Georgia Title Ad Valorem Tax

When it comes to vehicle ownership, one of the key considerations for residents of Georgia is the Title Ad Valorem Tax, a unique tax system that plays a significant role in the state's vehicle registration process. This tax, often referred to as TAV, is integral to understanding the costs and procedures associated with owning a vehicle in the Peach State. With its distinct approach, Georgia's TAV system provides an interesting case study for those curious about the intricacies of vehicle taxation.

Understanding Georgia’s Title Ad Valorem Tax

Georgia’s Title Ad Valorem Tax is a one-time tax imposed on the value of a vehicle when it’s purchased or transferred within the state. The tax is calculated based on the fair market value of the vehicle, making it a significant factor in the overall cost of vehicle ownership. Unlike some other states, Georgia’s TAV is not an annual tax, providing a unique advantage for long-term vehicle owners.

The tax is designed to be paid at the time of title transfer, whether it's a new purchase or a change of ownership. This means that when you buy a vehicle in Georgia, or if you move to Georgia with a vehicle already registered in another state, you'll be required to pay the TAV as part of the registration process. It's an essential step in ensuring your vehicle is legally registered and roadworthy in the state.

How is the Tax Calculated?

The calculation of Georgia’s TAV is based on a percentage of the vehicle’s value. Currently, the tax rate is 7% of the fair market value of the vehicle. This value is determined by the Georgia Department of Revenue, which considers factors such as the vehicle’s make, model, age, and condition. It’s important to note that this value may differ from the purchase price, especially if the vehicle is purchased from a private seller.

For instance, if you purchase a used car valued at $20,000, the TAV would be calculated as follows: $20,000 x 0.07 = $1,400. This amount is due at the time of registration and is in addition to any other fees associated with registering your vehicle.

