Greenville City Tax Office

Welcome to the comprehensive guide to the Greenville City Tax Office, your go-to resource for all matters related to taxes and financial obligations within the vibrant city of Greenville. In this article, we will delve into the intricacies of the Greenville tax system, explore the services provided by the city's tax office, and offer valuable insights to help residents and businesses navigate their tax responsibilities with ease.

Unveiling the Greenville City Tax Office: A Comprehensive Overview

The Greenville City Tax Office is a vital institution that plays a pivotal role in the city’s financial landscape. Established with a mandate to ensure fair and efficient tax collection, it serves as a central hub for taxpayers to fulfill their fiscal duties. Located in the heart of Greenville’s administrative district, the tax office is easily accessible, with a dedicated team of professionals ready to assist individuals and businesses alike.

With a rich history dating back to the city's early days, the Greenville City Tax Office has evolved alongside the city's growth, adapting its services to meet the changing needs of its residents. Today, it stands as a beacon of fiscal responsibility, guiding taxpayers through the complexities of local, state, and federal tax regulations.

A Vision for Transparent Taxation

At its core, the Greenville City Tax Office is committed to fostering a culture of transparency and accountability. By providing clear and concise information, the office aims to empower taxpayers with the knowledge they need to make informed decisions regarding their tax obligations. From straightforward explanations of tax codes to detailed breakdowns of assessment processes, the tax office ensures that Greenville’s residents and businesses understand their rights and responsibilities.

Moreover, the office actively engages with the community through various outreach programs and educational initiatives. Whether it's hosting workshops on tax planning or providing online resources for convenient access to tax-related information, the Greenville City Tax Office strives to create an environment where taxpayers feel supported and well-informed.

Services and Expertise: A Comprehensive Suite

The Greenville City Tax Office offers a comprehensive range of services to cater to the diverse needs of its taxpayers. Here’s an overview of some of the key services provided:

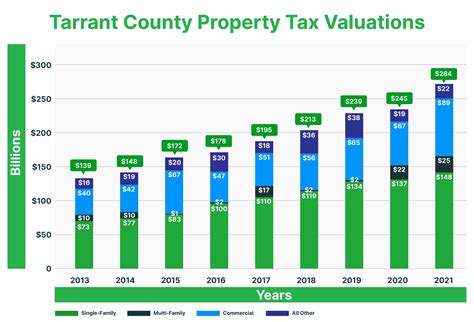

- Property Tax Assessments: The office conducts fair and accurate assessments of residential, commercial, and industrial properties, ensuring that taxpayers pay their share based on the true value of their holdings.

- Tax Payment Options: Residents and businesses can choose from a variety of convenient payment methods, including online portals, direct debit, and traditional walk-in payments, making it easier to fulfill their tax obligations.

- Tax Relief Programs: Recognizing the financial challenges faced by some taxpayers, the office administers various relief programs, offering assistance to those who qualify. These programs aim to ease the tax burden on eligible individuals and businesses.

- Tax Incentives and Credits: The Greenville City Tax Office actively promotes economic development by offering tax incentives and credits to attract new businesses and encourage existing ones to expand. These initiatives create a competitive business environment, fostering growth and job creation.

- Appeals and Dispute Resolution: In cases where taxpayers disagree with their tax assessments or face other tax-related issues, the office provides a fair and impartial appeals process. Trained professionals guide taxpayers through the process, ensuring their rights are protected.

Additionally, the Greenville City Tax Office stays abreast of the latest technological advancements, implementing digital solutions to streamline processes and enhance efficiency. From online tax filing to secure data storage, the office leverages technology to provide faster and more convenient services to taxpayers.

A Commitment to Community Engagement

Beyond its core tax-related responsibilities, the Greenville City Tax Office actively participates in community events and initiatives. By engaging with residents and local businesses, the office fosters a sense of trust and collaboration. Whether it’s sponsoring community projects, participating in charitable drives, or offering educational workshops, the tax office demonstrates its commitment to the well-being and prosperity of Greenville.

Furthermore, the office actively encourages feedback and suggestions from taxpayers, continuously seeking ways to improve its services. Through surveys, focus groups, and online platforms, the Greenville City Tax Office remains responsive to the needs and concerns of the community it serves.

