Rate Of Tax In Switzerland

Switzerland, renowned for its picturesque landscapes and thriving economy, presents a unique tax landscape that significantly influences the country's financial climate and the lives of its residents. Understanding the rate of tax in Switzerland is crucial for individuals, businesses, and investors alike, as it plays a pivotal role in shaping financial strategies and decision-making processes.

The Swiss Tax System: A Complex yet Effective Framework

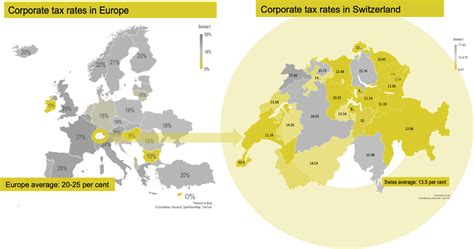

The Swiss tax system is characterized by its decentralized nature, with taxes being levied at the federal, cantonal, and municipal levels. This multi-tiered approach results in a complex but highly tailored tax environment, catering to the diverse needs and circumstances of different regions and individuals.

At the federal level, the Swiss government imposes taxes on income, value-added goods and services (VAT), and certain other specific activities. The income tax rate, for instance, varies based on the taxpayer's residency status and income level, with non-resident individuals generally subject to a flat rate of 24.5%. On the other hand, resident individuals are taxed progressively, with rates ranging from 1.5% to 11.5% on the first CHF 25,000 of income, and up to 24.5% for higher incomes.

In addition to federal taxes, Switzerland's 26 cantons and over 2,200 municipalities have their own taxation systems. This cantonal and municipal autonomy allows for significant variation in tax rates and regulations across the country. As a result, the total tax burden an individual or business faces can vary greatly depending on their location within Switzerland.

| Tax Type | Rate |

|---|---|

| Federal Income Tax (Non-Residents) | 24.5% |

| Federal Income Tax (Residents - First CHF 25,000) | 1.5% - 11.5% |

| Federal Income Tax (Residents - Higher Incomes) | Up to 24.5% |

| Value-Added Tax (VAT) | 7.7% |

| Capital Gains Tax (Varies by Canton) | 0% - 45% |

Taxation on Wealth and Investments

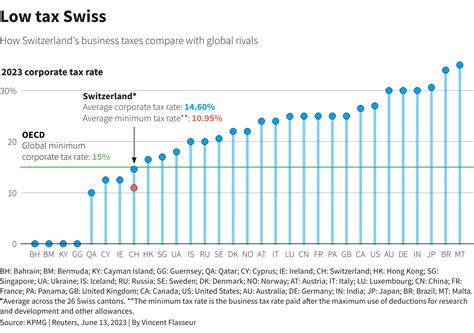

Switzerland is often perceived as a tax haven due to its favorable tax treatment of wealth and investments. While the country does not levy a wealth tax at the federal level, some cantons and municipalities impose taxes on net worth. However, these rates are generally lower compared to other European countries, making Switzerland an attractive destination for those seeking to optimize their wealth management strategies.

Furthermore, Switzerland's robust financial sector and its tradition of bank secrecy have long attracted investors and businesses seeking a stable and secure environment for their assets. The country's favorable corporate tax rates, ranging from 6.8% to 24.2% depending on the canton, further enhance its appeal as a hub for international businesses and financial institutions.

Capital Gains Taxation

Capital gains derived from the sale of assets, such as real estate or financial instruments, are subject to taxation in Switzerland. However, the tax treatment varies significantly depending on the canton and the type of asset. In some cantons, capital gains are exempt from taxation, while in others, they are taxed at rates as high as 45%. This variation underscores the importance of careful planning and a thorough understanding of cantonal regulations when investing in Switzerland.

The Impact of Swiss Tax Rates on the Economy

The Swiss tax system, with its competitive rates and decentralized approach, has played a significant role in shaping the country’s economic landscape. By offering a favorable tax environment, particularly for businesses and high-net-worth individuals, Switzerland has been able to attract substantial foreign investment and talent. This, in turn, has contributed to the country’s thriving economy, characterized by low unemployment rates, a high standard of living, and a robust financial sector.

Furthermore, the Swiss tax system's focus on cantonal autonomy has fostered a spirit of competition among regions, driving innovation and efficiency. Cantons often compete to offer the most attractive tax packages, resulting in a dynamic and responsive tax environment that adapts to the changing needs of businesses and individuals.

Tax Incentives and Business-Friendly Policies

To further enhance its appeal to businesses, Switzerland offers a range of tax incentives and business-friendly policies. These include reduced tax rates for holding companies, mixed companies, and domiciled companies, as well as tax holidays and grants for new businesses and those investing in research and development. Such measures have contributed to Switzerland’s reputation as a prime location for corporate headquarters and international business operations.

Navigating the Swiss Tax Landscape: Expert Advice

For individuals and businesses looking to navigate the complex Swiss tax system, seeking expert advice is essential. A thorough understanding of cantonal regulations, combined with strategic tax planning, can lead to significant tax savings and a more efficient financial structure. Here are some key considerations for those embarking on their Swiss tax journey:

- Engage a Qualified Tax Advisor: Partnering with a tax professional who specializes in Swiss taxation can provide invaluable guidance and ensure compliance with the country's complex regulations.

- Understand Cantonal Variations: Given the significant differences in tax rates and regulations across cantons, it's crucial to thoroughly research and understand the tax environment in your chosen canton or cantons.

- Consider Tax Optimization Strategies: Explore opportunities for tax optimization, such as taking advantage of reduced tax rates for specific business entities or investing in tax-efficient vehicles. However, always ensure that any strategies employed are compliant with Swiss tax laws.

- Stay Informed on Tax Developments: The Swiss tax landscape is subject to change, with new regulations and amendments being introduced periodically. Staying updated on these changes can help you adapt your tax strategies accordingly.

Conclusion: Embracing the Swiss Tax System

The Swiss tax system, with its decentralized approach and competitive rates, presents both opportunities and challenges for individuals and businesses. By understanding the nuances of this complex system and seeking expert guidance, one can navigate the tax landscape effectively, optimizing their financial position and contributing to Switzerland’s thriving economy.

Whether you're an individual seeking to manage your wealth efficiently or a business looking to establish a presence in a tax-friendly environment, Switzerland offers a unique and rewarding tax experience. With careful planning and a proactive approach, you can unlock the full potential of the Swiss tax system and achieve your financial goals.

What is the average tax rate for residents in Switzerland?

+The average tax rate for residents in Switzerland varies depending on income and canton. Generally, the federal income tax rate for residents ranges from 1.5% to 11.5% on the first CHF 25,000 of income, and up to 24.5% for higher incomes. Cantonal and municipal taxes can significantly impact the total tax burden, with variations across the country.

Are there any tax benefits for businesses in Switzerland?

+Yes, Switzerland offers various tax benefits for businesses, including reduced tax rates for specific types of companies, tax holidays, and grants for new businesses and those investing in research and development. These incentives are designed to attract and support businesses, contributing to the country’s thriving economy.

How does Switzerland’s tax system impact its economy and investment appeal?

+Switzerland’s tax system, with its competitive rates and cantonal autonomy, has played a significant role in shaping the country’s economic landscape. The favorable tax environment, particularly for businesses and high-net-worth individuals, has attracted substantial foreign investment and talent, contributing to a thriving economy and a robust financial sector.