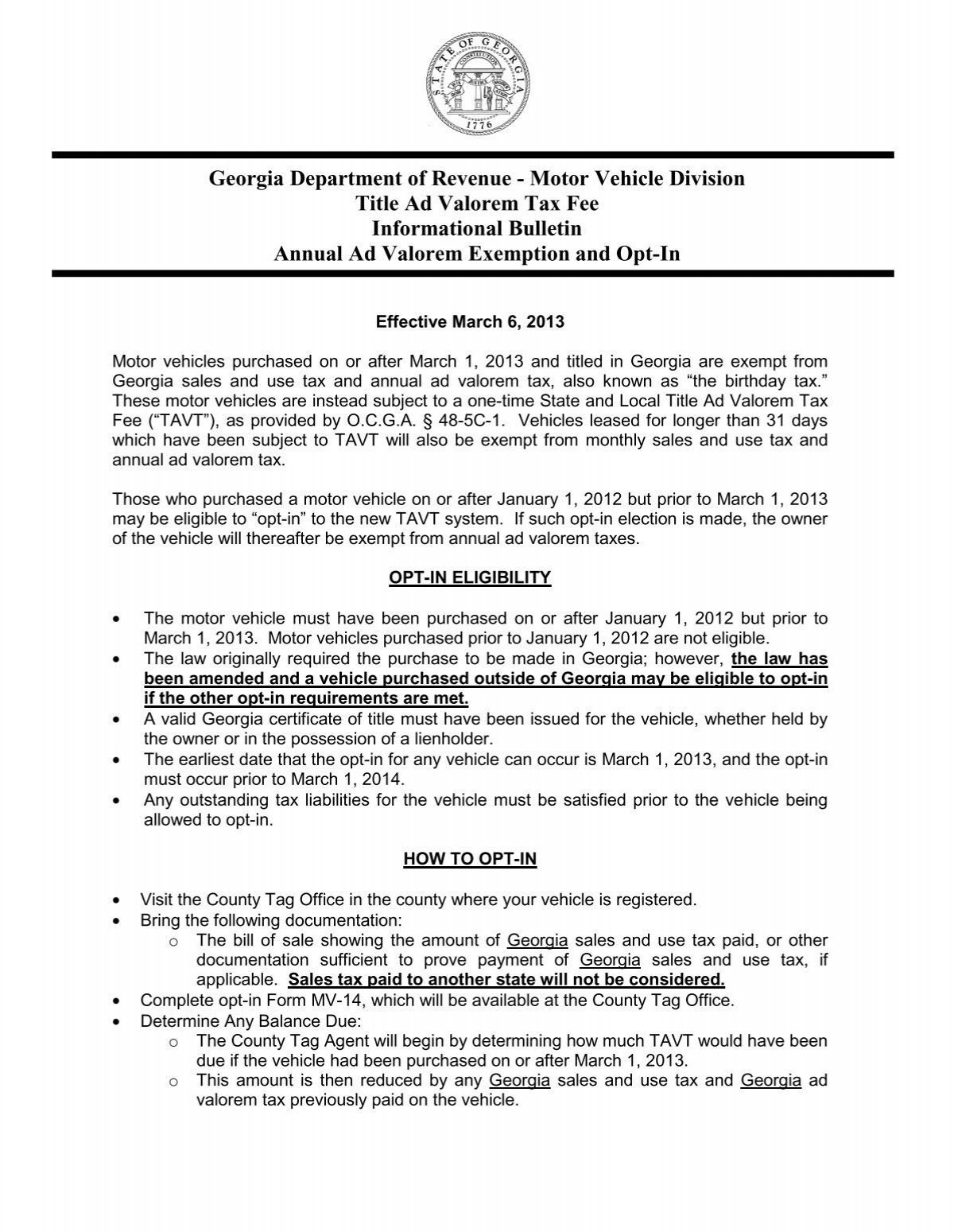

Exemptions and Special Cases

While the TAV is a standard requirement for most vehicle purchases, there are certain exemptions and special cases to be aware of. For example, active-duty military personnel and their spouses are exempt from paying TAV on vehicles purchased or transferred during their deployment. Additionally, certain types of vehicles, like motorcycles, have different tax rates.

It's crucial to consult the Georgia Department of Revenue's guidelines or seek professional advice to understand if your specific situation qualifies for any exemptions or special considerations.

| Vehicle Type | TAV Rate |

|---|---|

| Passenger Vehicles | 7% |

| Motorcycles | 6% |

| Electric Vehicles | 6.5% |

The Impact of TAV on Vehicle Ownership

Georgia’s Title Ad Valorem Tax has a significant impact on the vehicle ownership landscape within the state. It affects everything from the initial cost of purchasing a vehicle to the overall economic considerations of vehicle ownership over time.

Initial Cost Implications

For those purchasing a vehicle, the TAV adds a substantial amount to the overall cost. This is especially notable for high-value vehicles, where the tax amount can be significant. For instance, on a 50,000 vehicle, the TAV would amount to <strong>3,500, a considerable addition to the purchase price.

This upfront cost can be a deciding factor for many buyers, influencing their choice of vehicle and potentially their decision to purchase at all. It's a key consideration for both individual buyers and businesses looking to add vehicles to their fleet.

Long-Term Ownership Advantages

Despite the initial cost, the TAV’s one-time nature provides a long-term advantage. Unlike some states where vehicle taxes are annual, Georgia’s TAV means that once paid, vehicle owners are free from this tax burden for the duration of their ownership. This can result in significant savings over time, especially for those who keep their vehicles for many years.

Additionally, the TAV's calculation based on the vehicle's fair market value can be beneficial for buyers, as it often results in a lower tax amount than what might be assessed in other states that use different valuation methods.

Economic Considerations

From an economic perspective, the TAV system has a significant impact on the state’s revenue. The tax generates a substantial amount of funding for the state, which can be directed towards various public services and infrastructure projects. It also influences the vehicle market within the state, potentially affecting resale values and the overall vehicle industry.

For businesses, especially those in the automotive industry, the TAV system can impact their operations and financial strategies. It's a key consideration when deciding to open dealerships or service centers in Georgia, as it directly affects their customer base and the vehicles they handle.

Comparison with Other States

Georgia’s Title Ad Valorem Tax system sets it apart from many other states in the U.S. Each state has its own unique approach to vehicle taxation, with some states opting for annual registration fees, while others have sales taxes or a combination of these.

