Greenville County Taxes

Understanding Greenville County's tax landscape is essential for residents and businesses alike. In this comprehensive guide, we delve into the specifics of Greenville County taxes, providing an in-depth analysis of tax rates, exemptions, and the overall tax structure. By exploring the various aspects of the county's tax system, we aim to offer a valuable resource for those seeking clarity and insight into their financial obligations.

Greenville County’s Tax Overview

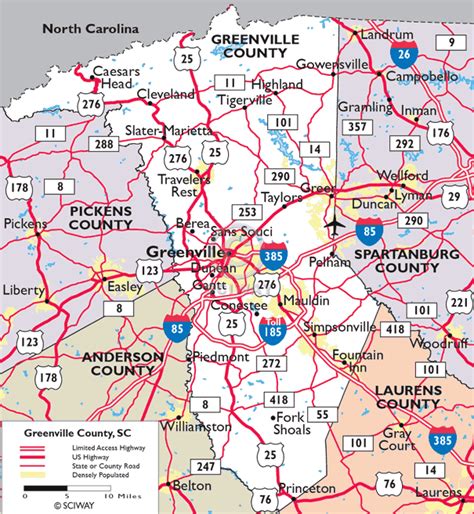

Greenville County, located in the beautiful state of South Carolina, boasts a vibrant economy and a thriving community. With its diverse businesses and residential areas, the county’s tax system plays a crucial role in funding essential services and infrastructure development. Let’s explore the key components of Greenville County’s tax structure.

Property Taxes: A Foundation of County Revenue

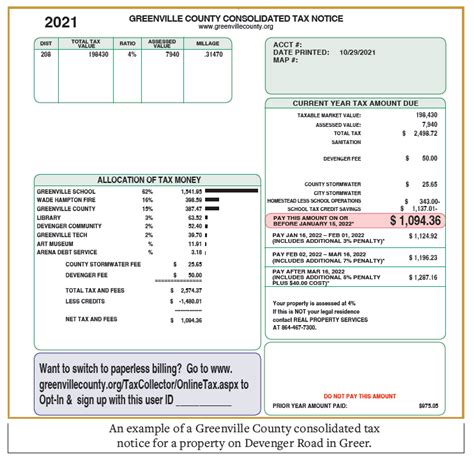

Property taxes form the backbone of Greenville County’s tax revenue. These taxes are levied on both real estate and personal property within the county. The tax rate is determined by the assessed value of the property, which is established by the Greenville County Assessor’s Office.

The county utilizes a uniform tax rate, ensuring fairness and consistency across different property types and locations. As of the latest assessment, the tax rate stands at 0.007785 per 100 of assessed value</strong>, which is applied to both residential and commercial properties.</p> <p>For instance, a homeowner with a property assessed at 250,000 would calculate their annual property tax liability as follows: 250,000 x 0.007785 = 1,946.25. This calculation provides a straightforward understanding of the tax obligation for property owners.

Tax Exemptions: Reducing the Burden

Recognizing the diverse needs of its residents, Greenville County offers a range of tax exemptions to alleviate the financial burden on certain property owners. These exemptions aim to provide relief to specific groups and promote community well-being.

- Homestead Exemption: This exemption benefits homeowners who use their property as their primary residence. By qualifying for the homestead exemption, residents can reduce their taxable property value by a set amount, resulting in lower property taxes. To qualify, homeowners must meet certain residency and income criteria.

- Senior Citizen Exemption: Greenville County extends a helping hand to its senior citizens by offering an exemption for those aged 65 and above. This exemption allows eligible seniors to reduce their property taxes, providing much-needed financial relief during their retirement years. The exemption amount varies based on income and property value.

- Veterans Exemption: As a way of honoring its veterans, the county provides tax exemptions for qualifying military veterans. This exemption aims to recognize the sacrifices made by those who have served their country. The amount of the exemption depends on the veteran's disability status and length of service.

