Georgia Vehicle Sales Tax

When purchasing a vehicle in Georgia, one of the key considerations is understanding the sales tax that applies to the transaction. The Georgia Vehicle Sales Tax is an essential aspect of the car-buying process, impacting the overall cost and requiring careful attention to ensure compliance with state regulations. This article delves into the intricacies of the Georgia Vehicle Sales Tax, providing a comprehensive guide to help prospective vehicle buyers navigate this crucial step.

Understanding the Georgia Vehicle Sales Tax

The Georgia Vehicle Sales Tax is a state-imposed tax levied on the purchase of motor vehicles, including cars, trucks, motorcycles, and certain types of recreational vehicles. This tax is a crucial source of revenue for the state and helps fund various public services and infrastructure projects. Understanding the mechanics and implications of this tax is vital for both individual buyers and businesses involved in vehicle sales.

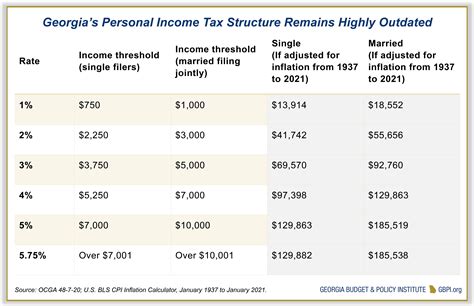

The tax rate for the Georgia Vehicle Sales Tax varies based on the location of the vehicle purchase. The state of Georgia is divided into different tax districts, each with its own specific sales tax rate. This means that the tax you pay can differ depending on the county or city where the vehicle is purchased.

| Tax District | Sales Tax Rate |

|---|---|

| Atlanta Metropolitan Area | 8.9% |

| Georgia Counties (excluding Atlanta) | 7.4% |

| Specific Cities (e.g., Savannah, Columbus) | Varies (typically higher than county rate) |

The Georgia Department of Revenue provides a comprehensive Sales Tax Rates resource, offering a detailed breakdown of tax rates by county and city. This resource is invaluable for prospective buyers, allowing them to estimate the exact tax they will pay based on their purchase location.

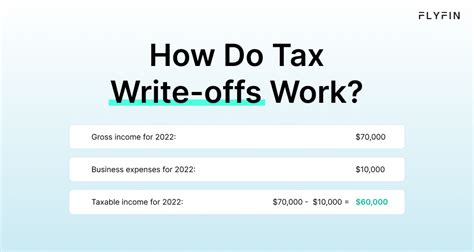

Calculating the Tax

The calculation of the Georgia Vehicle Sales Tax is relatively straightforward. The tax is applied to the total purchase price of the vehicle, including any additional costs such as dealer fees, extended warranties, and delivery charges. Here’s a simple formula to estimate the tax:

\[ \begin{equation*} \text{Vehicle Sales Tax} = \text{Purchase Price} \times \text{Tax Rate} \end{equation*} \]

For instance, if you are purchasing a vehicle in the Atlanta Metropolitan Area with a purchase price of $\text{\textdollar}30,000$, the sales tax would be calculated as follows:

\[ \begin{align*} \text{Vehicle Sales Tax} & = \text{\textdollar}30,000 \times 0.089 \\ & = \text{\textdollar}2,670 \end{align*} \]

So, in this example, the sales tax due would be $\text{\textdollar}2,670$.

Exemptions and Special Cases

While the Georgia Vehicle Sales Tax applies to most vehicle purchases, there are certain exemptions and special cases to be aware of. These include:

- Military Personnel: Active-duty military personnel stationed in Georgia are exempt from paying sales tax on vehicles purchased in the state. This exemption is applicable if the military member is not a resident of Georgia and plans to take the vehicle out of the state within 90 days of purchase.

- Vehicle Trade-Ins: If you trade in your old vehicle as part of the purchase, the sales tax is calculated based on the difference between the trade-in value and the new vehicle's purchase price. This can significantly reduce the tax liability.

- Disability Exemptions: Individuals with certain disabilities may be eligible for sales tax exemptions on vehicle purchases. This often applies to vehicles modified for disability access or use.

- Leased Vehicles: Sales tax for leased vehicles is typically paid upfront as part of the lease agreement. The tax is calculated based on the capitalized cost of the lease, which includes the vehicle's purchase price, taxes, and fees.

Payment and Filing Process

Once you’ve determined the applicable tax rate and calculated the sales tax for your vehicle purchase, the next step is understanding the payment and filing process.

Payment Options

The Georgia Department of Revenue offers several payment methods for the Vehicle Sales Tax, including:

- Online Payment: The most convenient option, allowing you to pay the tax via the DOR Online Services portal. This method is secure, fast, and accessible 24/7.

- Mail-In Payment: You can mail a check or money order along with the completed Form IT-841 to the address specified on the form. This method is suitable for those who prefer a more traditional payment approach.

- In-Person Payment: Certain DOR offices accept in-person payments. You can visit the DOR Contact Us page to find the nearest office and its payment hours.

