Maximize Your Refund: Essential Strategies for Iowa Taxes in 2024

When talking about Iowa taxes in 2024, most folks probably picture a tangle of forms, brackets, and perhaps a faint hint of dread—just enough to overshadow the potential benefits of strategic planning. But peel back those layers, and what emerges is a landscape of opportunities, choices, and nuances that can truly maximize your refund. Iowa, with its unique tax structure, offers a blend of state-specific credits, deductions, and planning avenues that, if navigated wisely, can result in a sizeable payout at the close of the fiscal year. This isn’t just about filling out forms; it’s about understanding the interplay of variables—income brackets, credits for education, investment incentives—that come into play in 2024. It's about leveraging what’s available, knowing where loopholes or benefits lie, and perhaps most critically, integrating tax strategies with your broader financial plans. Navigating Iowa’s tax system requires not only familiarity with current codes but an adaptive approach that responds to legislative changes and shifts in personal circumstances. Let’s explore the essentials for how you can optimize your 2024 Iowa tax return—covering everything from deductions and credits to strategic income management—because knowing the terrain can turn a hefty tax bill into a handsome refund, or at least a more favorable outcome.

Iowa Tax System in 2024: An Overview of Structure and Changes

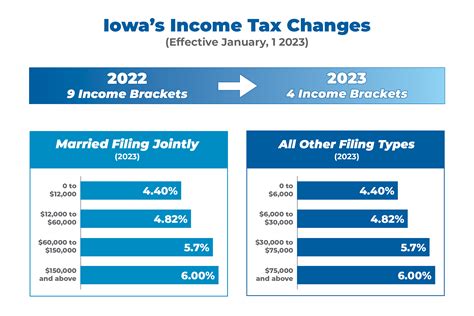

The Iowa tax landscape in 2024 retains much of its traditional structure but introduces subtle shifts aimed at easing burdens on middle-income filers while incentivizing specific economic behaviors. Personal income tax rates, which have historically been progressive, now see slight modifications—brackets are adjusted for inflation, and the phase-out thresholds for certain credits are recalibrated. An important feature to keep in mind is Iowa’s reliance on a graduated tax rate system, ranging from 0.33% for the lowest income bracket to a top marginal rate of 6.0% for earners above a specified threshold, which for 2024 begins at 74,530 for individual filers and 149,060 for joint filers. These rates are critical, but what’s nuanced is how behavioral incentives—like renewable energy credits, education deductions, or small business incentives—alter the calculus for many taxpayers. Efforts to improve tax compliance and reduce loopholes have led the Iowa Department of Revenue to enhance their online filing system, making proactive tax planning more accessible. For residents, understanding these shifts isn’t just about compliance; it’s strategic. The interplay of federal changes, such as adjustments to standard deductions or modifications in investment income reporting, also impacts Iowa’s tax liability, requiring a comprehensive approach to planning.

Legislative Updates and Their Impact on 2024 Returns

This year’s legislative session in Iowa saw noteworthy updates that shouldn’t be overlooked when preparing your taxes. Notably, the state increased the income thresholds for several tax credits—particularly the earned income tax credit (EITC)—aimed at reducing tax burdens for lower-income households. The Iowa EITC, which mirrors federal provisions but is tiered to complement federal credits, for 2024 increases its maximum benefit by approximately 10%, with the threshold for qualifying income rising accordingly. Additionally, Iowa expanded its solar and renewable energy incentives, allowing homeowners and small businesses to claim larger credits for investments in solar panels, wind turbines, and energy conservation measures. The legislation also enhanced the tax-credit caps for historically underserved communities, promoting economic development in rural and distressed urban areas. These shifts mean that both new and seasoned filers can find untapped benefits if they align their investments and expenses accordingly. Without integrating these legislative changes into your strategy, a missed opportunity for refund increases or liability reduction remains inevitable.

