Fl Property Tax Rates By County

Understanding property tax rates is crucial for homeowners and prospective buyers alike, as these taxes significantly impact one's financial obligations and overall cost of living. In Florida, a state known for its diverse real estate market and attractive retirement destinations, property tax rates vary by county, creating a complex landscape that demands careful navigation. This article aims to provide an in-depth analysis of Florida's property tax rates, offering a comprehensive guide to help residents and investors make informed decisions regarding their property-related expenses.

A Comprehensive Overview of Florida’s Property Tax Rates

Florida’s property tax system is unique, with each of its 67 counties setting its own tax rates, resulting in a wide range of variations across the state. This localized approach allows counties to fund essential services like schools, roads, and emergency services, but it also means that property owners’ tax liabilities can differ significantly from one county to the next.

Understanding the Property Tax Assessment Process

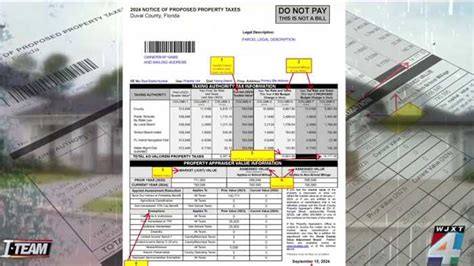

The property tax assessment process in Florida involves several key steps. First, the county property appraiser determines the Just Value of each property, which is its fair market value. This value is then subject to certain exemptions, such as the Homestead Exemption for primary residences or the Widow/Widower Exemption, which can reduce the taxable value. The remaining value, known as the Assessed Value, is then multiplied by the county’s millage rate to calculate the property tax.

| Step | Description |

|---|---|

| Just Value Determination | The property appraiser assesses the fair market value of the property. |

| Exemptions Application | Relevant exemptions are applied to reduce the taxable value. |

| Assessed Value Calculation | The taxable value is determined after exemptions. |

| Millage Rate Application | The county's millage rate is applied to the assessed value to calculate the property tax. |

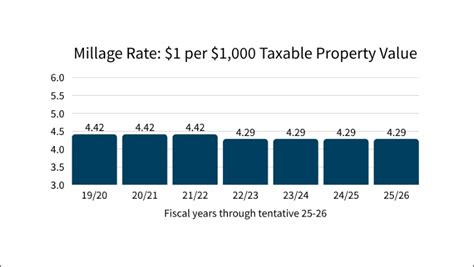

The millage rate, often referred to as the tax rate, is expressed in mills, with one mill equating to $1 of tax for every $1,000 of assessed value. For instance, a property with an assessed value of $200,000 and a millage rate of 10 mills would have a property tax of $2,000.

County-by-County Analysis of Property Tax Rates

Florida’s diverse landscape and wide range of property types lead to significant variations in property tax rates across counties. Here’s a detailed look at some of the key counties and their respective property tax rates:

- Miami-Dade County: With a population of over 2.7 million, Miami-Dade County boasts a vibrant real estate market. The county's millage rate for the 2022-2023 fiscal year is set at 10.3473 mills, making it one of the higher rates in the state. This rate includes the county's general fund millage rate of 4.5503 mills, special districts, and other funding sources.

- Broward County: Known for its beautiful beaches and diverse communities, Broward County has a millage rate of 10.5850 mills for the 2022-2023 fiscal year. This rate includes the county's general fund millage rate of 4.4700 mills, school board millage rate, and other special districts.

- Palm Beach County: Palm Beach County, with its upscale communities and famous golf courses, has a millage rate of 11.2775 mills for the 2022-2023 fiscal year. This rate includes the county's general fund millage rate of 4.7400 mills, school board millage rate, and other special district millage rates.

- Hillsborough County: Hillsborough County, home to Tampa, has a millage rate of 9.8417 mills for the 2022-2023 fiscal year. This rate includes the county's general fund millage rate of 4.2667 mills, school board millage rate, and various special district millage rates.

- Pinellas County: Pinellas County, which includes popular destinations like Clearwater and St. Petersburg, has a millage rate of 11.4400 mills for the 2022-2023 fiscal year. This rate includes the county's general fund millage rate of 4.4850 mills, school board millage rate, and special district millage rates.

- Orange County: Orange County, home to Orlando and famous theme parks, has a millage rate of 10.6465 mills for the 2022-2023 fiscal year. This rate includes the county's general fund millage rate of 4.4850 mills, school board millage rate, and other special district millage rates.

It's important to note that these millage rates can change from year to year, and they may vary within a county depending on the specific location and the type of property. For instance, some counties may have different millage rates for residential and commercial properties.

