New Jersey Income Tax Rates 2025

As we navigate the complexities of financial planning and taxation, understanding the income tax rates for different jurisdictions becomes essential. In this comprehensive guide, we will delve into the New Jersey income tax rates for the year 2025, offering you a detailed insight into the state's tax structure and providing valuable information for individuals and businesses alike.

Unraveling the New Jersey Income Tax Structure for 2025

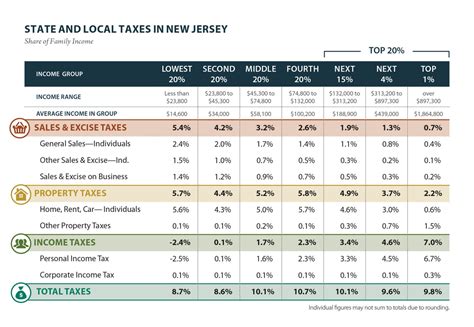

New Jersey, often referred to as the “Garden State,” has a progressive income tax system, which means that tax rates increase as your income rises. This approach ensures that higher-income earners contribute a larger share to the state’s revenue. For the tax year 2025, New Jersey’s income tax rates will follow a set of brackets, each with its own tax rate, reflecting the state’s commitment to fairness and equity in taxation.

It's important to note that while the federal government sets the overall framework for income taxation, each state has the autonomy to establish its own tax rates and brackets. This results in a diverse landscape of tax policies across the United States, making it crucial for taxpayers to stay informed about the specific regulations in their state of residence.

In the following sections, we will provide an in-depth analysis of New Jersey's income tax rates for 2025, covering the different tax brackets, the corresponding tax rates, and the income thresholds that determine which bracket an individual or entity falls into. We will also explore the potential impact of these rates on taxpayers and discuss any notable changes from previous years.

Tax Brackets and Rates: A Detailed Breakdown

The New Jersey income tax system for 2025 is structured with the following tax brackets and corresponding rates:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 1.4% | $0 to $20,000 | |

| 1.75% | $20,001 to $35,000 | |

| 3.5% | $35,001 to $40,000 | |

| 5.525% | $40,001 to $75,000 | |

| 6.37% | $75,001 to $150,000 | |

| 7.65% | $150,001 and above |

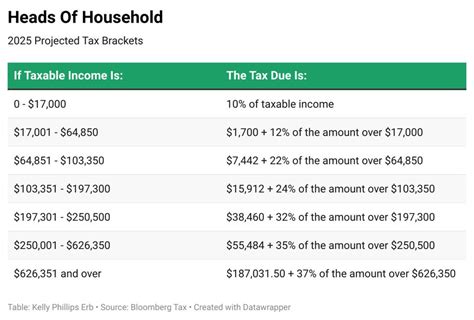

These tax brackets and rates are applicable to all individual taxpayers, regardless of their filing status. It's worth noting that New Jersey's tax system does not differentiate between single, married filing jointly, or head of household filers when it comes to tax brackets.

Let's take a closer look at each bracket to understand how it impacts taxpayers. For incomes up to $20,000, the tax rate is a modest 1.4%, ensuring that individuals with lower incomes are not burdened with a high tax liability. As income increases, so does the tax rate, with the highest bracket of 7.65% applying to incomes of $150,000 and above.

Understanding the Impact of New Jersey’s Income Tax Rates

The progressive nature of New Jersey’s income tax rates means that higher-income earners contribute a larger proportion of their income to the state’s revenue. This approach is designed to maintain a balance between generating sufficient tax revenue for essential state services and ensuring that the tax burden is distributed equitably across different income levels.

For individuals and businesses operating within New Jersey, understanding these tax rates is crucial for effective financial planning. By knowing which tax bracket they fall into, taxpayers can estimate their tax liability accurately and make informed decisions about their financial strategies. This includes considerations such as optimizing deductions, exploring tax credits, and planning for potential changes in income to navigate different tax brackets effectively.

It's important to remember that while New Jersey's income tax rates provide a clear framework, the actual tax liability can be influenced by various factors. These include deductions for expenses like mortgage interest, charitable contributions, and state and local taxes, as well as any applicable tax credits. Additionally, taxpayers should stay informed about any updates or amendments to the state's tax laws, as these can impact their overall tax position.

