South Dakota Income Tax

In the realm of personal finance and tax management, understanding the intricacies of state-level taxation is paramount. Among the 50 states in the US, South Dakota stands out for its unique approach to income taxation, offering a straightforward and competitive system that has drawn attention from taxpayers and businesses alike. This article aims to provide an in-depth analysis of South Dakota's income tax structure, shedding light on its rates, brackets, deductions, and other key features that make it an attractive option for many individuals and corporations.

South Dakota's Progressive Income Tax System

South Dakota employs a progressive income tax system, which means that higher income earners are taxed at higher rates. This approach is designed to ensure fairness and promote economic growth by allowing lower-income earners to keep a larger proportion of their income while contributing proportionally more as their income rises. The state's income tax rates are some of the most competitive in the country, making it an appealing destination for taxpayers seeking to optimize their financial strategies.

Income Tax Brackets and Rates

South Dakota's income tax brackets are divided into seven categories, each with its corresponding tax rate. As of 2023, these brackets and rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $3,670 | 0% |

| $3,671 - $6,490 | 2.5% |

| $6,491 - $9,590 | 3.5% |

| $9,591 - $13,390 | 4.5% |

| $13,391 - $17,890 | 5.5% |

| $17,891 - $36,790 | 5.9% |

| $36,791 and above | 6.5% |

These tax brackets are designed to ensure that individuals and families with lower incomes are taxed at lower rates, providing them with more disposable income to support their livelihoods. The higher tax rates for higher incomes are a reflection of the state's commitment to fiscal responsibility and progressive taxation.

Deductions and Credits

South Dakota offers a range of deductions and credits that can significantly reduce the tax burden for individuals and businesses. These include deductions for:

- Federal Income Tax Paid: South Dakota allows taxpayers to deduct the amount of federal income tax they paid in the previous year.

- Sales Tax: Residents can choose to deduct either sales tax paid or state income tax, whichever is greater.

- Social Security Benefits: Certain social security benefits are exempt from state income tax, making South Dakota an attractive option for retirees.

- Business Deductions: Businesses operating in South Dakota can benefit from various deductions and credits, such as the Research & Development Tax Credit and the Capital Investment Tax Credit.

These deductions and credits, combined with the state's competitive tax rates, make South Dakota an appealing choice for individuals and businesses looking to optimize their tax strategies.

Tax Exemptions and Special Considerations

South Dakota has a few notable exemptions and special considerations in its income tax structure. For instance, the state does not tax Social Security benefits for individuals of any age, which is a unique feature compared to many other states. Additionally, South Dakota does not impose a tax on inheritances, making it an attractive state for estate planning purposes.

Furthermore, the state offers tax incentives for specific industries, such as agriculture and renewable energy. These incentives can significantly reduce the tax burden for businesses operating in these sectors, encouraging economic growth and innovation.

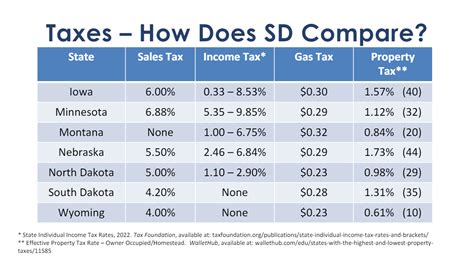

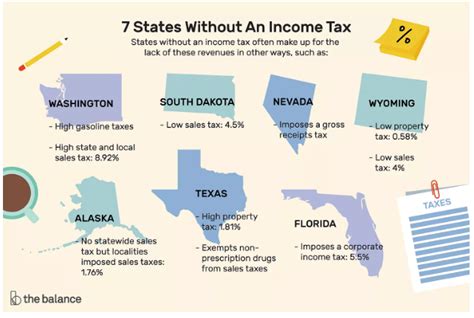

Comparison with Other States

When compared to other states, South Dakota's income tax system stands out for its simplicity and competitiveness. Many states have more complex tax structures with higher rates and fewer deductions. For instance, neighboring states like Nebraska and Minnesota have higher top tax rates, while states like Florida and Texas have no income tax at all, which can be attractive to certain taxpayers.

However, South Dakota's combination of competitive rates, progressive tax structure, and various deductions makes it an appealing option for taxpayers seeking a balanced approach to income taxation. The state's tax system is designed to encourage economic growth while maintaining fiscal responsibility, making it a desirable location for individuals and businesses.

Economic Impact and Tax Revenue

South Dakota's income tax system has a significant impact on the state's economy and overall tax revenue. The progressive nature of the tax system ensures that higher-income earners contribute a larger share of tax revenue, promoting fairness and economic stability. Additionally, the state's competitive tax rates and incentives encourage businesses to operate within its borders, fostering job growth and economic development.

The revenue generated from income taxes is a critical component of South Dakota's overall budget, supporting vital services such as education, healthcare, and infrastructure development. The state's fiscal policies, including its income tax structure, play a crucial role in maintaining a healthy economy and providing essential services to its residents.

Frequently Asked Questions

What is the average income tax rate in South Dakota?

+

The average income tax rate in South Dakota is approximately 5.25%, which is calculated as the weighted average of the state’s tax brackets. This rate is competitive when compared to other states and makes South Dakota an attractive destination for taxpayers.

Are there any tax incentives for businesses in South Dakota?

+

Yes, South Dakota offers various tax incentives for businesses, including the Research & Development Tax Credit, the Capital Investment Tax Credit, and tax exemptions for certain industries like agriculture and renewable energy. These incentives are designed to encourage economic growth and innovation within the state.

How does South Dakota’s income tax system compare to neighboring states?

+

South Dakota’s income tax system is generally more competitive than its neighboring states. While some states like Nebraska and Minnesota have slightly higher top tax rates, South Dakota’s progressive structure and various deductions make it an appealing option for taxpayers. States like Florida and Texas have no income tax, which can be attractive for certain taxpayers.

What is the process for filing income taxes in South Dakota?

+

Filing income taxes in South Dakota is a straightforward process. Residents can use the state’s online filing system or mail in their tax returns. The deadline for filing is typically April 15th, and taxpayers can choose to file for an extension if needed. The state also offers various resources and support for taxpayers to ensure compliance with its income tax laws.

Are there any special considerations for retirees in South Dakota’s income tax system?

+

Yes, South Dakota offers several benefits for retirees. The state does not tax Social Security benefits for individuals of any age, which is a unique feature. Additionally, the state does not impose a tax on inheritances, making it an attractive state for estate planning purposes. These considerations, combined with the state’s competitive tax rates, make South Dakota an appealing choice for retirees.