Car Sales Tax New York

When it comes to purchasing a new or used vehicle, understanding the sales tax implications is crucial. In the state of New York, the sales tax process can vary depending on several factors. This comprehensive guide will delve into the intricacies of car sales tax in New York, covering essential aspects such as tax rates, exemptions, and the impact on vehicle purchases.

Unraveling the Sales Tax Structure in New York

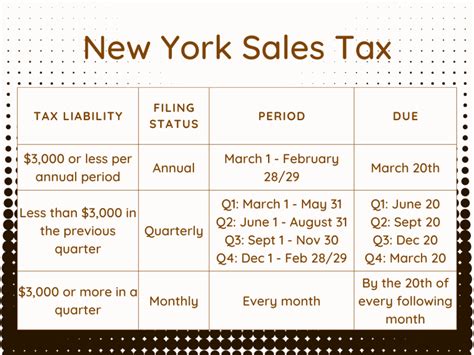

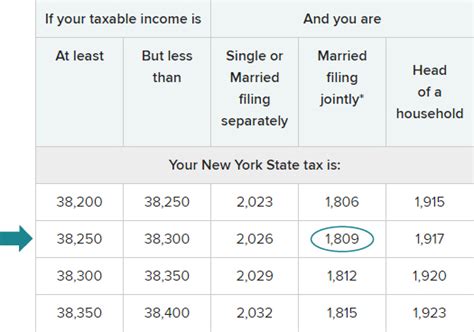

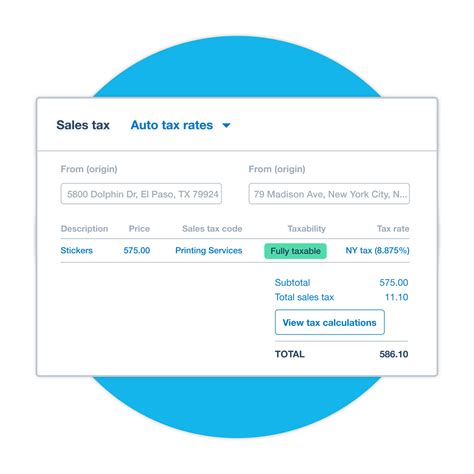

New York, like many other states, imposes a sales tax on the purchase of vehicles. The sales tax rate is determined by the location where the vehicle is registered and can vary across different counties and municipalities within the state. Understanding the tax structure is the first step in navigating the car sales tax process in New York.

The state of New York has a base sales tax rate of 4%, which applies uniformly across the state. However, this base rate is often supplemented by additional local and municipal taxes, resulting in a combined sales tax rate that can range from 7% to 8.875%, depending on the specific location.

For instance, in New York City, the combined sales tax rate is 8.875%, which includes the state's base tax rate and additional local and city taxes. On the other hand, counties like Suffolk, Nassau, and Westchester have a lower combined sales tax rate of 8%, while other counties like Albany and Onondaga have a rate of 7.75%.

To provide a clearer picture, here's a breakdown of the sales tax rates in some major counties in New York:

| County | Combined Sales Tax Rate |

|---|---|

| New York City (Manhattan, Bronx, Brooklyn, Queens, Staten Island) | 8.875% |

| Suffolk County | 8% |

| Nassau County | 8% |

| Westchester County | 8% |

| Albany County | 7.75% |

| Onondaga County | 7.75% |

| ...and more | ... |

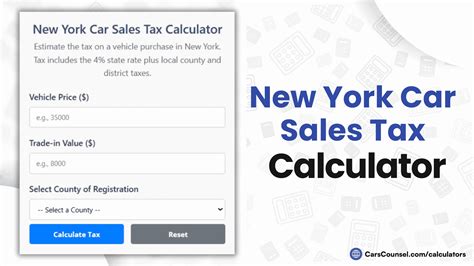

How Sales Tax is Calculated on Vehicle Purchases

The sales tax on a vehicle is calculated based on the purchase price or the vehicle’s fair market value, whichever is higher. This means that even if you acquire a vehicle through a private sale or as a gift, you may still be subject to sales tax based on the vehicle’s value.

