Oklahoma Sales Tax

Welcome to an in-depth exploration of the Oklahoma Sales Tax, a critical component of the state's revenue system. This article aims to provide a comprehensive understanding of the sales tax structure in Oklahoma, its historical context, key rates, exemptions, and its impact on businesses and consumers alike. We'll delve into the intricacies of this tax system, offering valuable insights and practical guidance for anyone interested in navigating Oklahoma's sales tax landscape.

Understanding Oklahoma Sales Tax: An Overview

Oklahoma’s sales tax is a state-level tax levied on the sale or lease of tangible personal property and certain services. It’s a critical revenue source for the state, funding essential public services and infrastructure development. The sales tax system in Oklahoma is a combination of state and local taxes, with the state setting a base rate and municipalities adding additional taxes, creating a complex but flexible tax structure.

Historical Context and Legislative Changes

The sales tax system in Oklahoma has evolved over the years, with significant legislative changes shaping its current form. The state first implemented a general sales tax in 1933, during the Great Depression, as a means to generate revenue and support economic recovery. Since then, the tax rate has fluctuated, with the most recent major change occurring in 2021, when the state legislature voted to increase the state sales tax rate.

| Year | State Sales Tax Rate |

|---|---|

| 1933 | 2% |

| 1941 | 3% |

| 1951 | 3.25% |

| 1986 | 4.5% |

| 2016 | 4.5% |

| 2021 | 4.5% |

The table above provides a glimpse into the historical evolution of Oklahoma's sales tax rates. These changes reflect the state's fiscal needs and economic conditions over time.

Key Components of Oklahoma Sales Tax

Oklahoma’s sales tax system is a multi-layered structure comprising state, county, and city taxes. The state sales tax rate is set at 4.5%, with additional local taxes varying depending on the jurisdiction. This structure allows for tailored tax rates to suit the specific needs of different regions within the state.

For instance, in Oklahoma City, the total sales tax rate is 8.5%, which includes the state tax, a county tax of 0.5%, and a city tax of 3.5%. On the other hand, in Tulsa, the total sales tax rate is 8.125%, reflecting a different combination of state, county, and city taxes.

| City | Total Sales Tax Rate | State Tax | County Tax | City Tax |

|---|---|---|---|---|

| Oklahoma City | 8.5% | 4.5% | 0.5% | 3.5% |

| Tulsa | 8.125% | 4.5% | 0.5% | 3.125% |

| Norman | 8.5% | 4.5% | 0.5% | 3.5% |

| Broken Arrow | 8.25% | 4.5% | 0.5% | 3.25% |

The table above illustrates the diverse sales tax rates across some of Oklahoma's major cities. These rates demonstrate the flexibility and adaptability of the state's sales tax system, catering to the unique needs of different communities.

Oklahoma Sales Tax Rates: A Comprehensive Breakdown

Oklahoma’s sales tax rates are determined by a combination of state, county, and city taxes, resulting in varying rates across the state. While the state sales tax rate remains uniform at 4.5%, local governments have the authority to impose additional taxes, leading to significant variations in total sales tax rates.

State Sales Tax Rate

The state sales tax rate in Oklahoma is currently set at 4.5%, a rate that has remained consistent since 2016. This rate applies to most tangible personal property and certain services across the state. The state tax is a critical component of Oklahoma’s revenue system, funding essential services and infrastructure projects.

County Sales Tax Rates

In addition to the state sales tax, Oklahoma counties have the authority to levy their own sales taxes. These county taxes are used to fund local government operations and specific initiatives. The rates vary from county to county, with some counties opting for a 0.5% tax, while others choose a higher rate.

For instance, Oklahoma County, which includes the city of Oklahoma City, has a county sales tax rate of 0.5%, while other counties, like Tulsa County, have a slightly higher rate of 0.625%.

| County | Sales Tax Rate |

|---|---|

| Oklahoma County | 0.5% |

| Tulsa County | 0.625% |

| Cleveland County | 0.5% |

| Rogers County | 0.5% |

City Sales Tax Rates

Oklahoma cities also have the authority to impose sales taxes to fund local projects and initiatives. These city taxes, when combined with the state and county taxes, can result in significant variations in total sales tax rates across the state.

