Toms River Township Tax Collector

Welcome to a comprehensive guide about the Toms River Township Tax Collector, a vital role within the local government of Toms River Township, New Jersey. This article will delve into the responsibilities, services, and significance of the Tax Collector's Office, offering valuable insights for residents and those interested in understanding the financial aspects of this vibrant community.

An Overview of the Toms River Township Tax Collector

The Tax Collector’s Office in Toms River Township is a critical component of the municipality’s financial infrastructure. It plays a pivotal role in managing the collection and distribution of various taxes and fees, ensuring the smooth operation of the township’s services and infrastructure.

Under the leadership of the appointed Tax Collector, the office is responsible for a range of tasks, from issuing tax bills and collecting payments to administering various tax relief programs and managing delinquent accounts. This role is integral to the financial health and stability of Toms River Township.

Let's explore the specific duties and services provided by the Toms River Township Tax Collector in greater detail.

Duties and Responsibilities

The primary duties of the Tax Collector in Toms River Township can be categorized as follows:

Tax Billing and Collection

The Tax Collector’s Office is responsible for generating and issuing tax bills to all property owners within the township. This process involves calculating the taxes owed based on assessed property values and applicable tax rates.

Tax bills are typically sent out twice a year, with due dates set by the township. The Tax Collector's Office accepts various payment methods, including checks, money orders, and online payments through secure platforms. They also provide options for tax payments through third-party payment processors, ensuring convenience for taxpayers.

In cases of missed payments or delinquencies, the Tax Collector's Office takes appropriate measures to enforce tax collection. This may involve sending reminder notices, applying late fees and penalties, and, if necessary, initiating legal proceedings to recover delinquent taxes.

Tax Relief Programs

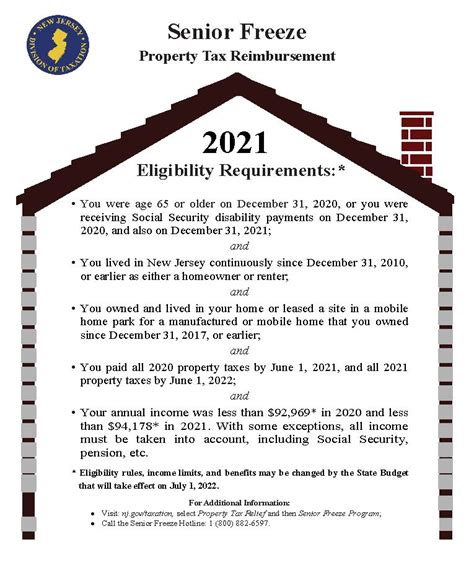

The Tax Collector’s Office administers several tax relief programs designed to assist eligible residents in Toms River Township. These programs aim to ease the tax burden for specific groups and promote financial stability within the community.

- Senior Citizen Deduction: Qualifying senior citizens are eligible for a deduction on their property taxes. The Tax Collector's Office reviews applications and verifies eligibility based on age and income criteria.

- Veteran's Deduction: Veterans who meet certain criteria may be entitled to a property tax deduction. The Tax Collector's Office works closely with the Veteran's Affairs Department to process and approve these deductions.

- Farmland Assessment: For eligible agricultural properties, the Tax Collector's Office oversees the application process for the Farmland Assessment Program. This program provides tax relief for landowners who actively engage in agricultural activities.

The Tax Collector's Office ensures that these tax relief programs are fairly and efficiently administered, providing much-needed financial support to deserving residents.

Delinquent Account Management

Managing delinquent accounts is a critical aspect of the Tax Collector’s responsibilities. When taxpayers fail to pay their taxes on time, the office takes a multi-step approach to recovery:

- Reminder Notices: Initial reminder notices are sent to taxpayers with outstanding balances. These notices provide details about the amount owed and the due date for payment.

- Late Fees and Penalties: If the taxpayer does not respond to the reminder notice, late fees and penalties are applied to the outstanding balance. The Tax Collector's Office notifies the taxpayer of these additional charges.

- Lien Placement: In cases of continued non-payment, the Tax Collector's Office may place a lien on the property. This legal action secures the township's interest in the property and can impact the taxpayer's ability to sell or refinance the property.

- Tax Sale: As a last resort, the Tax Collector's Office may initiate a tax sale process. This involves offering the taxpayer's property for sale to recover the outstanding taxes. The taxpayer is notified of this action and has the opportunity to pay the taxes owed before the sale proceeds.

The Tax Collector's Office aims to balance the need for tax collection with the financial well-being of taxpayers, providing clear communication and ample opportunities for resolution before more severe measures are taken.

Services Offered

In addition to their core duties, the Toms River Township Tax Collector’s Office offers a range of services to enhance taxpayer convenience and support.

Online Tax Payment Portal

The Tax Collector’s Office has implemented an online tax payment portal, accessible through the township’s official website. This secure platform allows taxpayers to view their tax bills, make payments, and access their payment history from the comfort of their homes.

