Is Optima Tax Relief Legit

When it comes to tax resolution services, Optima Tax Relief (OTR) is a prominent name in the industry. Founded in 2009, OTR has helped numerous individuals and businesses navigate complex tax issues and find relief from IRS tax debts. In this comprehensive article, we will delve into the legitimacy of Optima Tax Relief, exploring its services, reputation, and the value it brings to taxpayers seeking assistance.

Understanding Optima Tax Relief

Optima Tax Relief specializes in providing tax resolution services to taxpayers who are facing IRS tax liabilities, audits, or other tax-related issues. Their primary goal is to help clients reduce their tax burdens and find sustainable solutions to resolve their tax problems.

Services Offered by Optima Tax Relief

OTR offers a range of services tailored to different tax situations. These services include:

- IRS Back Tax Resolution: OTR assists taxpayers in negotiating with the IRS to resolve back tax debts, including installment agreements, offers in compromise, and penalty abatements.

- Tax Lien and Levy Release: They help clients remove tax liens and stop IRS levies, allowing individuals to regain control of their financial situation.

- Audit Representation: Optima Tax Relief provides expert representation during IRS audits, ensuring taxpayers’ rights are protected and accurate information is presented.

- Bank Levy Release: In cases where the IRS has levied a taxpayer’s bank account, OTR works to lift the levy and restore access to funds.

- Wage Garnishment Release: They assist in stopping IRS wage garnishments, allowing individuals to keep more of their income.

- Penalty Abatement: OTR experts can negotiate with the IRS to reduce or eliminate penalties associated with tax non-compliance.

- Unfiled Tax Returns: For those with unfiled tax returns, Optima Tax Relief prepares and files these returns, bringing taxpayers into compliance.

The Legitimacy of Optima Tax Relief

Optima Tax Relief’s legitimacy can be assessed through several key factors:

Accreditations and Memberships

OTR is accredited by the Better Business Bureau (BBB) and holds an A+ rating. This accreditation is a testament to their commitment to ethical business practices and customer satisfaction. Additionally, Optima Tax Relief is a member of several industry organizations, including the National Association of Tax Professionals (NATP) and the National Association of Enrolled Agents (NAEA). These memberships highlight their dedication to ongoing education and professional development.

Experience and Expertise

With over a decade of experience in the tax resolution industry, Optima Tax Relief has built a team of highly skilled professionals. Their team includes Enrolled Agents (EAs), CPAs, and tax attorneys who are well-versed in IRS tax laws and regulations. This expertise is crucial when dealing with complex tax matters, as it ensures clients receive accurate and effective representation.

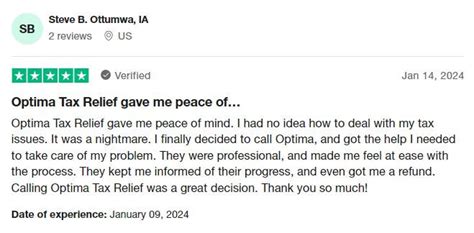

Client Reviews and Testimonials

A crucial aspect of evaluating a tax relief company’s legitimacy is considering the experiences of its clients. Optima Tax Relief boasts a large number of positive reviews and testimonials from satisfied customers. These reviews highlight the company’s ability to resolve tax issues, provide excellent customer service, and deliver on its promises. While it’s important to consider both positive and negative feedback, the overall sentiment toward OTR is largely positive.

Transparency and Communication

Optima Tax Relief emphasizes transparency throughout the tax resolution process. They provide clear and concise explanations of their services, fees, and expected outcomes. Regular communication with clients ensures that taxpayers are informed and involved in the decision-making process. This level of transparency builds trust and confidence in the company’s integrity.

Success Rates and Results

While it can be challenging to measure success rates precisely in the tax resolution industry, Optima Tax Relief has a track record of successfully resolving tax issues for its clients. Their case studies and client success stories showcase the positive outcomes achieved, including reduced tax liabilities, lifted liens, and improved financial stability for taxpayers.

The Benefits of Optima Tax Relief

Engaging the services of Optima Tax Relief can offer several advantages to taxpayers in distress:

Expertise and Knowledge

OTR’s team of tax professionals brings extensive knowledge and experience to the table. They stay updated on the ever-changing tax laws and regulations, ensuring that clients receive accurate and effective solutions tailored to their unique situations.

Negotiation Skills

Dealing with the IRS can be daunting, but Optima Tax Relief’s negotiators are skilled in communicating with tax authorities. They understand the IRS’s processes and can effectively advocate for their clients, often achieving favorable outcomes that taxpayers may not be able to secure on their own.

