What Is Medicare Tax

Medicare tax is an essential component of the United States healthcare system, playing a crucial role in funding Medicare, a federal program that provides health insurance coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities or end-stage renal disease. Understanding Medicare tax is vital for both employers and employees, as it impacts payroll processes and overall healthcare coverage.

The Purpose and Role of Medicare Tax

Medicare tax is a payroll tax levied on both employees and employers to support the Medicare program. This tax is a fundamental part of the social insurance system in the United States, ensuring that individuals have access to medical care and financial protection in their later years.

The revenue generated from Medicare tax primarily funds two parts of the Medicare program:

- Part A (Hospital Insurance): This covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services.

- Part B (Medical Insurance): Part B covers doctor's services, outpatient care, and some preventive services.

By contributing to Medicare tax, employees and employers play a vital role in ensuring the sustainability of this critical healthcare program.

How Medicare Tax Works

Medicare tax is calculated as a percentage of an employee’s wages, with a set maximum amount that is subject to the tax each year. The tax rate and income threshold are subject to change based on federal regulations.

| Tax Rate | Income Threshold |

|---|---|

| 1.45% | All wages |

| 0.9% | Wages above the threshold |

Here's a breakdown of how Medicare tax is typically calculated and applied:

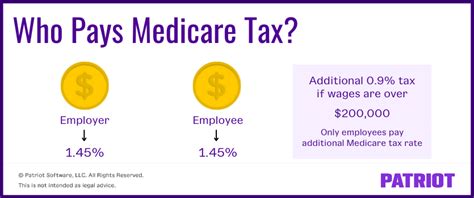

- Employee Medicare Tax: For most employees, Medicare tax is deducted from their wages at a rate of 1.45% on all earnings. An additional 0.9% is applied to wages above a certain threshold, which is $200,000 for the 2023 tax year. This additional tax is known as the Additional Medicare Tax.

- Employer Medicare Tax: Employers are also responsible for contributing to Medicare tax. They match the employee's contribution of 1.45% on all wages. For the Additional Medicare Tax, the employer does not contribute.

- Self-Employment Medicare Tax: Self-employed individuals must pay the full Medicare tax rate of 2.9% on their net earnings from self-employment. If their income exceeds the threshold, they are also responsible for paying the Additional Medicare Tax of 0.9% on the excess amount.

It's important to note that certain groups, such as railroad workers and federal employees, have slightly different Medicare tax rules due to their specific employment circumstances.

Medicare Tax Withholding and Reporting

Employers are responsible for withholding Medicare tax from employee wages and remitting these funds to the Internal Revenue Service (IRS) on a regular basis. The frequency of these payments depends on the employer’s overall tax liability.

Additionally, employers must report Medicare tax on their employees' wages using Form W-2, which provides a record of the employee's earnings and the amount of tax withheld.

Medicare Tax and the Self-Employed

Self-employed individuals face a different set of rules when it comes to Medicare tax. They are responsible for paying the full Medicare tax rate of 2.9% on their net earnings from self-employment, up to a certain income threshold. This is in addition to the standard income tax they pay on their business income.

To ensure they meet their Medicare tax obligations, self-employed individuals must make estimated tax payments throughout the year. Failure to do so can result in penalties and interest charges.

Medicare Tax and Social Security Tax: A Comparison

While Medicare tax and Social Security tax are both payroll taxes that fund critical social programs, they have some key differences. Social Security tax, also known as FICA (Federal Insurance Contributions Act) tax, is used to fund Social Security benefits, which provide income to retirees, disabled individuals, and survivors of deceased workers.

The Social Security tax rate is currently 6.2% for employees and employers, up to a wage base limit. In contrast, the Medicare tax rate is lower at 1.45% for employees and employers, with an additional 0.9% for higher-income earners. Both taxes are applied to all wages earned, but the wage base limits differ between the two taxes.

The Impact of Medicare Tax on Healthcare Coverage

Medicare tax plays a pivotal role in ensuring the availability and accessibility of healthcare services for eligible individuals. By contributing to Medicare tax, employees and employers are essentially pre-funding their future healthcare needs. This is especially crucial for individuals who may face high medical expenses in their retirement years.

Furthermore, Medicare tax contributes to the overall stability of the healthcare system, allowing for better planning and allocation of resources. This, in turn, can lead to improved healthcare outcomes and more efficient use of healthcare resources.

Conclusion

Medicare tax is a vital component of the United States healthcare system, funding the Medicare program that provides essential healthcare coverage to millions of Americans. Understanding the purpose, calculation, and impact of Medicare tax is essential for both employers and employees. By contributing to Medicare tax, individuals and businesses are actively supporting the healthcare safety net that protects them and their communities.

What happens if I don’t pay my Medicare tax as a self-employed individual?

+Failing to pay your Medicare tax as a self-employed individual can result in penalties and interest charges. It’s important to ensure you make estimated tax payments throughout the year to avoid any financial consequences.

Are there any exemptions or waivers for Medicare tax?

+Exemptions and waivers for Medicare tax are rare and typically apply to very specific situations. It’s best to consult with a tax professional to understand your eligibility for any potential exemptions.

How often do employers need to remit Medicare tax to the IRS?

+The frequency of Medicare tax payments to the IRS depends on the employer’s overall tax liability. Employers with a higher tax liability may need to remit payments more frequently, such as on a monthly or semi-weekly basis. Those with lower liabilities may be able to remit payments quarterly.