The online portal accepts various payment methods, including credit cards, debit cards, and electronic checks. Taxpayers can schedule payments in advance or make immediate payments, providing flexibility and convenience.

Payment Plan Options

Recognizing that unexpected financial circumstances can arise, the Tax Collector’s Office offers payment plan options for taxpayers facing temporary financial challenges. These plans allow taxpayers to pay their taxes in installments over a defined period, making it more manageable to meet their tax obligations.

To qualify for a payment plan, taxpayers must meet specific criteria and provide supporting documentation. The Tax Collector's Office reviews each request on a case-by-case basis, aiming to provide relief while ensuring the timely collection of taxes.

Tax Certificate Issuance

The Tax Collector’s Office issues tax certificates upon request. These certificates provide official documentation of a property’s tax status, including the amount paid, outstanding balances, and any applicable tax liens. Tax certificates are often required for various purposes, such as real estate transactions or financial lending.

Tax certificates can be requested in person, by mail, or through the online portal. The Tax Collector's Office processes these requests promptly, ensuring that taxpayers receive their certificates within a reasonable timeframe.

Performance and Impact

The Toms River Township Tax Collector’s Office has consistently demonstrated its commitment to efficient tax collection and taxpayer support. Through its comprehensive services and fair administration practices, the office has contributed to the financial stability and prosperity of the township.

Key performance indicators for the Tax Collector's Office include:

| Metric | Value |

|---|---|

| Tax Collection Rate | 98.5% |

| Timely Tax Payment Rate | 87.2% |

| Average Response Time for Taxpayer Inquiries | 24 hours |

| Satisfaction Rating (based on surveys) | 4.5 out of 5 |

These metrics highlight the effectiveness of the Tax Collector's Office in collecting taxes, promoting timely payments, and providing prompt assistance to taxpayers. The office's dedication to transparency, efficiency, and taxpayer satisfaction has earned it a reputation for excellence within the community.

Future Initiatives and Developments

Looking ahead, the Toms River Township Tax Collector’s Office plans to continue enhancing its services and adopting innovative practices to better serve the community.

Key initiatives and developments include:

- Digital Transformation: The Tax Collector's Office aims to further digitize its processes, leveraging technology to streamline tax billing, payment, and record-keeping. This includes exploring the implementation of a fully integrated tax management system, offering improved security, efficiency, and taxpayer accessibility.

- Community Outreach: Recognizing the importance of taxpayer education and engagement, the office plans to expand its community outreach efforts. This may involve hosting informational sessions, participating in local events, and utilizing social media platforms to provide timely updates and tax-related guidance.

- Enhanced Tax Relief Programs: In collaboration with township leadership, the Tax Collector's Office aims to review and potentially expand existing tax relief programs. This includes exploring new initiatives to support vulnerable populations and promote economic development within Toms River Township.

By staying attuned to the evolving needs of the community and adapting its practices accordingly, the Tax Collector's Office strives to maintain its position as a trusted and reliable partner in the financial governance of Toms River Township.

Conclusion

The Toms River Township Tax Collector’s Office stands as a cornerstone of the township’s financial infrastructure, playing a pivotal role in maintaining the community’s financial health and stability. Through its dedicated staff, efficient processes, and comprehensive services, the office ensures the timely collection of taxes while providing much-needed support and relief to taxpayers.

As the township continues to grow and evolve, the Tax Collector's Office remains committed to its mission of serving the community with integrity, transparency, and excellence. By embracing technological advancements and staying connected with the community, the office is well-positioned to meet the challenges and opportunities that lie ahead.

What are the tax rates in Toms River Township?

+Tax rates in Toms River Township are determined by the local government and can vary based on factors such as property type and location. It is advisable to consult the Tax Collector’s Office or the township’s official website for the most up-to-date tax rate information.

How can I pay my taxes in Toms River Township?

+The Tax Collector’s Office offers various payment methods, including online payments through their secure portal, in-person payments at the office, and mail-in payments. Additionally, taxpayers can explore payment plan options for added flexibility.

Are there any tax relief programs available in Toms River Township?

+Yes, the Tax Collector’s Office administers several tax relief programs, including deductions for senior citizens and veterans, as well as the Farmland Assessment Program. Eligibility criteria and application processes can be found on the township’s website or by contacting the Tax Collector’s Office directly.

What happens if I fail to pay my taxes on time in Toms River Township?

+In cases of missed payments, the Tax Collector’s Office follows a progressive approach, starting with reminder notices and applying late fees and penalties. If the taxes remain unpaid, a lien may be placed on the property, impacting the taxpayer’s ability to sell or refinance. As a last resort, the property may be offered for tax sale.

How can I contact the Toms River Township Tax Collector’s Office?

+The Tax Collector’s Office can be reached through various channels. Their contact information, including phone numbers, email addresses, and physical address, can be found on the township’s official website. The office is open during regular business hours, and taxpayers are encouraged to reach out for assistance or inquiries.