For example, Oklahoma City, the state's capital, has a city sales tax rate of 3.5%, while Tulsa, the state's second-largest city, has a slightly lower rate of 3.125%. These rates are in addition to the state and county taxes, resulting in total sales tax rates of 8.5% and 8.125%, respectively.

| City | Sales Tax Rate |

|---|---|

| Oklahoma City | 3.5% |

| Tulsa | 3.125% |

| Norman | 3.5% |

| Broken Arrow | 3.25% |

Exemptions and Special Cases in Oklahoma Sales Tax

While Oklahoma’s sales tax applies to a broad range of goods and services, there are certain exemptions and special cases that businesses and consumers should be aware of. These exemptions are designed to support specific industries, promote economic growth, and provide relief to certain segments of the population.

Food and Groceries

One notable exemption in Oklahoma’s sales tax system is the exemption on food and groceries. This exemption, known as the “grocery tax exemption,” removes the sales tax from most food items purchased for consumption off-premises. This includes items like bread, milk, fruits, vegetables, and other staples.

However, it's important to note that certain food items, such as prepared meals, soft drinks, and bottled water, are subject to sales tax. The exemption is designed to ensure that basic food items are more affordable for consumers, particularly those with lower incomes.

Prescription Drugs and Medical Devices

Oklahoma also exempts prescription drugs and certain medical devices from sales tax. This exemption is intended to reduce the financial burden on individuals with medical needs, making essential healthcare more accessible and affordable.

The exemption applies to a wide range of medical products, including prescription medications, prosthetic devices, wheelchairs, and certain medical equipment. However, it's important to note that over-the-counter medications and certain medical supplies are subject to sales tax.

Agricultural Sales

Oklahoma’s sales tax system recognizes the importance of agriculture to the state’s economy and provides certain exemptions for agricultural sales. This includes the exemption of sales tax on the sale of livestock, farm equipment, and certain agricultural supplies.

The exemption is designed to support Oklahoma's agricultural industry, allowing farmers and ranchers to operate more efficiently and competitively. It also encourages the development and growth of this vital sector, which is a significant contributor to the state's economy.

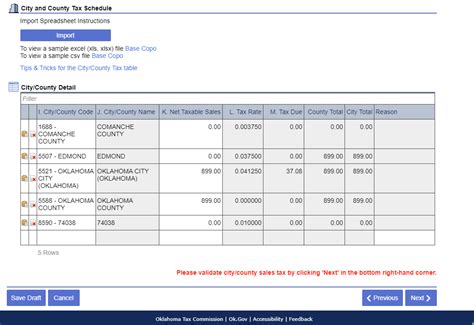

Compliance and Collection: Navigating Oklahoma Sales Tax

Navigating Oklahoma’s sales tax system requires a clear understanding of the tax rates, exemptions, and reporting requirements. Businesses operating in Oklahoma must register with the Oklahoma Tax Commission, collect the appropriate taxes, and remit them to the state on a regular basis.

Registration and Permits

To begin collecting and remitting sales tax in Oklahoma, businesses must first register with the Oklahoma Tax Commission. This involves completing the necessary forms and providing information about the business, its location, and the types of goods and services it offers.

Once registered, businesses are issued a Seller's Permit, which authorizes them to collect and remit sales tax. This permit must be displayed at the business location and is a critical component of the sales tax compliance process.

Sales Tax Collection and Remittance

Businesses in Oklahoma are required to collect sales tax from customers at the point of sale, based on the total purchase amount. The tax collected is then remitted to the Oklahoma Tax Commission on a regular basis, typically on a monthly or quarterly basis, depending on the business’s sales volume.

The remittance process involves completing a sales tax return, which includes details of the sales made, the tax collected, and any applicable exemptions. This return must be submitted along with the tax payment to the Oklahoma Tax Commission by the due date.