Time and Stress Reduction

Tax issues can be time-consuming and stressful. By hiring Optima Tax Relief, taxpayers can offload the burden of dealing with the IRS and focus on their personal and professional lives. OTR’s experts handle the complex negotiations and paperwork, providing peace of mind during a challenging time.

Customized Solutions

Every taxpayer’s situation is unique, and Optima Tax Relief recognizes this. They tailor their strategies to fit the individual needs of each client, ensuring that the resolution plan aligns with their financial capabilities and goals.

The Cost of Optima Tax Relief’s Services

The cost of Optima Tax Relief’s services varies depending on the complexity of the tax issue and the specific services required. OTR provides a free consultation to assess a client’s situation and offer a customized quote. It’s important to note that the fees are typically based on the complexity of the case and the time and resources needed to resolve it.

Comparative Pricing

When comparing Optima Tax Relief’s pricing to other tax resolution companies, it’s essential to consider the quality of services provided. OTR’s fees are competitive within the industry, and their focus on delivering results and customer satisfaction sets them apart. Additionally, they offer flexible payment plans to accommodate various financial situations.

Fee Structure and Transparency

Optima Tax Relief maintains transparency regarding their fee structure. They provide detailed information about their pricing during the initial consultation, ensuring that clients understand the costs involved. This upfront approach allows taxpayers to make informed decisions about engaging their services.

Performance-Based Fees

In some cases, Optima Tax Relief may offer performance-based fees, where clients pay a percentage of the tax debt reduction achieved. This fee structure aligns the company’s interests with those of the client, incentivizing OTR to negotiate the best possible outcome.

The Process of Working with Optima Tax Relief

Engaging Optima Tax Relief typically involves the following steps:

- Initial Consultation: Clients schedule a free consultation to discuss their tax issues and receive a preliminary assessment of their situation.

- Case Evaluation: OTR's experts thoroughly evaluate the client's tax records, financial status, and IRS notices to develop a comprehensive understanding of the case.

- Customized Plan: Based on the evaluation, Optima Tax Relief creates a tailored plan to resolve the tax issue, considering the client's goals and financial capabilities.

- Communication and Updates: Throughout the process, OTR keeps clients informed about the progress and provides regular updates on negotiations with the IRS.

- Resolution and Follow-Up: Once the tax issue is resolved, Optima Tax Relief ensures that all necessary steps are taken to finalize the case and prevent future tax problems. They also provide ongoing support and guidance to maintain financial stability.

FAQs about Optima Tax Relief

How much does Optima Tax Relief charge for their services?

+

Optima Tax Relief’s fees vary depending on the complexity of the case. They provide a free consultation to assess your situation and offer a customized quote. Their fees are typically performance-based, meaning they are tied to the results achieved.

Are there any upfront costs or hidden fees with Optima Tax Relief’s services?

+

Optima Tax Relief operates on a transparent fee structure. They provide detailed information about their fees during the initial consultation, ensuring there are no surprises. There are no hidden costs, and they offer flexible payment plans to accommodate different financial situations.

What makes Optima Tax Relief different from other tax relief companies?

+

Optima Tax Relief stands out for its team of highly skilled tax professionals, including Enrolled Agents, CPAs, and tax attorneys. Their expertise, combined with a focus on customer satisfaction and transparency, sets them apart in the industry.

How successful is Optima Tax Relief in resolving tax issues?

+

Optima Tax Relief has a strong track record of successfully resolving tax issues for its clients. Their case studies and client testimonials showcase their ability to negotiate favorable outcomes, reduce tax liabilities, and provide peace of mind to taxpayers.

Can Optima Tax Relief help with tax issues for businesses as well as individuals?

+

Yes, Optima Tax Relief provides tax resolution services for both individuals and businesses. Their team is experienced in handling a wide range of tax issues, including those specific to businesses, such as payroll tax problems and corporate tax liabilities.

What happens if Optima Tax Relief cannot resolve my tax issue as expected?

+

Optima Tax Relief strives to provide the best possible service, but tax resolution outcomes can vary based on individual circumstances. In cases where the desired results are not achieved, OTR works closely with clients to explore alternative strategies and ensure they receive the support they need.

Conclusion

Optima Tax Relief is a legitimate and reputable tax resolution company that has helped countless taxpayers find relief from their IRS tax burdens. With their team of experienced professionals, transparent practices, and focus on customer satisfaction, they have established themselves as a trusted partner in the tax resolution industry. If you’re facing tax issues, considering Optima Tax Relief as a potential solution is a wise step toward resolving your tax problems effectively.