State Of Ohio Tax Refund

For residents of the State of Ohio, tax refunds are an important financial topic that can significantly impact personal finances. Understanding the process, timelines, and strategies to optimize tax refunds is essential for individuals and families. This comprehensive guide will delve into the specifics of Ohio's tax refund system, providing valuable insights and practical tips to ensure you receive the maximum refund possible.

The State of Ohio’s Tax Refund Process

The Ohio Department of Taxation handles all tax-related matters, including the processing of tax returns and the disbursement of refunds. The state’s tax system is designed to ensure a fair and efficient process for all taxpayers. Let’s explore the key aspects of Ohio’s tax refund journey.

Filing Your Ohio Tax Return

The first step towards receiving a tax refund is filing your Ohio state tax return accurately and on time. The filing deadline is typically aligned with the federal tax deadline, which is usually April 15th. However, it’s crucial to note that this deadline can vary based on the year and any specific circumstances, such as weekends or public holidays.

Ohio offers multiple methods for filing tax returns, including:

- Paper Filing: Taxpayers can download and complete the necessary forms, such as the Ohio Individual Income Tax Return (IT 1040), and mail them to the Ohio Department of Taxation.

- Online Filing: Ohio provides an online filing system called Ohio e-file, which allows taxpayers to submit their returns electronically. This method is secure, efficient, and often preferred for its convenience.

- Professional Assistance: Many taxpayers choose to engage the services of tax professionals or software tools to ensure accurate filing. These options can be especially beneficial for those with complex tax situations.

It's essential to gather all relevant documents and information before filing. This includes income statements, deductions, credits, and any applicable forms or schedules. Accurate filing is crucial to ensure a timely and correct refund.

Understanding Ohio’s Tax Rates and Credits

Ohio operates on a progressive tax system, which means that taxpayers are subjected to different tax rates based on their income levels. As of the 2023 tax year, Ohio has three tax brackets with corresponding tax rates:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $5,700 | 0.479% |

| $5,701 to $11,400 | 1.978% |

| Above $11,400 | 2.978% |

Additionally, Ohio offers various tax credits that can reduce the amount of tax owed or increase the refund. These credits include:

- Earned Income Tax Credit (EITC): A federal and state credit for low- to moderate-income working individuals and families. The amount of credit depends on income and family size.

- Child and Dependent Care Credit: This credit helps offset the costs of childcare or dependent care services, allowing taxpayers to work or attend school.

- Ohio School District Property Tax Credit: A credit that provides relief for homeowners by reducing the amount of property taxes paid to school districts.

It's important to review all applicable credits and deductions to maximize your refund potential.

Refund Processing Timelines

The Ohio Department of Taxation aims to process tax refunds within a reasonable timeframe. However, the exact processing time can vary based on several factors, including the method of filing, payment options chosen, and the complexity of the return.

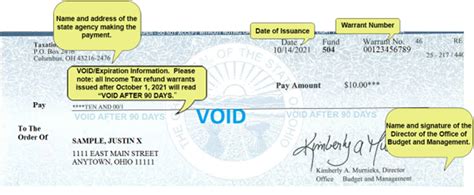

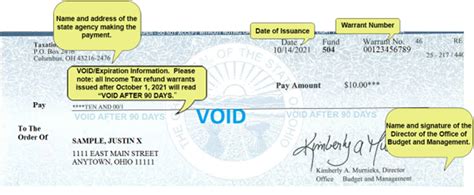

For taxpayers who file electronically and opt for direct deposit, refunds are typically issued within 10 business days. Paper returns may take longer, with a processing time of up to 6 weeks. It's essential to plan your finances accordingly and not rely on refund estimates as they can change.

The Ohio Department of Taxation provides a Where's My Refund tool on their website, allowing taxpayers to track the status of their refund. This tool provides real-time updates and can be a useful resource for those awaiting their refund.

Maximizing Your Ohio Tax Refund

Maximizing your tax refund can provide a significant financial boost. Here are some strategies to consider:

Take Advantage of Deductions and Credits

Ohio offers a range of deductions and credits that can reduce your taxable income or increase your refund. Some key deductions to consider include:

- Standard Deduction: Most taxpayers can choose to take the standard deduction, which is a set amount that reduces taxable income. For the 2023 tax year, the standard deduction for single filers is 12,950, while it's 25,900 for married filing jointly.

- Itemized Deductions: If your deductions exceed the standard deduction, it may be beneficial to itemize. Common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions.

- Education Credits: Ohio residents who pay for higher education expenses may be eligible for tax credits. The Ohio Tuition Credit and American Opportunity Tax Credit are two options to explore.

It's essential to review your financial situation and consult with a tax professional to identify all applicable deductions and credits.

Utilize Tax-Advantaged Retirement Plans

Contributing to tax-advantaged retirement plans, such as a 401(k) or an IRA, can provide significant tax benefits. These plans allow you to reduce your taxable income in the present and grow your savings tax-free until retirement.

Ohio residents can also take advantage of the Ohio Deferred Compensation Plan, a voluntary program that allows employees to set aside a portion of their income for retirement. Contributions to this plan are tax-deductible, further increasing your refund potential.

Claiming the Right Tax Credits

As mentioned earlier, Ohio offers various tax credits that can boost your refund. Some credits to consider include:

- Child Tax Credit: Taxpayers with qualifying children under the age of 17 may be eligible for this credit. The amount of the credit depends on income and other factors.

- Dependent Care Credit: This credit can help offset the costs of caring for dependents, allowing parents to work or attend school. It’s available to those who pay for childcare expenses.

- Property Tax Refund: Ohio’s Property Tax Refund Credit provides relief for homeowners by refunding a portion of their property taxes. This credit can significantly impact your refund, especially for those with high property tax burdens.

Conclusion: A Well-Planned Tax Strategy Pays Off

Navigating Ohio’s tax refund system can be complex, but with the right knowledge and strategies, you can maximize your refund and improve your financial situation. From understanding the filing process and tax rates to claiming the right deductions and credits, every step counts.

By staying informed, utilizing available resources, and seeking professional advice when needed, Ohio taxpayers can make the most of their tax refund. Remember, a well-planned tax strategy not only ensures compliance but also maximizes the financial benefits you deserve.

Frequently Asked Questions

When will I receive my Ohio tax refund?

+The timing of your refund depends on your filing method and payment choice. Generally, electronic filers who opt for direct deposit can expect their refund within 10 business days. Paper filers may have to wait up to 6 weeks. You can track your refund’s status using the Where’s My Refund tool on the Ohio Department of Taxation’s website.

What if my Ohio tax refund is delayed?

+Delays can occur for various reasons, such as errors in your return or additional verification needed. If your refund is significantly delayed, contact the Ohio Department of Taxation for assistance. They can provide specific guidance based on your situation.

How can I check the status of my Ohio tax refund online?

+You can check the status of your Ohio tax refund online by using the Where’s My Refund tool on the Ohio Department of Taxation’s website. This tool provides real-time updates on the processing of your refund and can help you estimate when to expect it.

Are there any tax credits specifically for Ohio residents?

+Yes, Ohio offers several tax credits that are specific to its residents. These include the Ohio School District Property Tax Credit, which provides relief for homeowners, and the Ohio Deferred Compensation Plan, which allows employees to set aside tax-deductible income for retirement.

Can I claim deductions for my dependent child’s educational expenses in Ohio?

+Yes, Ohio residents can claim deductions for their dependent child’s educational expenses. The Ohio Tuition Credit and the American Opportunity Tax Credit are two options to consider. These credits can help offset the costs of higher education and boost your tax refund.