Seminole County Taxes

In Seminole County, Florida, taxes play a significant role in shaping the local economy and community development. From property taxes to sales taxes and various other assessments, the tax system influences the lives of residents and businesses alike. Understanding the intricacies of Seminole County taxes is essential for making informed financial decisions and navigating the local tax landscape effectively.

The Seminole County Tax Structure: An Overview

Seminole County, nestled in the heart of Central Florida, boasts a diverse tax structure designed to fund essential public services, infrastructure development, and community initiatives. This comprehensive tax system is a critical component of the county’s fiscal policy, impacting both residents and businesses.

The tax landscape in Seminole County is primarily comprised of three key categories: property taxes, sales taxes, and special assessments. Each of these categories serves a unique purpose in supporting the county's operations and growth.

Property Taxes: The Backbone of Seminole County’s Revenue

Property taxes form the foundation of Seminole County’s revenue stream. These taxes are levied on real estate properties, including residential homes, commercial buildings, and vacant land. The tax rate is determined by the Seminole County Property Appraiser’s Office, which assesses the value of each property annually. The assessed value is then multiplied by the tax rate to calculate the property owner’s tax liability.

For instance, consider a residential property in Seminole County with an assessed value of $250,000. If the tax rate is set at 1.5%, the annual property tax bill would amount to $3,750. This calculation provides a clear illustration of how property taxes contribute to the county's revenue base.

To ensure fairness and accuracy, the Seminole County Property Appraiser's Office employs a team of skilled professionals who regularly inspect and evaluate properties. This process helps maintain a transparent and equitable tax system, benefiting both the county and its taxpayers.

| Property Type | Average Assessed Value | Tax Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential | $250,000 | 1.5% | $3,750 |

| Commercial | $500,000 | 1.75% | $8,750 |

| Vacant Land | $100,000 | 1.25% | $1,250 |

Sales Taxes: A Major Source of Revenue for Seminole County

In addition to property taxes, Seminole County collects sales taxes on various goods and services purchased within its borders. These taxes are imposed on both residents and visitors, contributing to the county’s overall revenue stream.

The current sales tax rate in Seminole County is 6.5%, which includes the state sales tax of 6% and a local option tax of 0.5%. This rate is applicable to most tangible personal property and certain services, such as restaurant meals and amusement park admissions.

For instance, if you purchase a new laptop in Seminole County for $1,000, you would be responsible for paying a sales tax of $65. This tax is typically included in the final purchase price, making it a transparent and straightforward process for consumers.

Sales taxes are a vital source of revenue for Seminole County, funding critical services such as public safety, education, and infrastructure maintenance. By collecting these taxes, the county can ensure the continuous improvement and development of its community.

Special Assessments: Funding Specific Projects and Services

Seminole County utilizes special assessments to fund specific projects and services that benefit the community. These assessments are typically levied on a per-property basis and are designed to cover the costs of infrastructure improvements, maintenance, and other designated purposes.

For example, a special assessment might be imposed on properties within a certain neighborhood to fund the construction of a new park or the improvement of local roads. These assessments are often implemented to enhance the quality of life for residents and promote economic growth in targeted areas.

The rates and purposes of special assessments vary depending on the project and the impacted properties. Property owners are typically notified in advance about the assessment, its purpose, and the estimated cost. This transparency ensures that residents understand the reasons behind the additional charges and can plan their finances accordingly.

| Special Assessment Type | Purpose | Estimated Cost per Property |

|---|---|---|

| Road Improvement | Resurfacing and widening of local roads | $200 annually for 5 years |

| Community Center | Construction of a new community center | $500 one-time assessment |

| Environmental Conservation | Funding for wetland restoration projects | $150 annually for 3 years |

Tax Incentives and Exemptions: Supporting Residents and Businesses

Seminole County recognizes the importance of providing tax incentives and exemptions to support its residents and businesses. These measures aim to promote economic growth, encourage homeownership, and foster a thriving business environment.

