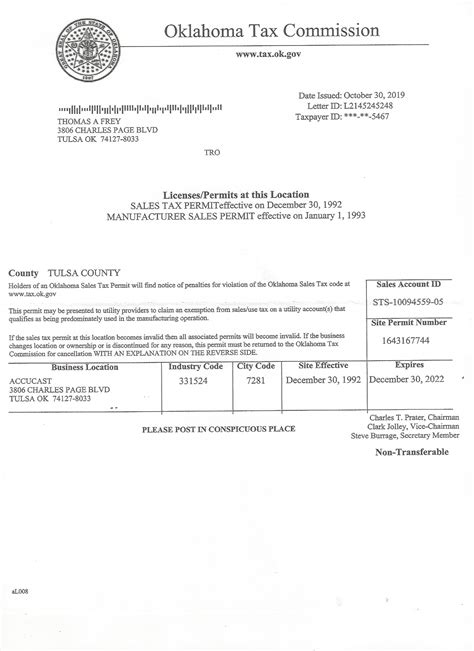

Oklahoma Sales Tax Permit

The Oklahoma Sales Tax Permit is a crucial document for businesses operating within the state, as it authorizes them to collect and remit sales tax on behalf of the Oklahoma Tax Commission. This permit is a legal requirement for most businesses engaged in taxable sales, including retailers, wholesalers, and certain service providers. In this comprehensive guide, we will delve into the intricacies of obtaining an Oklahoma Sales Tax Permit, covering the application process, eligibility criteria, and the responsibilities that come with this permit.

Understanding the Oklahoma Sales Tax Permit

An Oklahoma Sales Tax Permit, also known as a Seller’s Permit or a Sales and Use Tax Permit, is a form of registration that allows businesses to legally collect sales tax from customers and remit it to the state. This permit is a vital component of the state’s tax system, ensuring that businesses comply with tax regulations and contribute to the revenue generation of Oklahoma.

The Oklahoma Tax Commission, the state's primary tax administration body, is responsible for issuing these permits. They oversee the application process, ensure compliance, and provide resources for businesses to understand their tax obligations.

Why Do You Need an Oklahoma Sales Tax Permit?

The primary reason for obtaining an Oklahoma Sales Tax Permit is to ensure legal compliance. Here are some key reasons why this permit is essential for businesses:

- Legal Requirement: Selling taxable goods or services without a valid permit is illegal and can lead to penalties. The Oklahoma Tax Commission strictly enforces these regulations.

- Tax Collection: The permit authorizes businesses to collect sales tax from customers. This tax is then remitted to the state, contributing to Oklahoma's revenue and infrastructure development.

- Compliance and Reporting: Permit holders must file regular sales tax returns, reporting their taxable sales and remitting the collected tax. This process ensures transparency and accountability.

- Avoid Penalties: Non-compliance with sales tax regulations can result in severe penalties, including fines and even legal action. Obtaining a permit and following the tax guidelines help businesses avoid such consequences.

Eligibility and Application Process

Not all businesses need an Oklahoma Sales Tax Permit. The eligibility criteria and application process vary based on the nature of the business and its sales activities. Here’s a detailed breakdown:

Who Needs an Oklahoma Sales Tax Permit?

The following types of businesses typically require an Oklahoma Sales Tax Permit:

- Retail Businesses: Stores, shops, and any business selling tangible goods to the public directly.

- Wholesalers: Businesses that sell goods to other businesses for resale.

- Service Providers: Certain service-based businesses, especially those providing taxable services like repair, installation, or delivery services.

- Online Sellers: Businesses selling goods online to Oklahoma residents, even if they have no physical presence in the state.

- Out-of-State Sellers: Businesses located outside Oklahoma but selling goods to Oklahoma customers.

Application Process

The application process for an Oklahoma Sales Tax Permit is straightforward but requires attention to detail. Here are the steps involved:

- Register Your Business: Before applying for a sales tax permit, you must first register your business with the Oklahoma Secretary of State. This step ensures your business is legally recognized and authorized to operate in the state.

- Gather Required Information: Collect the necessary details, including your business name, address, Employer Identification Number (EIN), and the names and contact information of business owners or partners.

- Choose Your Application Method: The Oklahoma Tax Commission offers various application methods, including online, by mail, or in person. Online applications are the most convenient and efficient, but you can choose the method that best suits your needs.

- Complete the Application: Fill out the Oklahoma Sales Tax Permit application form accurately and completely. Provide all the required information, ensuring it is up-to-date and truthful.

- Submit Your Application: Once your application is ready, submit it to the Oklahoma Tax Commission using the chosen method. If you opt for an online application, you may need to create an account and provide electronic signatures.

- Wait for Approval: The Oklahoma Tax Commission will review your application and, if all the requirements are met, approve your permit. This process typically takes a few weeks, but it can vary based on the volume of applications and the completeness of your submission.

