucial role in maintaining the financial stability and growth of the region. With a dedicated team, the Riverside Tax Collector ensures a smooth tax payment process, offering various convenient options to taxpayers. The office's primary goal is to provide excellent customer service, ensuring residents and businesses understand their tax obligations and receive the necessary support. This article aims to delve deeper into the functions, services, and impact of the Riverside Tax Collector, shedding light on its significance in the local economy and community.

Understanding the Role of the Riverside Tax Collector

The Riverside Tax Collector serves as a key intermediary between the local government and taxpayers. Their primary responsibility is to enforce tax laws, collect revenue, and ensure compliance with tax regulations. The office handles a range of tax types, including property taxes, vehicle registration fees, business taxes, and other miscellaneous taxes. By efficiently managing these revenue streams, the Tax Collector contributes significantly to the county’s financial health and stability.

One of the critical aspects of the Tax Collector's role is educating taxpayers about their obligations. The office provides resources and guidance to help residents and businesses understand the tax system, deadlines, and payment options. This proactive approach not only simplifies the tax payment process but also fosters a culture of compliance and transparency.

Key Responsibilities and Services

The Riverside Tax Collector’s services are diverse and tailored to meet the needs of different taxpayers. Here’s an overview of their key responsibilities and the services they offer:

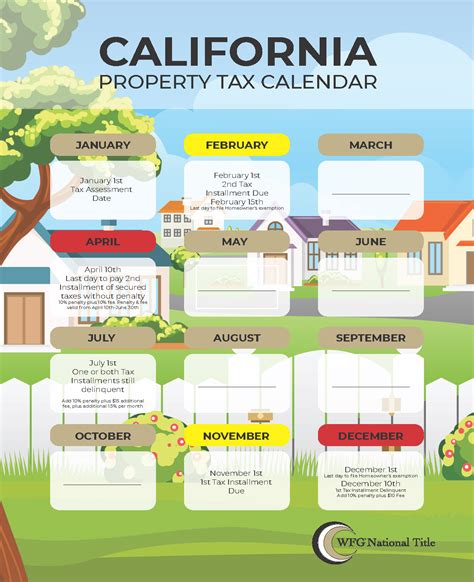

- Property Tax Collection: The Tax Collector is responsible for assessing and collecting property taxes. This involves sending out tax bills, managing payment plans, and enforcing late payment penalties. The office also provides resources to help property owners understand their tax obligations and offers online tools for convenient payment.

- Vehicle Registration and Fees: Riverside residents must register their vehicles and pay the associated fees. The Tax Collector's office handles this process, ensuring that vehicle owners comply with the law. The office provides convenient online and in-person options for registration and fee payment.

- Business Taxes: Businesses operating in Riverside County are subject to various taxes, including sales tax, business license tax, and other specific business taxes. The Tax Collector's office assists businesses in understanding their tax obligations, provides registration services, and collects the necessary taxes.

- Miscellaneous Taxes: In addition to the above, the Tax Collector also handles other taxes such as special assessments, utility user taxes, and various other fees. These taxes are vital in funding specific public services and infrastructure projects.

- Payment Options: The Tax Collector's office offers a range of payment options to cater to different taxpayer needs. These include online payments, in-person payments, and payment by mail. The office also provides resources to help taxpayers set up payment plans for larger tax obligations.

- Taxpayer Assistance: The Tax Collector's team is dedicated to providing excellent customer service. They offer assistance to taxpayers who have questions, concerns, or need help understanding their tax obligations. The office also provides resources and information on tax incentives, exemptions, and other relevant topics.

Impact on Riverside County’s Economy and Community

The Riverside Tax Collector’s office plays a pivotal role in the economic and social development of the county. The taxes collected by the office are essential in funding a wide range of public services and infrastructure projects. These include schools, roads, public safety, healthcare, and social services. By ensuring a steady flow of revenue, the Tax Collector contributes to the overall well-being and prosperity of the community.

Moreover, the Tax Collector's services are designed to be taxpayer-friendly, making it easier for residents and businesses to fulfill their tax obligations. This approach not only fosters a culture of compliance but also strengthens the relationship between the government and its constituents. By providing efficient and accessible services, the Tax Collector's office helps to build trust and encourage active participation in the local economy.

Financial Stability and Economic Growth

The efficient collection of taxes is crucial for the county’s financial stability. By effectively managing revenue streams, the Tax Collector ensures that the county has the resources needed to deliver essential services and maintain infrastructure. This stability is vital for attracting businesses and investors, contributing to the county’s economic growth.

Additionally, the Tax Collector's office plays a role in economic development by supporting local businesses. By offering guidance and resources on tax obligations, the office helps businesses navigate the complex tax system. This support is especially valuable for small businesses, which are often the backbone of local economies. By ensuring that businesses can thrive, the Tax Collector indirectly contributes to job creation and economic vitality.

| Tax Type | Revenue (2022) |

|---|---|

| Property Taxes | $560 million |

| Vehicle Registration Fees | $120 million |

| Business Taxes | $80 million |

| Miscellaneous Taxes | $40 million |

Future Initiatives and Technological Advancements

The Riverside Tax Collector’s office is committed to staying at the forefront of tax administration. In recent years, the office has embraced technological advancements to streamline processes and enhance taxpayer experience. Online payment portals, mobile apps, and digital record-keeping have made tax payment more accessible and efficient.

Looking ahead, the Tax Collector aims to continue implementing innovative solutions. This includes exploring blockchain technology for secure and transparent record-keeping, AI-powered customer service for faster query resolution, and data analytics for more efficient tax assessment and collection. These initiatives will not only improve the taxpayer experience but also enhance the office's operational efficiency.

Community Engagement and Outreach

In addition to technological advancements, the Tax Collector’s office places a strong emphasis on community engagement. Regular town hall meetings, workshops, and educational campaigns help to keep taxpayers informed about their rights and responsibilities. The office also collaborates with community organizations to ensure that all residents, regardless of their background or circumstances, have access to the necessary resources and support.

Furthermore, the Tax Collector's office is committed to transparency and accountability. Regular financial reports and audits ensure that taxpayers can trust that their contributions are being used effectively and ethically. This commitment to transparency fosters trust and encourages community participation in the tax process.

Conclusion: A Dedicated Public Service

The Riverside Tax Collector’s office is a vital public service that plays a critical role in the county’s financial health and community well-being. By efficiently collecting taxes and providing excellent customer service, the office ensures that Riverside County can continue to thrive and grow. With a commitment to technological innovation, community engagement, and transparency, the Tax Collector’s office is well-positioned to meet the challenges and opportunities of the future.

How can I pay my taxes in Riverside County?

+You can pay your taxes through various methods. These include online payment portals, in-person payments at the Tax Collector’s office, or by mail. The Tax Collector’s website provides detailed instructions and resources to guide you through the payment process.

What happens if I miss a tax payment deadline?

+Missing a tax payment deadline can result in late fees and penalties. It’s important to stay informed about your tax obligations and payment deadlines. The Tax Collector’s office provides resources to help you understand the consequences of late payments and offers options to set up payment plans if needed.

How does the Tax Collector’s office assist businesses with their tax obligations?

+The Tax Collector’s office offers dedicated support to businesses. This includes providing resources and guidance on business tax obligations, offering registration services, and assisting with tax compliance. The office also conducts outreach programs to ensure that businesses understand their tax responsibilities.