Sales Tax In Nebraska

In the United States, sales tax is a consumption tax levied on the sale of goods and services. It is a significant source of revenue for state and local governments, including the state of Nebraska. Sales tax rates vary across states and even within states, as they can be imposed by various jurisdictions, such as the state government, counties, and municipalities. This article will delve into the specifics of sales tax in Nebraska, covering its rates, regulations, and unique features.

Understanding Sales Tax in Nebraska

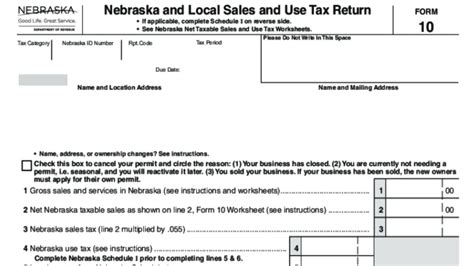

Nebraska’s sales tax system is relatively straightforward and is administered by the Nebraska Department of Revenue. The state imposes a uniform sales and use tax rate, which applies to the retail sale, lease, or rental of tangible personal property and some services. As of my last update in January 2023, the statewide sales tax rate in Nebraska is 5.5%.

However, it's important to note that in addition to the state sales tax, there may be additional local sales taxes levied by counties and municipalities. These local taxes can significantly impact the total sales tax rate that consumers encounter. For instance, in the city of Omaha, there is a 1.5% local sales tax, bringing the total sales tax rate to 7% in Omaha. Similarly, Lincoln has a 1% local sales tax, resulting in a total sales tax rate of 6.5% in Lincoln. These local variations in sales tax rates can create a complex landscape for businesses and consumers alike.

Furthermore, Nebraska's sales tax regulations also encompass use tax, which is applicable to purchases made outside the state but used or consumed within Nebraska. This ensures that all tangible personal property purchases are subject to tax, regardless of where they are made.

Sales Tax Exemptions and Special Considerations

Nebraska’s sales tax system, like many other states, includes a range of exemptions and special considerations. These exemptions can significantly impact the tax liability of certain businesses and individuals. Some of the notable sales tax exemptions in Nebraska include:

- Food and Drugs: Most food items intended for home consumption are exempt from sales tax in Nebraska. This includes unprepared food, produce, and certain dietary supplements. However, prepared foods and soft drinks are taxable.

- Prescription Drugs: Sales of prescription drugs and certain medical devices are exempt from sales tax.

- Clothing and Footwear: Sales of clothing and footwear are exempt up to a certain value. This exemption provides a tax break for essential items and can be especially beneficial for families.

- Agricultural Sales: Many agricultural inputs and machinery are exempt from sales tax, supporting the state’s agricultural industry.

- Manufacturing and Resale: Sales of goods intended for further manufacturing or resale are typically exempt from sales tax. This encourages economic activity and investment in the state.

It's worth noting that Nebraska's sales tax regulations are subject to change, and businesses and consumers should stay informed about any updates or amendments to the tax code. The Nebraska Department of Revenue provides comprehensive resources and guidance for taxpayers to navigate the sales tax landscape effectively.

| Sales Tax Rate | Tax Rate |

|---|---|

| Statewide Sales Tax | 5.5% |

| Omaha Local Sales Tax | 1.5% |

| Lincoln Local Sales Tax | 1% |

Compliance and Collection for Businesses

Businesses operating in Nebraska have a responsibility to understand and comply with the state’s sales tax regulations. This includes registering for a sales tax permit, which is required for all businesses making taxable sales. The permit allows businesses to collect and remit sales tax to the Nebraska Department of Revenue.

The frequency of sales tax filings and payments depends on the business's tax liability. Generally, businesses with higher tax liabilities are required to file and pay sales tax more frequently, such as monthly or quarterly. Those with lower tax liabilities may be permitted to file and pay on an annual basis.

Nebraska's sales tax system utilizes a self-assessment approach, where businesses are responsible for calculating and remitting the appropriate tax. This process involves maintaining accurate records of taxable sales, applying the correct tax rates, and ensuring timely payments to the state.

To assist businesses in their compliance efforts, the Nebraska Department of Revenue provides various resources, including online filing and payment systems, tax guides, and workshops. These resources aim to simplify the sales tax compliance process and ensure businesses understand their obligations.

Sales Tax Registration and Permits

Obtaining a sales tax permit in Nebraska is a straightforward process. Businesses can apply for a permit online through the Nebraska Tax Interactive (NTI) system. The application requires basic business information, including the business’s legal name, address, and taxpayer identification number.

Once the application is submitted, the Nebraska Department of Revenue reviews it for accuracy and completeness. Upon approval, the business receives its sales tax permit, which includes a unique permit number and other relevant information. This permit authorizes the business to collect and remit sales tax in Nebraska.

It's important for businesses to renew their sales tax permits periodically to maintain their active status. Failure to renew can result in penalties and interest, and it may impact the business's ability to collect and remit sales tax accurately.

Impact on Consumers and Businesses

Sales tax in Nebraska has a direct impact on both consumers and businesses. For consumers, the tax adds to the cost of goods and services, influencing their purchasing decisions and overall spending power. The varying sales tax rates across the state can also create price disparities, affecting consumer behavior and market dynamics.

For businesses, sales tax compliance is a critical aspect of their financial operations. Accurate sales tax collection and remittance are essential to avoid penalties and maintain a positive relationship with the Nebraska Department of Revenue. Businesses must stay informed about tax rate changes, exemptions, and compliance requirements to ensure they operate within the legal framework.

Additionally, businesses may leverage sales tax as a strategic tool to attract customers and drive sales. By offering tax-free periods or discounts on taxable items, businesses can stimulate consumer demand and boost their market position.

Sales Tax and Economic Development

Nebraska’s sales tax system plays a significant role in the state’s economic development. The revenue generated from sales tax contributes to the funding of essential public services, infrastructure projects, and community development initiatives. This revenue stream allows the state to invest in education, healthcare, and other vital sectors, ultimately benefiting the overall economic well-being of Nebraskans.

Moreover, the sales tax system can influence business investment and growth. By offering sales tax incentives or exemptions for specific industries or projects, Nebraska can attract new businesses and encourage expansion, contributing to job creation and economic growth.

Overall, Nebraska's sales tax system is a critical component of the state's fiscal framework, impacting consumers, businesses, and the economy as a whole. Understanding and navigating this system is essential for all stakeholders to ensure compliance, promote economic development, and support the state's prosperity.

How often do businesses need to file sales tax returns in Nebraska?

+The frequency of sales tax filings depends on the business’s tax liability. Generally, businesses with higher tax liabilities file monthly or quarterly, while those with lower liabilities may file annually. However, businesses should consult the Nebraska Department of Revenue for specific guidelines and requirements.

Are there any sales tax holidays in Nebraska?

+Yes, Nebraska has designated sales tax holidays, typically focused on back-to-school shopping. During these periods, certain items, such as school supplies and clothing, are exempt from sales tax. These tax-free periods aim to encourage consumer spending and support families with back-to-school expenses.

How can businesses stay updated on sales tax regulations and changes in Nebraska?

+Businesses can stay informed by subscribing to updates and notifications from the Nebraska Department of Revenue. Additionally, regularly reviewing the department’s website and resources, such as tax guides and newsletters, can provide valuable insights into any changes or amendments to the sales tax regulations.