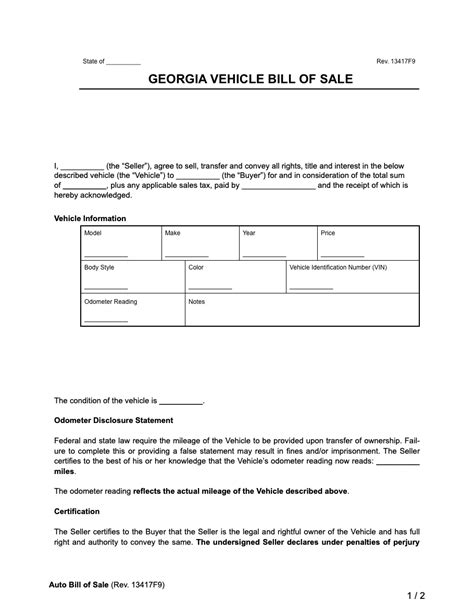

Filing Requirements

After paying the Vehicle Sales Tax, you must complete and file the Form IT-841 with the Georgia Department of Revenue. This form includes details about the vehicle purchase, such as the purchase price, tax rate, and tax amount paid. It’s crucial to file this form accurately and within the specified timeframe to avoid penalties.

The Form IT-841 also serves as the application for your vehicle's title and registration. By completing this form, you are initiating the process of obtaining the necessary documentation to legally operate your vehicle in Georgia.

Vehicle Registration and Titling

The Georgia Vehicle Sales Tax is just one part of the broader process of registering and titling your vehicle. This process ensures that your vehicle is legally recognized and registered with the state.

Registration Requirements

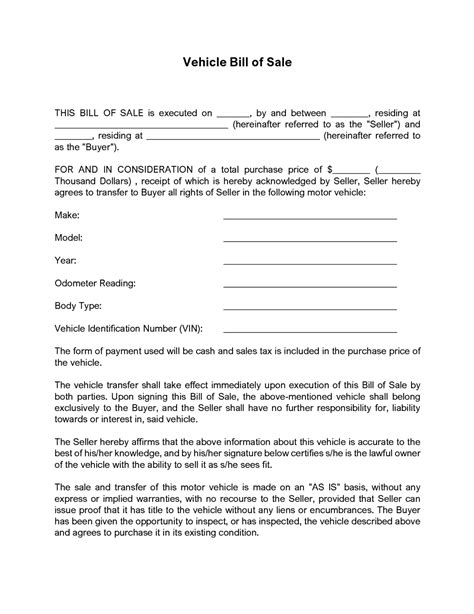

To register your vehicle in Georgia, you will need the following documents:

- Proof of Vehicle Sales Tax payment (usually the Form IT-841 receipt)

- Proof of insurance (a valid insurance policy covering the vehicle)

- A completed Form MV-1 (Application for Certificate of Title/Registration)

- A valid form of identification (e.g., driver's license, passport)

- The vehicle's odometer disclosure statement

You can find more detailed information about the registration process and required documents on the Vehicle Registration page of the Georgia Department of Revenue website.

Title Transfer and Fees

If you are purchasing a used vehicle, you will need to transfer the title from the previous owner to your name. This process involves completing the Form MV-1 and submitting it along with the vehicle’s existing title to the Georgia Department of Revenue.

There are fees associated with titling and registering your vehicle, which vary depending on the type of vehicle and the county where it is registered. These fees typically cover the cost of processing the title and registration, as well as the production of the license plate and decal.

Conclusion: Navigating the Georgia Vehicle Sales Tax

Understanding and complying with the Georgia Vehicle Sales Tax is an essential part of the vehicle-buying process in the state. By familiarizing yourself with the tax rates, calculation methods, and payment procedures, you can ensure a smooth and compliant transaction.

Remember, while the tax may add to the overall cost of your vehicle purchase, it is a necessary contribution to the state's revenue and infrastructure development. By following the guidelines and utilizing the resources provided by the Georgia Department of Revenue, you can navigate the Vehicle Sales Tax process with confidence and ensure your vehicle purchase is in compliance with state regulations.

What is the average sales tax rate in Georgia for vehicle purchases?

+

The average sales tax rate in Georgia for vehicle purchases varies depending on the location. Generally, it ranges from 7.4% to 8.9%, with specific cities having higher rates. It’s crucial to check the exact tax rate for your specific county or city to ensure accurate calculations.

Are there any ways to reduce the amount of sales tax I pay on a vehicle purchase in Georgia?

+

While the sales tax is a mandatory expense, there are a few strategies to reduce the overall cost. Trading in your old vehicle can lower the purchase price, and thus, the tax amount. Additionally, certain exemptions, such as for military personnel or individuals with disabilities, can result in reduced or eliminated sales tax. It’s important to research and understand these exemptions to determine if you qualify.

Can I pay the sales tax on my vehicle purchase online in Georgia?

+

Yes, the Georgia Department of Revenue offers an online payment option for the Vehicle Sales Tax. This method is secure, convenient, and accessible 24⁄7. Simply visit the DOR Online Services portal to make your payment.

What happens if I don’t pay the sales tax on my vehicle purchase in Georgia?

+

Failing to pay the sales tax on your vehicle purchase can result in significant penalties and fees. It’s important to ensure that you understand and comply with the tax payment requirements to avoid legal issues and additional costs.

Is there a time limit for paying the sales tax on a vehicle purchase in Georgia?

+

Yes, there is a time limit for paying the sales tax on a vehicle purchase in Georgia. Typically, you have 30 days from the date of purchase to pay the tax. Failing to meet this deadline can result in penalties and interest charges. It’s crucial to stay informed and adhere to the specified timeframe to avoid additional expenses.