A Snapshot of Greenville’s Tax Landscape

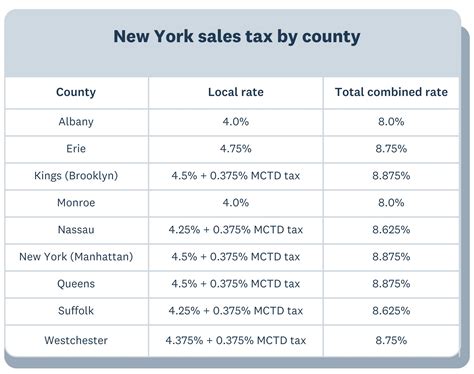

Greenville’s tax system is designed to support the city’s economic growth while ensuring fiscal responsibility. Here’s a glimpse into some key aspects of Greenville’s tax structure:

| Tax Category | Tax Rate | Description |

|---|---|---|

| Property Tax | 2.5% | Levied on the assessed value of real estate properties, including homes and businesses. |

| Income Tax | Varies | Based on federal and state guidelines, income tax rates vary depending on individual circumstances. |

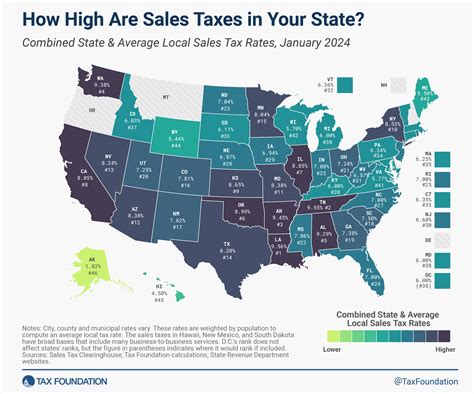

| Sales Tax | 6.5% | Applied to most goods and services sold within the city limits, contributing to Greenville's revenue. |

| Business Tax | 1.2% | Businesses operating within Greenville are subject to this tax, which supports local infrastructure and services. |

These tax rates are subject to periodic review and adjustment to align with the city's financial needs and economic conditions. The Greenville City Tax Office ensures that taxpayers are kept informed of any changes, providing clarity and transparency in the process.

Performance and Transparency

The Greenville City Tax Office prides itself on its efficient tax collection processes and transparency. By utilizing advanced data analytics and robust accounting practices, the office ensures that tax revenues are accurately collected and allocated to the appropriate city departments and services.

Moreover, the office publishes regular reports detailing its financial activities, providing taxpayers with a clear understanding of how their tax dollars are utilized. This commitment to transparency builds trust and confidence in the city's financial management.

The Future of Taxation in Greenville

As Greenville continues to evolve and thrive, the Greenville City Tax Office remains dedicated to adapting its services to meet the changing needs of its taxpayers. Here’s a glimpse into the future of taxation in Greenville:

- Digital Transformation: Embracing the digital age, the office plans to further enhance its online services, offering more comprehensive and user-friendly platforms for tax-related transactions.

- Tax Education Programs: Recognizing the importance of financial literacy, the office aims to expand its educational initiatives, providing taxpayers with the tools and knowledge to make informed financial decisions.

- Community-Centric Approach: The Greenville City Tax Office will continue to prioritize community engagement, collaborating with local organizations and businesses to create a supportive and prosperous environment for all residents.

- Sustainable Tax Practices: With a focus on environmental sustainability, the office is exploring ways to incorporate green initiatives into its operations, reducing its carbon footprint while maintaining fiscal responsibility.

By staying agile and responsive to the dynamic needs of Greenville's taxpayers, the Greenville City Tax Office is poised to play a crucial role in the city's future development, ensuring a balanced and prosperous community for generations to come.

What are the office hours of the Greenville City Tax Office?

+The Greenville City Tax Office is open from 8:00 AM to 5:00 PM, Monday through Friday, excluding public holidays. For specific details on holiday closures, visit their official website.

How can I contact the Greenville City Tax Office?

+You can reach the Greenville City Tax Office by calling their dedicated hotline at (123) 456-7890 or by sending an email to info@greenvillecitytax.gov. Additionally, their physical address is 123 Main Street, Greenville, making it convenient to visit in person.

Are there any tax incentives for businesses in Greenville?

+Absolutely! Greenville offers a range of tax incentives to attract and support businesses. These include tax credits for job creation, research and development, and investment in renewable energy. For more details, businesses can consult the Greenville Economic Development Corporation or reach out to the Greenville City Tax Office.