Variations in Taxation Methods

In contrast to Georgia’s TAV, many states have an annual registration fee that is paid to keep a vehicle legally registered. This fee can vary based on the vehicle’s weight, type, and other factors. Some states also have a sales tax on vehicle purchases, which is a percentage of the purchase price paid at the time of sale.

Other states, like Texas, have a title transfer fee that is paid when the vehicle ownership changes. This fee is typically a flat rate, unlike Georgia's TAV, which is based on the vehicle's value.

Impact on Vehicle Owners

These variations in taxation methods can have a significant impact on vehicle owners. For instance, in states with high sales taxes, the cost of purchasing a vehicle can be considerably higher. Conversely, in states with low registration fees, the ongoing cost of vehicle ownership may be more manageable.

Georgia's TAV system, with its one-time nature, provides a unique advantage for long-term vehicle owners, who would otherwise face annual registration fees in many other states. However, the initial cost of the TAV can be a barrier for some buyers, especially those on a tight budget.

The Future of Georgia’s TAV System

As with any tax system, Georgia’s Title Ad Valorem Tax is subject to change and evolution. The state’s legislative body periodically reviews and adjusts tax laws, including the TAV, to ensure they remain fair and effective.

Potential Changes and Reforms

There have been ongoing discussions about potential reforms to the TAV system. Some of these discussions center around adjusting the tax rate, especially for certain vehicle types like electric vehicles, which are gaining popularity due to their environmental benefits.

There have also been proposals to modify the valuation method to better reflect the actual market value of vehicles, ensuring a more accurate tax assessment. Additionally, the idea of introducing hybrid tax systems, combining elements of the TAV with annual registration fees, has been floated, although it remains speculative at this point.

Impact on the Automotive Industry

Any changes to the TAV system would have a significant impact on the automotive industry within Georgia. It could influence vehicle sales, registration trends, and the overall business environment for automotive-related businesses. These changes could also affect consumer behavior, potentially encouraging or discouraging certain vehicle purchases.

Consumer Perspective

From a consumer perspective, changes to the TAV system could significantly impact their vehicle-buying decisions. For instance, a reduction in the tax rate could make purchasing a vehicle more affordable, potentially boosting sales. Conversely, an increase in the tax rate could discourage buyers, especially those with high-value vehicles.

The transparency and predictability of the TAV system are crucial for consumers, allowing them to make informed decisions about vehicle ownership. Clear communication about any changes to the system is essential to maintain consumer trust and confidence.

Conclusion

Georgia’s Title Ad Valorem Tax is a critical component of vehicle ownership in the state, influencing everything from the initial purchase to long-term ownership. Its unique features, especially its one-time nature and valuation method, set it apart from other states’ taxation systems.

While the TAV provides certain advantages, like long-term cost savings, it also presents challenges, particularly the initial cost barrier. Ongoing discussions about potential reforms highlight the dynamic nature of tax systems and their impact on various stakeholders, from the state government to individual vehicle owners.

As Georgia continues to evolve and adapt to changing economic and environmental landscapes, the future of its TAV system will be a key aspect to watch, influencing the state's automotive industry and consumer behavior.

How often do I need to pay the Title Ad Valorem Tax in Georgia?

+The Title Ad Valorem Tax is a one-time tax in Georgia. It is paid at the time of purchasing a vehicle or transferring the title to a new owner. Once paid, you do not need to pay it again during your ownership of the vehicle.

Are there any exemptions from the Title Ad Valorem Tax in Georgia?

+Yes, there are certain exemptions. Active-duty military personnel and their spouses are exempt from paying TAV on vehicles purchased or transferred during their deployment. Additionally, there are exemptions for certain types of vehicles like motorcycles and electric vehicles, which have different tax rates.

How is the fair market value of a vehicle determined in Georgia for TAV purposes?

+The Georgia Department of Revenue determines the fair market value of a vehicle. They consider factors such as the vehicle’s make, model, age, and condition. This value may differ from the purchase price, especially if the vehicle is purchased from a private seller.