Amazon Tax Central

Welcome to Amazon Tax Central, your go-to resource for navigating the complex world of taxes within the Amazon ecosystem. As a third-party seller on Amazon, understanding the tax landscape is crucial for your business's success and compliance. This comprehensive guide aims to shed light on the various tax considerations you need to be aware of, providing expert insights and practical advice to ensure a smooth tax journey.

The Importance of Tax Compliance for Amazon Sellers

Tax compliance is a critical aspect of any business, and for Amazon sellers, it takes on an even more prominent role. With the ever-evolving tax regulations and the global nature of Amazon’s marketplace, staying on top of your tax obligations is essential. Non-compliance can lead to serious legal and financial consequences, not to mention the potential damage to your reputation and business operations.

Amazon, being a platform that facilitates e-commerce on a grand scale, has its own set of tax requirements and guidelines. As a seller, you must navigate these requirements while also adhering to the tax laws of various jurisdictions, including federal, state, and local regulations. This guide aims to demystify the process and provide you with the tools and knowledge to manage your tax obligations efficiently.

Understanding Amazon’s Tax Policies

Amazon’s tax policies are designed to ensure compliance with the tax laws of the countries and regions where it operates. These policies outline the seller’s responsibilities regarding tax collection, reporting, and remittance. As a seller, it is crucial to familiarize yourself with these policies to avoid any inadvertent violations.