| Relevant Category | Substantive Data |

|---|---|

| Tax Brackets | 0.33%–6.0%, adjusted for inflation; thresholds at $74,530 (single) and $149,060 (joint) |

| Education Credits | Increased maximum state deduction up to $2,644 per student |

| Renewable Energy Incentives | Credits up to 30% of installation costs for solar/wind projects |

| Earned Income Credit (EITC) | Maximum benefit increased by ~10% |

Top Strategies to Maximize Your Iowa Refund in 2024

Now, what are the real bread-and-butter moves, the actionable tactics that can turn knowledge into cash? First, itemize everything possible—think beyond just medical expenses and mortgage interest; consider charitable contributions, unreimbursed business expenses, and even certain legal fees if they qualify under specific IRS provisions, which may influence Iowa’s own deductions. Second, leverage Iowa-specific credits—like the earned income tax credit, the child and dependent care credit, or the new renewable energy credits, depending on your circumstances. Third, consider income timing: deferring income to next year if it keeps you in a lower bracket or accelerating deductible expenses now can prove advantageous. Fourth, examine educational expenses—tuition and related costs—especially if there are state-level deductions or credits that might not be well-known. Fifth, and perhaps often overlooked, is a review of your withholding and estimated payments—ensuring you’re not leaving money on the table throughout the year, which is a common pitfall for many taxpayers eager to avoid future surprises. Finally, consult with a tax professional, especially if you have complex income streams, investments, or business interests—while the IRS and state agencies set the rules, expert navigation often results in the largest refunds or the lowest liabilities.

Incorporating Investment and Retirement Planning

Investment income remains a standout component of tax planning. Iowa conforms broadly to federal policies, but nuances—such as the state’s treatment of capital gains or dividends—can influence overall liability. Real estate investments, stock portfolios, and retirement account withdrawals necessitate careful projection and timing. For example, Roth conversions or strategic sales of highly appreciated assets within the tax year can either help or hurt your refund depending on your overall income profile and the progressive brackets. Additionally, retirement contributions—such as IRA or 401(k)—not only reduce taxable income federally but also impact state liabilities, especially if Iowa offers additional incentives for low-income savers or early retirees. It’s a delicate dance—one that requires data-driven models combined with current legislative context—making professional guidance invaluable for optimizing these strategies.”

| Relevant Category | Substantive Data |

|---|---|

| Investment Income | Capital gains taxed federally; Iowa follows federal but offers specific exemptions for certain small investments |

| Retirement Contributions | IRA contributions deductible federally; Iowa provides up to an additional $1,000 for low-income filers |

| Real Estate | Potential deductions for property taxes, mortgage interest, and energy improvements—align with state incentives |

Common Pitfalls and How to Avoid Them

Taxpayers often stumble on overlooked details—like missing deductible expenses, ignoring available credits, or miscalculating income timing. Failing to update withholding based on anticipated bonuses or new income sources can lead to either a hefty bill or suppressed refund. Another trap is not staying current with legislative updates—what was tax-advantageous last year may be phased out or replaced in 2024. Not maintaining detailed records for deductions and credits often costs valuable refunds, especially if audits occur. Moreover, neglecting to incorporate federal changes—like the increased standard deductions or revisions in education credits—can skew your Iowa tax calculations. To navigate these pitfalls, a proactive review of last year’s return, combined with a comprehensive planning session in early 2024, can set the tone for strategic year-end moves.

The Role of Professional Guidance and Tools

While many do their own taxes, leveraging professional insights can unlock overlooked benefits. Tax software has advanced, integrating legislative updates and offering scenario modeling, but expert advice provides personalized nuance—especially in complex cases involving multiple states, business interests, or investments. Additionally, digital tools such as tax planning calculators or dedicated Iowa tax resource portals can help visualize your refund potential. By combining an understanding of legislative shifts, active planning, and quality tools, you position yourself to extract maximum refunds and minimize liabilities.

Key Points

- Leverage Legislative Changes: Stay current on Iowa's updated credits and incentives for 2024.

- Itemize Strategically: Maximize deductions for energy, education, and charitable giving.

- Income and Expense Timing: Shift income or expenses to optimize your tax bracket.

- Professional Consultation: Complex situations benefit from expert guidance.

- Tools and Resources: Use tax calculators and legislative portals for planning accuracy.

What are the key Iowa tax credits I should focus on in 2024?

+Major credits include the Iowa earned income tax credit—which has increased benefit thresholds—renewable energy incentives like solar and wind credits, and education-related deductions for tuition and related expenses. Staying updated on legislative changes can reveal additional opportunities like rural development incentives or specific industry credits.

How can I better plan for my Iowa taxes throughout the year?

+Maintain detailed records of your expenses and income, review potential credits periodically, and consult with a professional especially if your financial situation involves significant investments or business interests. Adjust your withholding or estimated payments mid-year to reflect expected deductions and credits effectively.

Are there specific strategies to reduce taxable income in Iowa?

+Yes, contribute to retirement accounts, defer income where possible, utilize energy upgrade credits, and maximize deductions for education and charitable contributions. Also, consider timing asset sales or income receipt to stay within lower tax brackets.