529 Tax Deduction

In the realm of financial planning, the topic of 529 plans and their tax benefits often arises, especially for those looking to secure their children's future education. These plans, officially known as Qualified Tuition Programs, are designed to encourage saving for higher education expenses and offer significant tax advantages. This article aims to delve into the specifics of 529 tax deductions, providing an in-depth analysis of their workings, eligibility criteria, and potential benefits.

Understanding 529 Tax Deductions

A 529 plan is a tax-advantaged savings plan designed to help families set aside funds for future qualified education expenses. The name “529” comes from the section of the Internal Revenue Code that authorizes these plans. These plans offer two distinct types of accounts: 529 prepaid tuition plans and 529 college savings plans, each with its own unique features and benefits.

Prepaid Tuition Plans

Prepaid tuition plans allow families to lock in current college tuition rates at participating colleges and universities. This means that regardless of future tuition increases, the beneficiary of the plan can attend these institutions at the pre-determined rate. This option is particularly beneficial for families who know which college they want their child to attend and can plan ahead. For instance, if a family invests in a prepaid tuition plan for a private college, they can save significantly on future tuition costs, which are often subject to annual increases.

| Plan Type | Benefits |

|---|---|

| Prepaid Tuition | Guaranteed tuition rates at participating institutions |

| College Savings | Flexible investment options and tax-free growth |

College Savings Plans

College savings plans, on the other hand, are more flexible. They allow families to invest in a variety of mutual funds, stocks, and bonds, offering a range of investment options to suit different risk tolerances. The earnings in these plans grow tax-free, and withdrawals for qualified higher education expenses are also tax-free. This means that not only can families save for future education costs, but they can also grow their savings without the burden of taxes.

One of the key advantages of 529 college savings plans is their adaptability. As the beneficiary grows, the investment strategy can be adjusted to align with their changing needs and the family's risk appetite. This dynamic approach ensures that the savings are not only protected but also have the potential to grow significantly over time.

Tax Benefits of 529 Plans

The tax benefits associated with 529 plans are a significant draw for many families. These plans offer both federal and state tax advantages, making them an attractive option for long-term education savings.

Federal Tax Advantages

At the federal level, 529 plans offer tax-free growth and tax-free withdrawals for qualified higher education expenses. This means that the earnings on investments within the plan are not subject to federal taxes, and when the funds are used for eligible education expenses, the withdrawals are also tax-free. This double tax advantage can result in substantial savings over time.

For example, if a family invests $10,000 in a 529 plan and the investment grows to $20,000 over 10 years, they would typically owe taxes on the $10,000 gain. However, with a 529 plan, this growth is tax-free, allowing the family to use the full $20,000 for education expenses without incurring additional tax liabilities.

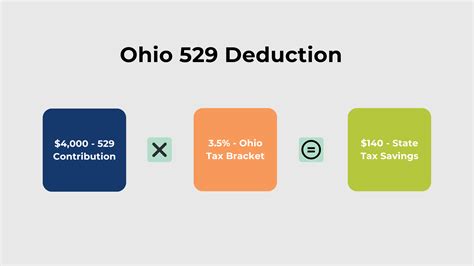

State Tax Advantages

In addition to federal tax benefits, many states also offer tax advantages for 529 plans. These advantages can vary widely, with some states providing tax deductions or tax credits for contributions made to 529 plans. For instance, in state X, contributions up to $10,000 per year are eligible for a state tax deduction, which can significantly reduce a family’s tax liability.

| State | Tax Benefit |

|---|---|

| State X | Up to $10,000 tax deduction on contributions |

| State Y | Tax credit of 20% on contributions up to $5,000 |

| State Z | Tax-free withdrawals for in-state college expenses |

Eligibility and Contribution Limits

Understanding the eligibility criteria and contribution limits for 529 plans is crucial for families planning their education savings strategy.

Who Can Open a 529 Plan

Any U.S. citizen or resident alien with a valid Social Security number can open a 529 plan. This means that not only parents but also grandparents, aunts, uncles, and even friends can start a 529 plan for a child’s future education. The beneficiary of the plan, typically a child or a young adult, must have a valid Social Security number as well.

Contribution Limits

The contribution limits for 529 plans vary depending on the state and the type of plan. For college savings plans, the limit is often set by the program and can range from 200,000 to 500,000 or more per beneficiary. However, some states allow for contributions beyond these limits through special arrangements or by pooling contributions from multiple family members.

Prepaid tuition plans, on the other hand, often have contribution limits tied to the cost of tuition and fees at participating institutions. These limits can vary significantly based on the institution and the plan's design. It's important for families to understand these limits to ensure they can meet their future education goals within the plan's framework.

Using 529 Plan Funds

529 plan funds can be used for a wide range of qualified higher education expenses, providing flexibility for families. These expenses include tuition and fees, room and board, books and supplies, computers, and even certain student loan repayments. The plan’s flexibility extends to covering expenses at a variety of eligible institutions, including colleges, universities, and even certain vocational schools.

Qualified Higher Education Expenses

Qualified higher education expenses under a 529 plan include:

- Tuition and fees

- Room and board (up to the institution’s cost of attendance)

- Books, supplies, and equipment required for enrollment

- Computers and related technology

- Certain student loan repayments

It's important to note that the funds can be used for eligible expenses at any accredited college, university, or vocational school in the United States, as well as some foreign institutions. This broad scope allows families to choose the best educational path for their child, whether it's a traditional four-year college or a specialized training program.

Conclusion: Maximizing 529 Plan Benefits

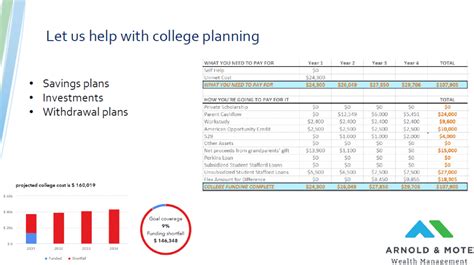

529 plans offer a powerful combination of tax advantages and flexibility, making them an attractive option for families looking to save for their children’s future education. By understanding the different types of plans, their tax benefits, and the associated eligibility criteria, families can make informed decisions to maximize their savings and minimize their tax liabilities.

Whether it's through a prepaid tuition plan that guarantees future tuition rates or a college savings plan that offers flexible investment options, 529 plans provide a secure and tax-efficient way to plan for the high cost of higher education. With careful planning and an understanding of the available options, families can take control of their financial future and ensure their children have the resources they need for a quality education.

Frequently Asked Questions

Can I use 529 plan funds for K-12 education expenses?

+No, 529 plan funds are primarily intended for higher education expenses. However, some states allow for limited use of 529 funds for K-12 expenses, typically for special needs or specific programs. It’s best to check with your state’s plan for specific guidelines.

Are there any penalties for withdrawing funds from a 529 plan for non-qualified expenses?

+Yes, if you withdraw funds for non-qualified expenses, you’ll incur a 10% penalty on the earnings portion of the withdrawal, and the earnings will be subject to federal income tax. Additionally, some states may impose their own penalties or revoke any state tax benefits associated with the plan.

Can I transfer funds between different 529 plans or change the beneficiary?

+Yes, you can transfer funds between 529 plans without any tax consequences, as long as the new plan is also a qualified 529 plan. You can also change the beneficiary to another member of the original beneficiary’s family without any tax implications.