Bell County Tax Appraisal

Welcome to our comprehensive guide on the Bell County Tax Appraisal process. In this article, we aim to provide an in-depth analysis of how property values are assessed and appraised in Bell County, offering valuable insights for property owners, investors, and anyone interested in understanding the local real estate market dynamics. Our team of experts has delved into the intricacies of Bell County's appraisal system, uncovering the key factors that influence property valuations and exploring the steps involved in the appraisal process. By the end of this article, you'll have a clear understanding of how property taxes are determined in Bell County and the role played by the Bell County Appraisal District (BCAD) in maintaining a fair and transparent system.

Understanding the Bell County Tax Appraisal Process

The Bell County Tax Appraisal process is a vital component of the local real estate ecosystem, impacting property owners and the overall economic landscape. This process is overseen by the Bell County Appraisal District (BCAD), an independent governmental body responsible for assessing the market value of properties within the county. BCAD’s primary role is to ensure that all taxable properties are accurately appraised, allowing for the fair distribution of property taxes.

Each year, BCAD engages in a comprehensive appraisal process, involving the following key steps:

- Data Collection and Analysis: BCAD collects and analyzes a vast amount of data, including recent sales transactions, building permits, and property characteristics. This data forms the foundation for determining the market value of properties.

- Field Appraisals: BCAD appraisers conduct on-site inspections of properties to verify the accuracy of the data collected. They assess factors such as property size, improvements, and overall condition.

- Market Value Estimation: Using sophisticated valuation models and industry standards, BCAD estimates the market value of each property based on the collected data and appraisals.

- Notices of Appraised Value: Property owners receive a Notice of Appraised Value, which details the estimated market value of their property. This notice serves as the basis for calculating property taxes.

- Protest and Appeal: If property owners disagree with the appraised value, they have the right to protest and appeal the decision. BCAD provides a formal process for property owners to present their case and request a review.

- Final Appraisal Roll: After considering all protests and appeals, BCAD finalizes the appraisal roll, which is the official record of appraised property values for the upcoming tax year.

Factors Influencing Property Values in Bell County

Several key factors influence the market value of properties in Bell County. Understanding these factors is crucial for property owners and investors alike, as it provides insights into the local real estate market and helps predict potential property value fluctuations.

- Location and Neighborhood: The location of a property within Bell County plays a significant role in its value. Neighborhoods with desirable amenities, such as excellent schools, access to transportation, and proximity to employment centers, often command higher property values.

- Property Characteristics: The physical attributes of a property, including its size, age, condition, and any unique features, are carefully considered during the appraisal process. Upgrades, such as renovated kitchens or added square footage, can positively impact a property's value.

- Market Conditions: The overall health of the real estate market in Bell County is a critical factor. Economic trends, interest rates, and supply and demand dynamics can influence property values. In a strong market, property values tend to appreciate, while economic downturns may lead to declines.

- Recent Sales Data: BCAD heavily relies on recent sales transactions to estimate property values. Properties that have sold recently provide a benchmark for the market value of similar properties in the area.

- Property Use and Zoning: The intended use of a property, whether residential, commercial, or industrial, can significantly impact its value. Zoning regulations and restrictions also play a role, as they determine the potential development and usage of the property.

The Role of the Bell County Appraisal District (BCAD)

The Bell County Appraisal District (BCAD) is an essential entity in the local real estate landscape, responsible for ensuring the equitable assessment and appraisal of all taxable properties within the county. Established under the Texas Property Tax Code, BCAD operates as an independent governmental body, providing a fair and transparent appraisal process for property owners.

BCAD’s Responsibilities and Functions

BCAD’s primary responsibility is to determine the market value of properties, serving as the foundation for property tax calculations. The district accomplishes this through a meticulous appraisal process, which involves data collection, field inspections, and the application of industry-standard valuation techniques.

Beyond appraising properties, BCAD also maintains accurate property records, ensuring that all taxable properties are accounted for and correctly categorized. The district's database includes detailed information about each property, such as ownership details, physical attributes, and historical appraisal data.

Additionally, BCAD provides valuable resources and support to property owners. They offer guidance on the protest and appeal process, ensuring that property owners have a fair opportunity to challenge their appraised values. BCAD also provides educational materials and workshops, helping property owners understand the appraisal process and their rights.

BCAD’s Commitment to Transparency and Fairness

Transparency and fairness are at the core of BCAD’s operations. The district maintains an open-door policy, encouraging property owners to actively participate in the appraisal process and providing clear communication channels for inquiries and concerns.

BCAD's commitment to transparency is evident in its annual publication of the appraisal roll, which is available for public inspection. This document details the appraised values of all taxable properties within Bell County, offering a comprehensive overview of the district's appraisal work.

Furthermore, BCAD actively engages with the community, attending public meetings and participating in local events to foster understanding and address any concerns or misconceptions about the appraisal process.

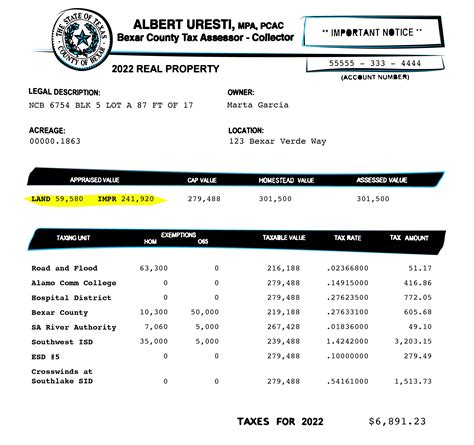

Property Tax Calculations in Bell County

Property taxes in Bell County are calculated based on the appraised value of a property and the tax rates set by various taxing entities, such as the county, cities, school districts, and special districts. Understanding how property taxes are determined is crucial for property owners, as it provides insights into their financial obligations and the impact of the local tax system on their overall costs.