- Receive Your Permit: Once approved, you will receive your Oklahoma Sales Tax Permit via email or regular mail, depending on your preference. This permit will include your unique Sales Tax Registration Number (STRN), which you must use when filing sales tax returns.

Responsibilities of a Sales Tax Permit Holder

Obtaining an Oklahoma Sales Tax Permit comes with several responsibilities. As a permit holder, you must adhere to the following:

Collecting Sales Tax

As a permit holder, you are authorized to collect sales tax from your customers. This tax is calculated based on the taxable sales price of goods or services. You must ensure that you charge the correct tax rate, which can vary depending on the location of the sale and the nature of the goods or services.

Filing Sales Tax Returns

Permit holders are required to file sales tax returns regularly, typically on a monthly, quarterly, or annual basis. These returns must be filed by the due date, and late filings can result in penalties. The sales tax return includes a detailed report of your taxable sales and the amount of tax collected during the reporting period.

Remitting Sales Tax

Along with filing the sales tax return, you must also remit the collected tax to the Oklahoma Tax Commission. This remittance ensures that the state receives the tax revenue it is due. Failure to remit the tax can lead to serious consequences, including penalties and interest charges.

Record Keeping

As a permit holder, you must maintain accurate records of your sales transactions, including the date, amount, and nature of each sale. These records must be retained for a minimum of three years, as they may be requested by the Oklahoma Tax Commission for audits or verification purposes.

Renewing Your Oklahoma Sales Tax Permit

Oklahoma Sales Tax Permits are valid for a specific period, typically one year. However, the renewal process is relatively simple. Here’s what you need to know:

Renewal Period

The Oklahoma Tax Commission will notify you when your permit is due for renewal. Typically, this notification is sent about three months before the permit’s expiration date. It is crucial to renew your permit on time to avoid any disruptions to your business operations.

Renewal Process

The renewal process is similar to the initial application process. You will need to provide updated information, such as any changes to your business details or ownership structure. The Oklahoma Tax Commission will review your renewal application and, if all requirements are met, approve the renewal.

Late Renewal Penalties

If you fail to renew your Oklahoma Sales Tax Permit on time, you may be subject to penalties. These penalties can include fines and the temporary suspension of your permit until the renewal is processed. It is essential to stay on top of your renewal deadlines to avoid any legal issues.

Conclusion: Navigating the Oklahoma Sales Tax Permit Process

Obtaining an Oklahoma Sales Tax Permit is a crucial step for businesses operating within the state. It ensures legal compliance, authorizes tax collection, and contributes to the state’s revenue. By understanding the eligibility criteria, following the application process, and fulfilling your responsibilities as a permit holder, you can navigate the sales tax landscape in Oklahoma smoothly.

Remember, the Oklahoma Tax Commission provides extensive resources and guidance to help businesses understand and fulfill their tax obligations. Utilize these resources, stay informed, and ensure your business operates within the bounds of the law. With a valid sales tax permit, you can focus on growing your business while contributing to the economic development of Oklahoma.

What are the consequences of not having an Oklahoma Sales Tax Permit when required?

+Operating a business without an Oklahoma Sales Tax Permit when required can lead to severe penalties. The Oklahoma Tax Commission may impose fines, penalties, and interest charges. In some cases, they may even pursue legal action against the business. Additionally, businesses may face reputation damage and loss of trust from customers and partners.

How often do I need to renew my Oklahoma Sales Tax Permit?

+Oklahoma Sales Tax Permits are typically valid for one year. The renewal process is usually initiated about three months before the permit’s expiration date. It is essential to renew on time to avoid any disruptions to your business operations and potential penalties.

Can I apply for an Oklahoma Sales Tax Permit online?

+Yes, the Oklahoma Tax Commission offers an online application process for Oklahoma Sales Tax Permits. This method is convenient, efficient, and allows you to track the status of your application. However, you can also choose to apply by mail or in person if you prefer.

What happens if I sell taxable goods online to Oklahoma residents without a permit?

+Selling taxable goods online to Oklahoma residents without a valid Oklahoma Sales Tax Permit is illegal. The Oklahoma Tax Commission may impose penalties, including fines and interest charges. In some cases, they may also pursue legal action against the business. It is crucial to obtain the necessary permits before engaging in online sales to Oklahoma customers.

Are there any exemptions or special considerations for certain types of businesses regarding sales tax permits in Oklahoma?

+Yes, there are certain exemptions and special considerations for specific types of businesses in Oklahoma. For example, some non-profit organizations and religious institutions may be exempt from sales tax collection. Additionally, certain types of transactions, such as sales of agricultural products, may have different tax implications. It is crucial to consult with the Oklahoma Tax Commission or a tax professional to understand your specific situation.