New Jersey Income Tax Return Status

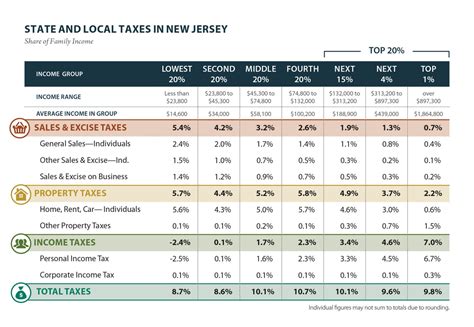

In the world of tax returns, staying informed about the status of your refund or payment is crucial. For residents of New Jersey, understanding the intricacies of the New Jersey Income Tax Return Status system can provide valuable insights into the processing and potential outcomes of their tax filings. This comprehensive guide aims to delve into the specifics, offering a detailed analysis of the process and the factors that influence the journey of a New Jersey income tax return.

Understanding the New Jersey Income Tax Return Process

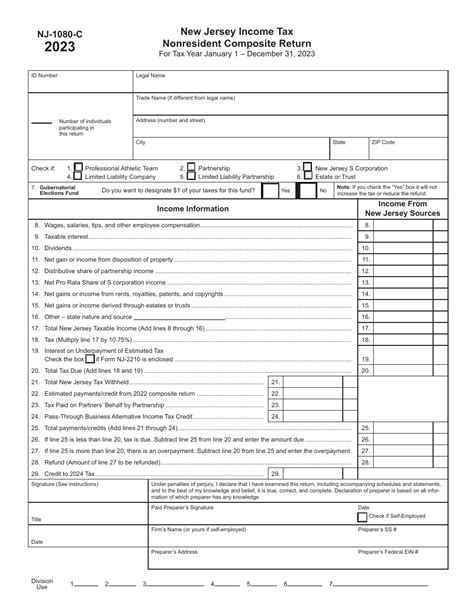

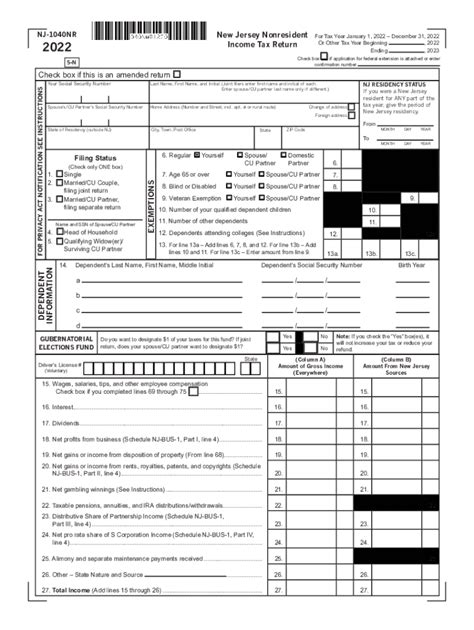

The New Jersey Division of Taxation plays a pivotal role in overseeing the income tax return process for the state’s residents and businesses. The journey of a tax return begins with the accurate completion and submission of the relevant tax forms, which include the NJ-1040 for individuals and the NJ-1065 for partnerships, among others.

One of the key aspects to consider is the filing deadline, which typically falls on April 15th each year. However, this date can vary based on the day of the week it falls on and potential federal or state-level adjustments. For instance, if April 15th lands on a weekend or a public holiday, the deadline is often extended to the following business day.

The Role of E-Filing and Direct Deposit

In today’s digital age, the majority of New Jersey taxpayers opt for electronic filing, or e-filing, which offers several advantages. Firstly, it provides a faster and more efficient way to submit tax returns, reducing the likelihood of errors that might occur with manual calculations and transcriptions. Additionally, e-filing often leads to quicker processing times, which can be especially beneficial for those eagerly awaiting their tax refunds.