Tax Rates and Millage Rates

Tax rates, often referred to as millage rates, are the key determinants of property tax liabilities. These rates are set annually by the various taxing entities and are typically expressed as a percentage or a decimal value. For instance, a tax rate of 0.0025 represents 2.5 mills or 25 cents per $100 of appraised property value.

Each taxing entity, such as the county, city, or school district, has its own tax rate, which is used to calculate the portion of property taxes allocated to that entity. The combined tax rates of all applicable taxing entities determine the total tax rate for a specific property.

| Taxing Entity | Tax Rate (Millage) |

|---|---|

| Bell County | 0.0020 |

| City of Killeen | 0.0022 |

| Killeen ISD | 0.0035 |

| Other Special Districts | Varies |

Property Tax Calculation Example

To illustrate how property taxes are calculated, let’s consider an example property with an appraised value of $200,000. Using the tax rates from the table above, we can calculate the property taxes as follows:

Total Tax Rate = Bell County Rate + City of Killeen Rate + Killeen ISD Rate + Other Special District Rates

Total Tax Rate = 0.0020 + 0.0022 + 0.0035 + (Varies)

Assuming a total tax rate of 0.0087 (including all applicable special districts), the property tax calculation would be:

Property Tax = Appraised Value x Total Tax Rate

Property Tax = $200,000 x 0.0087

Property Tax = $1,740

Therefore, the property owner would owe $1,740 in property taxes for the year.

Challenging Your Bell County Property Appraisal

If you believe that your Bell County property appraisal is inaccurate or unfair, you have the right to protest and challenge the appraised value. The Bell County Appraisal Review Board (ARB) is an independent body that oversees the protest process, ensuring that property owners have a fair opportunity to present their case and seek a review of their appraised value.

The Protest Process

The protest process is a formal procedure outlined by the Texas Property Tax Code. Property owners have the right to protest their appraised value if they believe it is incorrect, unequal, or based on incorrect property characteristics. Here’s a step-by-step guide to the protest process:

- Notice of Appraised Value: Review the Notice of Appraised Value you receive from BCAD. This notice details the appraised value of your property and provides important information for the protest process.

- Deadline for Protest: Note the deadline for filing a protest, which is typically within a specific timeframe after receiving the Notice of Appraised Value. Failure to meet this deadline may result in the loss of your right to protest.

- Preparing Your Case: Gather evidence and documentation to support your case. This may include recent sales data of similar properties, appraisals from licensed appraisers, or any other relevant information that demonstrates the inaccuracy of your appraised value.

- Filing a Protest: Complete and submit the required protest form to BCAD. You can obtain this form from the BCAD website or their office. Ensure that you provide all necessary information and supporting documentation.

- Hearing with ARB: If your protest is accepted, you will be scheduled for a hearing with the ARB. During the hearing, you will have the opportunity to present your case and provide evidence to support your claim. The ARB will consider your protest and make a decision based on the evidence presented.

- Decision and Notice: Following the hearing, the ARB will issue a written decision, notifying you of their determination. If the ARB reduces your appraised value, you will receive a corrected Notice of Appraised Value.

Tips for a Successful Protest

To increase your chances of a successful protest, consider the following tips:

- Gather Comprehensive Evidence: Ensure that you have a solid foundation of evidence to support your case. This may include recent sales data, appraisals, and any other relevant documentation.

- Seek Professional Guidance: Consider consulting a licensed appraiser or a property tax attorney who can provide expert advice and guidance throughout the protest process.

- Be Prepared for the Hearing: Familiarize yourself with the hearing process and prepare a clear and concise presentation of your case. Practice your argument and anticipate potential questions from the ARB.

- Stay Organized: Maintain a well-organized file with all relevant documents and correspondence related to your protest. This will ensure that you have easy access to the information you need during the protest process.

Conclusion: Navigating the Bell County Tax Appraisal Process

The Bell County Tax Appraisal process is a complex yet essential aspect of the local real estate landscape. By understanding the steps involved, the factors influencing property values, and the role of BCAD, property owners can navigate the appraisal process with confidence. Additionally, being aware of the protest process and the resources available from BCAD empowers property owners to actively participate in the appraisal system and ensure a fair determination of their property’s value.

As we've explored in this comprehensive guide, the Bell County Tax Appraisal process is designed to provide a transparent and equitable assessment of property values. From the meticulous data collection and analysis conducted by BCAD to the opportunity for property owners to protest and appeal their appraised values, every step of the process is geared towards maintaining a fair and just tax system.

We hope this article has provided valuable insights into the Bell County Tax Appraisal process and empowered you with the knowledge to make informed decisions regarding your property. Remember, staying informed and actively engaging with the appraisal process is key to ensuring a fair and accurate determination of your property's value.

How often does BCAD appraise properties in Bell County?

+BCAD conducts a full appraisal of all properties in Bell County every year. This comprehensive appraisal process ensures that property values are up-to-date and accurately reflect the current market conditions.

Can I request a reappraisal if my property’s value has decreased due to recent improvements or damage?

+Yes, you can request a reappraisal if there have been significant changes to your property that affect its value. BCAD offers a reappraisal process to consider such circumstances. Contact BCAD to initiate the reappraisal request and provide supporting documentation.

What happens if I don’t receive a Notice of Appraised Value from BCAD?

+If you do not receive a Notice of Appraised Value, it’s important to contact BCAD promptly. They can provide you with the necessary information and ensure that you receive the notice and have the opportunity to review and protest your appraised value if needed.