Sales Tax Collection

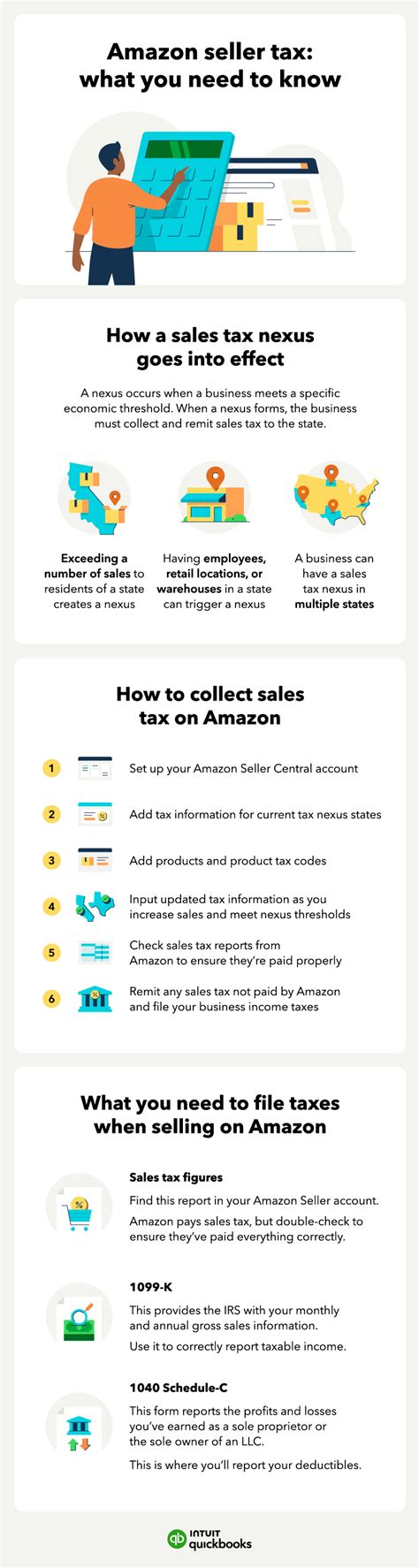

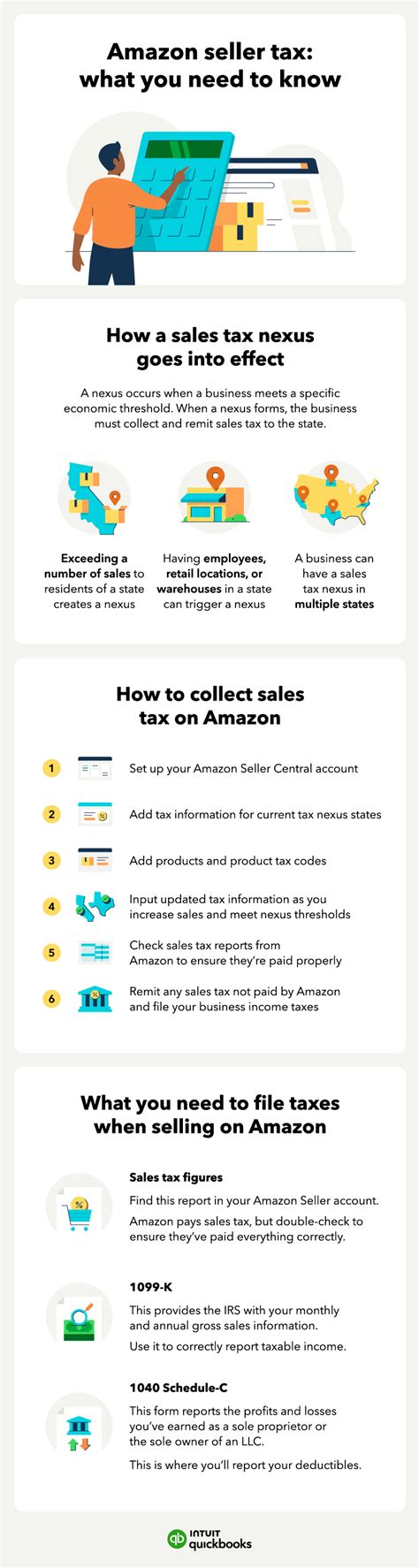

One of the key responsibilities of Amazon sellers is sales tax collection. Amazon provides a Sales Tax Calculator tool to assist sellers in determining the applicable sales tax rates for their products. However, it is important to note that the seller remains ultimately responsible for the accuracy of the collected taxes.

Amazon's role in sales tax collection varies depending on the seller's location and the buyer's destination. For sellers in the United States, Amazon may collect and remit sales tax on their behalf for certain transactions. This is known as the Marketplace Facilitator Law, which has been adopted by many states. However, sellers still need to register for sales tax permits and file returns for transactions not covered by Amazon.

| Marketplace Facilitator Law | Key Information |

|---|---|

| Description | A law that requires online marketplaces to collect and remit sales tax on behalf of third-party sellers. |

| States with MFL | California, New York, Washington, etc. (Check the latest updates for an accurate list) |

Value Added Tax (VAT) and Goods and Services Tax (GST)

For sellers operating in countries with a Value Added Tax (VAT) or Goods and Services Tax (GST) system, Amazon provides tools and resources to assist with compliance. Sellers must ensure they understand the VAT/GST regulations in their respective countries and register for the appropriate tax identification numbers.

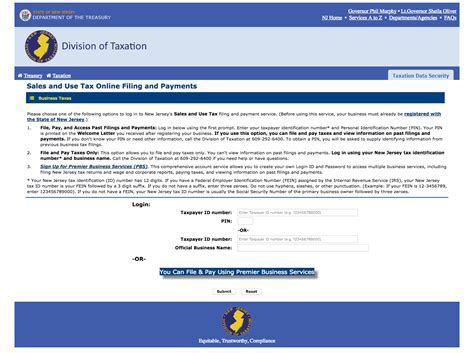

Reporting and Remittance

Amazon provides sellers with access to tax reports and transaction data to facilitate accurate reporting. Sellers are responsible for regularly reviewing these reports and ensuring that all transactions are correctly categorized and taxed. Any discrepancies should be addressed promptly to maintain compliance.

Navigating Tax Obligations as an Amazon Seller

As an Amazon seller, your tax obligations extend beyond sales tax collection. You must also consider income tax, payroll tax (if you have employees), and other applicable taxes based on your business structure and location.

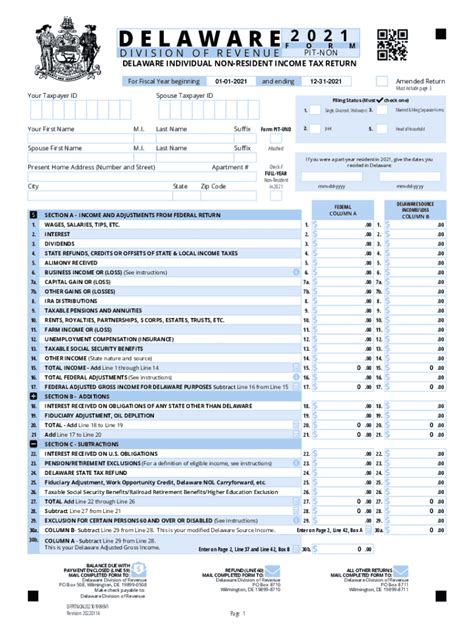

Income Tax and Business Structure

The income tax you owe as an Amazon seller depends on your business structure. Sole proprietors and single-member LLCs report their business income on their personal tax returns, while multi-member LLCs, corporations, and partnerships have separate tax obligations.

It is crucial to understand the tax implications of your chosen business structure and ensure compliance with the associated tax regulations. Consult with a tax professional to determine the most suitable structure for your business and navigate the associated tax requirements.

Payroll Tax and Employee Management

If you have employees working for your Amazon business, you must comply with payroll tax regulations. This includes withholding and remitting federal income tax, Social Security tax, and Medicare tax from your employees’ wages. Additionally, you may need to register for state payroll tax obligations, such as state income tax withholding and unemployment insurance taxes.

Proper employee management and record-keeping are essential to ensure compliance with payroll tax regulations. Stay informed about the latest changes in tax laws and regulations to avoid any non-compliance issues.

