Summit Ohio Property Tax

Property taxes are a significant aspect of homeownership, and understanding them is crucial for any homeowner. In the state of Ohio, property taxes are an essential source of revenue for local governments and contribute to funding essential services like schools, roads, and emergency services. This article aims to provide an in-depth analysis of Summit County's property tax system, its workings, and its impact on homeowners. By exploring the factors influencing property tax rates, the assessment process, and the various exemptions and appeals available, homeowners can make informed decisions and potentially reduce their tax burden.

Unraveling the Complexity of Summit County’s Property Tax Landscape

Summit County, nestled in the heart of Ohio, boasts a diverse range of residential properties, from quaint suburban homes to sprawling estates. The property tax system in this region is a finely tuned mechanism that plays a pivotal role in shaping the county’s financial landscape and the lives of its residents.

Property taxes in Summit County are determined by a meticulous process that takes into account various factors, including the assessed value of the property, its location, and the prevailing tax rates set by local authorities. This system ensures that each homeowner contributes their fair share towards the county's operational costs and public services.

The complexity of Summit County's property tax system is a reflection of its commitment to fairness and accuracy. However, this complexity can often leave homeowners with a myriad of questions and concerns. From understanding the intricacies of the assessment process to exploring avenues for potential tax relief, there is much to uncover in the world of Summit County property taxes.

The Role of Property Assessments in Determining Tax Liability

At the core of the property tax system lies the assessment process, a critical step that determines the value of each property within the county. The Summit County Auditor’s Office, a dedicated governmental body, oversees this process, ensuring that assessments are conducted fairly and accurately.

The assessment process involves a thorough evaluation of each property, taking into account its physical characteristics, such as size, age, and condition, as well as its market value. This data is then used to calculate the assessed value, which forms the basis for determining the property tax liability.

It is important to note that assessments are not conducted annually but rather on a scheduled basis, typically every six years. This interval allows for a more stable and consistent tax burden for homeowners, providing a sense of financial predictability.

However, the assessment process is not without its complexities. Factors such as market fluctuations, changes in property conditions, or errors in assessment data can lead to discrepancies in tax liabilities. In such cases, homeowners have the right to appeal their assessments, a process that will be explored in detail further in this article.

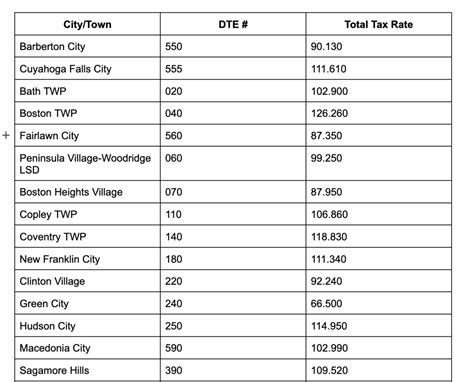

The Impact of Millage Rates and Tax Districts

Once the assessed value of a property is determined, the next step in calculating property taxes involves the application of millage rates. Millage rates, expressed in mills, represent the tax rate per dollar of assessed value. In Summit County, these rates are set by various tax districts, including local school districts, municipalities, and special districts.

Each tax district has its own unique millage rate, which is determined based on the budgetary needs of that particular district. This means that properties located within different tax districts may have varying tax liabilities, even if their assessed values are similar.

| Tax District | Millage Rate (Mills) |

|---|---|

| Akron City School District | 20.90 |

| Cuyahoga Falls City School District | 17.90 |

| Green Local School District | 19.40 |

| Cuyahoga Valley Joint Vocational School District | 3.60 |

The interplay between assessed values and millage rates is a critical factor in understanding the property tax landscape. It highlights the importance of not only the value of a property but also its location and the specific tax districts it falls within.

Exemptions and Relief Programs: A Glimpse of Tax Savings

In recognition of the diverse needs and circumstances of its residents, Summit County offers a range of exemptions and relief programs aimed at reducing the property tax burden for eligible homeowners.

One notable exemption is the Homestead Exemption, which provides a reduction in property taxes for homeowners who meet certain criteria, such as age, disability, or income level. This exemption aims to ensure that long-term residents are not priced out of their homes due to increasing property values and subsequent tax hikes.

Additionally, Summit County offers the Current Agricultural Use Value (CAUV) program, which allows eligible agricultural land to be taxed based on its agricultural value rather than its fair market value. This program recognizes the unique nature of agricultural land and provides much-needed relief for farmers and landowners.

For homeowners facing financial hardship, the Tax Abatement Program offers a reprieve by deferring a portion of their property taxes. This program is particularly beneficial for those who have recently experienced a significant change in income or are facing unforeseen financial challenges.

The Appeals Process: Ensuring Fairness and Accuracy

In the event that a homeowner believes their property assessment is inaccurate or unfair, the Summit County Board of Revision provides a platform for appeals. This independent body is tasked with reviewing assessment appeals and making adjustments as necessary to ensure fairness and accuracy in the property tax system.

The appeals process is a crucial safeguard for homeowners, allowing them to challenge assessments that may be based on outdated or incorrect information. It is important to note that appeals must be filed within a specified timeframe, typically within 30 days of receiving the tax bill or the date of the assessment notice.

During the appeals process, homeowners have the opportunity to present evidence, such as recent sales data or appraisals, to support their case. The Board of Revision carefully reviews each appeal, taking into account all relevant factors before making a final determination.

A Look Ahead: Future Trends and Considerations

As we navigate the ever-evolving landscape of property taxes, it is essential to consider the potential future trends and developments that may impact Summit County homeowners.

One notable trend is the increasing focus on sustainability and energy efficiency. As the county continues to embrace green initiatives, it is possible that future property tax policies may incorporate incentives or discounts for energy-efficient homes. This shift towards sustainable practices could not only benefit the environment but also provide financial savings for homeowners.

Additionally, the ongoing digital transformation of government services may further streamline the property tax process. Online platforms and mobile apps could make it easier for homeowners to access information, file appeals, and manage their property tax obligations, enhancing overall convenience and efficiency.

As Summit County continues to thrive and evolve, its property tax system will play a pivotal role in shaping the future of the region. By staying informed, engaging with local authorities, and taking advantage of available exemptions and appeals, homeowners can actively participate in this process, ensuring a fair and sustainable tax landscape for years to come.

How often are property assessments conducted in Summit County?

+Property assessments in Summit County are typically conducted every six years. This interval allows for a more stable and predictable tax burden for homeowners.

What is the process for appealing a property assessment in Summit County?

+Homeowners can appeal their property assessments by filing an appeal with the Summit County Board of Revision. The appeal must be supported by evidence, such as recent sales data or appraisals, and must be filed within a specified timeframe.

Are there any exemptions or relief programs available for property taxes in Summit County?

+Yes, Summit County offers various exemptions and relief programs, including the Homestead Exemption, the Current Agricultural Use Value (CAUV) program, and the Tax Abatement Program. These programs provide tax savings for eligible homeowners based on factors such as age, disability, income, or agricultural land use.