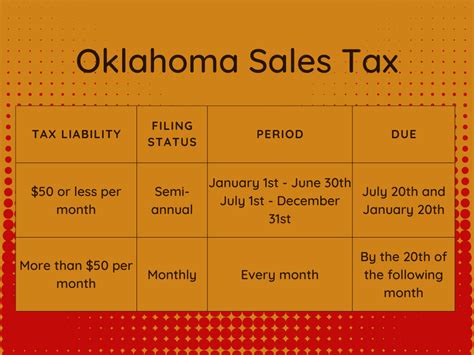

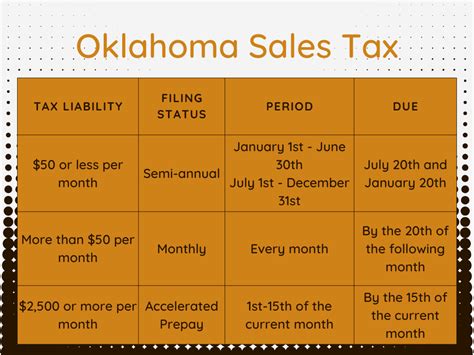

Sales Tax Filing Due Dates

The due dates for sales tax filings in Oklahoma vary depending on the business’s sales volume and the frequency of its tax returns. For businesses with higher sales volumes, the returns are typically due monthly, while those with lower sales volumes may file on a quarterly basis.

The specific due dates for each business are determined by the Oklahoma Tax Commission and are based on the business's registration information and sales history. It's important for businesses to stay informed about their filing due dates to ensure timely and accurate submissions.

Impact and Future Considerations for Oklahoma Sales Tax

Oklahoma’s sales tax system plays a critical role in the state’s fiscal health and economic development. It provides a significant portion of the state’s revenue, funding essential public services and infrastructure projects. However, the system also presents challenges and opportunities that merit careful consideration.

Economic Impact and Revenue Generation

Oklahoma’s sales tax system is a major contributor to the state’s revenue, accounting for a significant portion of its annual budget. The tax revenue is used to fund a wide range of services, including education, healthcare, transportation, and public safety. It also supports economic development initiatives and provides funding for critical infrastructure projects.

However, the reliance on sales tax as a primary revenue source can present challenges. As the tax is levied on consumption, it can disproportionately impact lower-income households, potentially leading to economic disparities. Additionally, the sales tax rate can influence consumer spending patterns, with higher rates potentially discouraging spending and impacting business growth.

Challenges and Opportunities

One of the key challenges in Oklahoma’s sales tax system is the variation in rates across the state. While this variation allows for local control and the ability to fund specific initiatives, it can also lead to complexity and confusion for businesses and consumers. Navigating the diverse tax rates can be a challenge, particularly for businesses operating in multiple jurisdictions.

On the other hand, the flexibility of the system also presents opportunities. Local governments can tailor their tax rates to suit their specific needs, providing a level of autonomy and control over their fiscal policies. This flexibility can support local economic development initiatives and fund critical community projects.

Future Considerations and Potential Reforms

Looking ahead, there are several considerations and potential reforms that could shape the future of Oklahoma’s sales tax system. One potential reform is the implementation of a uniform sales tax rate across the state, simplifying the system and reducing complexity for businesses and consumers.

Another consideration is the potential expansion of sales tax exemptions to support specific industries or community initiatives. This could involve exempting certain goods or services that are critical to the state's economy or providing tax relief to support community development projects.

Additionally, the state could explore the potential for a sales tax holiday, a period during which certain items are exempt from sales tax. This initiative, which has been successful in other states, could boost consumer spending and provide a boost to the economy, particularly during periods of economic downturn.

Frequently Asked Questions (FAQ)

How often do I need to file my sales tax returns in Oklahoma?

+

The frequency of your sales tax filings in Oklahoma depends on your business’s sales volume. If your business has a high sales volume, you may be required to file monthly. However, if your sales are lower, you may file on a quarterly basis. It’s important to check with the Oklahoma Tax Commission to determine your specific filing frequency.

Are there any special considerations for online sales in Oklahoma?

+

Yes, Oklahoma has specific regulations for online sales. If your business sells goods online to Oklahoma residents, you may be required to collect and remit sales tax, even if you don’t have a physical presence in the state. This is known as economic nexus, and it’s important to understand the thresholds and requirements to ensure compliance.

What happens if I fail to remit my sales tax on time in Oklahoma?

+

Failure to remit sales tax on time in Oklahoma can result in penalties and interest charges. The Oklahoma Tax Commission may impose penalties based on the amount of tax due and the length of the delay. It’s important to stay informed about your filing due dates and ensure timely remittance to avoid these penalties.

Are there any resources available to help me understand Oklahoma’s sales tax system?

+

Absolutely! The Oklahoma Tax Commission provides a wealth of resources to help businesses understand and navigate the sales tax system. This includes guides, webinars, and workshops, as well as a dedicated help desk to answer your questions. You can also consult with a tax professional or accountant for personalized advice.