Comparative Analysis: New Jersey’s Income Tax Rates in Context

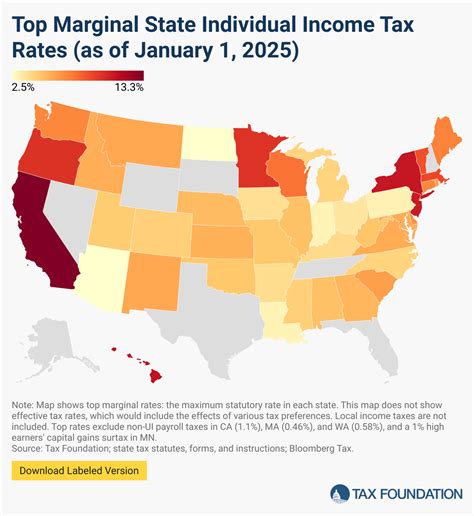

When viewed in the context of other states, New Jersey’s income tax rates for 2025 position the state in the middle range. Some states, like Florida and Texas, have no income tax, while others, like California and New York, have higher tax rates for certain income brackets. This variability in state tax policies underscores the importance of conducting a thorough analysis before making any significant financial decisions.

For individuals considering a move to New Jersey or for businesses contemplating expansion into the state, a comprehensive understanding of the tax landscape is essential. By comparing New Jersey's tax rates with those of other states, taxpayers can make informed decisions about their financial strategies and ensure that they are prepared for the tax implications of their choices.

Moreover, staying informed about potential changes in tax laws is crucial. While the rates outlined above are expected to remain in effect for the tax year 2025, legislative changes or economic factors could lead to adjustments in the future. Monitoring these developments ensures that taxpayers can adapt their financial planning accordingly.

Tax Strategies and Planning for New Jersey Residents

Given the progressive nature of New Jersey’s income tax system, effective tax planning becomes a crucial aspect of financial management. Here are some strategies that individuals and businesses can consider to optimize their tax position:

- Maximizing Deductions: Explore all eligible deductions to reduce your taxable income. This can include deductions for mortgage interest, medical expenses, and state and local taxes.

- Utilizing Tax Credits: Take advantage of any applicable tax credits, such as the Child and Dependent Care Credit or the New Jersey Property Tax Credit. These credits can significantly reduce your tax liability.

- Strategic Income Management: For those nearing the threshold of a higher tax bracket, consider strategies to manage your income. This might involve timing the sale of assets or deferring income to a future tax year.

- Retirement Planning: Contribute to tax-advantaged retirement accounts, such as 401(k)s or IRAs, to reduce your taxable income and save for the future.

- Consulting a Tax Professional: Complex tax situations may benefit from the expertise of a certified public accountant (CPA) or tax attorney. These professionals can provide tailored advice and ensure compliance with New Jersey's tax laws.

Conclusion: Navigating New Jersey’s Income Tax Landscape for 2025

In conclusion, understanding New Jersey’s income tax rates for 2025 is a crucial step in effective financial planning. The state’s progressive tax structure, with its carefully calibrated brackets and rates, ensures a fair and equitable approach to taxation. By staying informed about the tax landscape and employing strategic tax planning, individuals and businesses can navigate their financial journeys with confidence and make the most of their hard-earned income.

As we move forward into the tax year 2025, it is essential to remain vigilant about any potential changes to New Jersey's tax laws. Keeping abreast of these developments ensures that taxpayers can adapt their strategies accordingly and continue to make informed financial decisions. Whether you are an individual taxpayer or a business owner, staying informed and proactive is key to successfully navigating the complexities of New Jersey's income tax system.

What is the difference between a tax bracket and a tax rate in New Jersey’s income tax system?

+A tax bracket refers to a range of income levels, while a tax rate is the percentage of tax applied to that specific bracket. For instance, in New Jersey, incomes between 20,001 and 35,000 fall into the 1.75% tax bracket, meaning that 1.75% of this income range is subject to state income tax.

Are there any deductions or credits that can reduce my New Jersey income tax liability?

+Yes, New Jersey offers various deductions and credits to reduce your tax liability. These include deductions for medical expenses, charitable contributions, and state and local taxes. Additionally, there are credits available for individuals with dependent care expenses and for those who have paid significant property taxes.

How do New Jersey’s income tax rates compare to those of neighboring states?

+New Jersey’s income tax rates are relatively similar to those of neighboring states like Pennsylvania and Delaware. However, it’s important to note that each state has its own unique tax structure, and comparing tax rates across states should be done with a thorough understanding of each state’s specific tax laws and brackets.