Property Tax Exemptions: Saving for Homeowners

The county offers a range of property tax exemptions to eligible homeowners, helping them reduce their tax burden and make homeownership more affordable. These exemptions include:

- Homestead Exemption: Seminole County residents who own and occupy their primary residence can qualify for a homestead exemption. This exemption reduces the assessed value of their property for tax purposes, resulting in lower property taxes.

- Senior Citizen Exemption: Property owners who are 65 years or older may be eligible for an additional exemption on their property taxes. This exemption is designed to provide financial relief to seniors, ensuring they can continue to afford their homes as they age.

- Military Exemption: Active-duty military personnel and veterans can receive exemptions on their property taxes as a way of recognizing their service and supporting their financial well-being.

By offering these exemptions, Seminole County demonstrates its commitment to supporting its residents and making homeownership an achievable goal for all.

Business Tax Incentives: Attracting and Retaining Businesses

To foster economic growth and attract new businesses, Seminole County provides a range of tax incentives and programs. These initiatives aim to create a competitive and attractive business environment, encouraging investment and job creation.

One notable program is the Seminole County Enterprise Zone, which offers tax incentives to businesses that locate or expand within designated enterprise zones. These incentives can include reduced sales taxes, property tax abatements, and other financial benefits.

Additionally, Seminole County actively promotes and supports the growth of small businesses through various initiatives. This includes offering resources and guidance on tax obligations, providing access to financing options, and hosting networking events to connect local businesses.

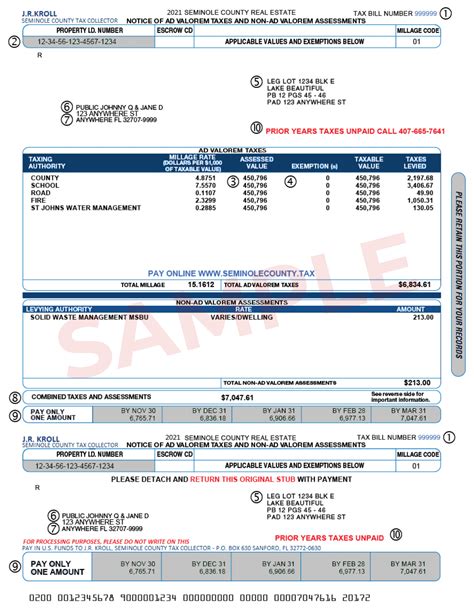

Tax Collection and Payment: A Convenient and Transparent Process

Seminole County has implemented a user-friendly and transparent system for tax collection and payment, ensuring that taxpayers can fulfill their obligations with ease and efficiency.

Online Tax Payment: Convenience at Your Fingertips

Taxpayers in Seminole County have the option to pay their taxes conveniently through the county’s official website. The online tax payment portal offers a secure and efficient way to settle property taxes, sales taxes, and special assessments.

The portal provides a clear breakdown of the taxpayer's obligations, including the amount due, payment due dates, and any applicable penalties or interest. This transparency empowers taxpayers to manage their finances effectively and avoid late payments.

To further enhance convenience, the online payment system accepts various payment methods, including credit cards, debit cards, and electronic checks. This flexibility ensures that taxpayers can choose the method that best suits their preferences and financial situation.

Tax Payment Options: Catering to Different Needs

In addition to online payments, Seminole County offers alternative payment options to accommodate the diverse needs of its taxpayers.

- Mail-In Payments: Taxpayers can mail their tax payments to the designated address provided by the Seminole County Tax Collector's Office. This option is ideal for those who prefer traditional methods or who wish to include additional documentation with their payment.

- In-Person Payments: The Seminole County Tax Collector's Office maintains multiple physical locations where taxpayers can visit and make their payments in person. This option is particularly beneficial for those who prefer face-to-face interactions or who require immediate assistance with their tax inquiries.

- Automatic Payment Plans: Seminole County understands that some taxpayers may require a more flexible approach to tax payments. To accommodate this need, the county offers automatic payment plans, allowing taxpayers to set up recurring payments through their bank accounts. This option ensures timely payments without the hassle of manual transactions.

By providing a range of payment options, Seminole County ensures that taxpayers can choose the method that aligns with their preferences and financial circumstances, making the tax payment process as seamless as possible.