Furthermore, taxpayers can choose to receive their refunds via direct deposit, a method that is not only convenient but also secure. Direct deposit ensures that the refund amount is swiftly and safely transferred into the taxpayer's designated bank account, eliminating the risk of physical checks getting lost or stolen during transit.

| E-Filing Benefits | Direct Deposit Benefits |

|---|---|

| Faster processing times | Secure and swift refund transfer |

| Reduced error rates | Elimination of physical check risks |

| Efficient and accurate submission | Convenience and accessibility |

Exploring the Factors Affecting Return Status

The journey of a New Jersey income tax return is influenced by various factors, each playing a unique role in determining the overall status and outcome. From the complexity of the tax return to the accuracy of the submitted information, these factors can significantly impact the timeline and result of the tax filing process.

Complexity of the Tax Return

The complexity of a tax return can vary significantly, often depending on the taxpayer’s unique financial situation. For instance, a simple return for a single individual with no additional income streams or deductions may be straightforward and quick to process. In contrast, a more complex return, such as that of a business owner or an individual with multiple sources of income and various deductions, can take longer to review and process.

One of the key indicators of complexity is the number of schedules and forms required to accurately report all income and deductions. The more schedules and forms a taxpayer needs to complete, the more intricate the return becomes, potentially leading to a longer processing time.

- Simple Returns: Typically require fewer than 3 forms and schedules.

- Complex Returns: Often necessitate 5 or more forms and schedules.

Accuracy of Submitted Information

The accuracy of the information provided on a tax return is paramount. Errors or discrepancies in the submitted data can lead to delays in processing, as well as potential audits or additional scrutiny from the New Jersey Division of Taxation. It is crucial for taxpayers to carefully review their returns for any mistakes, ensuring that all figures are correct and that the necessary supporting documentation is attached.

Some common errors that can impact the return status include:

- Incorrect Social Security Numbers or Taxpayer Identification Numbers.

- Miscalculations in income, deductions, or credits.

- Missing or incomplete forms.

- Inaccurate reporting of income sources.

Tracking Your New Jersey Income Tax Return Status

Staying informed about the status of your New Jersey income tax return is easier than ever, thanks to the online tools and resources provided by the state’s Division of Taxation. Taxpayers can utilize these platforms to gain real-time insights into the progress of their tax returns, ensuring they are always aware of the current stage of processing.

Using the NJ Taxpayer Portal

The NJ Taxpayer Portal is a comprehensive online platform that offers a range of services to New Jersey taxpayers. One of its key features is the ability to track the status of your income tax return and refund. By logging into the portal with your secure credentials, you can access your personal tax information, including the current status of your return.

The portal provides a detailed breakdown of the various stages of the tax return process, from acceptance to processing and eventually, completion. This level of transparency allows taxpayers to have a clear understanding of where their return stands in the overall journey.

Additionally, the portal offers a convenient refund status lookup tool, which provides real-time updates on the status of your refund. You can check the anticipated refund amount, the date it was issued, and the method of payment, whether it be direct deposit or a physical check.

Exploring Other Resources

Apart from the NJ Taxpayer Portal, taxpayers can also leverage other resources to stay informed about their New Jersey income tax return status. The New Jersey Division of Taxation’s website provides a wealth of information, including frequently asked questions, important dates, and updates on the tax return process.

Furthermore, the Division of Taxation offers a dedicated telephone helpline for taxpayers seeking assistance or information about their returns. While this method may not provide real-time updates, it offers a direct line of communication with tax experts who can provide personalized guidance and answers to specific queries.

What to Do If Your Return is Delayed

Despite the efficiency of the New Jersey income tax return process, there may be instances where a return is delayed, either due to processing issues or additional scrutiny from the Division of Taxation. In such cases, it is crucial for taxpayers to remain patient and take the appropriate steps to address the delay.

Contacting the Division of Taxation

If you believe your return is experiencing an unusual delay, the first step is to contact the New Jersey Division of Taxation. Their team of experts can provide insights into the potential reasons for the delay and offer guidance on the next steps. It is important to have your tax return information readily available when making this call, as it will help the tax representatives provide more accurate and tailored assistance.

The Division of Taxation may request additional information or documentation to resolve the delay. It is crucial to provide these promptly to ensure the process can move forward efficiently.