Other Applicable Taxes

Depending on your business activities and location, you may be subject to other taxes, such as property tax, excise tax, or local business taxes. Research and understand the tax landscape in your jurisdiction to ensure you are meeting all applicable tax obligations.

Tax Planning and Optimization Strategies

Tax planning is a crucial aspect of managing your Amazon business effectively. By implementing strategic tax planning, you can minimize your tax liabilities, maximize your profits, and ensure compliance with tax laws.

Record-Keeping and Documentation

Maintaining accurate and organized records is essential for tax planning and compliance. Keep track of all your business transactions, including sales, purchases, expenses, and inventory. Proper record-keeping will not only help you with tax preparation but also provide valuable insights for business decision-making.

Tax Deductions and Credits

Familiarize yourself with the tax deductions and credits available to Amazon sellers. These can include deductions for business expenses, such as advertising costs, shipping expenses, and office supplies. Additionally, keep an eye out for tax credits that may be applicable to your business, such as research and development credits or employment-related credits.

Consult with a tax professional to identify the deductions and credits that are relevant to your business and maximize your tax savings.

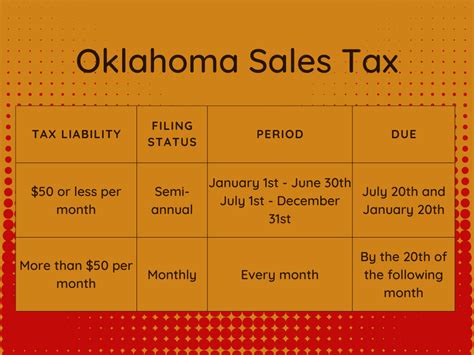

Sales Tax Nexus and State Tax Obligations

Understanding your sales tax nexus is crucial for determining your state tax obligations. A sales tax nexus is established when a seller has a physical presence or sufficient economic activity in a state. This presence triggers the requirement to register for sales tax and collect and remit sales tax on transactions with buyers in that state.

Stay informed about the sales tax nexus rules in each state where you operate and ensure you are meeting your tax obligations accordingly. Failing to comply with sales tax laws can result in penalties and interest charges.

Staying Informed and Updated

The tax landscape is dynamic, with frequent changes and updates. To stay compliant and avoid any surprises, it is essential to stay informed about tax law changes and how they may impact your Amazon business.

Tax Law Changes and Updates

Keep an eye on tax law changes at the federal, state, and local levels. Follow reputable sources, such as government websites and tax professional associations, to stay updated on the latest developments. Subscribe to tax newsletters or alerts to receive timely information about changes that may affect your business.

Utilizing Tax Resources and Tools

Amazon provides a range of resources and tools to assist sellers with tax compliance. Utilize these resources to stay informed and ensure you are using the latest tools to manage your tax obligations efficiently.

Some of the key resources include:

- Tax Documents: Access your tax documents and reports through Seller Central.

- Tax Calculators: Use Amazon's Sales Tax Calculator to determine the applicable sales tax rates for your products.

- VAT/GST Resources: Find guidance and tools for VAT/GST compliance in the countries where you operate.

- Tax Support: Reach out to Amazon's tax support team for assistance with tax-related queries.

Conclusion

Navigating the tax landscape as an Amazon seller can be complex, but with the right knowledge and resources, you can ensure compliance and manage your tax obligations effectively. By understanding Amazon's tax policies, staying informed about tax law changes, and implementing strategic tax planning, you can minimize your tax liabilities and maximize your business's success.

Remember, tax compliance is an ongoing process. Stay proactive, seek professional advice when needed, and utilize the resources available to you to navigate the ever-changing tax landscape with confidence.

Frequently Asked Questions

How often should I update my tax information with Amazon?

+It is recommended to update your tax information annually or whenever there are changes to your business structure, location, or tax obligations. This ensures that Amazon has the most accurate information to assist with tax compliance.

What happens if I fail to collect and remit sales tax as an Amazon seller?

+Failure to collect and remit sales tax can result in penalties, interest charges, and potential legal consequences. It is crucial to stay compliant with sales tax laws to avoid these issues.

Can I use tax software to manage my Amazon business taxes?

+Yes, tax software can be a valuable tool for managing your Amazon business taxes. It can help automate tax calculations, generate reports, and streamline the tax preparation process. Consult with a tax professional to choose the right software for your needs.

How can I stay updated with Amazon’s tax policies and changes?

+Amazon communicates tax policy updates through Seller Central and email notifications. It is essential to regularly check these platforms and stay engaged with Amazon’s tax support resources to stay informed.

What is the Marketplace Facilitator Law, and how does it affect Amazon sellers?

+The Marketplace Facilitator Law requires online marketplaces like Amazon to collect and remit sales tax on behalf of third-party sellers. This law has been adopted by many states, shifting the sales tax collection responsibility to the marketplace. Sellers should understand their obligations under this law and ensure compliance.