For example, if you purchase a used car for $15,000 in a county with an 8% sales tax rate, the sales tax due would be calculated as follows:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $15,000 x 0.08 = $1,200

Therefore, in this scenario, the sales tax due on the vehicle purchase would be $1,200.

Sales Tax Exemptions and Considerations in New York

While the sales tax rate can vary across New York, there are certain exemptions and considerations that can impact the tax liability on vehicle purchases. Understanding these exemptions can help buyers navigate the sales tax landscape more effectively.

Exemptions for Specific Vehicle Types

New York offers exemptions for certain types of vehicles, including:

- Electric Vehicles (EVs): There is a partial sales tax exemption for the purchase of new and used electric vehicles. The exemption applies to the first $50,000 of the vehicle's purchase price. For example, if you purchase a new EV for $60,000, you would only pay sales tax on $10,000 of the purchase price.

- Hybrid Vehicles: Similar to EVs, there is a partial sales tax exemption for the purchase of new and used hybrid vehicles. The exemption also applies to the first $50,000 of the vehicle's purchase price.

- Military Vehicles: Vehicles that are exclusively used for military purposes are exempt from sales tax in New York.

Trade-Ins and Vehicle Transfers

When trading in an old vehicle or transferring a vehicle’s title, the sales tax calculation can become more complex. Here’s how it typically works:

If you trade in your old vehicle as part of a new purchase, the sales tax is calculated on the difference between the new vehicle's price and the trade-in allowance. For example, if you purchase a new car for $30,000 and receive a $10,000 trade-in allowance for your old vehicle, the sales tax would be calculated on the remaining $20,000.

In the case of a vehicle transfer, such as inheriting a car or receiving a gift, the sales tax is typically based on the fair market value of the vehicle at the time of transfer. This can be determined by referencing the vehicle's value in the Kelley Blue Book or other reputable valuation sources.

The Impact of Sales Tax on Vehicle Purchases

Sales tax can significantly impact the overall cost of a vehicle purchase. While the base sales tax rate in New York is relatively low compared to some other states, the addition of local and municipal taxes can result in a substantial increase in the total cost.

For instance, a vehicle purchased in New York City with a combined sales tax rate of 8.875% can result in a tax liability of thousands of dollars for more expensive vehicles. This additional cost should be carefully considered when budgeting for a vehicle purchase.

Moreover, the sales tax on vehicles can vary significantly depending on the purchase price. A luxury vehicle with a higher price tag will generally result in a higher sales tax liability compared to a more affordable vehicle.

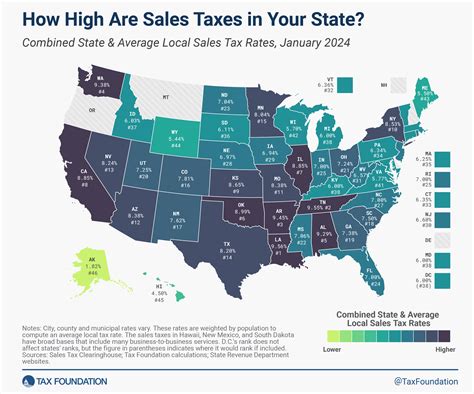

Comparing Sales Tax Rates with Other States

To provide a broader perspective, here’s a comparison of New York’s sales tax rates with other states:

| State | Sales Tax Rate |

|---|---|

| New York | 4% (base rate) to 8.875% (combined rate in NYC) |

| California | 7.25% |

| Texas | 6.25% |

| Florida | 6% |

| Pennsylvania | 6% |

| ...and more | ... |

As seen in the table above, New York's sales tax rates can be higher than some neighboring states, which may influence vehicle purchasing decisions for individuals living near state borders.