The Impact of Property Tax Rates on Florida’s Real Estate Market

Florida’s diverse property tax landscape has a significant influence on the state’s real estate market. High property tax rates can deter potential buyers, especially those on a tight budget or looking for more affordable options. Conversely, lower tax rates can make a county more attractive, encouraging investment and potentially driving up property values.

Strategies for Managing Property Tax Obligations

For homeowners and prospective buyers, understanding the property tax system and the strategies to manage these obligations is essential. Here are some key strategies to consider:

- Exemptions and Credits: Florida offers various exemptions and tax credits that can significantly reduce one's property tax liability. The Homestead Exemption, for instance, can provide substantial savings for primary residence owners. Other exemptions, such as the Senior Exemption or the Disability Exemption, can also provide relief.

- Appealing Assessments: If you believe your property's assessed value is too high, you can appeal to the county property appraiser. This process can be complex, but with the right approach and evidence, you may be able to reduce your assessed value and, consequently, your property tax.

- Strategic Timing: The timing of your purchase or the date of residency can impact your property tax obligations. In some counties, moving into a new primary residence after the assessment date but before the tax roll date can qualify you for the Homestead Exemption for that year.

- Consider County-Specific Benefits: Different counties offer unique benefits and programs. For instance, some counties provide tax relief for veterans or have specific initiatives to encourage investment in certain areas. Understanding these benefits can be advantageous when choosing a county to live in or invest in.

Future Trends and Implications

Florida’s property tax landscape is continually evolving, and understanding future trends is essential for long-term planning. Several factors can influence these trends, including changes in state and local legislation, economic shifts, and demographic changes.

One significant trend to watch is the increasing focus on property tax reform at the state level. Proposals to limit or reduce property taxes, especially for homeowners, are gaining traction. While these reforms could provide relief to residents, they may also impact the funding of essential services and could potentially lead to changes in the way counties budget and allocate resources.

Additionally, the real estate market's performance can significantly influence property tax rates. A thriving market with increasing property values could lead to higher assessments, which, in turn, could result in increased tax obligations. On the other hand, a stagnant or declining market might lead to lower assessments and potentially lower tax bills.

Demographic shifts, particularly the aging population and the growing number of retirees in Florida, can also impact property tax rates. Counties with a higher proportion of retirees may experience increased demand for services, potentially leading to higher tax rates to fund these services. Conversely, counties with a younger population might see lower tax rates as they may require fewer services.

Conclusion: Navigating Florida’s Diverse Property Tax Landscape

Florida’s property tax system, with its county-by-county variations, presents a complex but fascinating landscape for homeowners and investors. By understanding the assessment process, comparing effective tax rates, and employing strategic management techniques, individuals can navigate this system more effectively and make informed decisions about their property-related expenses.

As Florida continues to evolve, with potential changes in legislation, economic conditions, and demographic patterns, staying informed about these trends will be crucial for long-term financial planning and investment strategies. Whether you're a long-term resident or a new buyer, Florida's diverse property tax landscape offers both challenges and opportunities that require a strategic and informed approach.

How often do property tax rates change in Florida counties?

+Property tax rates can change annually in Florida. Each county sets its own millage rate, which is typically approved during the county’s budget process. As a result, property tax rates can fluctuate from year to year based on the county’s financial needs and priorities.

What is the average property tax rate in Florida?

+The average property tax rate in Florida varies greatly by county. As of the 2022-2023 fiscal year, the average millage rate across all Florida counties was approximately 10.39 mills. However, this is just an average, and individual county rates can be significantly higher or lower.

Are there any ways to reduce my property tax bill in Florida?

+Yes, there are several strategies to reduce your property tax bill in Florida. These include applying for various exemptions like the Homestead Exemption, Senior Exemption, or Disability Exemption, appealing your property’s assessed value if you believe it is too high, or taking advantage of county-specific programs or initiatives that offer tax relief.

How do I calculate my property tax bill in Florida?

+To calculate your property tax bill in Florida, you can use the following formula: Property Tax Bill = (Assessed Value - Exemptions) x Millage Rate. For example, if your property has an assessed value of 200,000, you qualify for a 50,000 Homestead Exemption, and your county’s millage rate is 10 mills, your property tax bill would be (200,000 - 50,000) x 0.010 = $1,500.

What happens if I don’t pay my property taxes in Florida?

+Failure to pay property taxes in Florida can have serious consequences. Unpaid taxes can lead to penalties, interest charges, and eventually a tax certificate sale, where the county sells the right to collect your unpaid taxes to a third party. This can result in the loss of your property through tax deed sales.