The Future of Seminole County Taxes: A Vision for Growth and Development

As Seminole County continues to thrive and evolve, the tax system will play a pivotal role in shaping its future. The county’s leadership and tax authorities are committed to fostering a sustainable and prosperous community, and the tax structure is a key instrument in achieving this vision.

Investing in Infrastructure: Enhancing Quality of Life

A significant portion of Seminole County’s tax revenue is dedicated to infrastructure development and maintenance. This includes investments in roads, bridges, public transportation, and other critical infrastructure projects.

By allocating resources to these initiatives, the county aims to enhance the quality of life for its residents and create a more attractive environment for businesses and visitors. Improved infrastructure not only facilitates smoother daily commutes but also contributes to economic growth and development.

For instance, the county's investment in widening and improving major roads not only reduces traffic congestion but also enhances safety and accessibility for all road users. These infrastructure projects are a tangible example of how tax revenue is directly benefiting the community.

Supporting Education and Community Initiatives

Seminole County recognizes the importance of investing in education and community programs to foster a well-rounded and thriving society. A portion of the tax revenue is allocated to support local schools, libraries, and community centers.

These investments ensure that residents have access to quality educational opportunities, cultural enrichment, and recreational facilities. By supporting these initiatives, the county contributes to the overall well-being and development of its citizens, creating a vibrant and engaged community.

For instance, the county's investment in after-school programs provides a safe and enriching environment for children, fostering their growth and development beyond the classroom. These community initiatives are a testament to Seminole County's commitment to its residents' holistic development.

Tax Policy Reforms: Adapting to Changing Needs

Seminole County’s tax authorities are committed to staying responsive to the evolving needs of its residents and businesses. As such, they continuously evaluate and reform tax policies to ensure fairness, transparency, and efficiency.

One key aspect of these reforms is ensuring that tax rates remain competitive and do not hinder economic growth. The county regularly conducts economic impact assessments to gauge the effects of tax policies on businesses and residents, making adjustments as necessary to promote a healthy and vibrant economy.

Additionally, Seminole County aims to simplify its tax system, making it easier for taxpayers to understand and comply with their obligations. This includes streamlining tax forms, providing clear and concise guidelines, and offering accessible support services to assist taxpayers with their inquiries.

Conclusion

Seminole County’s tax system is a vital component of its fiscal framework, supporting the county’s operations, development, and growth. From property taxes to sales taxes and special assessments, each element contributes to the overall well-being and prosperity of the community.

By offering tax incentives and exemptions, Seminole County demonstrates its commitment to supporting its residents and businesses. The county's investment in infrastructure, education, and community initiatives further underscores its dedication to creating a vibrant and thriving society.

As Seminole County continues to evolve, its tax system will remain a dynamic and responsive tool, adapting to the changing needs of its residents and businesses. Through ongoing reforms and community engagement, the county ensures that its tax policies remain fair, efficient, and aligned with the aspirations of its citizens.

How can I estimate my property taxes in Seminole County?

+You can estimate your property taxes by multiplying your property’s assessed value by the current tax rate. For example, if your property has an assessed value of 300,000 and the tax rate is 1.5%, your estimated annual property tax would be 4,500. However, it’s important to note that the tax rate may vary based on the type of property and any applicable exemptions or assessments.

Are there any tax relief programs for low-income homeowners in Seminole County?

+Yes, Seminole County offers tax relief programs for eligible low-income homeowners. These programs provide reductions in property taxes based on income and other qualifying factors. To learn more about these programs and determine your eligibility, you can visit the Seminole County Property Appraiser’s Office website or contact their office directly for assistance.

How often are property values assessed in Seminole County?

+Property values in Seminole County are assessed annually by the Property Appraiser’s Office. This annual assessment ensures that property values remain up-to-date and accurately reflect the current market conditions. The assessed value is then used to calculate property taxes for the upcoming year.

Can I pay my Seminole County taxes online?

+Yes, Seminole County offers convenient online tax payment options through its official website. You can pay your property taxes, sales taxes, and special assessments securely and efficiently online. The online payment portal provides a breakdown of your tax obligations and allows you to choose from various payment methods, including credit cards, debit cards, and electronic checks.