Understanding Potential Reasons for Delay

There are several reasons why a New Jersey income tax return might be delayed. Some common causes include:

- Errors or Omissions: Inaccurate or incomplete information can lead to delays as the Division of Taxation works to verify the data.

- Additional Review: Some returns may be selected for further review, especially if they involve complex financial situations or significant deductions.

- Missing Documentation: If supporting documents are not attached or are incomplete, the processing of the return may be paused until the necessary information is provided.

- System Issues: In rare cases, technical problems with the tax processing system can cause delays in the overall timeline.

Future Outlook and Continuous Improvement

The New Jersey Division of Taxation is dedicated to continuous improvement and modernization of its tax return processes. By leveraging technology and implementing efficient systems, the state aims to enhance the overall taxpayer experience, making it faster, simpler, and more transparent.

Digital Transformation Initiatives

The Division of Taxation is actively working towards a more digital and streamlined tax return process. This includes the ongoing development and improvement of online platforms like the NJ Taxpayer Portal, which offers a secure and user-friendly interface for taxpayers to manage their returns and refunds.

Additionally, the Division is exploring the potential of artificial intelligence (AI) and machine learning to further automate and enhance the tax return processing journey. These technologies can help identify errors or anomalies more efficiently, potentially reducing processing times and improving accuracy.

Taxpayer Education and Support

Education plays a pivotal role in ensuring taxpayers understand the process and can navigate it effectively. The New Jersey Division of Taxation provides a range of resources, including online guides, webinars, and workshops, to help taxpayers better understand their tax obligations and the return process.

By empowering taxpayers with knowledge, the Division aims to reduce errors and improve the overall efficiency of the tax return system. This includes offering clear guidelines on what to expect during the return journey and providing timely updates on any changes or improvements to the process.

Conclusion

Understanding the intricacies of the New Jersey Income Tax Return Status process is a vital step towards a smoother and more efficient tax return journey. By familiarizing yourself with the factors that influence the status of your return, you can take proactive steps to ensure your tax filing is accurate, complete, and timely.

From leveraging the tools provided by the NJ Taxpayer Portal to staying informed about potential delays, this guide has offered a comprehensive overview of the New Jersey income tax return process. With a clear understanding of the journey, taxpayers can navigate the system with confidence, ensuring their tax obligations are met with efficiency and accuracy.

How long does it typically take to process a New Jersey income tax return?

+

The processing time for a New Jersey income tax return can vary depending on several factors, including the complexity of the return and the method of filing. On average, simple returns filed electronically can be processed within 4-6 weeks, while more complex returns may take up to 12 weeks or more. Returns filed by mail may take slightly longer due to processing delays.

Can I check the status of my New Jersey income tax refund online?

+

Yes, you can check the status of your New Jersey income tax refund online through the NJ Taxpayer Portal. This portal provides real-time updates on the progress of your refund, including the date it was issued and the method of payment. It’s a convenient way to stay informed about your refund status without having to call or visit a tax office.

What should I do if I haven’t received my New Jersey income tax refund within the expected timeframe?

+

If you haven’t received your New Jersey income tax refund within the expected timeframe, it’s important to take action. First, check the status of your refund through the NJ Taxpayer Portal to ensure there aren’t any processing delays or issues. If the refund status indicates a problem, you can contact the New Jersey Division of Taxation for further assistance. They may request additional information or documentation to resolve the issue.

Are there any penalties for filing a New Jersey income tax return late?

+

Yes, there are penalties for filing a New Jersey income tax return late. The late filing penalty is typically 5% of the unpaid tax amount for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax balance. It’s important to file your return on time to avoid these penalties and potential interest charges.

Can I e-file my New Jersey income tax return if I owe taxes?

+

Yes, you can e-file your New Jersey income tax return even if you owe taxes. When you e-file, you have the option to pay your taxes online through the NJ Taxpayer Portal or by using a third-party payment service provider. It’s important to ensure that you have the necessary funds available to pay your taxes in full or make arrangements for a payment plan to avoid any penalties or interest charges.