Tips for Navigating Car Sales Tax in New York

Understanding the sales tax landscape in New York is crucial for making informed vehicle purchasing decisions. Here are some tips to help navigate the process effectively:

- Research Local Sales Tax Rates: Before finalizing a vehicle purchase, research the sales tax rate in the county or municipality where the vehicle will be registered. This information is readily available on official government websites or through local tax offices.

- Utilize Online Sales Tax Calculators: Several online tools and calculators are available to estimate the sales tax on a vehicle purchase based on its price and location. These can provide a quick and accurate estimate of the tax liability.

- Consider Trade-Ins and Transfers: If you're trading in an old vehicle or receiving a gift, understand how these transactions impact the sales tax calculation. Consult with the dealership or tax professionals to ensure an accurate assessment.

- Explore Exemptions and Incentives: Stay informed about any sales tax exemptions or incentives offered by the state or local governments. These can significantly reduce the tax liability on certain types of vehicles, such as EVs and hybrids.

- Budget for Sales Tax: When budgeting for a vehicle purchase, allocate a portion of your budget specifically for sales tax. This ensures that you have sufficient funds to cover the tax liability and avoid any financial surprises.

Future Outlook and Potential Changes

The sales tax landscape in New York is subject to change, and staying informed about potential modifications is crucial for vehicle buyers. Here are some factors to consider:

- Legislative Changes: The New York State Legislature periodically reviews and adjusts tax laws, including sales tax rates and exemptions. Keeping an eye on legislative updates can provide insights into potential changes that may impact vehicle purchases.

- Environmental Initiatives: With a growing focus on environmental sustainability, New York and other states may introduce or expand sales tax exemptions for electric and hybrid vehicles. These initiatives can make eco-friendly vehicles more affordable for consumers.

- Economic Factors: Economic conditions, such as recessions or periods of high inflation, can influence tax policies. In times of economic hardship, states may adjust tax rates or introduce temporary incentives to stimulate the economy and support consumers.

Potential Impact of Remote Sales

With the rise of online vehicle sales and remote purchasing options, the sales tax landscape may become more complex. In such cases, understanding the tax implications of out-of-state purchases and the potential for tax audits becomes crucial.

Conclusion: Navigating the Complex World of Car Sales Tax

Understanding the sales tax implications on vehicle purchases is an essential aspect of responsible financial planning. In the state of New York, with its varying sales tax rates and exemptions, staying informed and proactive is key.

By researching local tax rates, utilizing online calculators, and exploring exemptions, vehicle buyers in New York can make more informed decisions and budget effectively for sales tax liabilities. With the potential for legislative and environmental changes, staying updated on tax policies is crucial to navigating the complex world of car sales tax.

What is the average sales tax rate in New York for vehicle purchases?

+The average sales tax rate for vehicle purchases in New York can range from 7% to 8.875%, depending on the location where the vehicle is registered. This includes the state’s base tax rate of 4% and additional local and municipal taxes.

Are there any sales tax exemptions for specific vehicle types in New York?

+Yes, New York offers partial sales tax exemptions for the purchase of new and used electric vehicles and hybrid vehicles. The exemption applies to the first $50,000 of the vehicle’s purchase price. Additionally, military vehicles used exclusively for military purposes are exempt from sales tax.

How is sales tax calculated on a vehicle trade-in or transfer?

+When trading in a vehicle, the sales tax is calculated on the difference between the new vehicle’s price and the trade-in allowance. For vehicle transfers, the sales tax is typically based on the fair market value of the vehicle at the time of transfer, as determined by reputable valuation sources.

Can I negotiate sales tax rates with dealerships in New York?

+Sales tax rates are set by law and are non-negotiable. However, dealerships may offer incentives or discounts on the vehicle’s purchase price, which can indirectly reduce the overall sales tax liability.

How can I stay updated on potential changes to sales tax rates in New York?

+To stay informed about potential changes to sales tax rates and exemptions, it’s advisable to monitor official government websites, local tax office updates, and news sources that cover tax-related topics. Additionally, consulting with tax professionals can provide valuable insights into emerging tax policies.