To apply for these exemptions, residents can visit the Greenville County Assessor's Office or access the online application portal. The process involves submitting the required documentation, such as proof of residency, income statements, and veteran status verification.

Sales and Use Taxes: Supporting Local Businesses

Greenville County also imposes sales and use taxes to generate revenue and support local businesses. These taxes are applied to various transactions, including retail sales, rentals, and certain services.

The sales tax rate in Greenville County is currently set at 6%, which is applied to the purchase price of tangible goods and certain services. This rate is comprised of a state-level sales tax and a local tax imposed by the county. For instance, a customer purchasing a 100 item would pay an additional 6 in sales tax.

In addition to sales tax, Greenville County also levies a 1% local option sales tax to fund specific projects and initiatives. This tax is applied to the same transactions as the general sales tax, providing an additional revenue stream for the county.

Furthermore, the county imposes a use tax on goods and services purchased outside the county but used or consumed within Greenville County. This tax ensures fairness and prevents tax evasion by holding consumers accountable for their purchases, regardless of where they were made.

Business Taxes: Encouraging Economic Growth

Greenville County understands the importance of a thriving business community and has implemented tax policies to support and encourage economic growth. Businesses operating within the county are subject to various taxes, including:

- Income Tax: Greenville County levies an income tax on businesses, with rates varying based on the type of business and its income level. This tax contributes to the county's overall revenue and helps fund essential services.

- Property Taxes for Businesses: Similar to residential properties, businesses are subject to property taxes based on the assessed value of their commercial real estate. The tax rate is the same as for residential properties, ensuring fairness across property types.

- Business License Tax: To operate within Greenville County, businesses are required to obtain a business license and pay the associated tax. The tax amount varies based on the type of business and its gross receipts. This license ensures compliance with local regulations and contributes to the county's revenue.

Businesses can obtain more information about their tax obligations and apply for the necessary licenses through the Greenville County Business Services Office. The office provides resources and guidance to ensure businesses understand their tax responsibilities and can navigate the licensing process smoothly.

Tax Incentives: Attracting Investments

To attract new businesses and encourage economic development, Greenville County offers a range of tax incentives. These incentives aim to make the county an attractive destination for investors and entrepreneurs.

- Job Tax Credits: The county provides tax credits to businesses that create new jobs within the community. These credits offset the income tax obligations of the business, making it more financially viable to hire additional employees. The amount of the credit depends on the number of jobs created and the average wage of the new positions.

- Property Tax Abatements: In certain designated areas, Greenville County offers property tax abatements to businesses that invest in real estate development. This incentive reduces the property tax burden for a specified period, encouraging businesses to invest in the county's growth and development.

- Research and Development Tax Credits: To promote innovation and technological advancement, the county offers tax credits to businesses engaged in research and development activities. These credits provide a financial incentive for companies to invest in cutting-edge research, fostering a culture of innovation within the county.

Businesses interested in exploring these tax incentives can reach out to the Greenville County Economic Development Office. The office provides detailed information about the eligibility criteria, application process, and potential benefits of each incentive program.

Tax Appeals and Disputes: Ensuring Fairness

Greenville County recognizes that tax assessments and obligations may sometimes be disputed. To address such situations, the county has established a comprehensive appeals process to ensure fairness and accuracy.

If a taxpayer believes their tax assessment is incorrect or unfair, they can initiate the appeals process. This process involves submitting a formal appeal to the Greenville County Tax Appeals Board, which reviews the case and makes a determination based on the evidence presented.

The Tax Appeals Board considers various factors, including the accuracy of the assessment, the property’s actual value, and any relevant exemptions or deductions. If the appeal is successful, the taxpayer’s tax liability may be adjusted accordingly.

Online Tax Services: Convenience and Efficiency

Greenville County understands the importance of technology and convenience in today’s world. To enhance the taxpayer experience, the county offers a range of online tax services, making it easier and more efficient for residents and businesses to manage their tax obligations.

- Online Tax Payment: Taxpayers can pay their property taxes, business taxes, and other tax obligations online through the county's secure payment portal. This service allows for quick and convenient payments, eliminating the need for in-person visits or mailing checks.

- e-Filing for Business Taxes: Businesses can file their tax returns electronically, streamlining the process and reducing paperwork. The e-filing system ensures accurate and timely submission of tax information, providing businesses with a more efficient way to meet their tax obligations.

- Tax Record Access: Residents and businesses can access their tax records and account information online. This feature provides transparency and allows taxpayers to review their tax history, view current obligations, and download important documents, such as tax bills and receipts.

The online tax services offered by Greenville County aim to improve efficiency, reduce wait times, and provide taxpayers with greater flexibility in managing their financial obligations.

Future Outlook and Tax Initiatives

As Greenville County continues to grow and evolve, its tax landscape is also subject to change and development. The county’s leadership is committed to maintaining a balanced and sustainable tax system that supports the community’s needs while promoting economic growth.

Looking ahead, Greenville County plans to explore additional tax initiatives to further enhance its financial stability and support its residents. Some potential areas of focus include:

- Property Tax Reform: The county may consider reforms to the property tax system, such as implementing a more progressive tax structure or exploring alternative assessment methods. These reforms aim to ensure fairness and alleviate the tax burden on certain segments of the population.

- Revenue Diversification: Greenville County aims to diversify its revenue streams to reduce reliance on any single source of income. This may involve exploring new tax options, such as a tourism tax or a surcharge on certain luxury goods, to generate additional revenue without placing an excessive burden on residents.

- Tax Incentives for Renewable Energy: With a focus on sustainability and environmental stewardship, the county may introduce tax incentives for businesses and individuals who invest in renewable energy sources. These incentives could promote the adoption of clean energy technologies and contribute to a greener future.

As these initiatives develop, Greenville County will engage with its residents and stakeholders to gather feedback and ensure that any changes align with the community's best interests.

Conclusion

Greenville County’s tax system is designed to support the community’s growth and well-being while funding essential services and infrastructure. By understanding the various tax obligations and exemptions, residents and businesses can navigate the tax landscape with confidence. The county’s commitment to fairness, transparency, and economic development ensures that Greenville County remains a desirable place to live, work, and invest.

How can I estimate my property taxes in Greenville County?

+

To estimate your property taxes, you can use the Greenville County Assessor’s online property tax estimator tool. This tool allows you to input your property’s assessed value and provides an estimated tax liability based on the current tax rate. It’s a convenient way to get an approximate idea of your property tax obligations.

Are there any upcoming changes to Greenville County’s tax rates or exemptions?

+

As of my last update, there are no announced changes to Greenville County’s tax rates or exemptions. However, it’s always a good idea to stay informed and keep an eye on local news and official announcements, as tax policies may evolve over time. The county’s website often provides updates on any proposed changes or new initiatives.

How can I apply for a tax exemption in Greenville County?

+

To apply for a tax exemption, you can visit the Greenville County Assessor’s Office or access their online application portal. The process typically involves submitting an application form along with the required supporting documentation, such as proof of eligibility for the specific exemption you’re seeking. It’s important to carefully review the criteria and requirements for each exemption before applying.

What are the penalties for late tax payments in Greenville County?

+

Late tax payments in Greenville County may incur penalties and interest charges. The exact penalties vary depending on the type of tax and the duration of the delay. It’s important to make timely payments to avoid additional financial burdens. The county’s website provides detailed information on penalty structures and payment deadlines for different tax types.

How can I stay updated on Greenville County’s tax initiatives and policies?

+

To stay informed about Greenville County’s tax initiatives and policies, you can regularly visit the county’s official website, which often provides updates and announcements related to tax matters. Additionally, you can subscribe to the county’s newsletters or follow their social media channels for timely notifications. Staying engaged with local news and community forums can also help you stay abreast of any relevant tax developments.